The US government shutdown has officially ended, but the capital markets have not seen a rebound.

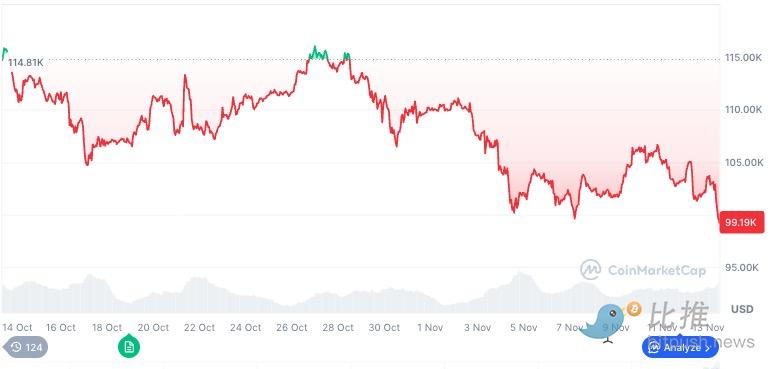

On Thursday, local time, all three major U.S. stock indexes fell sharply, with the Nasdaq down more than 2% and the S&P 500 closing down 1.3%. Gold broke through a key support level, and Bitcoin suffered a severe blow, briefly falling below the $99,000 mark. This is the third time this month that Bitcoin has fallen below the $100,000 mark, and market sentiment has slipped from its highs, returning to the "extreme fear" zone.

This long-awaited "government resumption of operations" has not alleviated structural pressures in the market:

Tightening liquidity , concentrated selling by long-term holders, continuous outflows from ETFs , and a rapid cooling of expectations for interest rate cuts.

Bitcoin fell again, mainly due to a sharp drop in risk appetite in the US stock market.

Bitcoin prices rebounded to around $104,000 during Asian trading hours, but quickly weakened during US trading hours, falling below the $100,000 mark in the afternoon and hitting a low of $98,000.

This trend is highly consistent with the synchronized decline of US tech stocks:

Nasdaq plunges

Crypto-related stocks such as Coinbase and Robinhood generally declined.

Mining stocks fared even worse, with Bitdeer plummeting 19% in a single day, Bitfarms falling 13%, and several other mining companies experiencing declines exceeding 10%.

The large-scale outflow of funds from high-beta assets is essentially a decline in risk appetite caused by the cooling of expectations for interest rate cuts .

Last week, the market believed there was an 85% chance of a rate cut in December, but now, FedWatch data shows that the probability has fallen to 66.9% .

With future "cheap money" uncertain, asset prices are naturally difficult to sustain.

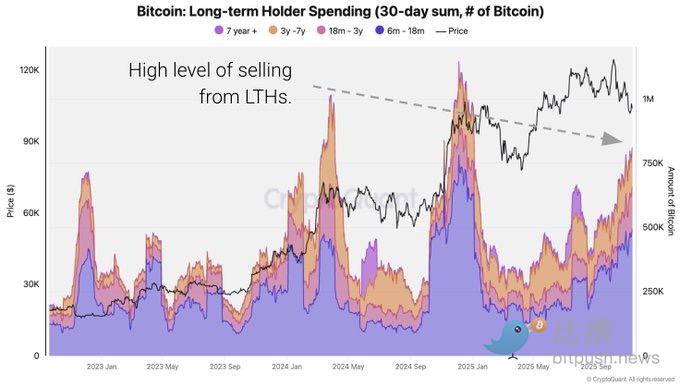

On-chain selling pressure was concentrated: LTH profit-taking combined with whale selling led to a synchronized downward trend.

The recent drop in Bitcoin below $100,000 was not caused by panic among retail investors, but rather by a typical structural adjustment resulting from the simultaneous reduction of holdings by medium- and long-term funds on the blockchain .

