1. What is Bitfinex lending? Why is it considered a blue ocean market for stable returns in the cryptocurrency industry?

In the world of cryptocurrency, there are more ways to make money than just trading. In addition to the common flexible or fixed-term investments offered by centralized exchanges (CEXs) , Bitfinex's margin lending market is also an option that cannot be ignored for users seeking stable, low-risk passive income .

Bitfinex is a well-known P2P (Peer-to-Peer) lending platform. Simply put, you, as a lender, lend your idle stablecoins (USD/USDT) to leveraged traders. The traders pay interest, and you earn a stable profit.

Bitfinex's advantages in lending:

- Stable and predictable returns: Compared to highly volatile transactions, interest income from lending is relatively stable.

- High level of fund security: Funds operate within Bitfinex and are cleared by the exchange, making the risk manageable.

- Low barrier to entry: Suitable for users of all capital sizes, it is an excellent starting point for beginners to enter the field of passive income.

2. Why do we need "automated loan disbursement robots"? Four major pain points of manual operation.

If lending is so profitable, why is a robot still needed? The reason is that to maximize profits from Bitfinex, the following pain points of manual operation must be overcome:

- The 24/7 monitoring dilemma: The cryptocurrency market operates year-round, and manual lending requires 24-hour monitoring of market interest rates. Once a loan matures, it needs to be re-ordered immediately, otherwise the funds will be idle and profits will be missed.

- Interest rate fluctuations are difficult to predict: interest rates change constantly, and it is impossible for people to capture the best interest rate and place orders in the first instance.

- Inefficient order placement: When a large amount of capital flows into the market, the speed of manual order placement is far slower than that of automated programs.

- Setting up complex settings: For beginners, setting the appropriate term and interest rate often leaves them feeling lost and confused.

Therefore, an efficient and intelligent automated lending robot is an essential tool for maximizing your financial returns.

3. How to choose a lending platform? What is BAT Lending Pro? Comparison of its two core advantages.

BAT Lending Pro is a fully automated lending program that runs on the Bitfinex platform . It continuously manages your funds on the Bitfinex platform to earn interest with maximum efficiency. It is designed for users who seek flexibility in their funds and efficient order placement .

Core Advantage 1: Unique Business Model and Extreme Funding Flexibility

Lending Pro is more than just "automatic lending"; it's a highly customizable financial management tool.

- Beginner-friendly mode: Offers four exclusive strategies: conservative, normal, aggressive, and high-interest. Beginners can choose one with a single click based on their risk appetite , without having to manually set the interest rate or term.

- Customizable term percentage: Allows experienced users to precisely set the allocation ratio of funds across different loan terms. For example, you can choose to focus only on short-term loans such as 2-day loans to ensure extremely high liquidity, ready to withdraw funds or invest in other areas at any time, truly achieving "flexible cryptocurrency trading".

- High degree of financial flexibility: You can freely set an acceptable minimum interest rate to ensure that your returns are not diluted.

Core Advantage Two: Fastest in the Industry! Execution cycle per minute and highest priority.

Efficiency is key to profitable lending. Every minute your funds are idle means a minute less interest earned. While other lending robots exist, BAT Lending Pro leads the market by a wide margin in crucial execution efficiency, making it the most cost-effective option in the Asian market.

| Product Name | BAT Lending Pro | Loan robot W | Loan robot F |

| Multi-currency lending | Two types (USD, USDT) | Two types (USD, USDT) | 1 type |

| Loan execution cycle | Every minute | 15 minutes | 20 minutes |

| Order sequence | All options are unified (highest priority). | Last | Last |

| Annual fee | 64 USDT | 86 USDT | 92 USDT |

| Annual payment discount | Get 2 months free with exclusive offers. | 2 months free | Free 1 month |

| Funding flexibility | High (customizable term) | Low | Low |

BAT Lending Pro 's execution cycle of one minute means that your funds are idle for a significantly shorter time, allowing them to be reinvested in the market more quickly, greatly improving capital efficiency and the effect of compound interest!

4. Lending Pro Paid: Exclusive benefits for fans: free trial and renewal discounts!

BAT Lending Pro's pricing strategy is highly competitive, aiming to provide the fastest and most stable service in the Asian market at the best price.

Lending Pro has an annual fee of only 64 USDT , lower than its main competitors, and offers excellent value for money while providing higher efficiency (orders placed per minute) and higher order priority.

To allow Noneland readers to experience the powerful features of BAT Lending Pro firsthand, we've secured an exclusive discount!

Use the exclusive code: NONELAND25 to try BAT Lending Pro for free for one month ! Renewing directly will also get you an extra month of free subscription.

