- Solana Expansion: WLFI partners with Bonk and Raydium on November 5th, integrating USD1 into Solana’s DeFi ecosystem to challenge USDC’s $9 billion dominance.

- Explosive Growth: USD1 stablecoin rockets from zero to $2.9 billion in seven months, becoming the sixth-largest stablecoin despite WLFI token’s 73% crash.

- Transparency Crisis: Insider trading allegations and five-month silence on reserve audits erode trust as mysterious whale profits $200M before Trump tariff announcements.

World Liberty Financial’s USD1 hits $2.9B in 7 months, partners with Solana’s Bonk and Raydium, but insider trading allegations threaten its credibility.

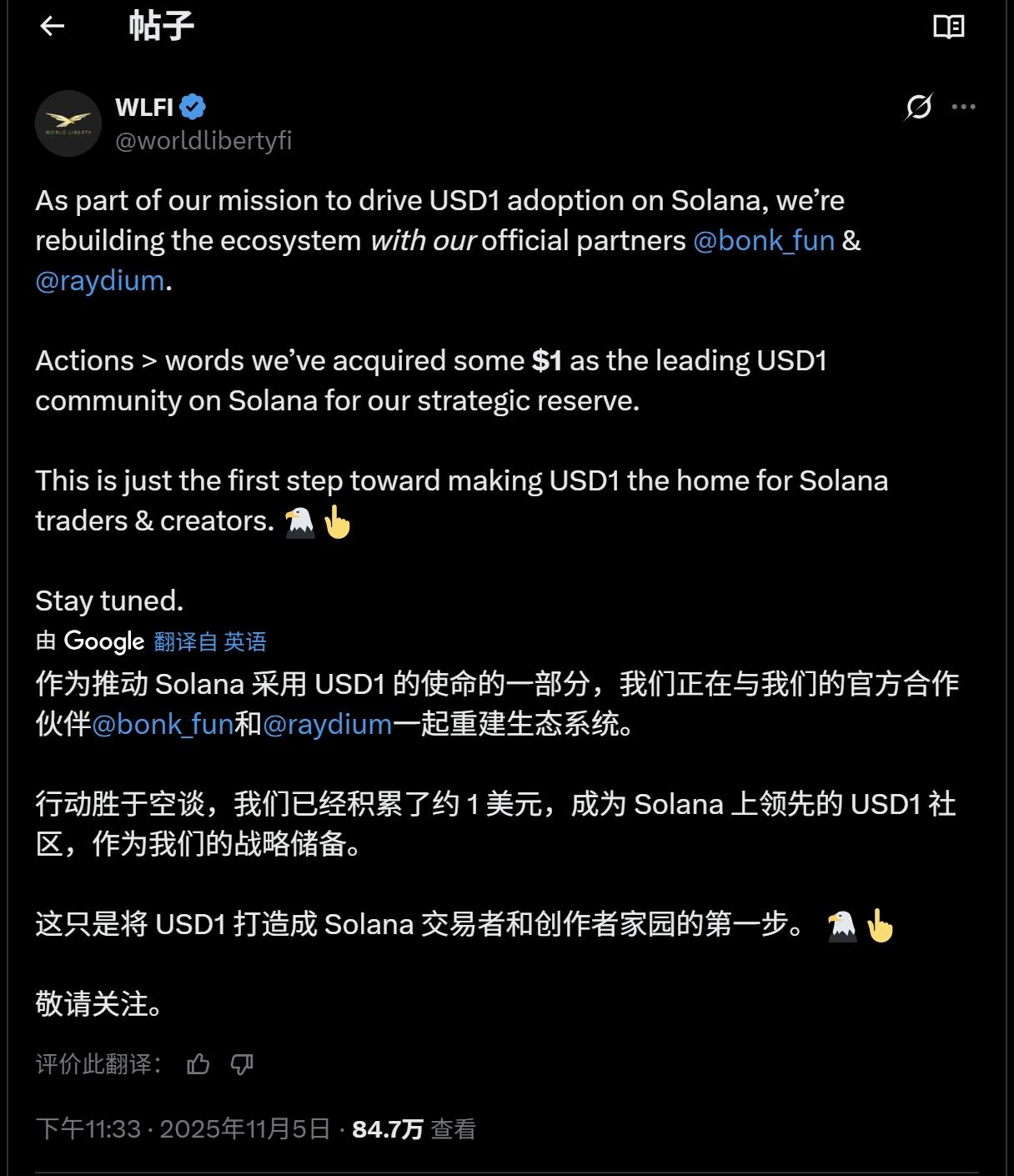

World Liberty Financial dropped a bombshell on November 5th that sent ripples through the crypto community.

