South Korea’s KOSPI index hit a record high in early November, while crypto volume fell more than 80%.

This stark disparity has frustrated crypto investors as Capital flows have shifted decisively towards traditional stocks.

Record Stock Rally and Crypto's Unprecedented Plunge

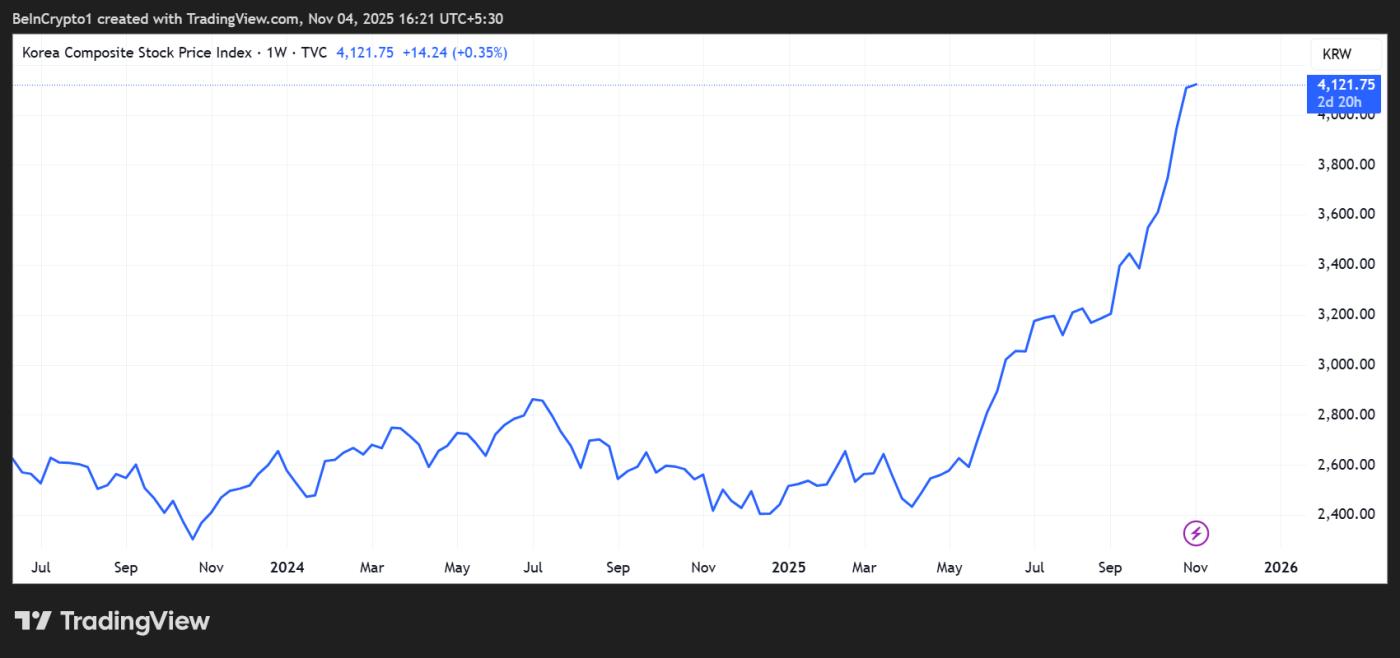

The Korea Composite Stock Price Index (KOSPI), South Korea's main stock market index, hit an All-Time-High as volume on crypto exchanges fell to its lowest level since late 2023. The KOSPI represents the performance of all common stocks traded on the Korea Stock Exchange (KRX).

According to a local media report on November 4, 2025, the KOSPI's daily volume soared to 34.04 trillion KRW, marking a 208% increase from 11.05 trillion KRW on January 2, 2025 – the first trading day of the year.

