HyperUnit, the whale that made $200 million from the US-China tariff war last month, is now betting on a recovery in Bitcoin and Ether, opening $55 million in long positions.

A crypto whale who made $200 million from the crypto crash caused by US-China tariffs last month is now betting $55 million that Bitcoin and Ethereum will rebound.

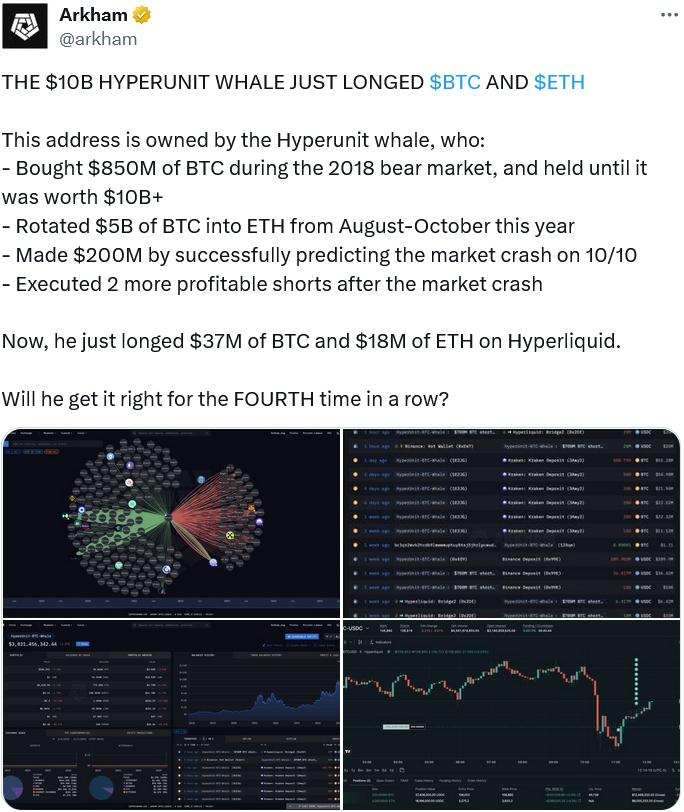

Cryptocurrency analytics platform Arkham was among the first to identify the whale’s new long positions in a post on X on Monday, including a $37 million Bitcoin long position and an $18 million Ether long position on decentralized Derivative exchange Hyperliquid.

Dubbed the “Hyperunit Whale,” the trader recently rose to fame for making $200 million by successfully predicting the collapse of the US-China tariff market on October 10.

HyperUnit has also made two more profitable short sales since then, which leaves Arkham wondering if they “Just got it right the FOURTH time in a row?”

This whale has been in the market for at least seven years, buying $850 million in Bitcoin during the 2018 bear market and holding it until its value hit $10 billion. And they may be onto something.

Bitcoin is currently trading at $106,598 on BingX , while Ether is trading at $3,602. Bitcoin is down 15.5% from its All-Time-High, while Ether is down 27.3% from its record high.

The Crypto Fear and Greed Index is currently in the “Fear” zone with a score of 42 out of 100.

OG Bitcoin Followers Can't Hold Forever; They Have “Life to Live”

The CEO of Cryptoasset manager Bitwise, Hunter Horsley, said OG whale investors have largely contributed to the recent market correction, explaining on Saturday that staying in the market after achieving 100x or 1000x returns can be “emotionally stressful” for these investors.

“They have their whole lives to live / It's emotionally difficult to see $100 million or a third of their wealth disappear in a bear market, even if it's temporary. They plan to continue to hold onto most / most of it.”

Data from CryptoQuant also shows that long-term holders sold 405,000 Bitcoins between around October 2 and November 2.

Horsley, however, remains adamant that many of the biggest stock holders have no plans to sell their shares.

Dip may be near: Santiment

However, according to blockchain analytics platform Santiment, much of the market pain may have already been felt, as the platform noted that there are currently 208,980 fewer BTC on cryptocurrency exchanges than there were six months ago.

“Although Bitcoin's market value has dropped 14% since All-Time-High on October 6, an encouraging sign is that BTC is generally not traded on exchanges.”

“Generally, when a coin's supply is not transferred to exchanges, the risk of a subsequent sell-off is limited.”

Source: Cointelegraph