Hyperliquid’s native Token , HYPE, is showing signs of weakness following recent market volatility. After several failed recovery attempts, the altcoin is struggling to stay above key support levels.

While short-term traders expect a potential recovery, technical indicators suggest long-term traders should be cautious.

Traders on Hyperliquid may face losses

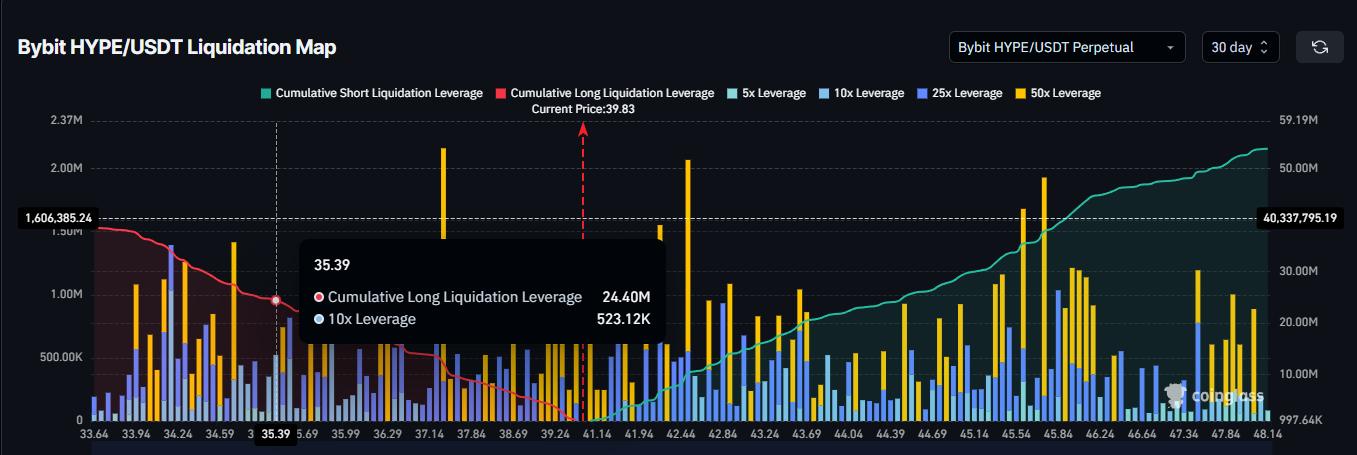

The liquidation map reveals that HYPE long traders could face up to $24.40 million in liquidations if the Token falls to the key monthly support level of $35.30. This would be a major risk as it could trigger widespread position closing among leveraged traders.

What makes this situation more worrying is that this level has been tested twice in the past month. A third test could dampen market confidence and discourage new long positions, leaving HYPE vulnerable to increased volatility and downward price pressure.

Want more in-depth information on Token like this? Sign up for Editor Harsh Notariya's Daily Crypto Newsletter here .

HYPE Liquidation Map. Source: Coinglass

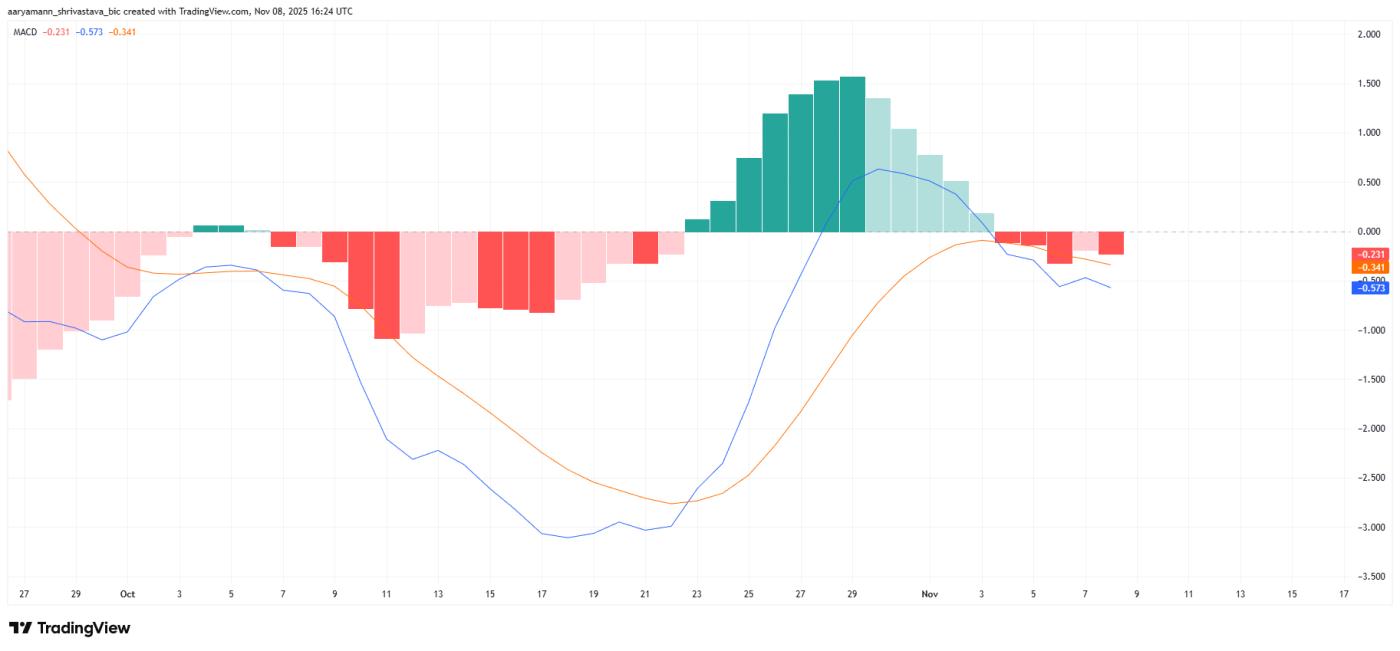

HYPE Liquidation Map. Source: CoinglassThe Moving Average Convergence Divergence (MACD) indicator is giving an early warning of increasing bearish momentum.

A recent bearish crossover has occurred, suggesting that selling pressure may continue. While the current downturn is not severe, the loss of market sentiment could add to losses.

If broader crypto market sentiment deteriorates, HYPE may struggle to maintain its current trading range. A deeper downtrend could prolong recovery efforts, forcing traders to exit before conditions improve. Conversely, stability in the Bitcoin and altcoin markets could ease selling pressure on HYPE.

HYPE MACD. Source: TradingView

HYPE MACD. Source: TradingViewHYPE price may drop to support level

HYPE is trading at $39.9 at the time of writing, trading in a tight range between $42.4 and $38.4. Opportunities for a bullish breakout appear limited unless market sentiment improves significantly and buyers return.

If the bearish conditions persist, HYPE could lose support at $38.40, retesting $35.30. A break below this level could trigger millions of dollars in long liquidations, intensifying the decline and delaying any recovery attempt.

HYPE Price Analysis. Source: TradingView

HYPE Price Analysis. Source: TradingViewConversely, if positive momentum builds and investor support becomes stronger, HYPE could attempt to clear the $42.2 resistance.

Successfully converting this level into support could send the altcoin up to $47.1, invalidating the bearish sentiment and restoring optimism among traders.