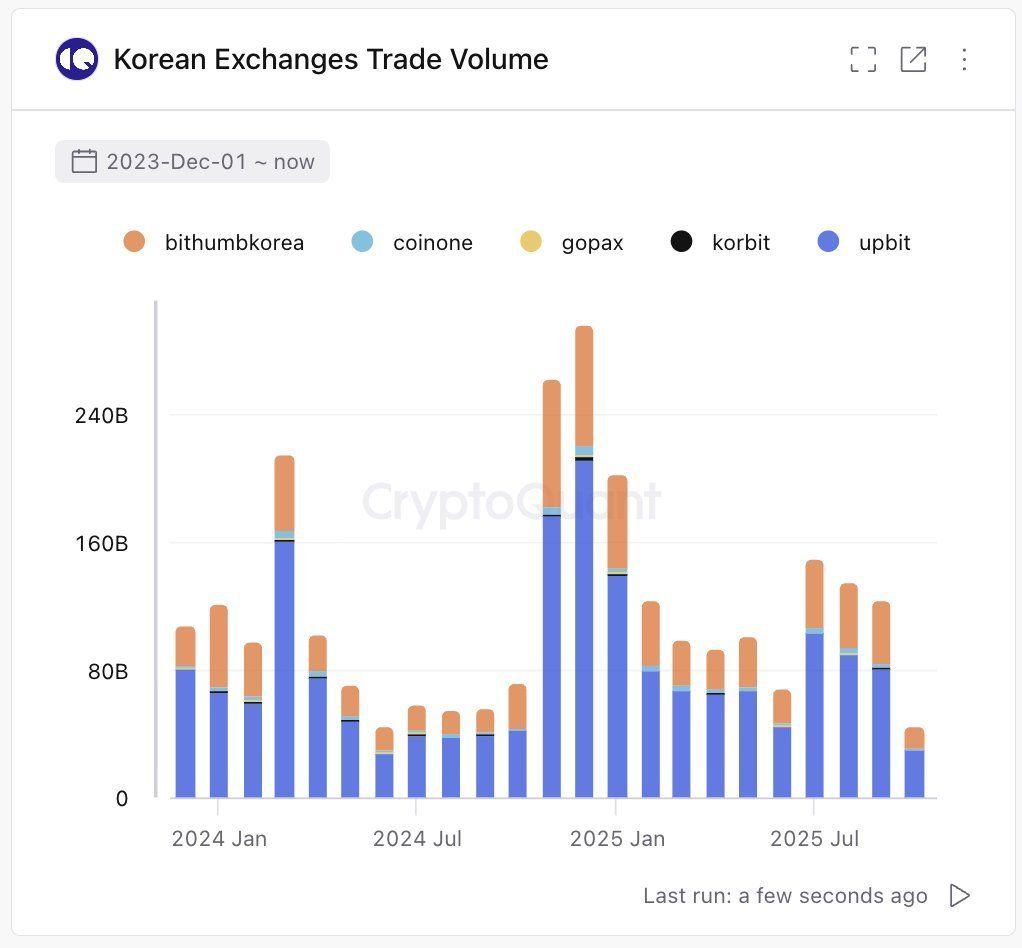

During the same period, the five largest crypto exchange in South Korea saw their daily volume drop to 5.57 trillion KRW. These exchanges include Upbit, Bithumb, Coinone, Korbit, and Gopax, which use KRW. This represents a 45% drop from January, when volume comfortably surpassed 10 trillion KRW.

Data from CryptoQuant shows that trading on these five exchanges has collapsed to almost zero. This compares to a high of over 240 billion units in early 2025.

CryptoQuant's stacked bar chart shows South Korean crypto volume from December 2023 to November 2025, with Upbit and Bithumb dominating and a sharp decline to a record low in November 2025. Source: CryptoQuant (via BeInCrypto)

CryptoQuant's stacked bar chart shows South Korean crypto volume from December 2023 to November 2025, with Upbit and Bithumb dominating and a sharp decline to a record low in November 2025. Source: CryptoQuant (via BeInCrypto)The KOSPI has jumped 71.8% year-to-date, making it the world's best-performing major stock index. The surge has been fueled by continued gains in domestic stocks, particularly Samsung Electronics and SK Hynix, supported by the new government and investor enthusiasm for artificial intelligence .

Upbit, South Korea's largest crypto exchange , saw its 24-hour volume drop 12.8% to $2.02 billion as of October 31, 2025. The sharp decline reflects investors' declining interest in speculating on digital assets.

“Where have all the Korean retail investors in the crypto space gone? Answer: They have moved to the stock market next door,” said analyst AB Kuai Dong.

President Lee Jae-myung's market-friendly policies boost the market

The South Korean stock market has been on a tear since May this year, in the run-up to the presidential election. The election was held after martial law was lifted, so a victory for opposition leader Lee Jae-Myung was widely expected.

Mr. Lee, a lawyer who previously invested in the stock market, has long expressed interest in stimulating the stock market. His market-friendly campaign promises helped fuel investor optimism that has now translated into a record performance for the KOSPI.

KOSPI Price Performance. Source: TradingView

KOSPI Price Performance. Source: TradingViewAI semiconductor chip suppliers Samsung Electronics and SK Hynix led the rally. Samsung shares have risen about 95% year to date, while SK Hynix has surged 242%, both significantly outperforming the broader market.

Last week, the APEC summit took place in Gyeongju, South Korea, with world leaders including Donald Trump and Xi Jinping in attendance. NVIDIA CEO Jensen Huang also traveled to South Korea for the CEO conference, where he made headlines by enjoying beer and fried chicken with the presidents of Samsung and Hyundai.

Huang also met with President Lee and announced plans to prioritize the supply of more than 260,000 AI chips to the South Korean government and some of the country's largest companies, including Samsung, SK Hynix, and Hyundai. Following the “Jensen Moment,” the South Korean stock market hit records for two consecutive days.

Crypto Market Feels Forgotten Amid Stock Boom

South Korea is known for its high crypto volume , and listings on Upbit and Bithumb are still XEM as major drivers of growth in the global crypto market. However, as Capital flows into the stock market surge, South Korea’s domestic crypto market feels somewhat left out.

The recent weakness in crypto markets is not unrelated to this trend. In terms of returns, the stock market is outperforming Bitcoin, which is up 11% year-to-date.

Crypto market participants expressed frustration. CryptoQuant CEO Ki Young Ju agreed with an analyst who said the president had boosted stocks to divert speculation away from real estate.

Future prospects for both markets

South Korean political speculators say that President Lee has shown considerable interest in the crypto market. In the recent presidential election, he campaigned on policies that included approving a Bitcoin spot ETF and adopting stablecoins, even explaining stablecoins in televised debates.

A ruling party politician recently told a BeInCrypto reporter, “In the future, President Lee will be remembered as someone who boosted both the stock market and the cryptocurrency market—a similar model to Trump today.”

Currently, the South Korean market is showing a rare decoupling between traditional and digital assets. Whether this is a temporary phase or a deeper shift in retail investor behavior remains to be XEM as political and economic dynamics continue to evolve. The market experienced a -2.7% correction on Tuesday, with the cryptocurrency market also experiencing a decline.