Get the best data-driven crypto insights and analysis every week:

Zcash’s Breakout and the Revival of On-Chain Privacy

Key Takeaways:

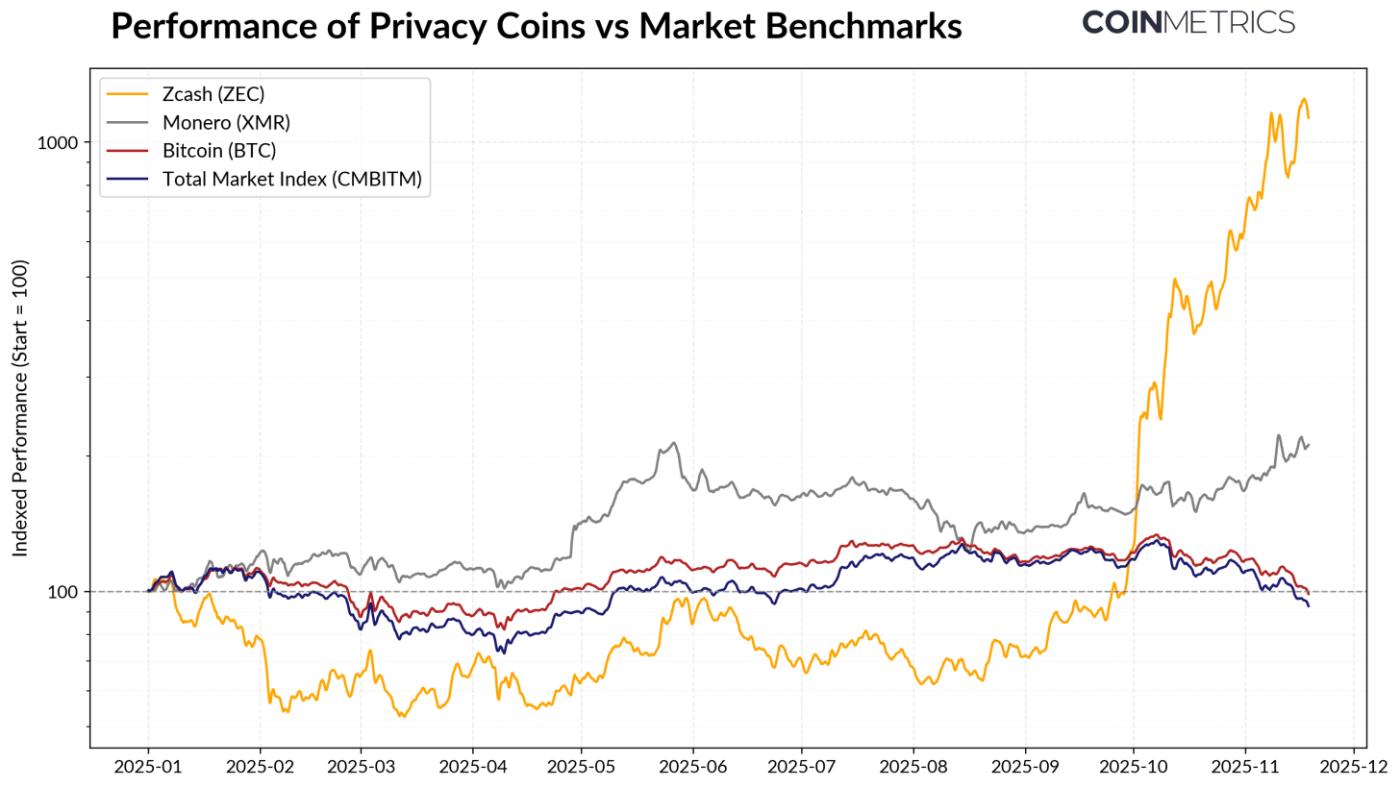

Zcash has sharply outperformed the broader market, with ZEC up nearly 10x since October as interest in on-chain privacy sees a revival.

Shielded supply has climbed to 4.9M ZEC (~30% of supply), driven mostly by growth in partially shielded flows rather than fully private transactions.

Advances in zero-knowledge proving, unified-address wallets like Zashi, and cross-chain rails such as NEAR Intents have meaningfully lowered the friction of adopting on-chain privacy.

