Solana ’s price continues to fall, extending losses for investors and reinforcing the ongoing bearish trend in the broader cryptocurrency market.

Despite some recovery in the past few months, the altcoin is now facing increased downward pressure. Its close correlation with Bitcoin may be the main factor pushing Solana to its recent weakness.

Solana Relies on Bitcoin

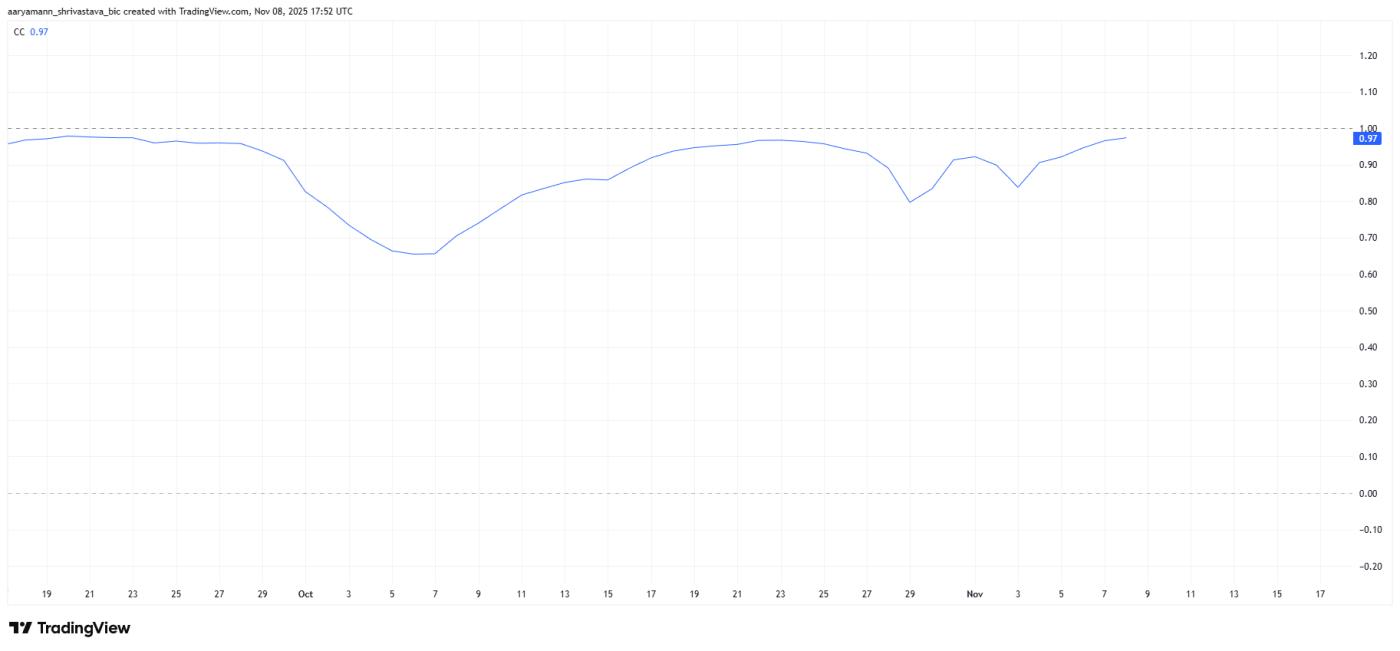

The correlation between Solana and Bitcoin is currently at an extremely high 0.97, which means that SOL 's price movements almost mirror those of the world's largest cryptocurrency. This correlation means that any weakness in Bitcoin's market performance directly affects the direction of Solana's movements .

As Bitcoin hovers near $100,000 and struggles to break higher, Solana 's price faces the risk of further decline.

The lack of bullish momentum from Bitcoin translates into stagnation for SOL, limiting the Token 's independent growth potential and raising concerns about its short-term stability.

Want more information about Token like this? Sign up for Editor Harsh Notariya's daily Crypto Newsletter here .

