This week, the cryptocurrency market witnessed a strong surge led by established Altcoin. Projects launched before 2022, including ZEC, FET, FIL, and ICP, collectively rallied, dominating Binance's top ten gainers list. This rally finally offered a glimmer of hope to long-time investors. Notably, on November 8th, excluding the top ten cryptocurrencies by market capitalization, Altcoin contributed 37% of total trading volume, but their market capitalization accounted for only 7.3%. This significant imbalance indicates a rapid influx of funds into established Altcoin, with market risk appetite surging dramatically.

Why might an epic market shift occur now? The core reason is that two key signals that trigger a style shift have been met simultaneously for the first time: First, the dramatic fluctuations on October 11th have completely restructured the market, laying the foundation for a new trend; second, a leading stock capable of garnering market consensus and continuously guiding the direction has emerged.

First, although the divergence between Bitcoin and Altcoin will eventually converge, the shift in market style is often accompanied by sharp pain rather than a smooth transition. The fundamental reason is that for funds to complete a "high-low switch," two stringent conditions must be met: funds speculating on Bitcoin trends must be transferred, and historical trapped positions in the Altcoin market must be fully cleared.

The crash on October 11th was the catalyst for this process: a large number of long-held low-leverage positions (i.e., positions held by seasoned investors) were forcibly liquidated in the extreme drop, greatly relieving Altcoin of their historical burdens. From then on, the Altcoin/ Bitcoin exchange rate began to bottom out and strengthen, indicating that the channel for capital shifting had been opened.

Secondly, established Altcoin like ZEC, DASH, and ICP have ignited market sentiment with their explosive price increases. The deeper significance lies in validating the market principle that "the height of the leading coin determines the height of the market rally"—the strong performance of leading coins opens up valuation space for the entire sector, driving the spread of profit-making opportunities. This pattern closely resembles the market performance in February 2024, when AI leaders like RENDER, WLD, and ARKM also kicked off the previous altcoin boom with gains exceeding tenfold. The current market seems to be replaying this historical scenario.

So why are most of these established Altcoin that lead the market trends projects launched before the 2022 bear market?

1. They possess healthier valuation and asset structure: These projects have not only undergone a full bear market reshuffling, significantly squeezing out valuation bubbles, but their token economies are also more mature. Most have a circulating supply exceeding 80%, and the VC and team shares have been largely unlocked within three years, significantly releasing potential selling pressure and clearing structural obstacles for price increases.

2. The "Sedimentation Effect" of Capital Cycles Drives Value Reversion: History shows that after each wave of capital investment, although bubbles burst, the core investments ultimately yield true winners. Just as 12% of companies embarked on long-term growth after the 2000 dot-com bubble, the achievements of the 2020-2021 crypto investment boom should not be solely attributed to the SOL case. The market needs more projects from that era to realize their value; this is an inherent requirement of the capital cycle.

3. The technological cycle lull reinforced its "first-mover advantage": This cycle lacked disruptive innovations like the DeFi Summer, with most new projects being technological improvements. In this context, established projects that have withstood the test of time and possess mature ecosystems and community consensus have built up a strong moat with their accumulated brand recognition and infrastructure, becoming the preferred choice for funds seeking certainty amidst uncertainty.

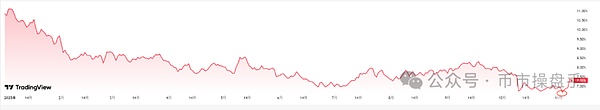

On October 11th, the market capitalization of Altcoin(excluding the top ten) plummeted to 6.05%, a record low since the ICO boom of July 2017. Behind this extreme figure lies a serious question concerning the future of the industry: if the Altcoin ecosystem, which carries the vast majority of technological applications and innovative attempts, is abandoned by the market, then blockchain may degenerate into a "digital gold" system with only a store of value function and no widespread application vitality, and its grand narrative of the "Internet of Value" will collapse. A true bull market must be built on the prosperity of Altcoin, which are quietly building themselves in countless scenarios such as DeFi, gaming, and social networking, in addition to Bitcoin, Ethereum, and Solana. They are key to realizing the transformation of blockchain from a "ledger" to a "platform." Therefore, the current extremely low market share is not the end, but rather a historic opportunity to re-price the future of blockchain applications.

In classic technical analysis, the "sudden surge" pattern often manifests as a sudden, massive bullish candlestick appearing after a prolonged period of low-volume consolidation at the bottom. This price action is far from ordinary fluctuation; rather, it's a strong signal of a fundamental reversal in market trends. It signifies the instantaneous release of pent-up long momentum, reflecting a consensus among major investors who have begun a strong entry into the market.

Observing the recent strong performance of established Altcoin such as ZEC and ICP, their typical "sudden surge" pattern precisely confirms that this is not a short-term drive by retail investor sentiment, but rather an organized and large-scale collective accumulation behavior by institutional funds based on a consensus on the potential for valuation repair.

For ordinary investors, accurately predicting trend reversals is certainly difficult, but actively following the trend signals when they are already clear is often the safest strategy to avoid subjective misjudgments and seize market opportunities.