Introduction

Public blockchains like Bitcoin introduced a radically new way to transfer value without relying on intermediaries, using openly verifiable ledgers where transaction activity is visible to anyone. However, the pseudonymous nature of addresses still leave activity observable and, in many cases, traceable to real-world entities, revealing spending patterns, counterparties, and other sensitive information that can limit types of activity being conducted on blockchains.

Zcash was created in 2016 as a privacy-focused alternative. Built on Bitcoin’s codebase and preserving its monetary design, it introduced opt-in privacy through zero-knowledge (ZK) proofs, allowing users to keep transaction details encrypted while remaining fully verifiable by the network. The goal was to enable private ownership and transfer of value without compromising the trust model of a public blockchain.

Almost a decade later, this vision is seeing new momentum. As the broader market pulls back, privacy coins, and particularly Zcash (ZEC) are swimming against the current, with ZEC up over 900% since October. While this has brought fresh attention to the privacy theme, is this just another speculative rotation, or a sign of genuine, growing adoption?

Source: Coin Metrics Reference Rates

In this issue of State of the Network, we examine the resurgence of Zcash and the revival of on-chain privacy, tracing Zcash’s origins, analyzing the growth in shielded activity, and exploring the fundamentals and catalysts behind its recent breakout.

The Emergence and Building Blocks of Zcash

Zcash was born out of academic research on blockchain privacy that began at Johns Hopkins University in 2013. Early work produced protocols such as Zerocoin and Zerocash, precursors that pioneered the use of zero-knowledge proofs to enhance privacy on public blockchains.

Building on that foundation, the Electric Coin Company launched Zcash as a Bitcoin-fork in 2016. It inherited Bitcoin’s monetary structure and proof-of-work consensus but introduced the ability for users to opt for shielded transactions powered by zk-SNARKs, zero-knowledge proofs that let the network verify a transaction’s validity without revealing its internal details, such as the sender, receiver, or amount.

