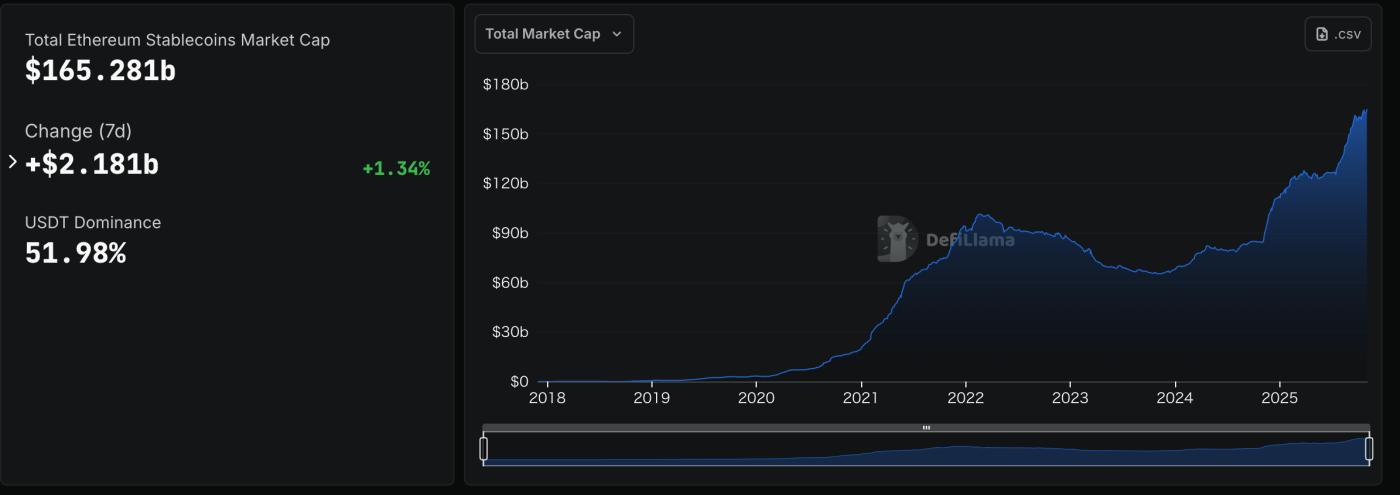

The Ethereum ecosystem continues to attract attention as stablecoins on its blockchain reach around $165 billion in reserves, making the network among the largest in the world.

