Since writing my last post I’ve had a few people reach out around what specifically I’m investing in and where. While I don’t intend to be converting this newsletter into a full stock picking newsletter, I did want to share the thematics and how I think about these picks from a logical stand point.

Let’s get into it.

My mental models for thinking about where value lies when investing or building is through dependency chains. Who depends on what, by how much and what does it take to break that dependency? I’ve used the same lens to think about my Machine Economy investments.

First up, we have to construct our macro thesis and that’s the fact that humanity is going to need a lot more compute. I’ve outlined why in this post and recommend reading it if you haven’t already.

For this compute, the core of all this lies around the GPU as a proxy to AI and accelerated computing workloads.

NVIDIA has all the mindshare however we have to remember they simply design the chips, not manufacture them. Therefore we have to ask the following questions:

Who is making these chips?

What other components do you need to make these chips run?

Where do you source the land, power and labour to tie it all together?

Are there any downstream dependencies that will go parabolic as everything in this supply chain reconfigures?

Which are companies are required to harness the full power of this compute?

Through asking these questions we can form a clear picture of which subsectors and companies to concentrate capital around and of course, bet size accordingly.

Energy

This is the most obvious and direct play, but basically all these data centers are going to need power to be able to come online. When you think about data center power there is what is know as Behind the Meter (BTM) and Front of Meter (FOM) power. FOM power means that you are connecting directly to the grid which means that the power is delivered directly to you. BTM means you have to figure out power yourself aka onsite power generation.

To invest in energy relative to data centers you have to figure out how much exposure you’re getting to data center demand versus normal electricity demand. Companies that specialise in providing BTM power to data centers will be tied closer to data center growth while FOM power you can have diluted returns because their businesses are already extremely large (electricity grids).

An example of each that I like is:

Front of Meter: Constellation Energy. They operate a broad portfolio of generating assets such as nuclear, hydroelectric, wind, solar, natural gas, etc. Their stock has done incredibly well over the past few years which shows a correlation to AI trends.

Created with TradingView Behind the Meter: Bloom Energy. This company produces Solide Oxide Fuel Cells (SOFC) which are capable of converting natural gas into electricity at the scale of operating a data center. While the stock has run up tremendously, the earnings and growth are nothing short of impressive.

Created with TradingView

I am by no means an energy expert, however I find this framework valuable to think about what energy bets to make when thinking about it in relation to data centers. Their are many other plays in the market but this should serve as a conceptual framework in this category at least.

Semiconductor Manufacturers

I’ve called this category Semiconductor Manufacturers and not Semiconductors as I have a separate category for memory which I will elaborate on further. This category can have many rabbit-holes but to keep it fairly high level, this category represents everything around how you make chips that power the AI game. Two names that most people would have heard of are:

NVDA (they design the GPU chips)

TSMC (they make the actual chips)

However, there are other plays here that you can change your perspective with.

GOOG: Yes, you read that correctly. Google back in 2014 invested in their TPU (Tensor Processing Units) after realising their NVDA bill was going to be very high. That investment is now paying off and they have are actually another NVDA, one that the market does not fully appreciate just yet.

NVTS: This is a more smaller play but showcases what is possible. Navitas creates power transformers based on GaN (Gallium Nitride) and SiC (Silicon Carbide) that allows you to step down large currents to ones needed by individual components. This is critical since the newer generation of GPUs etc are drawing increasingly more power.

A notable mention I want to make here is IShares MSCI Korea ETF! This ETF is accessible to US investors and is made up of two companies that are important to the future of semiconductors: Samsung and SK Hynix. I won’t go in too much detail here but here’s a chart of its historical performance. You have to remember that the semiconductor industry is dominated in Asia, not the West!

