0. Introduction

The recent industry hype has been shifted by the rise of the X402 payment track, the panic of Black Monday, Tuesday, Wednesday, Thursday, and Friday, and the rotation of the Niu Mo Legend privacy sector.

This world is so wonderful, and so noisy.

It's good to be in a bear market now, because a common mistake smart people make is trying to optimize something that shouldn't exist in the first place (from Musk). Now, we should calm down, review the brilliance of past successful products, see which competitors are making ineffective moves, and identify those who are just riding the wave. Only when the wind stops can we truly see the long-term value of the future.

If asked what the representative industry trends are this year?

My first choice is DeFi. It's been four years since the DeFi summer, and over the past 25 years, several iconic products have emerged, garnering significant attention both conceptually and in the market. The most amazing thing about this sector is that just when you think everything is done and the landscape has settled, you suddenly see certain projects emerge as dark horses, rising from the smallest details. This is true of Hyperliquid in perps and fomo in meme bots.

Aside from the challenges posed by new platforms, Uniswap, a perennial player in DeFi, continues to innovate. This article will provide an in-depth analysis of two major moves by Uniswap this week.

1. The Development History of Uniswap

If you are interested in the development process, you can refer to previous analyses:

2. Current Market Situation of Uniswap

Uniswap has processed approximately $4 trillion in transactions to date, making it the undisputed leading DEX platform.

As shown in the chart below, even with new challengers emerging in 25 years, they still account for 70-80% of the market share on the Ethereum mainnet.

In the last 25 October months, he traded approximately 138 billion. Even excluding monthly fluctuations, his average trading volume was still 60-100 billion.

Market share of various DEXs on Ethereum

However, beneath the surface of this prosperity, there are actually quite a few challengers. Uniswap's TVL is constantly decreasing, which means there are better places to stake in the market. Moreover, even though Uniswap's v3 and v4 versions have more optimizations in terms of performance, gas, and LP, they are still competing with Uniswap for a shrinking market.

Market share of different versions of Uniswap on Ethereum

And he's not the only one in the entire Dex market.

In the cross-chain swap market, UniswapX's actual performance is far inferior to that of its competitor, PancakeSwap, in terms of user experience optimization. Since 2024, its market share has been steadily eroded, and it now only holds a 20-30% market share.

However, the potential of this market should not be underestimated, as Uniswap still accounts for about 200 billion of the monthly cross-chain swap transaction volume.

EVM-based cross-chain DEX transaction volume

There are clearly a lot of problems here. The most criticized is the poor performance of the UNI token itself. Compared to its peak 21 years ago, its current state is simply appalling.

Can UNIFICATION turn the tide now?

3. UNIFICATION New Unification Proposal

UNIfication, a proposal jointly put forward by Uniswap Labs and the Uniswap Foundation, aims to completely overhaul the way Uniswap operates—from fee allocation to governance structure to token economic model.

The more important actions are as follows:

• Enable Protocol Fees and UNI Burning: Enable the built-in "fee switch" so that a portion of the transaction fees go to the protocol (instead of all to liquidity providers). This portion of the fees collected by the protocol will be used to burn UNI tokens, permanently reducing the supply of UNI. Therefore, future Uniswap usage will be directly linked to token scarcity.

• Unichain Sequencer fees will be used for burning: Uniswap now has its own Layer-2 network called Unichain. The fees earned by the Unichain Sequencer (currently generating approximately $7.5 million annually) will also be used for the UNI token burning mechanism. Therefore, every layer of Uniswap (the main exchange and its L2 chain) participates in the same burning mechanism, increasing the scarcity of the UNI token as usage grows.

• Protocol Fee Discount Auction (PFDA): A new mechanism that internalizes the Maximum Extractable Value (MEV) and enhances the returns for liquidity providers (LPs). In short, traders can bid for a temporary fee discount (i.e., trade without paying protocol fees for a short period). The highest bid (paid in UNI) is used to burn the contract. This way, MEV that would otherwise flow to bots or validators is captured by Uniswap and used to burn UNI.