Redemption method:

- Show your exclusive code, NONELAND25 , to BAT customer service .

- If you don't already have a Bitfinex account , you can apply for one using our referral code: ImcEz2FbO .

- Start your first month free trial now!

5. BAT Lending Pro Robot Setup Tutorial: Three Steps for Beginners to Start Automated Loan Disbursement

BAT Lending Pro's user interface is designed to be very intuitive, allowing even beginners to quickly get started. Here's a simple tutorial from registration to starting to lend:

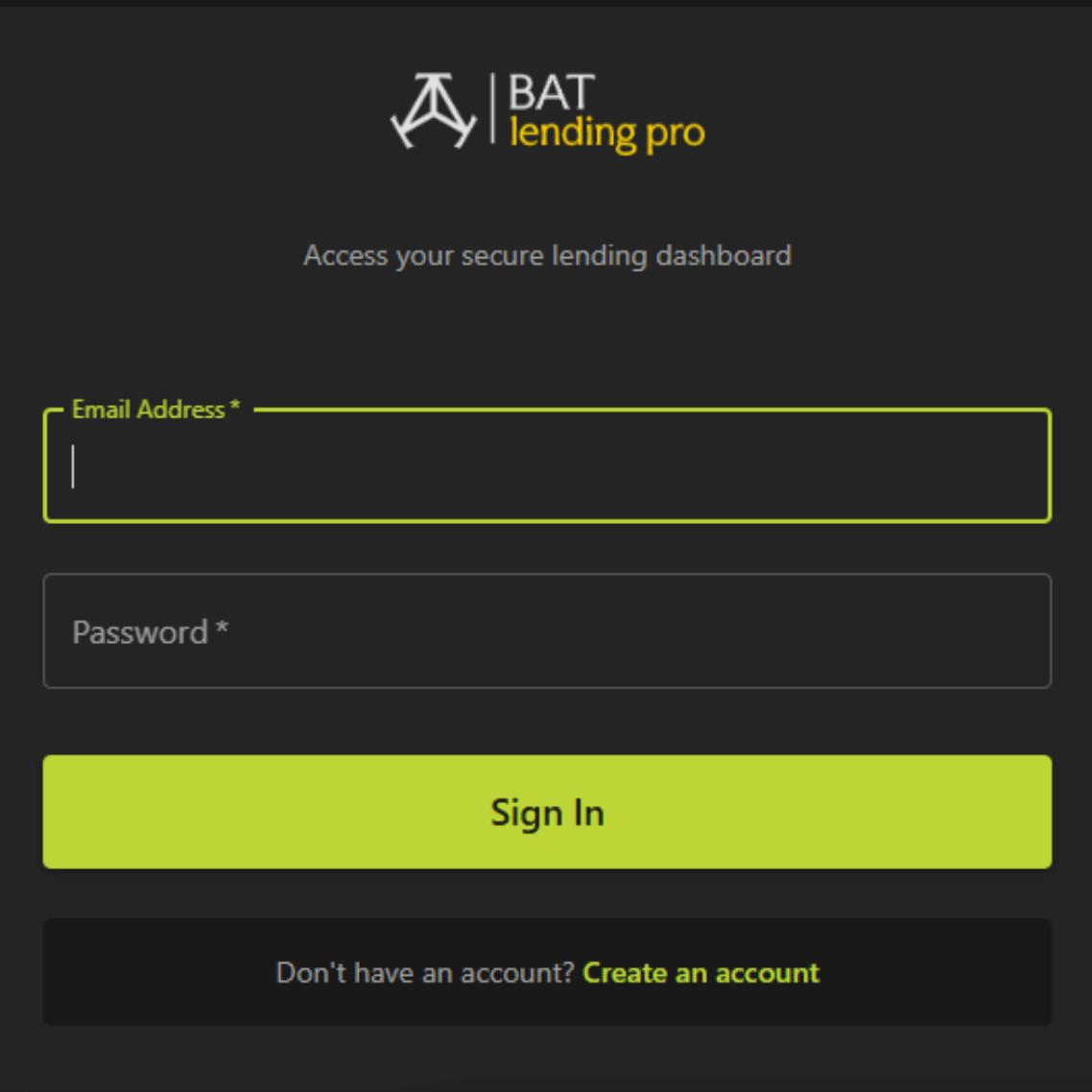

Step 1: Register and log in to the Lending Pro platform

- To create an account: Go to the BAT Lending Pro website and click "Create an account".

- Fill in the information: Enter your email, full name and password, and click "Create Account".

- Log in: Return to the homepage and enter your email address and password to log in to the dashboard.

