XRP continues to struggle under increased bearish pressure as its price action continues to languish after a prolonged downtrend. The altcoin has fallen 10% in recent days as traders remain cautious about the volatility in the broader market.

However, despite the weakness, it appears that new investors are stepping in, signaling optimism ahead.

XRP Investors Show Mixed Signals

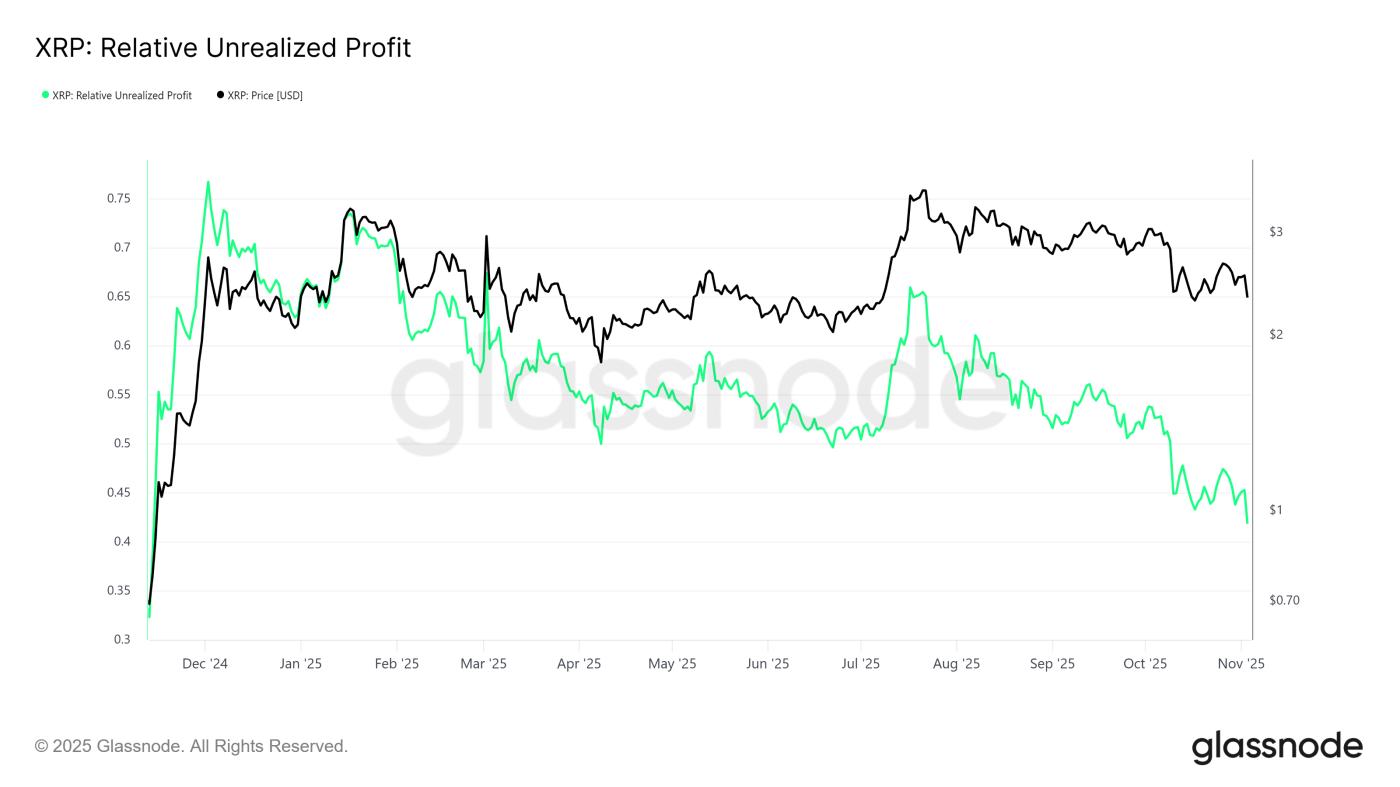

Unrealized profits for XRP holders have fallen to a 12-month low, reflecting a worrying trend in the asset's investor base. Unrealized profits refer to paper gains based on the asset's purchase price rather than actual sales. The drop suggests that most investors currently holding XRP are either losing money or making minimal profits.

A sharp drop in this indicator often triggers panic selling, especially when market confidence is weak. If long-term investors start liquidating positions to avoid larger losses, XRP could face further downward pressure.

Want more Token analysis like this? Subscribe to Editor Harsh Notariya's Daily Crypto Newsletter here .

