XRP fell 5% this week as its decline continued despite growing institutional interest. The altcoin is struggling to recover, despite the launch of two XRP ETFs and the launch of two more next week.

This has raised questions about why prices remain weak.

XRP Sharks Are Selling

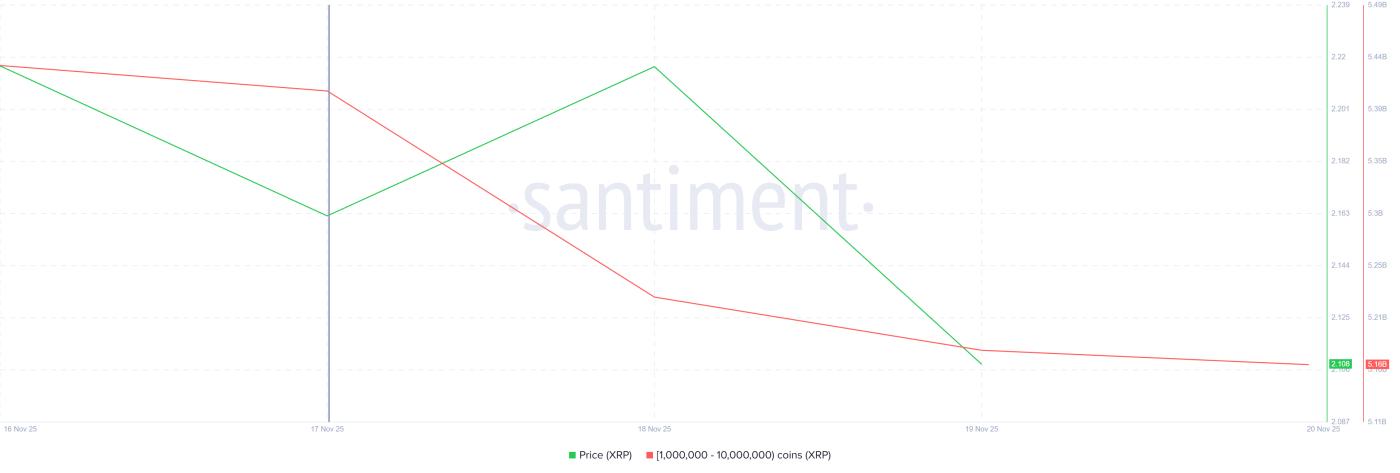

Whale activity is the most obvious explanation for this weakness. Large investors have continued to sell throughout the week, adding to the downward pressure on XRP . In the past 48 hours alone, wallets holding between 1 million and 10 million XRP have sold more than 250 million Token, worth more than $528 million.

Whales still have a lot of influence due to their ability to change liquidation and market sentiment. The continued selling by these holders signals a lack of confidence in the short-term outlook. If the selling continues, it could cause XRP to fall further, especially as the price approaches important support levels.

Want more Token insights like this? Sign up for Editor Harsh Notariya's daily Crypto Newsletter here .