• Burning 100 Million UNI Tokens (Retroactive Burn): To compensate UNI holders for the fees they "missed" during the fee conversion closure, they proposed burning 100 million UNI tokens from the Treasury in a single transaction. This is equivalent to burning approximately 16% of the circulating supply of UNI !

• No more interface/wallet fees: Uniswap Labs will stop charging fees for its products (Uniswap official web application, mobile wallet, and API).

• A growth budget of 20 million UNI per year (allocated quarterly) has been introduced for Uniswap Labs.

How should we understand this?

Okay, that's a lot of information. Let's think about it from the perspectives of different stakeholders.

3.1 For LP

Clearly, the cost is ultimately borne by the liquidity provider. For example, in Uniswap v2, transaction fees will be adjusted from 0.30% (entirely going to liquidity providers) to 0.25% going to liquidity providers and 0.05% going to the protocol. Therefore, after the protocol fees are implemented, the LP's earnings per transaction will decrease by 1/6.

While the proposal also includes the Agreement Fee Discount Auction (PFDA) scheme, which is also expanding the pie, it involves, for example, internalizing a portion of the Market Execution Value (MEV), channeling external liquidity and charging a fee, and increasing trading volume overall.

Some market analyses have calculated that this mechanism will increase LPs' earnings by approximately $0.06 to $0.26 per $10,000 of transaction volume, which is significant considering that LPs' profits are typically very low.

However, I am not so optimistic, since the return of profits from exploiting MEVs to LPs and users has always been a major challenge. LPs also simultaneously bear Impermanent Loss; see: Understanding Impermanent Loss in Dex: Principles, Mechanisms, and Formula Derivation .

3.2 For ordinary users

First, user transaction fees will be directly reduced. On one hand, high-end users can obtain fee discount coupons through the PFDA mechanism combined with auctions. On the other hand, transaction fees for using the Uniswap app page will be directly eliminated.

However, it is significant that UNI can finally benefit from Uniswap's success, because previously UNI was only a governance token and did not actually share in Uniswap's transaction fees (which were previously given to LPs).

Furthermore, UNI itself has become a deflationary asset closely related to cash flow, rather than a passive governance token.

This is clearly inspired by Hyperliquid's governance model. In a sense, destruction and buyback are analogous. (See: In-depth discussion of Hyperliquid's success and hidden risks).

3.3. Regarding Lab operations

Secondly, previously employee salaries were paid through additional fees based on app usage, but now it's done through a budget of 20 million Uni. Based on current market prices...

That's a research and development operating budget of 140 million US dollars, which is quite high.

Sometimes I wonder if he only went through all this trouble for the sake of these 2kwuni, since the scale is clearly much larger than the previous transaction fee income.

Furthermore, Uniswap Labs and the foundation will merge: the Labs responsible for protocol development and the foundation responsible for funding/governance plan to merge. Most of the foundation's team members will join the Labs, forming a joint team focused on Uniswap's development. This does seem to indicate a renewed commitment to improvement.

3.4 Is this mechanism worth being optimistic about in the long term?

Perhaps there were too many black swan events this week, as the valuation increase brought about by the destruction quickly fell back.

Putting aside these external factors, I believe that its short-term fluctuations stem from the fact that the initial announcement that everyone would quickly grasp would be destroyed, thus causing growth. However, destruction is not the source of long-term value.

Uniswap hopes that increased trading volume, MEV sharing, and other incentives will offset the impact of reduced revenue over time. How can they stabilize LP returns?

In the initial chart, we can see that long-term Uniswap LPs are gradually migrating away.

Furthermore, similarly, competitors (who also act as LPs) will have to hold a large amount of conventional tokens when staking on UNI tokens, which are often the most vulnerable to losses during black swan events, thus amplifying the Impermanent Loss of LPs. On the other hand, staking on mainstream platform tokens offers a clear annualized 4% staking yield on Ethereum, while staking on Sol yields 8% or even higher returns, taking advantage of market forces and Jito's capture of MEVA, without the worry of the Altcoin.

For details, please see: 10,000-word research report: The evolution of the MEV landscape and its merits and demerits on Solana.

Therefore, the departure of LPs will ultimately affect trading depth, increase trading slippage, and ultimately harm users.