Token Economics & Monetary Design

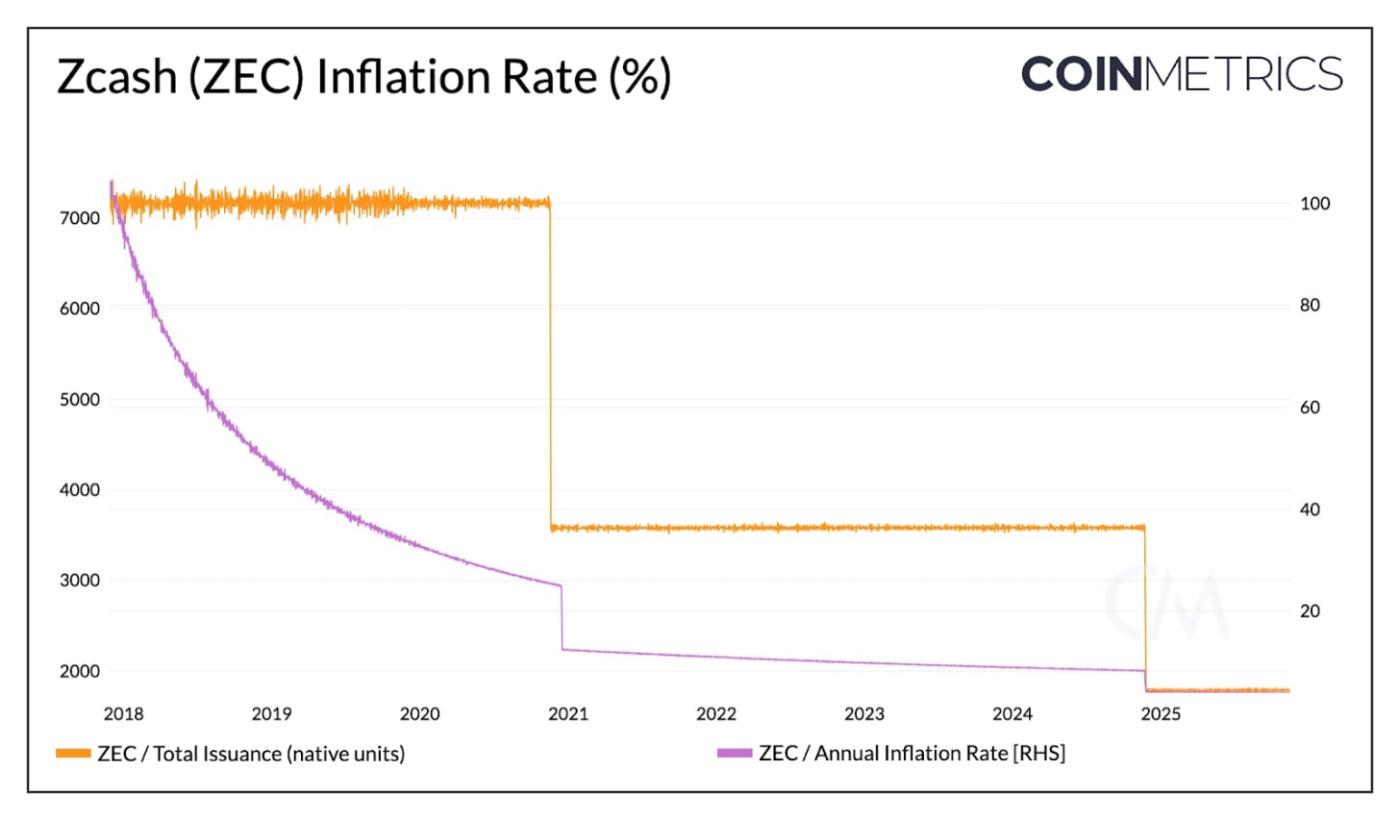

Like Bitcoin, Zcash follows a fixed issuance schedule, balancing long-term scarcity with predictable issuance of block rewards. The supply is capped at 21 million ZEC, and new coins are issued roughly every 75 seconds, mirroring Bitcoin’s proof-of-work design with a faster block cadence. It also inherits the four-year halving cycle, reducing block rewards over time.

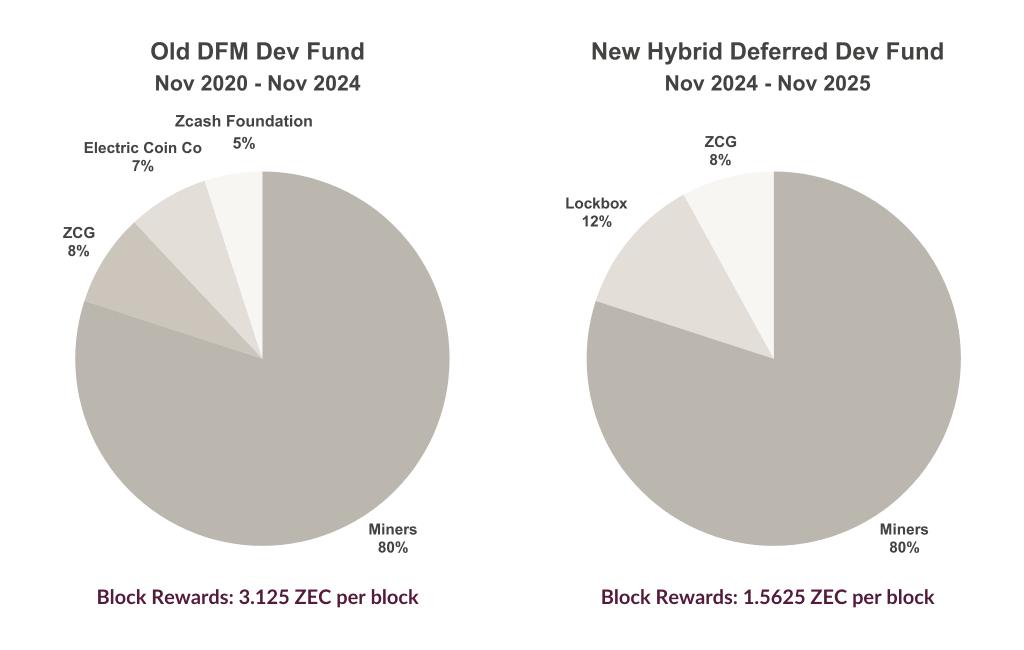

With the most recent halving in November 2024, the block reward was reduced to 1.5625 ZEC per block, resulting in an annual inflation rate of ~4%.

Source: Coin Metrics Network Data Pro

Zcash has gone through several network upgrades, with the latest being NU6 in November 2024. NU6 changed the structure of the development-fund allocated from the Zcash block subsidy, directing 80% of block rewards to miners, 8% to Zcash Community Grants (ZCG) to fund ecosystem teams and 12% to an in-protocol “lockbox”, a deferred funding pool governed by token holders.

