The news of DappRadar 's shutdown has once again cast a familiar chill over the crypto community. It may not be the most dazzling project, but it is one of the earliest infrastructures in the Web3 world—from early blockchain games and CryptoKitties to the later DeFi , NFT, and multi-chain explosion, it has always been an observer and recorder of the industry.

Now, seven years later, the lamp has finally given out.

In its announcement, DappRadar frankly admitted that maintaining the platform's scale under the current environment is "financially unsustainable." This is not an exaggeration, but a natural consequence of a long-term compressed business model finally reaching its end.

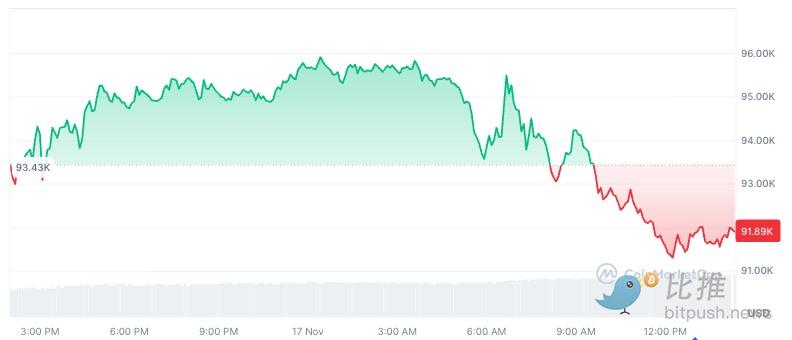

Meanwhile, the crypto market continued its decline: Bitcoin briefly fell below the $92,000 mark, once dipping to around $91,200, ETH fell below $3,000, and DappRadar's RADAR token fell by more than 36% intraday.

The departure of a long-established data platform, coupled with the overall market correction, raises the question: does this mean that the chill of this crypto bear market has arrived earlier and is more severe than we anticipated?

From "the world's Dapp store" to "financial difficulties"

DappRadar was founded in 2018 by Skirmantas Januškas and Dragos Dunica, and is headquartered in Lithuania.

What started as a small project by two engineers on weekends quickly grew into "World's Dapp Store"—one of the world's most influential dapp data and discovery platforms, with monthly active users once exceeding 1 million.

At its peak, DappRadar tracked over 14,000 dapps and 50+ public chains (later expanded to 75+ chains and 16,000 dapps), covering mainstream ecosystems such as Ethereum , BNB Chain, and Solana. It served as the "homepage" for countless project teams, researchers, and retail investors to view on-chain activity, TVL, and NFT transactions.

In terms of funding , it raised approximately $2.3 million in seed funding in 2019 and $5 million in Series A funding in 2021. Investors included well-known institutions such as Blockchain.com Ventures and Prosus. In the same year, it issued its platform token RADAR and attempted decentralized governance through DAO.

More importantly, DappRadar's annual/quarterly "Dapp Industry Report" has been cited by VCs and projects for a long time. Many people first learned about the "DeFi Summer", "NFT Explosion" or blockchain game related trend charts through it.

However, in recent years, with the continuous decline in advertising revenue, slowing user activity, and the overall downturn in the crypto market, DappRadar's "free C-end + limited B-end monetization" model has become insufficient to support the high operating costs necessary for its role as data infrastructure. Ultimately, the platform chose to exit gracefully at this point, rather than dragging it out until an even uglier outcome.

More than half of the projects launched after 2021 have failed.

If we put DappRadar back into the broader context, it's more like a statistical sample with delayed presentation.

