In October 2025, the US and UK jointly prosecuted and sanctioned Chen Zhi, chairman of Cambodia's Prince Group, uncovering Southeast Asia's largest cross-border money laundering network. The case revealed a hidden corner of Singapore's "family office paradise"—Chen Zhi used Singapore's family office DW Capital as a central hub, employing family offices and shell companies to launder funds and whitewash his image, a practice dubbed "Singapore washing" by the US media.

This case has thus become a "stress test" for Singapore's financial system, exposing the "double-edged sword" effect of regulatory vacuum and high trust levels in Singapore's private financial institutions. Currently, Singapore is accelerating the improvement of its systems, speeding up approvals, and strengthening due diligence, seeking a new balance between "attracting genuine capital" and "rejecting grey funds."

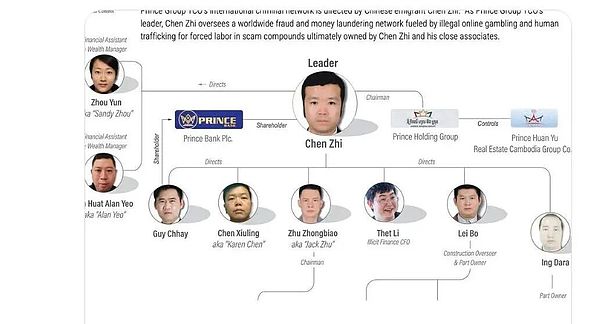

Cross-border crackdown: Southeast Asia's largest fraud network

On October 14, the United States and the United Kingdom acted in unison, indicting and sanctioning Chin Chee, chairman of Cambodia’s Prince Group, for allegedly leading a cross-border “pig butchering” investment scam and money laundering network. This is the largest joint operation between the two countries to date targeting cybercrime in Southeast Asia.

The U.S. Treasury Department’s Office of Foreign Assets Control ( OFAC) added the Prince Group TCO and 146 related individuals and entities to its sanctions list; prosecutors in the Eastern District of New York indicted Chen Zhi on charges of conspiracy to commit wire fraud and conspiracy to commit money laundering. The U.S. Department of Justice seized 127,271 bitcoins (approximately $15 billion , or estimated at the exchange rate/market price at the time ), setting a record for the largest civil forfeiture in history.

The indictment reveals that Prince Group, ostensibly engaged in real estate, banking, hotels, and watchmaking, actually operated fraud parks that relied on human trafficking and forced labor. The parks were described as "prisons with barbed wire," where thousands of trafficked laborers were forced to engage in online fraud.

Chen Zhi

According to available information, Chen Zhi was born in Fujian, China in 1987. He immigrated to Cambodia around 2011, obtaining citizenship and the honorary title of "Neak Oknha" in exchange for a $250,000 donation. He also holds Cypriot and Vanuatu passports. Capitalizing on the influx of capital into the casino industry, he founded the Prince Group, expanding its business into real estate, banking, hotels, and watchmaking, becoming one of Cambodia's most influential private enterprises.

Chen Zhi faces five charges: forced labor and human trafficking, bribery and corruption, corporate money laundering, transnational asset transfer, and concealment of illicit funds. The funds were allegedly used to purchase luxury homes, yachts, private jets, and Picasso paintings. If convicted, he could face up to 40 years in prison.

DW Capital: The Center of the "Laundering Machine"

Multiple international media outlets and documents from the U.S. Treasury Department indicate that Chen Zhi's team used Singapore as a transit point, employing family offices, shell companies, law firms, and academic collaborations to create a "legitimate facade," achieving a "double laundering" of funds and image. This practice has been dubbed "Singapore washing" by the media—utilizing Singapore's financial reputation and tax system to provide channels and cover for cross-border criminal networks.

According to the analysis by Home Office New Wisdom Point, Chen Zhi and his team's "whitewashing" operations in Singapore mainly manifested in the following aspects:

First, DW Capital, a privately-owned company: from a wealth management tool to a "money laundering hub".

In 2018, Chen Zhi established DW Capital Holdings Pte. Ltd in Singapore, claiming to be a single entity. The website stated that it managed assets exceeding S$60 million and enjoyed a 13X tax incentive. Following sanctions imposed by the US and UK on Prince Group, the Monetary Authority of Singapore (MAS) stated it was investigating whether the company had violated relevant requirements; as of now, no investigation findings or penalties have been released.

Multiple media outlets, citing information from the Hong Kong Monetary Authority (HKMA), reported that DW Capital does not hold a Capital Markets Services (CMS) license. Industry insiders pointed out that if a private office only manages its own funds, it may not need a license under existing exemptions; furthermore, the 13X rating is a tax incentive, not a financial regulatory license.

Furthermore, media reports indicate that Chen Zhi's team established more than ten "management consulting/holding" companies in Singapore. The report states that among the 17 Singapore-registered entities sanctioned, 14 are registered at the same address, 2 Jalan Kilang Barat (Redhill, Singapore), which is seen by outsiders as a "node for fund transfers and nominee shareholding."