Source: Electric Coin Company Zcash Halving

Upcoming upgrades will introduce several improvement proposals like ZIP-234, which will make ZECs issuance schedule smoother as part of its long-term sustainability efforts.

Adoption of Zcash Shielded Supply & Transactions

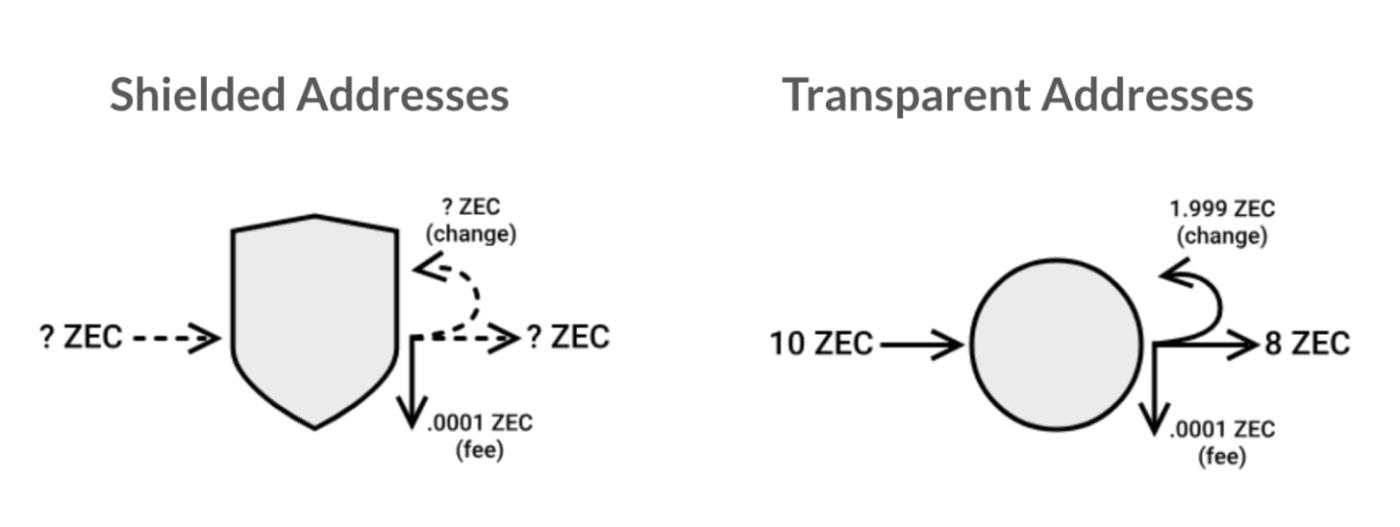

A core feature of Zcash is its use of two distinct kinds of addresses: transparent (t-addresses) and shielded (z-addresses). Transparent addresses function similarly to Bitcoin, with the sender, receiver, and transaction amount being publicly visible. By contrast, shielded addresses use zero-knowledge proofs so that transactions and fees still appear on the ledger but contents like participants and amounts remain hidden.

Since funds can interoperate between these address types, users can opt between fully transparent to fully private transactions.

