Right now, BTC's rally is mainly retail-driven, lacking real institutional risk exposure, so it's hard to see sustainable new highs. The real bull run will come in 2026 when US regulations loosen up on physical collateral, unlocking structural new liquidity. Until then, BTC is acting more like a high-beta tech stock than a standalone asset.

This article is machine translated

Show original

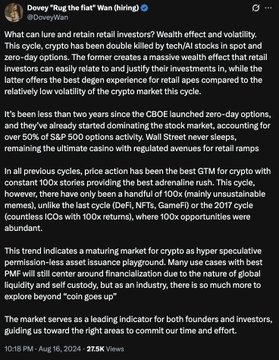

Dovey "Rug the fiat" Wan (hiring)

@DoveyWan

11-18

When I wrote this in 2024, our thesis @primitivecrypto was that we entered a new regime where the market views Bitcoin as a trillion mcap, high-beta growth tech sister trade instead of a monetary toy. The price action since the March 2024 ATH has validated that framing: $BTC has

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content