Main structure (function):

DW Capital (a privately-owned entity; publicly claims to be regulated)

Skyline Investment Management (a shell of wealth management/lending, using auto loan business as a cover for cash flow)

Warpcapital Yacht Management, Capital Zone Warehousing (Asset transfer through yacht and high-end spirits storage)

Hongshan Shared Office Space ( 8th Floor): 14 shell companies are registered here, which has been identified as a "money laundering activity node". It is equipped with a cigar bar, KTV and wine cellar. "It looks like a startup base, but it is actually a financial cover".

Second, the "family-run trio": three Singaporean front desk operators.

All three were added to the SDN List on October 14, 2025 (asset freeze, US ban on trading).

Karen Chen Xiuling : CFO of DW Capital, formerly an independent director of Temasek-affiliated listed company 17Live, resigned after being sanctioned; responsible for the company network in Singapore, Mauritius, and Taiwan.

Alan Yeo Sin Huat: CEO of DW Capital (since 2022), a financial advisor by training, and Chen Zhi is a "wealth manager".

Nigel Tang Wan Bao Nabil: In charge of yacht and warehousing businesses, accused of using luxury assets to conceal cash flow.

Third, the "breeding ground for whitewashing": gaps in assets, social connections, and institutions.

Luxury Homes and Social Circle: From 2017 to 2022, Chen Zhi purchased luxury homes and assets in Singapore worth over S$40 million, including a penthouse in Gramercy Park on Orchard Road (approximately S$17 million); and a luxury suite in Le Nouvel Ardmore (approximately S$16.2 million), which was converted into a private club with a cigar bar and karaoke room for business meetings .

He often travels in a black Maybach (license plate "5555"), frequently hosts parties on his 53-meter yacht "NONNI II" in Sentosa, and associates with diplomats and tycoons. DW Capital has become a "shadow aristocratic club".

Fund flow path and institutional loopholes : Accounts are opened under the guise of "investment advisors/private equity management," enjoying tax benefits and privacy protections, and then circulated through shell companies, investing in high-value assets such as real estate, yachts, and cryptocurrencies. Scholars summarize this as a standardized routine of "using high-reputation legal jurisdictions to conceal the source of illicit funds."

Fourth, three "whitewashing chains": reputation, institutions, and law.

Reputation endorsement: Registering the Prince Foundation in Singapore allows the company to cultivate a "charitable" image under the guise of education, healthcare, and "corporate social responsibility" (CSR projects), diluting external accusations of money laundering/fraud.

Institutional endorsements: Nanyang Technological University ( NTU) collaborated with a foundation under the Prince Group on a short-term education and entrepreneurship project from 2022 to 2024, which has since been terminated; Surbana Jurong, a subsidiary of Temasek Holdings, provided master planning for Canopy Sands' "Ream City" (later renamed "Bay of Light"), a subsidiary of Prince Group, with the collaboration ending in 2022; The Ascott, a subsidiary of CapitaLand, signed a management agreement with Canopy Sands for two hotels in 2024, which was terminated on October 17, 2025, after the sanctions were announced.

Legal firewall: Singapore law firm Duane Morris & Selvam LLP, which had previously represented Prince Group in issuing a lawyer's letter threatening the media and academics with a defamation lawsuit, later confirmed that it was terminating its representation.

Tearing open the cracks in the "home office paradise"

On October 14, the U.S. Treasury Department and the British Foreign Office jointly filed a lawsuit and imposed sanctions on the Prince Group of Cambodia and its founder, Chin Chee. Singaporean authorities immediately launched an investigation, cooperating with international law enforcement agencies. Initially, the police stated they were "aware of the situation and in contact with foreign counterparts," but formally opened a case after the U.S. and UK released their sanctions lists.

On October 30, the Singapore Police Force (SPF) announced a restraining order against Chen Zhi Network, freezing approximately S$150 million in assets. The Monetary Authority of Singapore (MAS) stated that local banks had submitted suspicious transaction reports and closed relevant accounts as early as 2024, and are cooperating with the police and international regulatory agencies to review the compliance status of the institutions involved.

Several US media outlets pointed out that this marks the case's transition from "international sanctions" to "local enforcement," and also exposes this "financial center," known for its "cleanliness," to the risk of being "laundered" by a transnational fraud group.

U.S. documents also show that Chen Zhi’s network extended to the Pacific island nation of Palau, Taipei, and Hong Kong.

The Prince Group's ability to remain dormant for so long, according to Home Office New Wisdom, stems from a "regulatory vacuum" in Singapore's home office system.