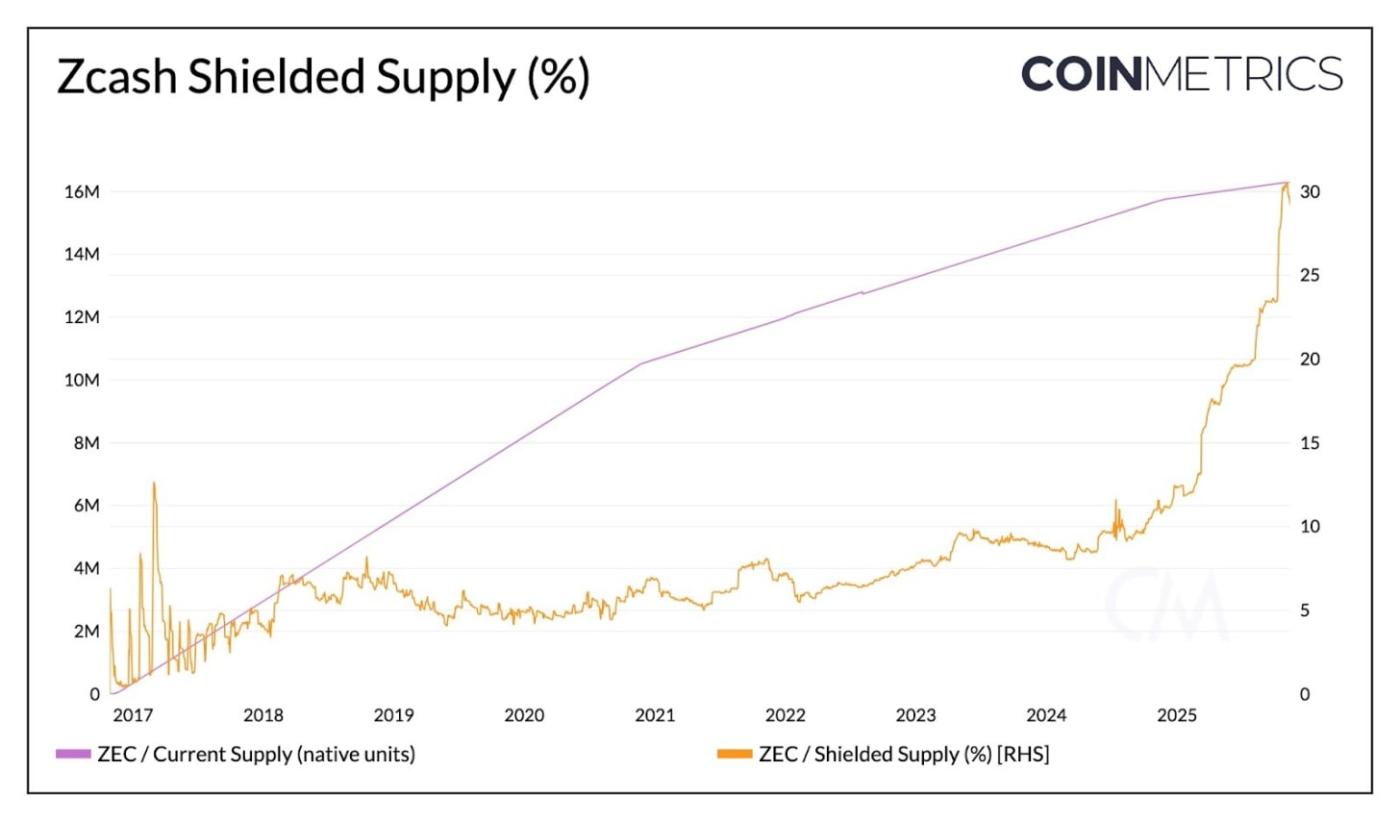

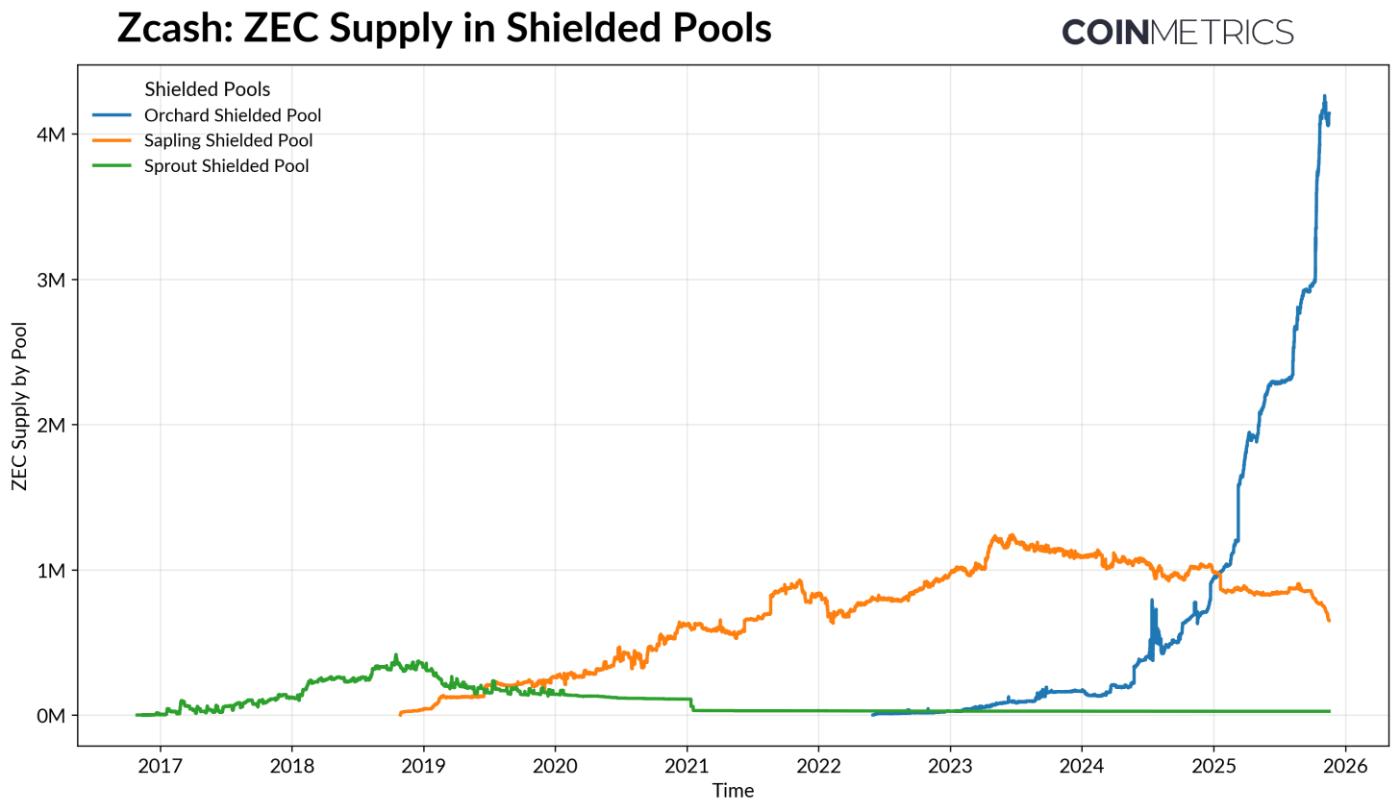

With this in mind, we can now look at adoption of shielded activity grown on-chain. Recent data shows a meaningful expansion of Zcash’s private usage. The amount of ZEC held in shielded addresses has grown to 4.9 million, representing around 30% of current supply, up from just 11% at the start of 2025. This suggests that a meaningful portion of ZEC holders are opting into the privacy layer rather than staying fully transparent.

Source: Coin Metrics Network Data Pro

Much of this growth stems from the Orchard pool, a more efficient shielded pool introduced in 2022. Its lighter, faster proofs make it well-suited for everyday use, and tooling like the Zashi wallet (launched in 2024) introduced unified addresses and direct shielded transfers, reducing many of the usability barriers that once limited activity. Additionally, its integration with NEAR Intents allows users to swap shielded ZEC for other assets natively across chains, effectively lowering friction and expanding on-ramps into Zcash.

