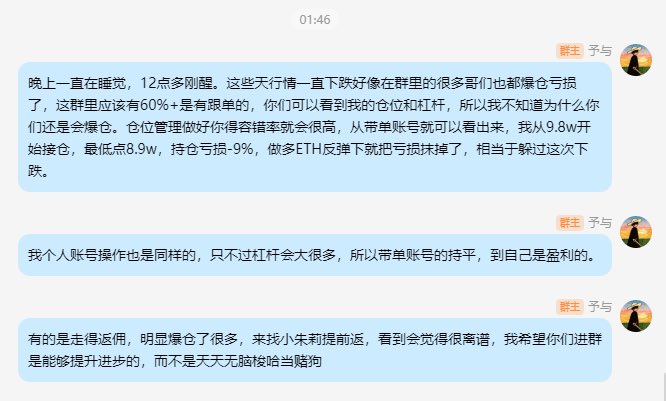

I started building my position at 98,000, but I've been busy with other things these past few days, so I only opened up a position of 1x+. Until yesterday, when it dropped to a low of 89,000, the loss on my position was only 9%. As I mentioned before, once it reaches the 80s, I will definitely use leverage. In addition, ETH performed very strongly during the decline, so I long on 35M at an average price of 3030+ and added to my BTC position at 90,000. In the end, the average price was 93,000+, and the position turned from loss to profit in the early morning rebound. By controlling the position size of the trading account, the profits returned to the level before the decline, which meant that the account avoided this wave of decline. The market trend has shifted, but subjectively, I haven't changed (I don't think it can fall this much). Moreover, the continuous decline has already brought it back 29% from its high; how much further can it fall? There's been a bit of excessive panic, and the market needs time to recover. The key is the strength of the rebound after this consolidation, but the upside and downside potential is limited. It'll likely oscillate within a range of 9-9.5; shorting at this level is definitely not an short.

This article is machine translated

Show original

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content