CryptoQuant data shows that long-term holders (LTH) sold a total of approximately 815,000 BTC in the past 30 days , marking the largest sell-off since January 2024. On November 7th alone, on-chain profits reached $3 billion , highly similar to key profit-taking periods in the middle of the 2021 and 2020 bull markets.

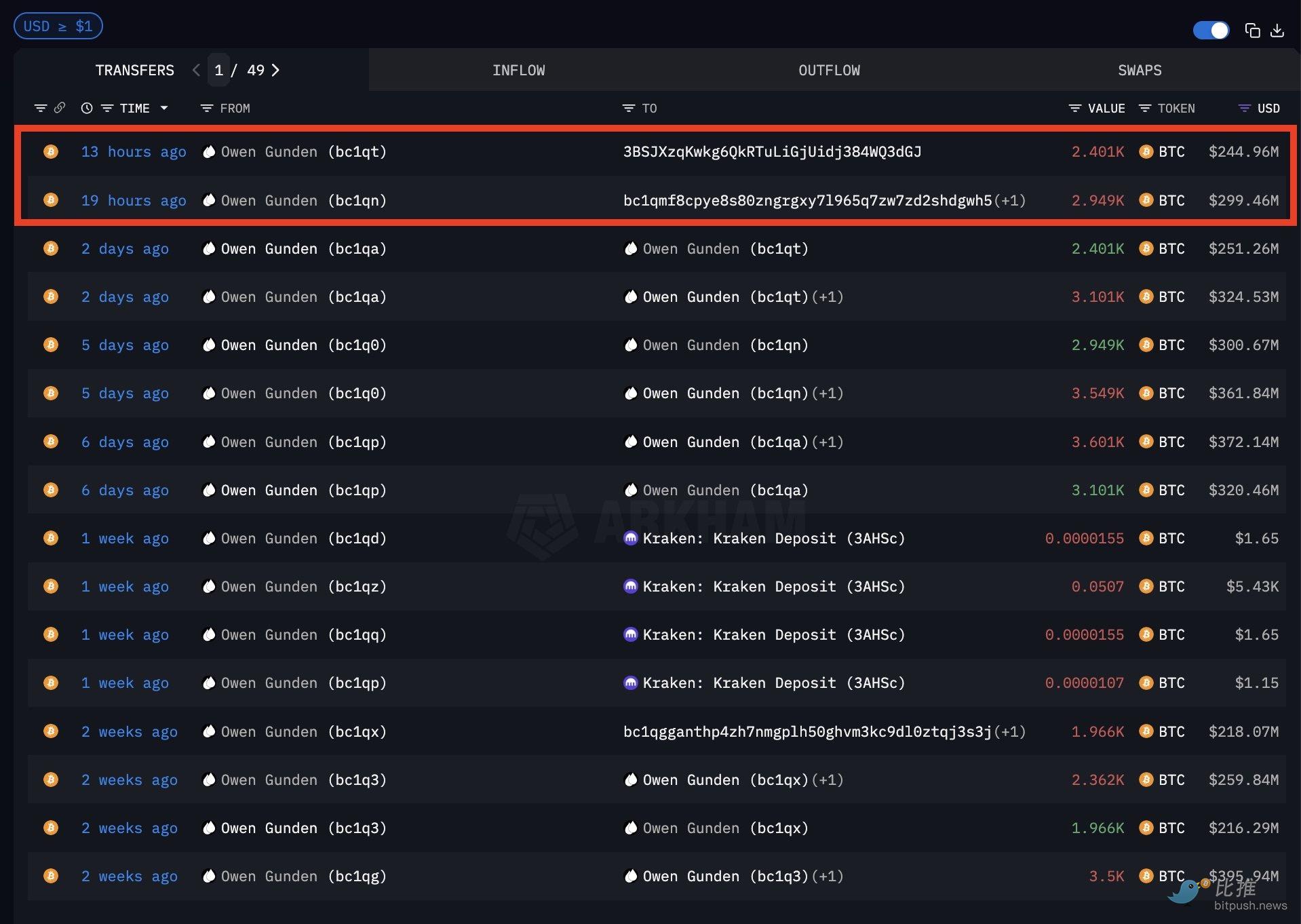

At the same time, whale behavior increased significantly , accelerating the downward pressure.