The Trump-backed DeFi platform announced its partnership with Bonk and Raydium, two of Solana’s biggest players, marking a strategic push to establish its USD1 stablecoin as a major force in one of crypto’s fastest-growing ecosystems.

The move signals WLFI’s aggressive expansion beyond Ethereum and BSC, targeting Solana’s thriving DeFi landscape where USDC currently commands over $9 billion of the network’s $14.12 billion stablecoin supply.

WLFI’S ROLLERCOASTER RIDE SINCE TGE

The journey began with considerable fanfare back on September 1st when WLFI launched its token generation event.

That day saw extraordinary trading volume as early presale participants—who bought in at $0.015 and $0.05—finally got their chance to trade. The token hit an all-time high of $0.46 within hours, delivering returns exceeding 2,900% for those earliest believers. However, what goes up often comes down hard in crypto, and WLFI proved no exception to this rule.

By October 11th, the token had crashed to its all-time low of $0.091, representing a brutal 80% drawdown from peak prices. Fast forward to today, and WLFI trades around $0.122 with a market cap hovering near $3 billion. That October crash coincided with broader market turbulence triggered by Trump’s tariff announcements, but the token has since stabilized and even showed signs of recovery following the recent Solana partnership news, jumping nearly 10% in 24 hours.

The tokenomics designed into WLFI’s launch created interesting market dynamics from day one.

Only 3 billion tokens—roughly 3% of the 100 billion total supply—became tradable at TGE, while the remaining 80% of presale allocations stayed locked in the Lockbox smart contract, subject to community governance votes. This careful supply management aimed to prevent massive sell pressure, though it hasn’t stopped the token from experiencing significant volatility throughout its first three months of trading.

USD1’S EXPLOSIVE GROWTH TRAJECTORY

While the WLFI token itself has struggled to maintain momentum, the project’s USD1 stablecoin tells a remarkably different story. Launched in April 2025, USD1 has catapulted from zero to $2.91 billion in circulation within just seven months, making it the sixth-largest stablecoin globally. This blistering pace positions USD1 among the fastest-growing stablecoins of 2025, trailing only behind the established giants: Tether’s USDT ($146 billion), Circle’s USDC ($56 billion), MakerDAO’s DAI, and Sky’s USDS.

The stablecoin’s growth got a massive boost when Binance listed it on October 29th. Within days of that listing, USD1’s market cap exploded from $127 million to over $2.1 billion—an increase of more than 1,550%. The exchange simultaneously formed a dedicated task force to deepen WLFI integration, citing “strong institutional demand” for the dollar-pegged asset. Currently, the vast majority of USD1 supply sits in Binance wallets, allowing World Liberty Financial to generate approximately $80 million annually by investing these reserves in government bonds and money market funds.

The USD1 Points Program has proven particularly effective at driving adoption. Launched about two months before TGE, this loyalty platform generated over $500 million in trading activity by rewarding users who traded USD1 pairs on partner exchanges. On October 28th, WLFI announced it would distribute 8.4 million WLFI tokens to early USD1 adopters across six exchanges—Gate.io, KuCoin, LBank, HTX, Flipster, and MEXC—as a thank you for helping bootstrap liquidity.

SOLANA STRATEGY TARGETS USDC DOMINANCE

The latest Bonk and Raydium partnership represents WLFI’s most aggressive expansion move yet. Through this collaboration, USD1 will integrate into Bonk.fun’s memecoin launchpad and Raydium’s automated market maker pools, giving token creators the option to pair new launches with USD1 instead of traditional alternatives like USDC or USDT. The integration also enables trading of USD1 pairs through both platform interfaces and third-party trading bots, significantly expanding accessibility for Solana users.

This strategic push makes sense when you consider the numbers. USDC controls more than 64% of Solana’s stablecoin market, creating a massive opportunity for any competitor that can offer comparable utility with better incentives. WLFI is sweetening the deal with multi-million dollar promotional rewards for users who provide liquidity or trade USD1 pairs, leveraging the platform’s political connections and deep pockets to compete against Circle’s established dominance.

