Ethereum prices remain under pressure as the altcoin king struggles to find investor support. After weeks of sideways trading, ETH appears stuck in an accumulation phase as optimism fades.

The lack of recovery momentum raises concerns that Ethereum could soon retest lower price zones if sentiment does not improve.

Ethereum holders face losses

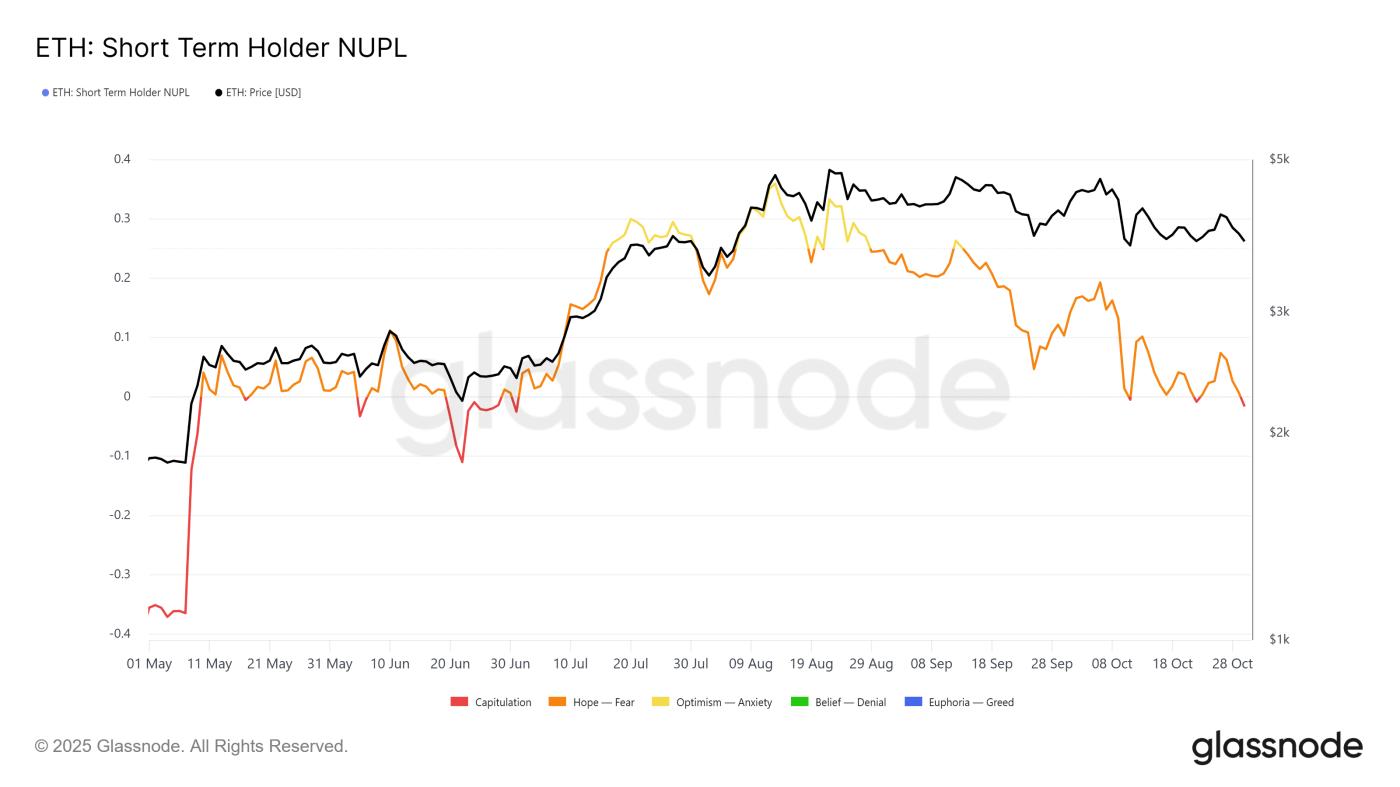

The Net Unrealized Profit/Loss (NUPL) indicator is sliding into capitulation, a range that has historically preceded short-term Ethereum rallies. When investors capitulate, the price often hits oversold territory, creating conditions for a temporary technical pullback.