Therefore, while the UNI-ization is arguably the biggest change Uniswap has undergone since the launch of the UNI token, it has resolved the long-standing issue of the lack of a direct correlation between the value of the UNI token and the actual performance of Uniswap.

In the long run, competition among decentralized exchanges (DEXs) over the past 25 years has been exceptionally fierce, and Uniswap's scale means its liquidity can withstand fluctuations for some time. Launching this move at this time is reasonable, but it will inevitably cause turbulence.

4. CCA (Continuous Clearing Auction)

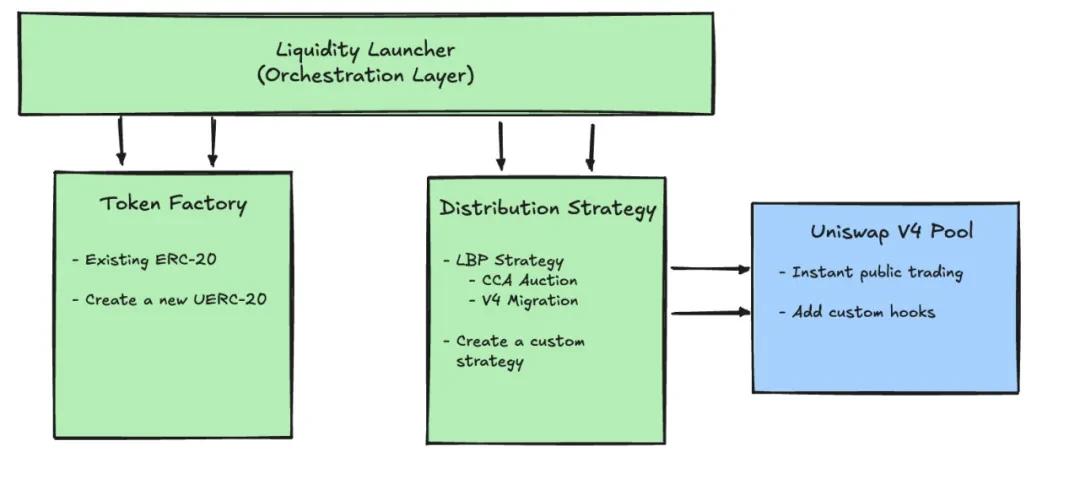

This is the new protocol CCA recently released jointly by Uniswap and Aztec. It is specifically designed for price discovery and liquidity initiation for new assets.

After the auction process is completed, the project team can import the funds and tokens raised into Uniswap v4 and directly connect to the secondary market for trading.

4.1 Evolution of Asset Pricing Schemes

In fact, how to price assets has always been a huge issue. In my previous explanation of the mechanisms of uniswapX and uniswapV2, I mentioned that, objectively speaking, uniswap's rise to prominence was due to its grasp of the demand for new asset pricing back then.

After all, the formula x*y=k for the quantity of two tokens in the on-chain AMM is the easiest way to quickly return to a reasonable price in the performance-constrained EVM architecture.

However, this mechanism is not perfect. Significant slippage, MEV attacks, and the Impermanent Loss of LP are all key factors affecting its effectiveness.

Therefore, fair price discovery and fair initial token distribution have always been major issues for DEX platforms. However, most issuances still feel like behind-the-scenes deals disguised as "community events." Insiders get certainty, while others get leftovers.

Later, various platforms also made many attempts at pricing new assets, such as team airdrops, Dutch auctions, fixed-price sales, as well as LBP, Bonding Curve, Fee mint, fair launch, and so on.

Moreover, the above solution still has flaws, such as...

1. Fixed-price sales can lead to pricing errors and disputes over priority, resulting in insufficient or unstable liquidity.

2. Dutch auctions create a time-based game, giving professionals like us an advantage over actual participants.

3. One-off auctions reduce demand and often trigger last-minute bidding wars.

4. Various curves exhibit path dependence and are easily manipulated.

4.2 Design Concept of CCA

Essentially, CCA is a protocol independent of Uniswap v4, serving as a complete issuance and pricing framework. However, it leverages Uniswap v4's hooks mechanism to connect with the AMM kernel. In the entire issuance workflow, this is represented by the CCA Auction module shown in the diagram below.