Step 2: Connect to the Bitfinex API key

To enable the bot to lend money on Bitfinex, you need to provide API permissions. However, rest assured, you only need to grant permissions related to "margin" and "lending," without needing to enable withdrawal permissions, thus ensuring the safety of your funds.

- After logging into Bitfinex, click "Generate New Key" under "API Key" in the upper right corner.

2. API Settings : Enable the four options as shown in the image below, and remember to disable the rest.

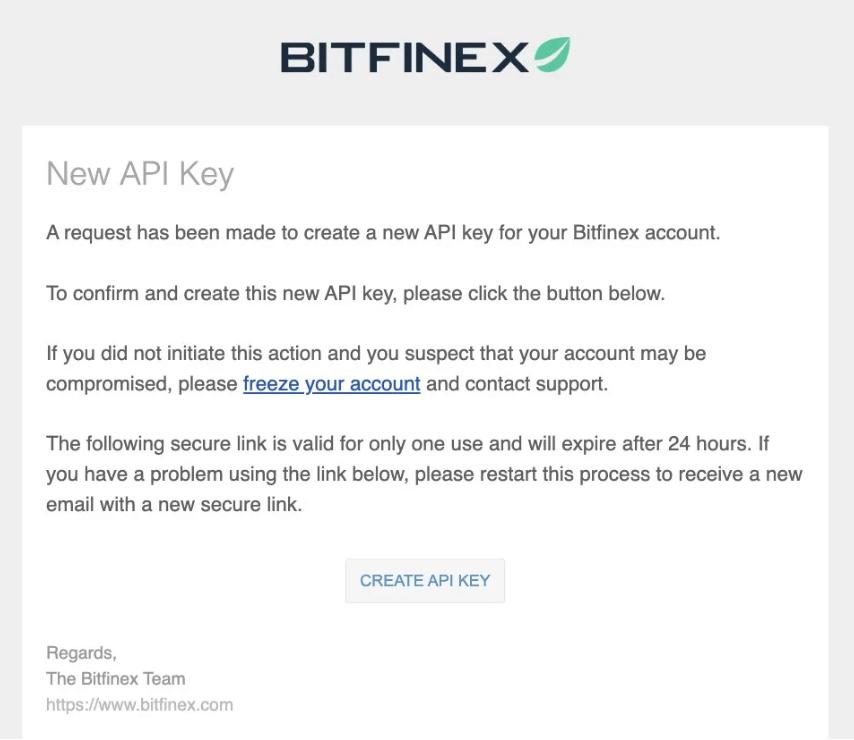

3. Go to your email inbox and click "CREATE API KEY" to generate the API key.

4. Store your "API Key" and "API Key Password".

5. Connect the API to BAT Lending Pro and start lending.

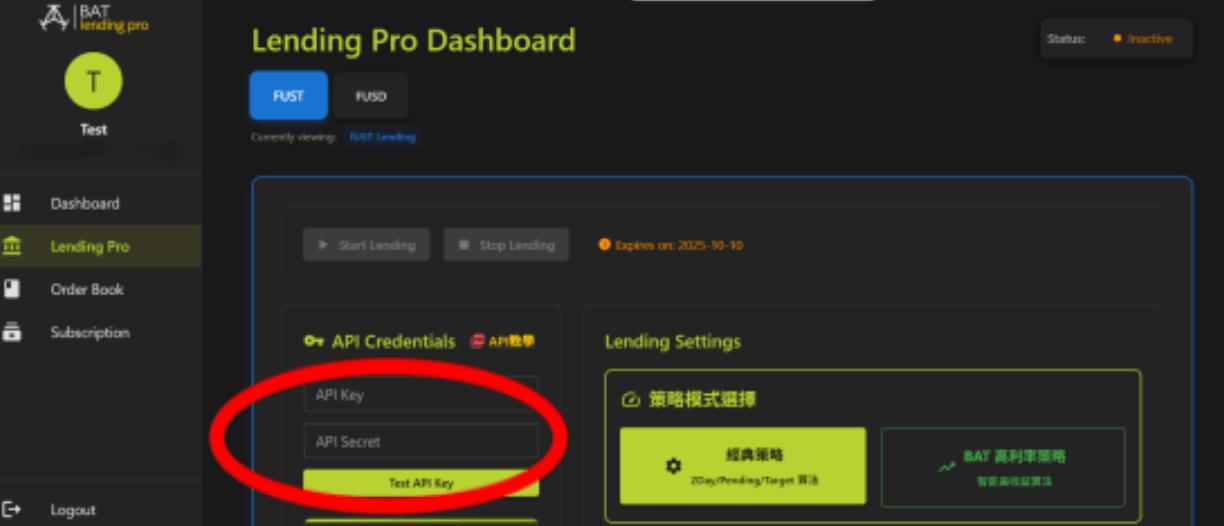