Short-term holders, known for their quick reaction to price movements, often limit their selling at a loss. This behavior can trigger a small recovery as they try to push the price up before taking profits. Ethereum has seen two similar short-lived rallies this month under similar conditions. If this pattern repeats, the market could see a temporary bump before the overall trend takes over.

Want to read more Token insights like this? Subscribe to Editor Harsh Notariya's Daily Crypto newsletter here .

Ethereum STH NUPL. Source: Glassnode

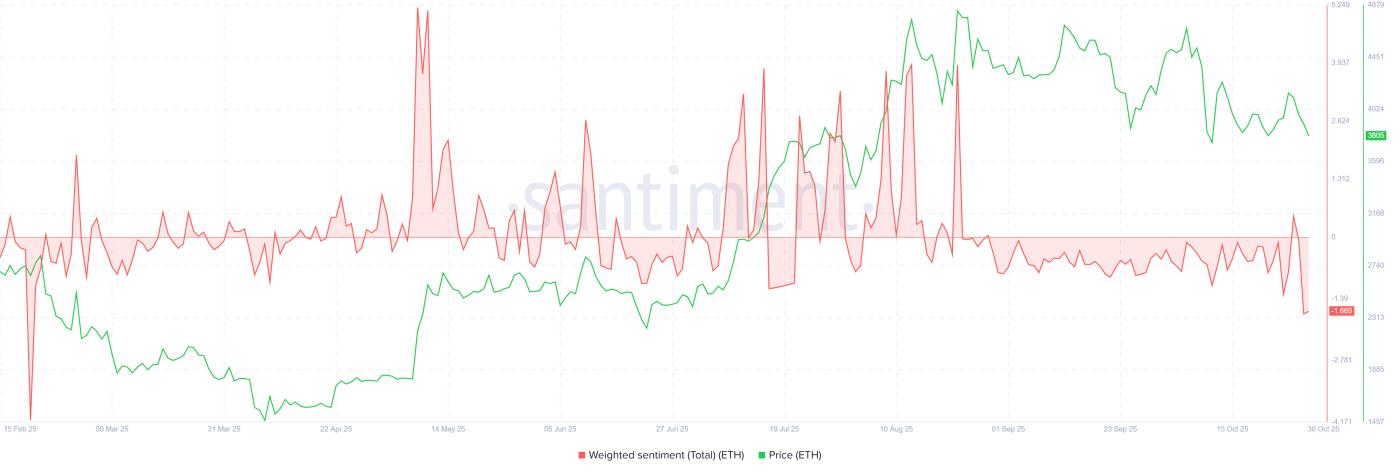

Ethereum STH NUPL. Source: GlassnodeOn a macro level, Ethereum’s weighted sentiment is falling sharply, reflecting growing pessimism among investors. The indicator is at its lowest level in nine months, its weakest since February. Such negative sentiment typically reflects weakness in buying power and traders’ reluctance to open new long positions.

While this pessimism may be short-lived, Dai bearish sentiment could intensify selling pressure and erode any short-term recovery. If sentiment does not improve soon, Ethereum could face greater difficulty holding key support levels.

Ethereum's weighted sentiment. Source: Santiment

Ethereum's weighted sentiment. Source: SantimentETH price is moving sideways in a range

At the time of writing, Ethereum is trading at $3,846, holding just above the $3,802 support zone. The altcoin king is likely to remain range-bound as market conditions suggest limited volatility.

Ethereum is currently trading between $4,154 and $3,802. This consolidation range could continue in the coming sessions, with ETH potentially testing resistance again if short-term momentum returns.

ETH Price Analysis. Source: TradingView

ETH Price Analysis. Source: TradingViewHowever, if bearish conditions intensify and Ethereum loses support at $3,802, the decline could extend. A break below this level could push the price below $3,742 and towards $3,500, invalidating the bullish thesis and signaling deeper market weakness ahead.