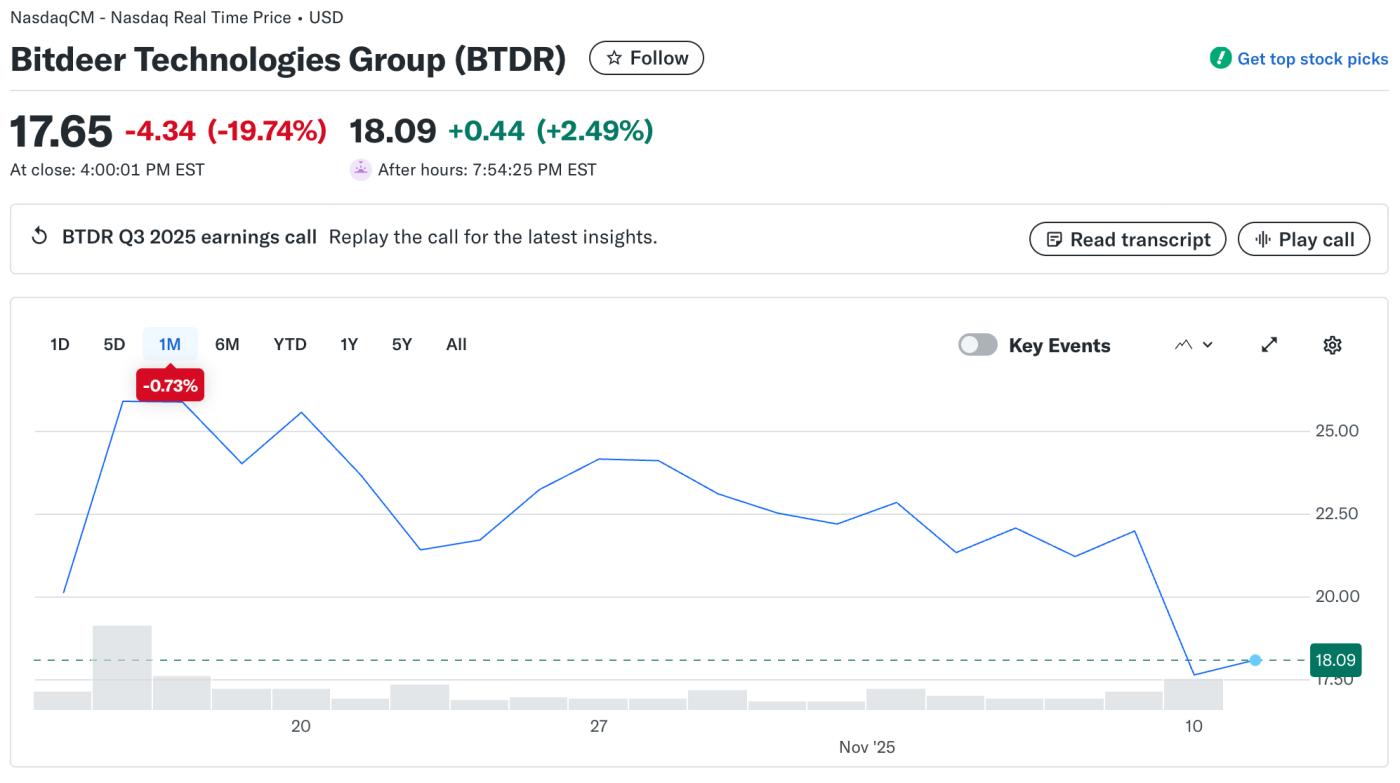

Bitdeer Technologies shares fell nearly 32% to close at $17.65 after reporting a $266 million quarterly loss. The decline followed a 30% gain on October 15, when the stock hit $25.90, on investor optimism about its data center expansion and AI plans.

The development highlights the tension between revenue growth and Bitcoin production, along with the impact of non-cash losses, Capital expenditures and large-scale infrastructure investments on profits.

October growth spurt fueled by AI and infrastructure expansion

Bitdeer (NASDAQ: BTDR) shares surged more than 30% to $25.90 on October 15 after announcing plans to expand into AI and high-performance computing (HPC). On Monday, BTDR shares fell to $17.65, marking a nearly 32% decline from their October peak.

Bitdeer Stock Price: Yahoo Finance

Bitdeer Stock Price: Yahoo FinanceThe company said it will allocate 200 MW of power to AI services. It aims to exceed $2 billion in annual revenue by 2026. Bitdeer also added 241,000 mining machines in Norway, the US, and Asia. The company mined 1,109 BTC this quarter.

The expansion places Bitdeer alongside other miners like MARA, IREN, and Core Scientific, which are increasingly integrating AI and HPC capabilities. Investors initially responded positively, XEM the diversification into AI as a way to offset volatility in Bitcoin mining margins.

Quarterly losses and market reaction

Bitdeer has released its unaudited Q3 2025 results, with revenue up 174% year-over-year to $169.7 million. Adjusted EBITDA was $43 million. The growth reflects higher Bitcoin production and improved efficiency from expanded self-mining.

“Q3 marked a strong and financially successful quarter. Revenue, gross profit, and adjusted EBITDA all improved significantly. The performance improvement was driven by our organic mining expansion. The 200 MW allocation to AI cloud services could generate annual revenue exceeding $2 billion by the end of 2026,” said Matt Kong, Chief Business Officer at Bitdeer.

However, optimism was turned upside down when the company reported a net loss of $266.7 million , compared with a loss of $50.1 million in the same period last year, mainly due to non-cash revaluation losses on convertible debt and higher operating costs.

Despite increased mining and infrastructure expansion, including an AI conversion that generated $1.8 million in revenue, investors focused on the impact of these paper losses. Bitdeer shares fell nearly 30% on the NASDAQ following the report.

Continued AI Transformation and Operational Highlights

In October, Bitdeer continued to make progress in building its AI-focused infrastructure. Operational data confirmed increased production capacity and growing Hash rate, indicating the company's intention to expand its AI-related work while maintaining its mining operations. However, Q3 results showed that financial pressures from Capital -intensive expansion and market volatility weighed on short-term investor sentiment.