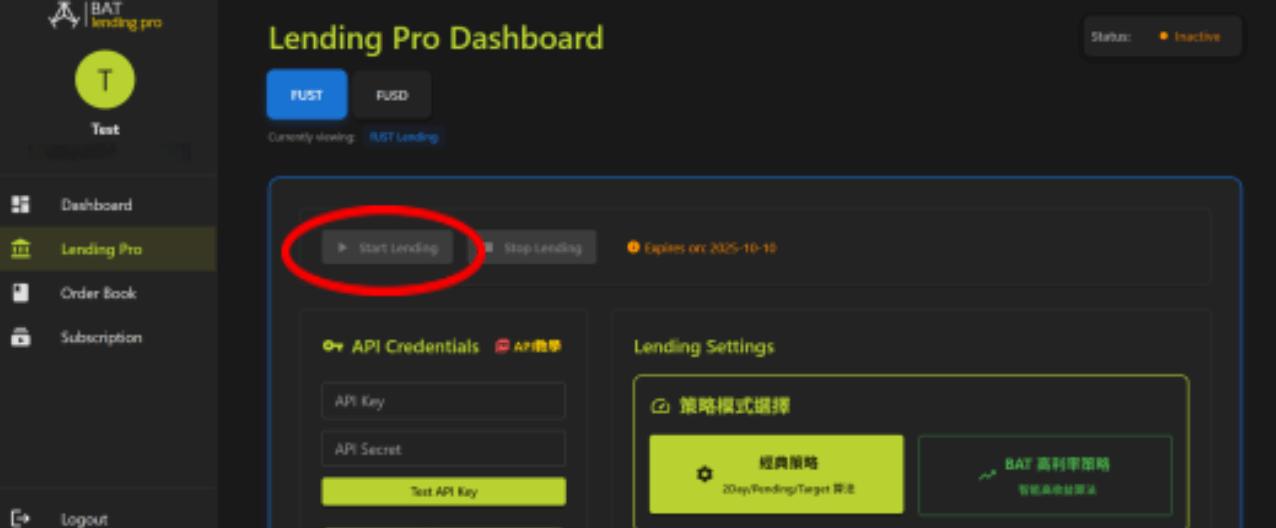

- Access the dashboard: After logging in, click "Lending Pro" in the left-hand menu .

- Paste the API Key: In the "API Credentials" field, paste the API Key and API Secret Key that you created on Bitfinex .

- Test connection: Click "Test API Key" to confirm successful connection.

*Important Reminder: The API Key and Secret Key can only be entered once. Please be sure to copy and paste them, and check for any extra spaces before and after to avoid errors.

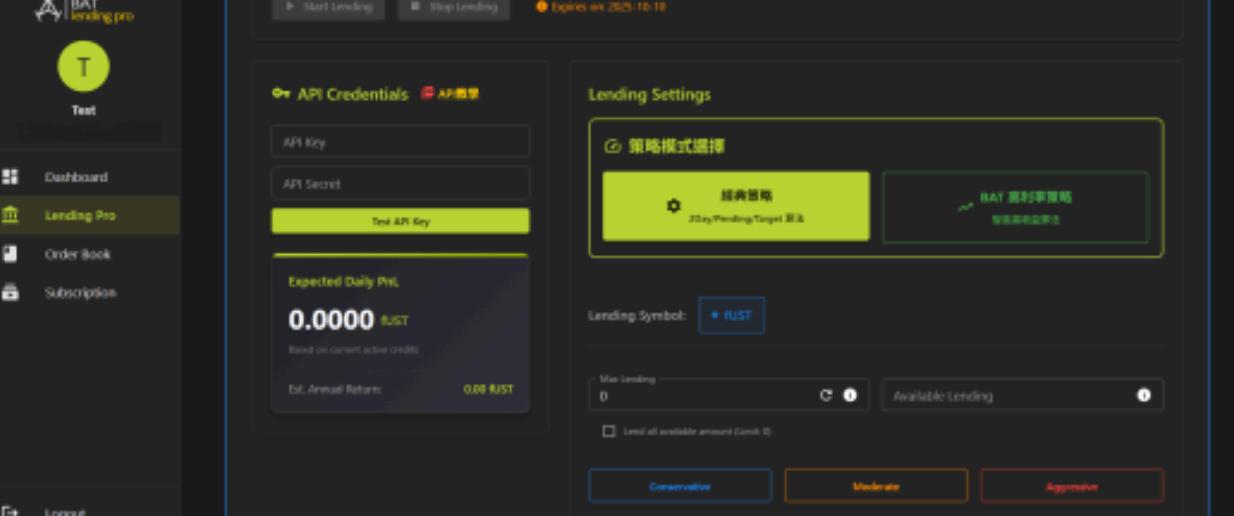

Step 3: Set lending parameters and start the process

In the "Lending Settings" area, you can set the basic parameters for lending:

- Choose the lending currency (Lending Symbol):

- Choose the currency you want to lend in, such as fUST (USDT), fUSD (US Dollar), etc.