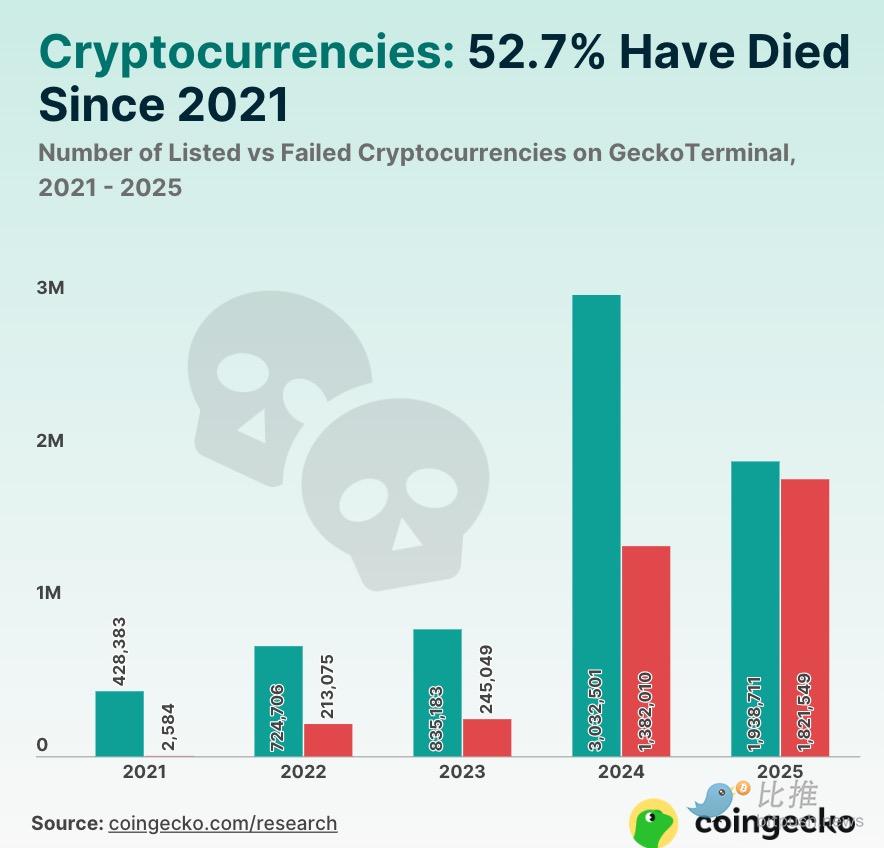

According to a research report released by CoinGecko in April of this year:

Of the tokens launched since 2021, 52.7% have become "dead" (prices have been close to zero for a long time, there are no transactions, they have been delisted, etc.).

Approximately 1.38 million projects failed throughout 2024.

In the first quarter of 2025, approximately 1.82 million tokens were marked as failures, accounting for nearly half of all failure records from 2021 to 2025 in that single quarter.

Looking further back, BitcoinKE's 2024 research already provided a warning:

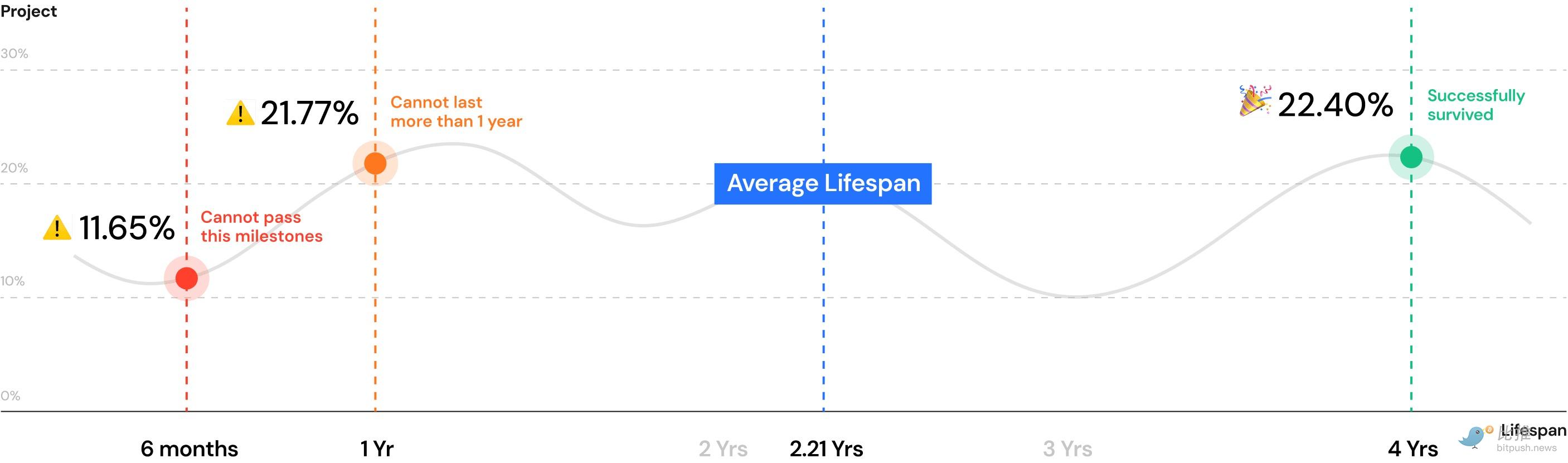

After analyzing over 12,000 projects, it was found that approximately two-thirds of crypto projects will disappear within three years.