Correlation between Solana and Bitcoin. Source: TradingView

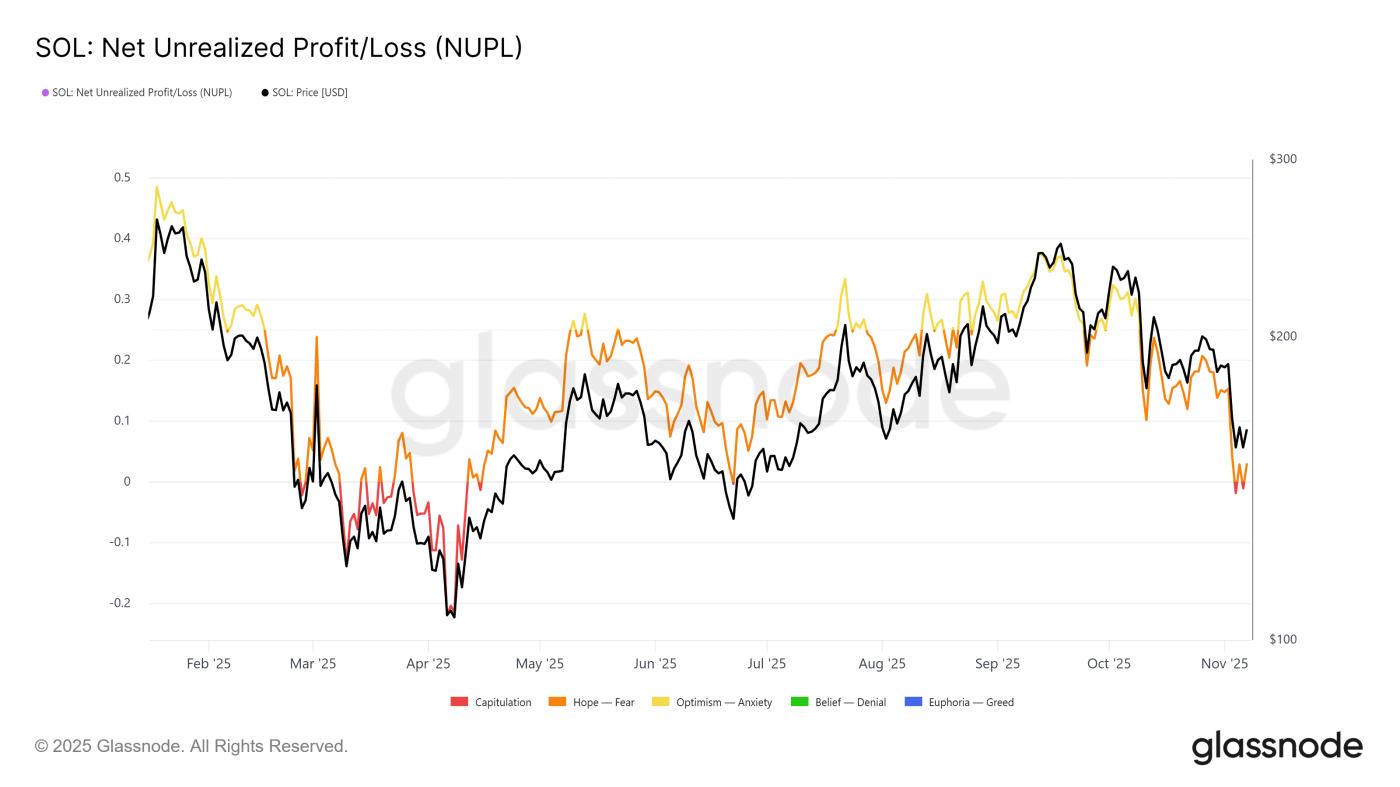

Correlation between Solana and Bitcoin. Source: TradingViewFrom a macro perspective, Solana 's Unrealized Profit and Loss (NUPL) has entered weakness territory, signaling investor caution.

Historically, dips into this area have marked important turning points for Solana , as investors typically hold rather than sell at a loss, slowing further declines.

Solana ’s NUPL is currently in a bearish zone. However, given its strong correlation with Bitcoin, this indicator could deepen if BTC ’s weakness continues.

Ironically, this decline could create the conditions for a recovery, as periods of weakness have historically led to accumulation and rallies for SOL.

Solana NUPL. Source: Glassnode

Solana NUPL. Source: GlassnodeSOL price may rise again

At the time of writing, Solana is trading at $157, extending its month-long downtrend. The Token ’s performance is dependent on Bitcoin’s volatility, making further price declines likely if BTC fails to stabilize.

In the short term, Solana could face further downside pressure, falling to $150 or even $146. Such a drop could spark buying interest, helping SOL recover to $163 and possibly $175 as confidence returns.

Solana Price Analysis. Source: TradingView

Solana Price Analysis. Source: TradingViewHowever, if Bitcoin continues to fall, Solana ’s downtrend could intensify. A break above $146 could push the Token down to $140, deepening investor losses and undermining any bullish recovery in the near future.