Arkham tracked down:

Early Bitcoin whale Owen Gunden sold approximately $290 million worth of Bitcoin in a single day, but still holds $250 million in assets;

A Satoshi-era whale who had held cryptocurrency for nearly 15 years sold off approximately $1.5 billion worth of its holdings last week.

In October, the large address 195DJ also sold a total of 13,004 BTC and continued to transfer tokens to exchanges.

The increased frequency of large on-chain transactions indicates that major holders are transferring some of their tokens to exchanges in preparation for profit-taking . The combined forces of LTH selling and whale selling pressure constitute the core structure of this round of adjustments.

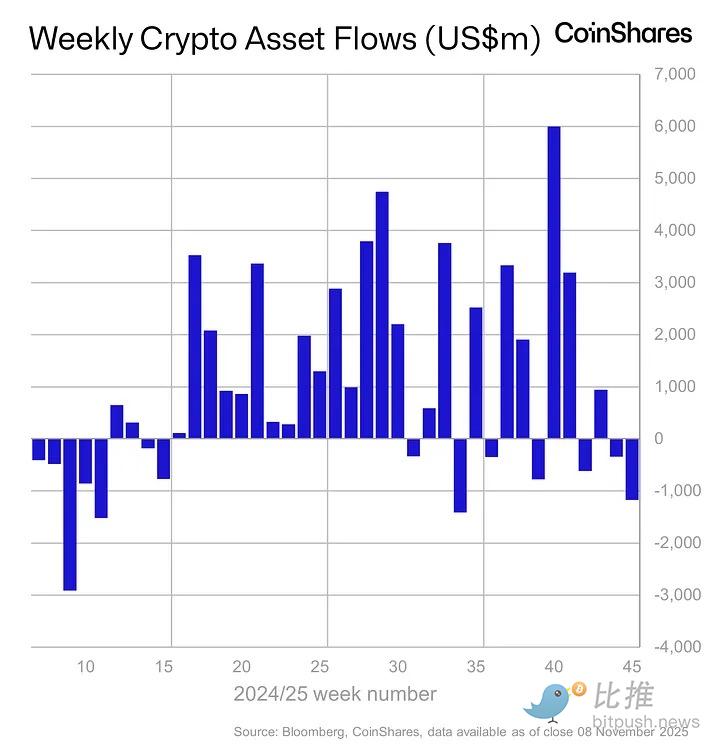

ETF/ETP funds continue to flow out, with the US market under the heaviest pressure.

According to a CoinShares report, global digital asset investment products have seen significant capital outflows for the second consecutive week, with a net outflow of $1.17 billion last week. Most of the outflows occurred in the US market, amounting to $1.22 billion, while the European market (Germany and Switzerland) still recorded a net inflow of approximately $90 million, showing a stark divergence.

Bitcoin and Ethereum are the main battlegrounds for this round of capital withdrawal.

Bitcoin products saw a net outflow of $932 million.

Ethereum products saw a net outflow of $438 million.

During the same period, short Bitcoin products recorded a net inflow of $11.8 million, the highest level since May 2025.

ETFs contributed significantly to Bitcoin's upward momentum in 2025, and when this buying activity stalled and turned into outflows, prices naturally came under pressure.

Facing dual pressures at the macro level, liquidity remains "dry."

At the same time, the market is facing two macroeconomic headwinds: "tightening fiscal liquidity" and "cooling expectations for monetary policy".

