The recent Alpha Arena trading competition initiated by Nof1.AI has caused a sensation, seemingly becoming the AI Aha! moment in the investment world.

In this 17-day competition, traders who frequently bought and sold various assets were replaced by AI: Alibaba's Qwen 3 Max stood out, winning the championship with a return of 23%; DeepSeek V 3.1 from Magic Square Quant took second place with a return of 4.9%. Meanwhile, well-known large-scale models such as Claude Sonnet 4.5, Google Gemini 2.5 Pro, X Grok 4, and OpenAI GPT-5 suffered losses at an all-time high.

Despite the less-than-ideal short-term performance of some large AI models in this round of on-chain transaction competition, the UXUY team realized that AI is redefining the way we trade and reshaping on-chain transactions.

Alpha Arena competition: Trend chart of total trading account value for various AI models

The debate about AI making money continues, forcing people to re-examine: Will human traders be replaced by AI? What exactly does AIGM "AI Generate Money" mean? Today, we are welcoming the AIGM era together with AI Traders.

"AIGM" uses AI to create money.

AIGM is short for AI Generate Money, a concept first proposed by UXUY's Global AI R&D Center at Hong Kong Fintech Week. As the name suggests, AIGM involves trading and earning profits directly through an AI agent. AI is no longer just a trading tool for humans, and it no longer relies on human trading instructions. The UXUY team has given this product a catchy Chinese name: "7 x 24 Automatic Money Making".

In the AIGM era, AI is the true subject of transactions.

"Teaching AI to trade" has always been a relentless pursuit, as it truly realizes humanity's long-held ultimate dream of "making money while lying down": top investment institutions such as Medallion Fund, Two Sigma, and Magic Square Quant have all invested in it. In fact, this field is becoming one of the most favored tracks for investors, with scientists with computer science and mathematics backgrounds flocking in to continuously optimize their trading models from massive amounts of trading data.

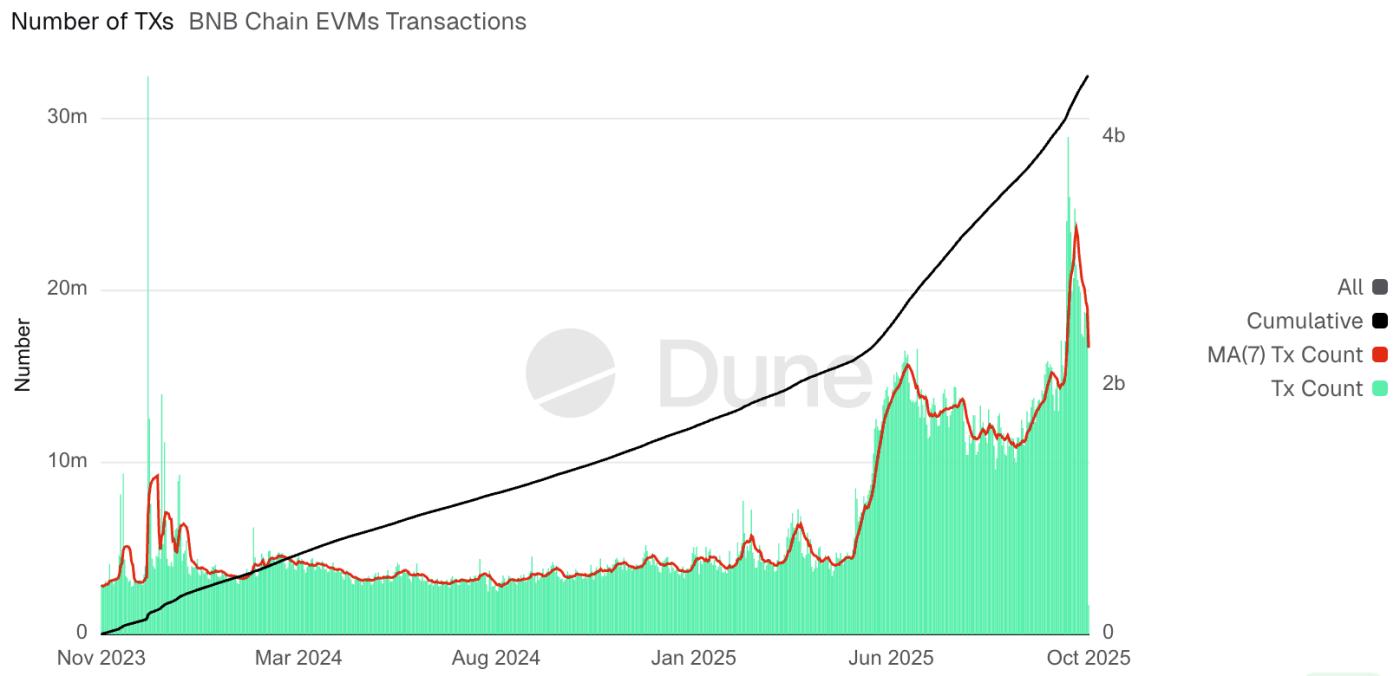

BNB Chain Transaction Volume Trend Chart

The ever-increasing volume of on-chain transaction data is fueling the development of AI trading. Unlike traditional securities trading rules, on-chain trading has no opening or closing restrictions, operates 24 hours a day, and its transaction data is publicly transparent on the blockchain. This provides UXUY with an excellent scenario for developing on-chain AI trading.

This trend is accelerating as crypto trading continues to evolve from centralized exchanges (CEXs) to decentralized exchanges (DEXs). Taking BNB Chain as an example, approximately 14 million on-chain transactions are generated daily . This massive transaction volume is providing AI with more training opportunities, making AI increasingly intelligent.

The world's first 100% stablecoin-based native AI trading platform

While continuously promoting AI trading, UXUY has gone a step further: it has achieved 100% stablecoin-based on-chain trading. Users can not only copy Smart Money and AI trading models with one click, but all of this is based on stablecoins (USDT, USDC, USD 1, etc.), which significantly lowers the trading threshold.

Seeking "Earlier Alpha Opportunities"

The role of AI is not only reflected in trading, but also in discovering profit opportunities earlier.

Every day, tens of thousands of on-chain assets are created and traded. On October 8th alone, BNB Chain's fair issuance platform, Four.meme, broke its own record again, issuing 47,875 tokens in a single day. This number will continue to increase as the on-chain ecosystem continues to thrive.

With such a massive amount of on-chain data, how can we effectively retrieve "potential on-chain assets" and complete buying and selling transactions? For humans, this may already be information overload, but for AI, it is the best "nutrients".

Machine learning is key to the rapid development of AI: without human input or instructions, AI will autonomously explore scale and conduct simulated transactions within complex data, thereby repeatedly training and improving the model's success rate. The focus of trading has long since shifted from "human monitoring" to "how to train your own AI agent."

The future world will be a "hunting ground" where humans and AI compete for money; the era of AIGM has begun. This is UXUY's opportunity, and also UXUY's adjustment. We are leveraging the opportunity of AIGM to reshape on-chain transactions.