XRP Unrealized Profit . Source: Glassnode

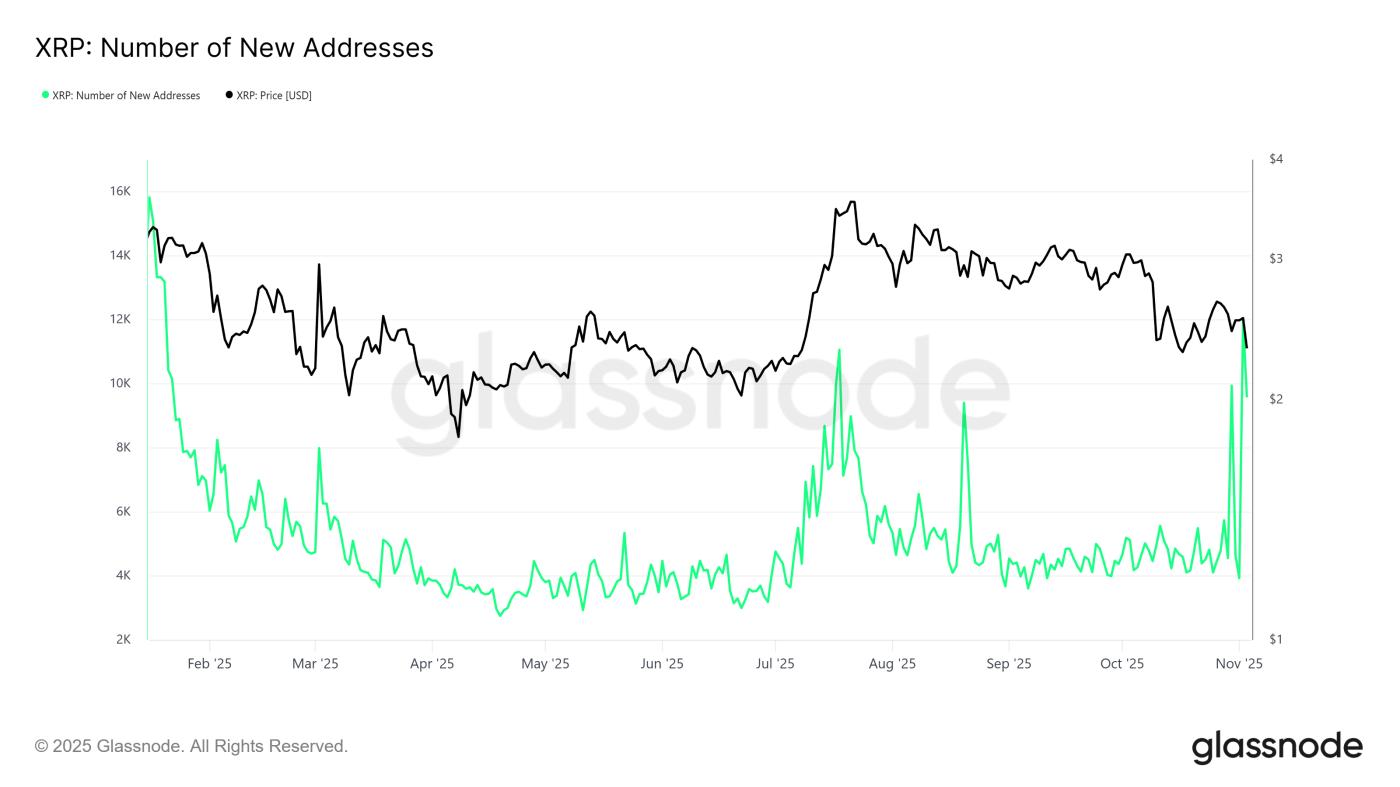

XRP Unrealized Profit . Source: GlassnodeAmid the bearish sentiment, an interesting trend is emerging — an increase in the number of new addresses accumulating XRP . Lower prices appear to be attracting new investors who XEM current prices as an opportunity to enter the market before a potential recovery. This new Capital inflow could help stabilize selling pressure in the short term.

New investors, reaching 12,000 at its peak, also contributed liquidation to the ecosystem, creating demand that could offset profit-taking from long-term holders. Historically, periods of low profitability followed by an influx of new participants have often preceded rallies in XRP's price.

New XRP Address . Source: Glassnode

New XRP Address . Source: GlassnodeXRP price may recover

At the time of writing, XRP is trading at $2.26, down 10% over the past 24 hours. The altcoin continues to face resistance from the broader bearish sentiment. However, strong support remains near $2.27, providing hope for a potential recovery.

If XRP holds this key support level, it could move sideways in the short term, with a potential bounce to $2.35 or $2.45 as buyers regain confidence. This consolidation could lay the groundwork for a stronger move higher later in November.

XRP Price Analysis. Source: TradingView

XRP Price Analysis. Source: TradingViewHowever, if selling pressure increases, XRP could fall below $2.27, slide past $2.23, and hit $2.13. Such a decline would refute the bullish scenario and confirm a deeper correction.