On the one hand, the government shutdown led to a significant reduction in fiscal spending, creating a rare temporary surplus. Market observer Mel Mattison pointed out that the US federal government recorded a fiscal surplus of approximately $19.8 billion in September, and the surplus may be even higher in October due to the large-scale shutdown in Washington. This means that the "fiscal deficit liquidity" that originally supported the performance of risky assets was temporarily withdrawn, forcing the market into a period of tight liquidity.

Mattison described the current situation as "one of the driest fiscal liquidity environments in months, even years." This is why the news of the government resuming operations did not trigger a market rebound, but instead continued to weaken.

On the other hand, investor confidence in a December rate cut by the Federal Reserve is rapidly waning. Last week, the market gave it an over 80% probability of a rate cut, but now, under the dual pressures of weak employment and sticky inflation, the probability has fallen back to the 60%–65% range. In his latest speech, Fed official Hamak stated that monetary policy still needs to remain tight to curb inflation.

Fiscal liquidity shortages and a cooling monetary policy have jointly compressed the market's valuation space for risky assets. Bitcoin's multiple rapid drops during the US trading session are a typical reaction to the simultaneous tightening of macro liquidity.

However, Mel Mattison believes this "dry period" will not last long:

"The fiscal floodgates will be reopened next, and the Trump administration will need to release massive stimulus before the midterm elections."

Can it reach a new high this year?

Bitcoin is currently hovering below its 365-day moving average. CryptoQuant views this as a key trend support level for the current bull market: once it returns above the moving average, the price is expected to strengthen again; if it continues to be under pressure, a mid-term pullback similar to that of September 2021 may occur.

The Fear & Greed Index has fallen to 15 (extreme fear), which is highly similar to the deep shakeout phases in the middle of past bull markets.

From a comprehensive perspective, considering macroeconomic, on-chain, ETF, and technical signals, the likelihood of breaking the $126,000 high this year has significantly decreased. Currently, the market lacks short-term incremental funds, and selling by medium- to long-term holders continues; the window for a liquidity recovery has not truly opened.

Bitcoin is more likely to fluctuate between $95,000 and $110,000 before the end of the year.

Unless three things happen simultaneously—

ETF funds have turned into net inflows again.

The US government has introduced a clear fiscal stimulus package.

US Treasury yields fell significantly and dollar liquidity improved.

—Only then will BTC have the conditions to retest new highs. However, considering the time window and policy pace, these factors are more likely to be concentrated in early 2026 rather than the end of 2025.

Looking ahead to 2026: Liquidity and cycles may resonate.

Despite short-term pressures, the medium- to long-term fundamentals remain robust, and 2026 may even become the "resonance year" of this cycle.

1) Macro liquidity may be on a real turnaround. With the US economy slowing and employment weakening, the probability of the Federal Reserve entering a substantial interest rate cut cycle in 2026-2027 is increasing. Once monetary policy truly eases, the valuation space for risky assets will be reopened.

2) ETFs are the main channel for the next round of capital inflows.

The ETFs of 2025 have already demonstrated the allocation power of traditional institutions , and during the interest rate cut cycle, the entry of medium- and long-term capital such as pension funds, global asset management institutions, and RIAs will further change the valuation framework of Bitcoin.

3) 2026 is the "second year after the halving " - the strongest window in history. In the past three cycles (2013, 2017, 2021), Bitcoin has made even greater breakthroughs in the second year after the halving.

The periodic position of 2026 completely overlaps with it.

Taking all the above factors into account, our forecast for the 2026 range is as follows:

Basic target range: $160,000 – $240,000

If liquidity is extremely loose and the number of ETF institutions expands, then an upper limit of $260,000 to $320,000 cannot be ruled out.

Therefore, what will truly determine the next peak for Bitcoin will be the resonance between macroeconomic conditions and capital flows in 2026.

Author: Bootly

Twitter: https://twitter.com/BitpushNewsCN

BitPush Telegram Community Group: https://t.me/BitPushCommunity

Subscribe to Bitpush Telegram: https://t.me/bitpush