The failure rate was even higher for the wave that emerged during the 2020–2021 bull market.

If we extend the timeline, the types and names of projects that disappeared in the past two bear markets are countless, but some representative cases are worth revisiting:

Three Arrows Capital (3AC): Heavily invested in highly volatile assets such as LUNA and GBTC, coupled with high leverage and misappropriation of funds, it went bankrupt and was liquidated in 2022 due to a chain of liquidations.

Lending platforms such as Celsius, Voyager, and BlockFi attracted a large number of users during the bull market with high interest rates and "yield narratives," but their underlying assets were highly correlated and their risk control was weak. They filed for bankruptcy one after another in 2022.

Blockchain game/NFT platforms like F1 Delta Time: They burn money to buy licenses and heavily rely on new funds and secondary market activity. When transaction volume plummets, maintenance costs far exceed revenue, leaving them with no choice but to shut down or transform their business.

LocalBitcoins, Paxful, and other P2P platforms, under the dual pressure of compliance and revenue constraints, announced the cessation of operations or permanent shutdown between 2023 and 2025.

These projects have different stories, but the core logic is similar:

Narratives can inflate valuations, but they can't support long-term operating costs;

In an environment of rising interest rates and liquidity withdrawal, those without real income are the first to be eliminated.

Compliance and risk management, which are often overlooked during bull markets, can become fatal weaknesses during bear markets.

The message conveyed by all this data together is very clear:

The average lifespan of crypto projects is roughly three years, with the vast majority failing to survive a complete bull and bear market cycle. The decline in 2024-2025 wasn't a sudden cooling down, but rather a concentrated removal of projects from the "death list" that had accumulated over the previous two years.

Founded in 2018, DappRadar has survived for seven years, outlasting most projects by a full cycle. However, as the market entered a new round of contraction and its business model failed to support cash flow, it still couldn't escape the statistical curve.

The rules of the game have changed; survival of the fittest.

The shutdown of DappRadar may not be the most prominent news in the "bear market," but it does carry a certain symbolic significance. Its closure came at just the right time, coinciding with a complete shift in industry sentiment.

A few months ago, "bear market" was just a few jokes on Twitter. Now, trading volumes are falling, financing is becoming more difficult, and hot money is retreating. Nobody's pretending to be optimistic anymore. The reversal of sentiment isn't announced by prices, but by reality gradually reminding you: this time it's really cold.

What's even colder is the environment, not just the market. In the past few years, crypto-native projects enjoyed a period of "idealistic dividends"—as long as the narrative was novel enough and the white paper was long enough, they could get seed funding, and trial and error or even failure were not considered a sin. But things are different now. The door has narrowed, and only a few can squeeze in; the threshold has risen, and those who survive must solve their own revenue problems, compliance issues, and even talent retention problems.

Meanwhile, the true "strong players" have quietly completed their "upgrade." Previously, Web3 projects liked to mock Web2 giants for "not understanding blockchain," but now those players once ridiculed as "old-school tech companies" are becoming increasingly stronger.

Coinbase has transformed from an exchange into an infrastructure and identity tier provider;

Web2 companies such as Stripe and Shopify are leveraging their compliance advantages to enter businesses such as on-chain payments, KYC, and RWA;

Even Google Cloud and AWS have started offering service modules designed specifically for blockchain.

They don't rely on issuing tokens, airdrops, or "consensus" to survive. They rely on customers, cash flow, and time.

So the question now is no longer "who is still alive," but "who deserves to live." It's not about storytelling or market hype, but about whether you can build a legitimate business and survive this winter.

DappRadar crashed not because it did anything wrong, but because it wasn't robust enough. For projects still in development, in this era of compressed liquidity and attention, the best outcome might be being acquired by a larger player.

Author: Seed.eth

Twitter: https://twitter.com/BitpushNewsCN

BitPush Telegram Community Group: https://t.me/BitPushCommunity

Subscribe to Bitpush Telegram: https://t.me/bitpush