It's a configurable auction framework, and everything happens on-chain (which is much better than UniswapX). The five phases are...

It's a configurable auction framework, and everything happens on-chain (which is much better than UniswapX). The five phases are...

Configuration phase -> Bidding phase -> Allocation phase -> Liquidation phase -> Injection phase

- Configuration phase: The auction initiator first sets the rules on the chain, such as the start and end times, the total number of "rounds" or time periods in the auction, the proportion of tokens released in each time period, the minimum price (floor price), and additional configurations, such as whether whitelisting/identity verification is required, and how to import liquidity into Uniswap v4 after the auction ends, etc.

- Bidding phase: During the auction, participants can place bids at any time. Each bid includes two parameters: how much money to invest and the highest acceptable unit price.

- Spreading Phase: The system will automatically spread a bid across the remaining "release periods". Therefore, the earlier you bid, the longer the time you participate, and the more rounds you have the opportunity to participate in the liquidation.

- Liquidation Phase: In each round, the system accumulates all valid offers for that round and then uses a unified rule to find a price that can sell all the tokens to be released in that round, which is the final transaction price for that round.

- Injection Phase: After the auction ends, participants can claim their tokens and the funds from the unsold transactions. The protocol then injects the raised assets and the other side's assets prepared by the project team into Uniswap v4 according to the pre-agreed strategy, officially opening the liquidity pool in the secondary market.

4.3 How to understand

In summary, it essentially involves dividing a one-time auction into multiple smaller auctions, distributing the game-playing process across these multiple auctions. This addresses the previous issue where a large number of transactions were completed in the last second (before the block was generated), turning the auction into a black box.

But is that good enough?

Clearly, the complexity will deter many new coins from launching on this platform. It also reduces efficiency. Objectively speaking, Uniswap's auction logic has been unsuccessful since version X, and too many DeFi protocols leave complexity to the user.

In my opinion, this approach is difficult to replicate as the success of Uniswap V1, where 200 lines of code rewrote the history of new coin issuance and pricing. Furthermore, it relies on V4, and as the data above shows, its development lags behind mainstream V2 and V3 versions by a factor of five.

5. On Asset Growth and Value Discovery

Regarding asset growth, what I've discussed so far has been the initial pricing platform. I'd like to add some information about the pricing logic in the mid-to-large development stage.

Although trading financial derivatives, especially perpetual platforms, is the most profitable of all trading channels.

Many people are initially drawn to this, but Perps' core value lies in its ability to help with asset pricing.

For very small assets, you can list them on Uniswap or the Meme platform. When you grow to small to medium-sized assets, you can list them on BN's Alpha platform or other small to medium-sized CEX platforms. But objectively speaking, 25 years ago, when moving from small to large assets, there were few decentralized pricing platforms in the market.

Therefore, during this lull period, the market is prone to misjudgment, which often leads to investors quickly exiting their investments after the assets are listed on the exchange.

Firstly, because Perps are futures contracts, you need to know that if you want to price them in the market, you have to put assets on them, and your liquidity has to be locked up in the market, which is actually disadvantageous for an asset.

If you have too small an asset, it's actually quite easy for you to lend your coins to market makers. People often run out of small coins because they don't coordinate well with market makers, and the two of them are driving up the price together. Then, when the official releases or is buying, they are driving up the price.

Therefore, due to the influence of many market makers, small-cap coins cannot take off. Then, in the mid-cap coin stage, you have to put liquidity on them to form a higher depth, which makes the cost to the project team very high. Furthermore, the returns for LPs also become unstable and insignificant because people are unwilling to hold coins with high volatility for the long term.

So from this perspective, since the perpetual platform is a futures market, you don't actually need to take delivery of anything; you just need to believe that it has this price. Therefore, it is a very good pricing platform for Chinese assets.

Recently, we've been facing a bull-bear market transition. Having experienced two cycles myself, I can say objectively that bull and bear markets are constantly changing, and those who survive long enough are those who have grasped the platforms that meet long-term demand.