Industry analysts point out that Chenzhi Networks positions itself as a "reputational jurisdiction" in Singapore, adopting a "single-entity" model and registering multiple entities at the same address to create a "legitimate facade." Simultaneously, they "forward" the core responsibilities of anti-money laundering and know-your-customer due diligence to the banks—the banks audit accounts and transactions based on the Monetary Authority of Singapore's Anti-Money Laundering Circular No. 626 and the cross-bank information sharing platform, the Collaboration and Information Sharing System for Anti-Money Laundering (COSMIC). Furthermore, a single-entity entity managing only family funds is exempt from applying for a capital markets services license.

On top of the outer structure, multiple vehicles such as "variable capital companies," trusts, and offshore shell companies are added. Although variable capital companies must comply with the Monetary Authority of Singapore's "Circular on Anti-Money Laundering and Counter-Terrorism Financing for Variable Capital Companies" and engage qualified financial institutions to conduct due diligence, the superposition of multiple layers significantly increases the difficulty of "penetrating the controlling shareholder and the source of funds," thus providing room for "packaging illicit funds as cross-border investments."

This operational model corroborates reports from multiple media outlets that the group "used Singapore to build legitimacy." Thus, a system originally designed for wealth governance was transformed into a "legitimacy shield." Prince Group exploited these loopholes to create a complete "legitimacy facade": enjoying tax benefits under the guise of a family business, laundering assets with luxury homes and yachts, shaping its image through charitable partnerships, suppressing the media with lawyer's letters, and beautifying its image with narratives of "responsibility, legacy, and sustainability."

A financial advisor pointed out: "The more trusted a market is, the easier it is to launder money, because no one suspects it."

MAS subsequently stated that Singapore will not tolerate illegal activities using the family office system, and that "financial integrity is the core of the nation's foundation." By 2025, the number of family offices in Singapore has exceeded 2,000, but the Prince Group case reveals that behind the influx of wealth lies a "dual test" of regulation and trust.

Which way will the pendulum tip?

The Prince Group case has prompted the world to re-examine whether Singapore has lost its balance between "financial attractiveness" and "risk control".

Home Office New Wisdom believes that as Asia’s most trusted wealth and home office center, City State now must find a new balance between “attracting quality capital” and “preventing gray money”.

Shortly before the scandal broke on September 29, Singapore's Minister for National Development, Desmond Lee, proposed at the Global Family Office (GFO) Summit to expedite the approval process for family office establishments and optimize tax incentives and regulatory cooperation mechanisms to attract more high-net-worth families to Singapore. The government hoped to solidify Singapore's position as a "global family office hub" through a more favorable system. However, the Prince Group scandal erupted in October, quickly putting this policy direction to the test.

In fact, Singapore's tightening of regulations has already begun. Since 2023, the Monetary Authority of Singapore (MAS) has successively introduced a single office (SFO) regulatory framework, revised the 13O/13U tax incentive provisions, strengthened anti-money laundering requirements for variable capital companies (VCCs), and launched the interbank information sharing platform COSMIC in 2024 to identify suspicious cross-bank customers and transactions.

During the same period, ACRA upgraded the beneficial owner registration system (RORC), requiring companies to update the information of the beneficial owner within two days of establishment or change, thus reducing the space for "shell companies" to operate as family offices.

The Prince Group case has become a "stress test" for Singapore's institutional reforms. The US and UK have accused Chen Zhi of laundering illicit funds through private offices and shell companies in Singapore, raising international concerns about whether this "private office paradise" is becoming a haven for transnational crime.

Over the past two years, Singapore has seen a series of major money laundering cases , including the S$3 billion money laundering case in 2023 and the recent Prince Group incident. These cases all involve the use of family offices, offshore companies, and luxury assets (such as mansions, yachts, and jewelry) as transit points for funds.

Finding a balance between attracting wealth and preventing its abuse has become Singapore's most challenging issue: "Tightening the reins too much" could weaken its appeal to ultra-high-net-worth families, causing capital to flow to competing centers like Dubai and Hong Kong; "loosening the reins too much" could allow it to be exploited by transnational criminal groups, eroding financial credibility.

The Monetary Authority of Singapore (MAS) is implementing "differentiated regulation"—on the one hand, accelerating approvals threefold (from 6 months to approximately 2 months) while retaining the 13X tax credit and business facilitation; on the other hand, strengthening verification of funding sources, due diligence on controlling shareholders, and independent custody requirements, and planning to establish a home-based regulatory data platform to track fund flows and risky accounts. Industry insiders believe that Singapore is attempting to build a more sophisticated firewall between "openness" and "control."

As pointed out in the previous article "Are Chinese Tycoons 'Withdrawing' from Singapore and Returning to Hong Kong?", "With stricter regulations and rising reputational risks, some funds seeking anonymity and low disclosure are withdrawing, while those truly pursuing long-term succession and transparent governance are choosing to stay." Market analysts believe that Singapore's home-based business ecosystem is shifting from "quantity expansion" to "quality screening."

This case, involving Prince Group, serves as a reminder to Singapore that the standard for measuring the strength of a financial center is no longer limited to capital flows, but also to its ability to uphold integrity and transparency.