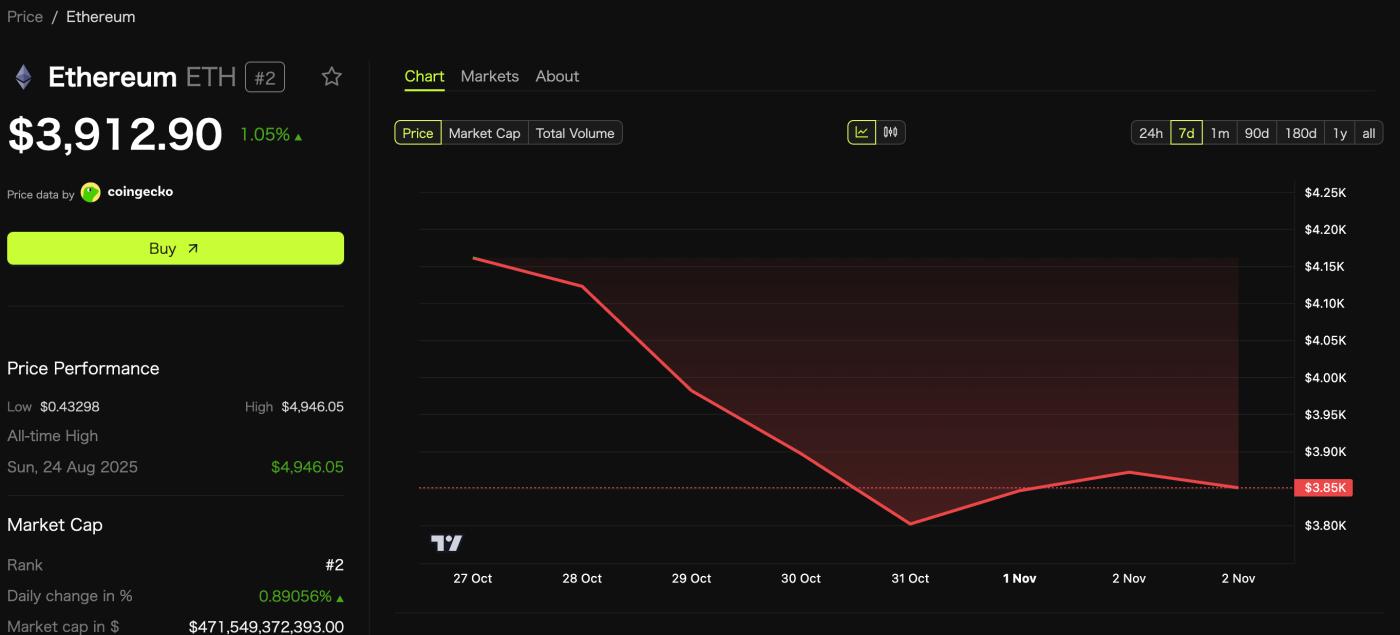

However, ETH ’s spot price is weakening, falling below $4,000, reflecting cautious investor sentiment. The market is closely watching institutional positioning and on-chain indicators, waiting to XEM if Ethereum’s Vai as a macro digital reserve will soon reignite the rally.

The global reserve Vai for Ethereum-based stablecoins

Stablecoins issued on the Ethereum blockchain have now accumulated about $165 billion in reserves, ranking around 22nd in the size of global foreign exchange reserves. This figure surpasses several national reserves, including Singapore and India, underscoring Ethereum’s expanding Vai beyond a decentralized smart contract platform.

Total stablecoin Capital on Ethereum: DefiLama

Total stablecoin Capital on Ethereum: DefiLamaAnalysts say the development shows that the Ethereum ecosystem is maturing structurally, with stablecoins increasingly being used as collateral, payment assets or digital reserves, rather than purely speculative Token .

“When you look closely and realize how much of $ETH is incorporated into stablecoins, it’s hard not to be optimistic. According to the data, stablecoins on $ETH are in the top 20 largest foreign exchange reserves, second only to the US,” crypto investor BigBob wrote on X.

This reserve accumulation shows growing confidence in Ethereum's core infrastructure as a foundational component of digital finance.

Position signals for institutional investors and traders

on-chain data and trading activity show that large institutions and traders are strategically positioning for a bullish ETH scenario. The number of Longing positions has increased, reflecting interest in spot exposure and liquidation tied to stablecoins. For example, some whale wallets hold around 39,000 ETH ($150 million) as long positions, indicating significant accumulation by large players.

These trends mirror the behavior of traditional reserve assets, market observers say, highlighting Ethereum’s potential as a macro-level Capital allocator. Investor confidence is growing, but execution remains key. Tokenomics, Staking yields, regulatory clarity, and network performance will determine whether Ethereum can sustain the “reserve asset” narrative.

In the Derivative market, funding rates have recently turned negative, suggesting a balance between Longing and Short positions and implying the possibility of a short-term price squeeze. This situation, combined with institutional Capital flows and stablecoin issuance, will likely shape ETH 's trajectory in the coming weeks and months.

ETH Price Trend and Outlook

Amid all this, Ethereum’s spot price has shown weakness. On October 29, ETH fell below $4,000; at the time of writing, it was at $3,912.90. It appears the market is waiting for confirmation of macro narratives, including continued stablecoin inflows and increased network activity, before accelerating upward.

Investors remain cautious; the sideways price action reflects both short-term profit-taking and broader market sentiment. While on-chain indicators suggest continued accumulation, further catalysts—such as institutional Capital or regulatory clarity—may be needed to restore momentum. Analysts note that if Ethereum continues to demonstrate real-world utility and stablecoin integration, its Vai as a “digital reserve asset” will be cemented, which could support a recovery to the $4,200–$4,500 range in the medium term.