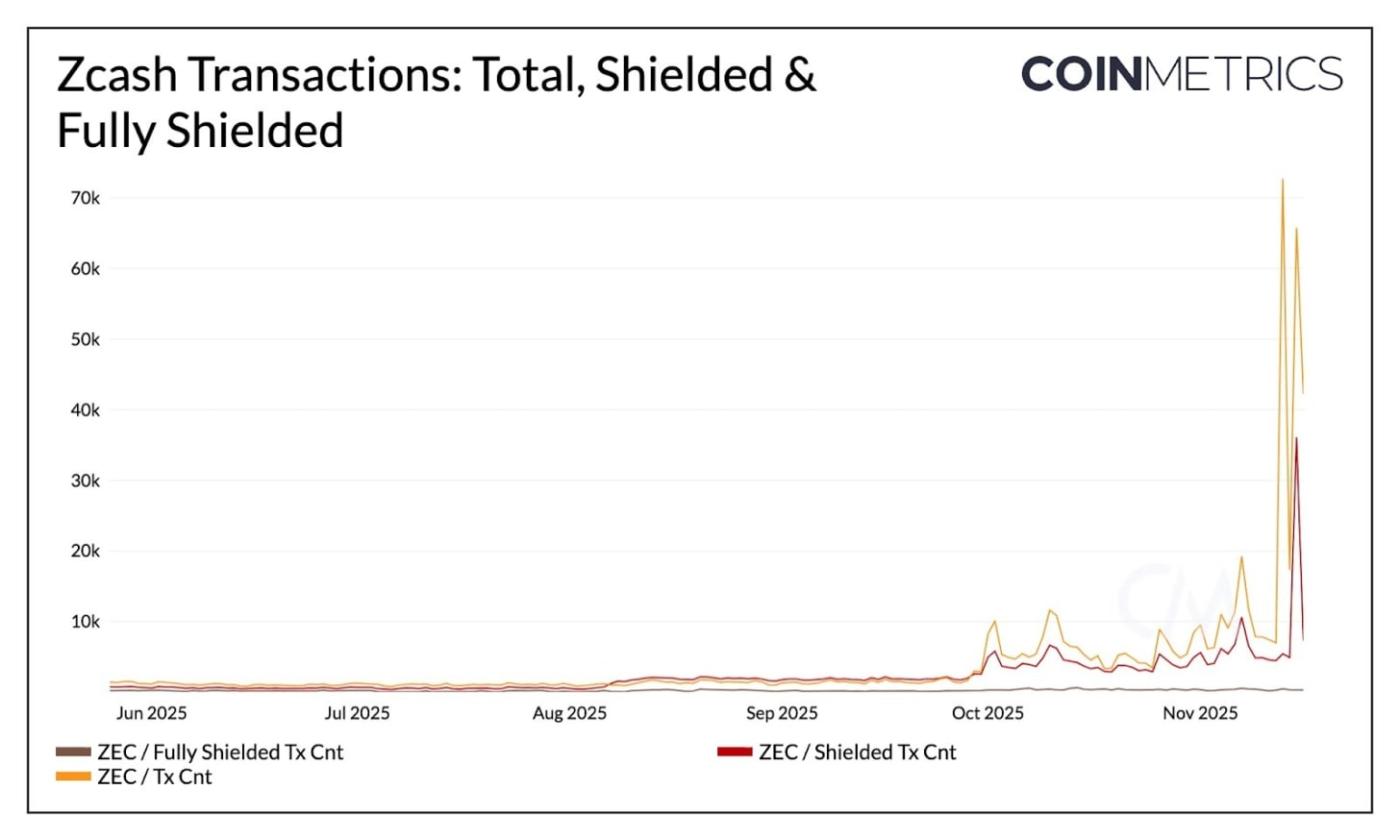

Total ZEC transactions have also surged by over 10x in recent weeks. Shielded transactions, which includes shielding, deshielding, and mixed transactions, has risen sharply, while fully shielded transfers remain a small share. This indicates that recent growth is being driven primarily by moving value into or out of the shielded pool rather than staying entirely within it. Combined with the rise in shielded supply, this suggests that more users are opting into Zcash’s privacy layer, even if they are not adopting fully private flows end-to-end.

Source: Coin Metrics Network Data Pro

Conclusion

Zcash’s recent breakout looks less like a speculative spike and more like a repricing of fundamentals already shifting beneath the surface. Shielded supply began rising well before the rally, supported by faster proofs, better wallet UX, and easier cross-chain access. The surge in shielding and deshielding transactions, however, is more recent, suggesting that price momentum and renewed interest in privacy helped pull additional users into the shielded layer.

Tooling like the Zashi wallet, with unified addresses and seamless shielded transfers, and rails such as NEAR Intents, which enable cross-chain swaps directly into shielded ZEC, have lowered friction meaningfully. At the same time, a broader resurgence in zero-knowledge technology, from rollups to scaling initiatives like Tachyon, has brought renewed attention to Zcash’s long-running privacy model.

Overall, fundamentals and price appear to be reinforcing each other. Infrastructure-driven growth set the stage, and narrative momentum accelerated usage. The rise in partially shielded flows suggests growing demand for selective, opt-in privacy. Whether this trend endures will depend on shielded activity continuing to deepen and on continued improvements in tooling and integrations that lower the cost and improve the convenience of adopting on-chain privacy.

Coin Metrics Updates

Follow Coin Metrics’ State of the Market newsletter which contextualizes the week’s crypto market movements with concise commentary, rich visuals, and timely data.

As always, if you have any feedback or requests please let us know here.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you’d like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.