Whales holding XRP. Source: Santiment

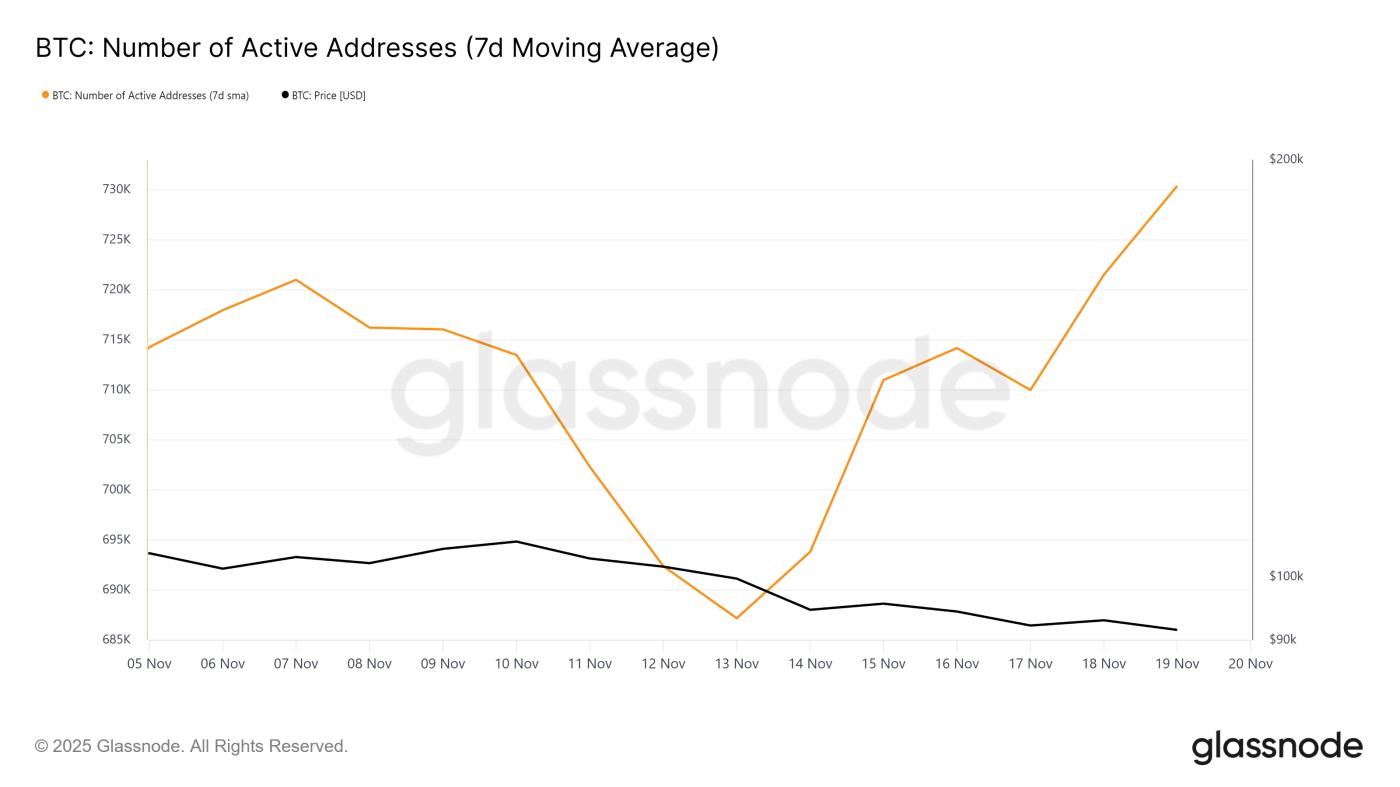

Whales holding XRP. Source: SantimentHowever, the macro environment paints a more complex picture. New XRP addresses have surged over the past week, reaching a monthly high. The surge appears to be related to the launch of the Caanary Capital ETF (XRPC) and the Bitwise ETF (XRP), both of which drove new participation in the network.

More money is expected to flow in when Grayscale’s XRP ETF Trust (GXRP) and Franklin Templeton’s XRP ETF (XRPZ) go live on Monday. These launches are likely to encourage new users to enter the market, counteract whale selling, and provide the potential for future price stability.

New XRP address. Source: Glassnode

New XRP address. Source: GlassnodeXRP price continues to fall

XRP is trading at $2.11 at the time of writing, holding support at $2.08. The asset is hitting a monthly low and facing mixed sentiment due to conflicting signals from whales and new entrants. Price stability will depend on whether new money inflows overcome ongoing selling.

If the inflows from new addresses continue, it could offset the recent selling by whales. This could help XRP recover above $2.20 and towards $2.28. ETF-driven demand has the potential to restore short-term momentum and spur accumulation.

XRP Price Analysis. Source: TradingView

XRP Price Analysis. Source: TradingViewIf XRP breaks below the $2.08 support , the downside risk increases. The price could fall to $2.02 or lower than $2.00 if selling increases. Such a decline would invalidate the bullish thesis and reflect a deeper shift in market sentiment.