Beyond Solana, USD1 continues expanding its DeFi footprint across multiple chains. The stablecoin now operates on four major networks—Ethereum, Solana, TRON, and BNB Smart Chain—with TRON hosting roughly 85% of USD1’s market share. On October 24th, USD1 added Aptos blockchain support, further enhancing its cross-chain accessibility. The stablecoin has also integrated with lending protocols like JustLend, yield platforms through partnerships with Euler and KernelDAO, and DeFi infrastructure providers like Chainlink for price data.

INSIDER TRADING ALLEGATIONS SHAKE CONFIDENCE

However, USD1’s impressive growth story now faces serious credibility challenges stemming from widespread market manipulation concerns. The crypto community erupted with suspicion following the October 10-11 market crash, when a mysterious whale opened massive short positions on Bitcoin and Ethereum just 20-30 minutes before Trump announced shocking 100% tariffs on Chinese goods. That perfectly-timed trade netted the whale approximately $160-200 million in a single day, with many speculating the trader had advance knowledge of Trump’s policy announcement.

The timing was simply too precise to ignore. This “10.11 insider whale” shorted $1.1 billion worth of crypto right before markets tanked, leading to $19 billion in total liquidations across the industry. Social media immediately lit up with theories connecting the whale to Trump’s youngest son Barron, though no definitive proof has emerged. The whale has since denied being a “Trump insider” but continues making massive leveraged bets that seem suspiciously well-timed with Trump family announcements.

This incident wasn’t isolated, either. Senator Adam Schiff publicly called for congressional investigations into whether Trump engaged in insider trading when he posted “Now is a great time to buy!!! DJT” on Truth Social in April, just hours before announcing a 90-day tariff pause that sent the S&P 500 soaring 9.5% in a single day. Trump personally gained approximately $410 million from that move through his holdings in Trump Media & Technology Group. CNN’s Abby Phillip described Trump’s prediction betting market venture as “insider trading by another name,” highlighting how political power creates unprecedented opportunities for market manipulation.

TRANSPARENCY CONCERNS MOUNT

These insider trading controversies have amplified existing concerns about USD1’s transparency—or rather, its troubling lack thereof. Unlike USDT, which publishes quarterly attestations, and USDC, which provides monthly reserve reports, USD1 hasn’t released any reserve documentation since July 2025 despite its $2.9 billion market cap. This five-month silence stands in stark contrast to the stablecoin’s claims of “full transparency with monthly attestation reports” prominently featured on World Liberty Financial’s website.

The opacity becomes even more concerning when you consider USD1 maintains zero excess reserves, unlike most major stablecoins that hold surplus capital as a safety buffer. While USD1 is supposedly backed 1:1 by U.S. Treasury bills, dollar deposits, and money market funds managed by Fidelity Investments—with custody provided by BitGo Trust Company—the absence of independent verification leaves users taking these claims on faith. Approximately 78% of USD1 supply sits in offshore exchange wallets, further complicating efforts to verify proper backing.

Market data reveals another red flag: USD1’s trading volume turnover rate sits at just 15.1%, dramatically lower than USDC’s approximately 50% turnover. This suggests the stablecoin primarily functions as a reserve asset rather than an actively traded medium of exchange, raising questions about whether its $2.9 billion market cap accurately reflects genuine demand or whether it’s inflated by strategic holdings and political maneuvering.

The combination of insider trading allegations, lack of reserve audits, political conflicts of interest, and the Trump family’s documented history of market manipulation creates a perfect storm of credibility issues. If future investigations reveal that Trump associates profited from insider information while promoting USD1 and WLFI, the regulatory and reputational fallout could be severe. With the GENIUS Act expected to establish comprehensive stablecoin regulations by 2027, USD1’s current opacity may become legally untenable, forcing either dramatic transparency improvements or potential regulatory action.

For now, USD1’s growth continues unabated, driven by exchange listings, DeFi integrations, and the Trump family’s unparalleled ability to generate attention. Whether this momentum can survive mounting scrutiny over market manipulation and transparency failures remains the billion-dollar question facing World Liberty Financial as it charges into 2026.

〈WLFI Partners Solana as USD1 Hits $3B Amid Insider Fears〉這篇文章最早發佈於《CoinRank》。