on-chain data shows that institutional investors have been buying Bitcoin and Ethereum heavily during the recent bear market.

The increased activity of these institutions suggests potential stabilization and reversal of the recent downtrend.

Bitcoin demand hits record high in 48 hours

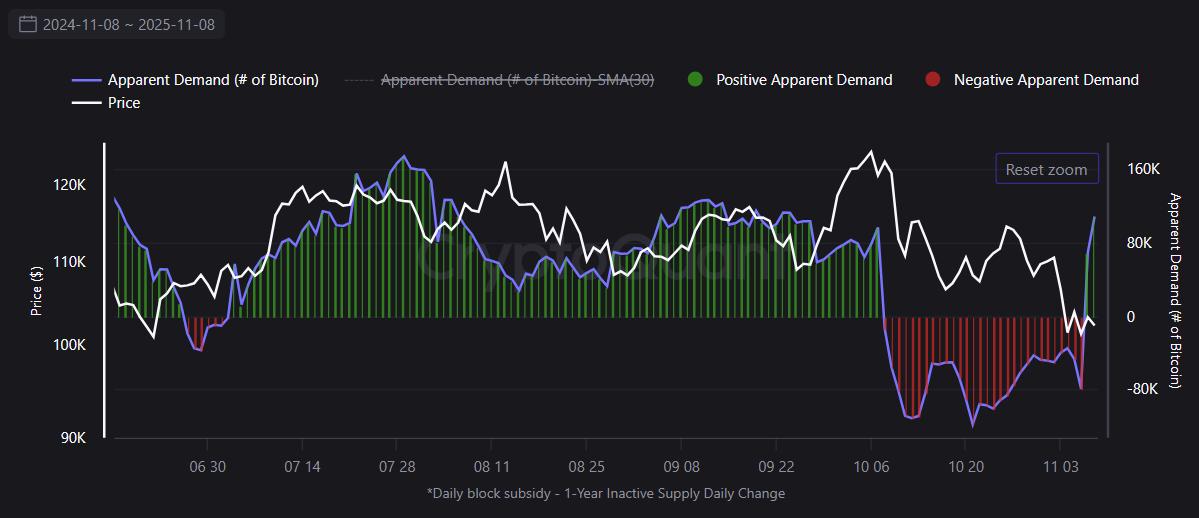

According to CryptoQuant’s “Bitcoin: Apparent Demand (30-day sum)” indicator, net Bitcoin buy demand surged from -79,085k BTC on November 6 to +108,5819k BTC two days later. This surge was the strongest movement recorded in the indicator all year.

The 'Apparent Demand' index compares Bitcoin production (supply) with the behavior of long-term holders (LTHs). This comparison measures the true strength of net buying demand.

Bitcoin: Apparent Demand (30-day sum). Source: CryptoQuant

Bitcoin: Apparent Demand (30-day sum). Source: CryptoQuantIt tracks cumulative net demand over the past 30 days, using on-chain movements of spot BTC . This method helps analysts differentiate between speculative, price-driven Capital and true structural accumulation. Because large investors use it to identify activity.

Historically, the move from negative to positive is known as a “pivot point.” This event signals the entry of new institutional Capital and is often a precursor to a major price recovery or the establishment of a solid base of support. The larger the change in the index, the higher the probability that large investor demand has stepped in. Notably, the index remained negative from its decline on October 8, just before the crash on October 10, until it returned to positive on November 7.

Whale Activity Spikes as Ethereum Dip

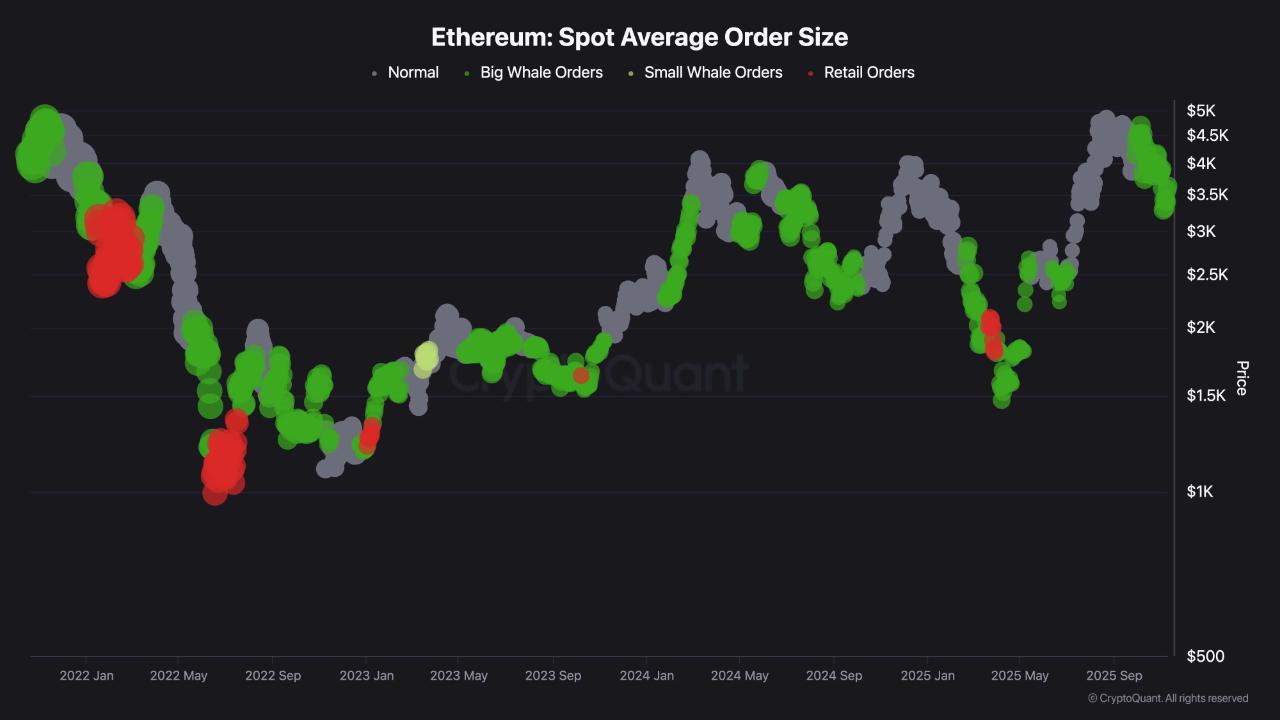

Evidence of institutional buying has also been noted in Ethereum’s on-chain data. CryptoQuant analyst ShayanMarkets revealed in a report on Monday that a short-term increase in whale activity was detected during ETH drop to $3.2K.

Ethereum: Spot Average Order Size. Source: CryptoQuant

Ethereum: Spot Average Order Size. Source: CryptoQuantAnalysis shows that whale order activity (green) was previously concentrated at the short-term low in April . A similar pattern was observed during the recent drop from $4.5K to $3.2K.

ShayanMarkets assesses this shift: “This shift implies that large market participants are returning to participate at discounted prices, while retail investors remain cautious.”

The analyst also hinted at a bullish scenario ahead. He said that if this behavior continues and the $3K–$3.4K zone holds as structural support, Ethereum could be entering a low-volatility consolidation zone, preparing for an eventual upside push towards $4.5K–$4.8K.