Memory

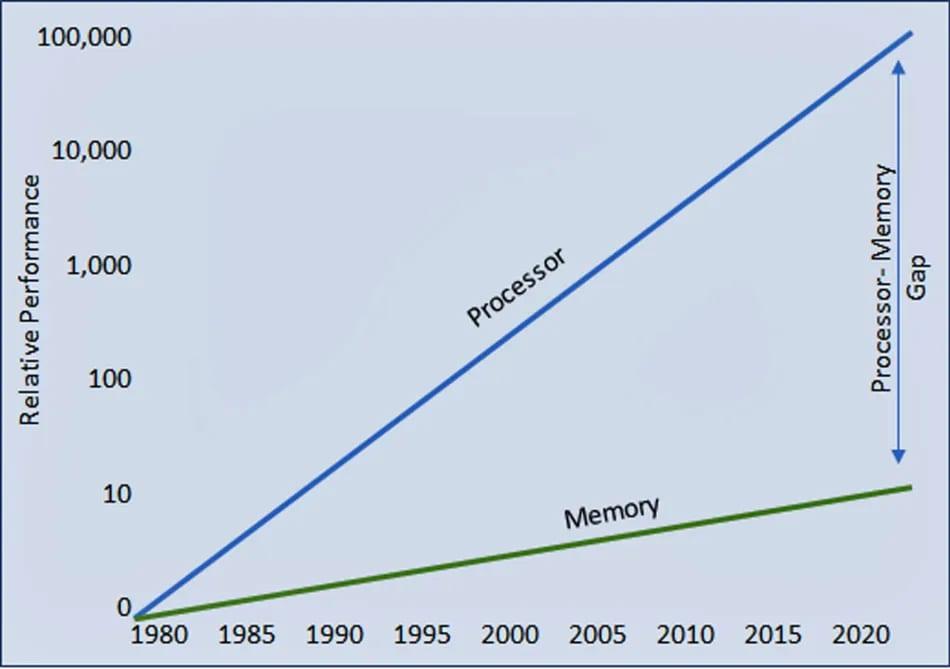

Okay so this is one of my favourite categories and probably has the most upside still baked into it. While compute has scaled via GPUs, one component that has lagged behind is memory. The rate of progress between compute and memory can be showcased in the chart below:

To highlight the importance of memory, you need to understand how GPUs and AI models work. Once a GPU has done some amount of work that it then needs to build on later but needs to be access very quickly, it needs to store it in memory! There are many layers to memory:

RAM (closest to the processor)

Flash (think NVMe SSD drives)

HDD (classical hard drives)

This entire sector is basically constrained and blowing up massively with the rise of AI models. Now what’s under appreciated here is the fact that when it comes to RAM you have two types to be aware of:

DDR Ram (the stuff your computer probably use)

High Bandwidth Memory (stuff that GPUs need because their speed is remarkable)

Since September, DRAM prices have exploded and there is a huge memory shortage. However, what makes this even more interesting is there are only 3 companies in the world that can produce HBM (SK, Samsung, Micron). The expertise to do so requires decades of compounding that is impossible to reproduce even in a few years. Outside of HBM, Flash and HDD companies are doing extremely well. Here’s the chart of Western Digital (yes the one that makes hard drives you have probably purchased)…

I could go on and on about memory but I may save this for another article if there is interest!

Pivoted BTC Miners

Remember how I talked about Front of Meter earlier in this article and how it is extremely hard to get connected to the grid (up to 5 years at this point)? Well turns out there’s a class of companies that have pre-existing power and know how to run high performance computers — BTC miners! They realised their advantage and have pivoted to running AI data centers instead. Now this landscape is more complex since you have a business that was geared to do one thing, now pivoting to do something else. While there are many in this category I’ll talk about one that is common amongst most investors.

IREN: Originally from Australia, they pivoted their 100% sustainable Bitcoin business to AI data center play. They currently have 3 GW of power secured which is the equivalent of 3 full scale Nuclear reactors.

Created with TradingView

I think what you have to understand in this category is how much purchasing power do these companies have relative to the people who rent their infrastructure? If power really is the constraint then these companies will do exceptionally well. If power is a cheap commodity that anyone can get (little evidence towards this), then expect to be bearish.

Data Centers

Last but not least is the actual data center companies! These are probably the hardest to reason about as you have to understand:

What their contracted demand actually is and for how long?

What their costs are like? Do they have access to power or will they pay a premium for it?

What is their financing base currently and moving forward?

Many of the AI bears talk about these variables and they could be right about certain aspects! However, the fact is that the demand for AI is not going to slow down and building a data center is hard! If it was easy, then the hyperscalers would do it themselves. While I do think the concerns are valid to some extent, people are overly bearish at this moment on these companies. To illustrate my point I’ll talk about two different businesses:

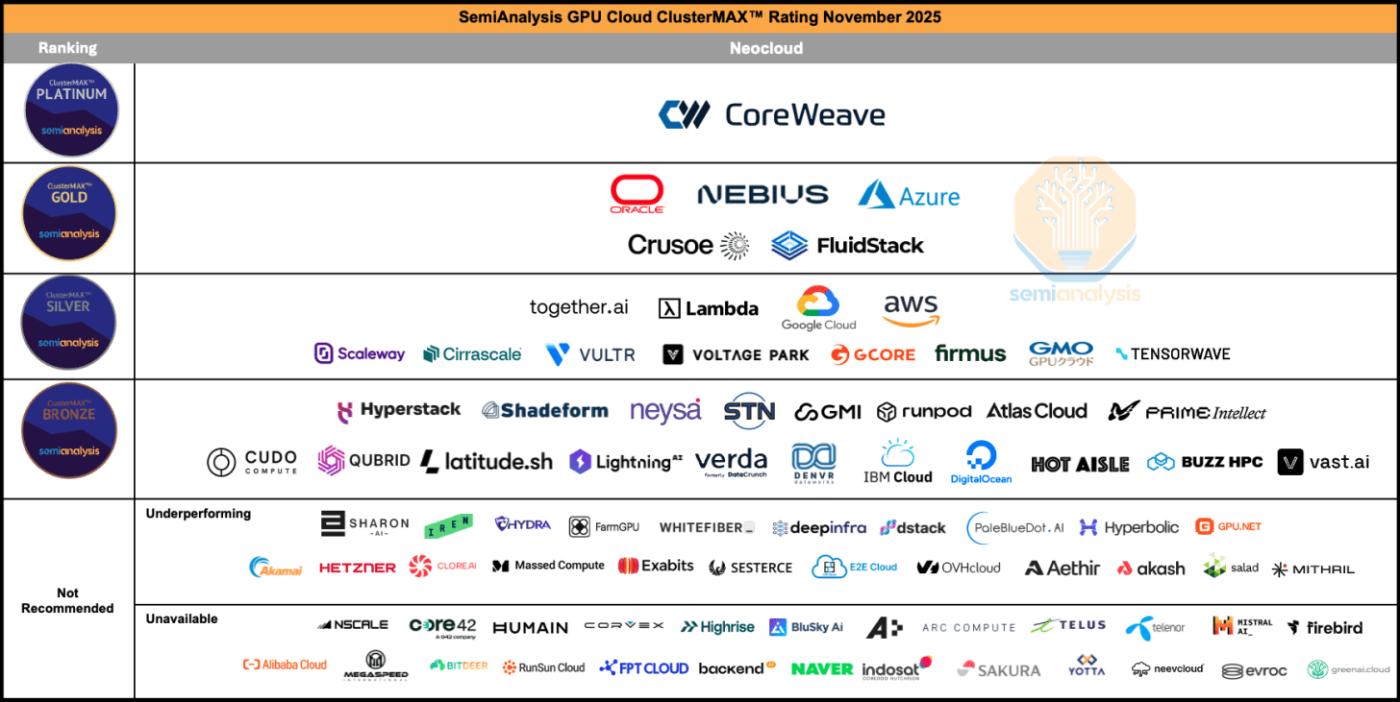

Coreweave. The darling of the industry but also highly levered. The credit market is pricing the chance of them defaulting to be high. However, at the same time they’re one of the best cloud hosting platforms!

Nebius. It’s the same people from Yandex and Clickhouse (two both insanely impressive Russian based companies). They’re going for become a full stack AI cloud business and have the chops to do so. Their software background gives them an impressive edge that other Neoclouds won’t be able to rival so easily.

I’m not going to go into tons of detail into both of these but I do want to highlight the fact that these businesses need to be evaluated on their own merits. Regardless, building data centers is not easy and anyone who thinks these things are going to 0 is delusional.

Data Center Adjacent

There is a class of companies that I couldn’t exactly figure out how to brand but are directly related to this whole build out that are worth mentioning.

VRT: Vertiv Holdings. In order to run these GPUs, you need liquid cooling. Vertiv is the leader in this category.

Created with TradingView APLD: Applied Digital is in the construction business of theses actual data centers. They have $11b of contracted revenue with a market cap of $6b.

CRDO: They make special connectivity cables that every data center needs to run. They can support about 100GB/s through their Active Electric Cable technoloy.

CAT: Caterpillar, the construction company with the yellow branding! They have turbines that are driving growth in a subset of their business that is rapidly growing. An interesting twist for a multi hundred billion dollar market cap company!

Closing

While I do own many of the stocks listed in this article, it serves to aim as an illustrative example of how I think about investing in the machine economy and what the various sub-sectors are. I have rotated a significant portion of my net-worth from crypto into these names as the CAGR of AI-adjacent names is going to be 40% till at least 2030. I still retain certain holdings in crypto (BTC, SOL, ETH) and a full-time business (RouteMesh) however from an investing perspective, I believe my capital can be put to work harder in the machine economy (of which crypto is a subset).

I’m also very interested in robotics and will start writing more about it as I get deeper into hardware. How does all of this tie together? I’m not fully sure but curiosity is a key personal value for me and when I’m drawn towards something I don’t question it, I just keep learning :)