- Set the maximum lending amount (Max Lending):

- Enter the maximum amount you are willing to lend . You can also click the "Refresh" button next to it , and the system will automatically set it to the maximum amount you can lend in your account.

- Choose the lending mode:

- Beginners are advised to start with the preset modes: Conservative, Moderate, Aggressive, or High Rate .

* High-interest-rate strategy: The ratio of different loan periods cannot be adjusted. This strategy is suitable for customers who want higher interest rates but do not mind poor liquidity.

- start up!

After completing the setup, click "Save" first, then click "Start Lending". Your BAT Lending Pro bot will then begin automatically placing and disbursing loans for you every minute on Bitfinex!

6. For advanced users: Perfectly customize Target Rate and Max Proportion.

For advanced users with higher demands, BAT Lending Pro also offers powerful advanced settings:

- Max Proportion Settings: You can precisely set the proportion of funds allocated to different loan terms (such as 2 days, 30 days, 120 days). For example, if you want funds to be readily available (pursuing high liquidity), you can increase the proportion of short-term loans (2 days and 7 days) and decrease the proportion of long-term loans.

- Min Rate Settings: Set the minimum acceptable daily interest rate for each term (2/7/30/120 days). If the market's available interest rate is lower than this standard, the bot will not lend, ensuring you do not lend funds during periods of low interest rates.

- Target Rate Settings: Set the system to immediately grant you a loan when the market interest rate reaches your target rate. This allows you to instantly capture high-interest opportunities in the market and not miss any high-yield orders.

7. Bitcoin Algo Traders Overview: From Quantitative Trading to Stable Lending

Bitcoin Algo Traders (BAT) , founded in 2020, is a team specializing in quantitative cryptocurrency trading. Their core philosophy is:

- Quantifying the value of data mining

- Extremely strict risk control

- Focus on long-term asset appreciation

- Extremely high transparency , providing real-time, tamper-proof transaction records.

- Diversified investment portfolio reduces single-entity risk

BAT (Baidu, Alibaba, Tencent) boasts a diversified product portfolio designed to help clients achieve asset appreciation and risk diversification:

- BAT Intraday Quantitative Strategy: A mature strategy that has been running for over 5 years, achieving a 140% increase in profits in 2024, and even making a huge profit against the trend during the black swan event in October this year.

- BAT Leaderboard (copy trading tool): Provides optimized copy trading services.

- BAT Lending Pro (Loan Robot): A new product launched in 2024, it still achieved a real-money return of up to 10,021 USDT in October this year.

BAT Lending Pro is a flagship product designed to provide users with stable returns, based on BAT's experience in the quantitative field.

8. Frequently Asked Questions (FAQ)

Q1: Will my funds be locked if I use BAT Lending Pro?

A: No. One of the major advantages of BAT Lending Pro is its high degree of funding flexibility . You can adjust the loan term ratio at any time, for example, focusing on short-term loans of 2 days, ensuring that funds are readily available and can be withdrawn when needed, without affecting fund allocation.

Q2: If I am a lending novice, is Lending Pro suitable for me?

A: Perfect for you. Lending Pro offers four exclusive modes (Conservative, Normal, Aggressive, and High-Interest). Beginners can simply select the corresponding mode to immediately start automatic lending without having to figure out the complicated interest rate and term settings themselves.

Q3: Is BAT Lending Pro safe?

A: It's very secure . BAT Lending Pro executes automated order placement through the API interface provided by Bitfinex . Your funds always remain in your personal Bitfinex exchange account and do not need to be transferred to the BAT platform . As long as you do not disclose your API Key and Secret Key to others, the security is equivalent to that of the Bitfinex exchange itself.

Q4: How do I contact customer service at BAT Lending Pro?

A: Users can join BAT's Telegram community or contact customer service directly to get immediate technical support and operational advice.

The article " How to Choose a Crypto Lending Platform? In-Depth Analysis of BAT Lending Pro: Earn Stable and High Returns While Lying Down on Bitfinex " was originally published on NONE LAND .