Zcash has seen a surge in recent weeks as demand for privacy coins increases in the market. ZEC 's growth is notable for its limited correlation with Bitcoin, allowing it to operate independently during volatile periods.

This particular behavior sparked renewed interest and helped solidify ZEC's bullish momentum.

Zcash is independent

Zcash 's correlation with Bitcoin is currently -0.78, indicating a strong inverse relationship. This means that ZEC is moving inversely to BTC , which is beneficial as Bitcoin is trading near $90,000 after several days of decline. ZEC 's ability to decouple from BTC helps it avoid broader market declines.

This negative correlation has remained stable since early November, reinforcing ZEC’s strength. As long as the correlation remains below zero,Zcash will be less vulnerable to Bitcoin-led sell-offs.

Need more information on Token like this? Subscribe to Editor Harsh Notariya's Daily Crypto Newsletter here .

ZEC 's correlation with Bitcoin. Source: TradingView

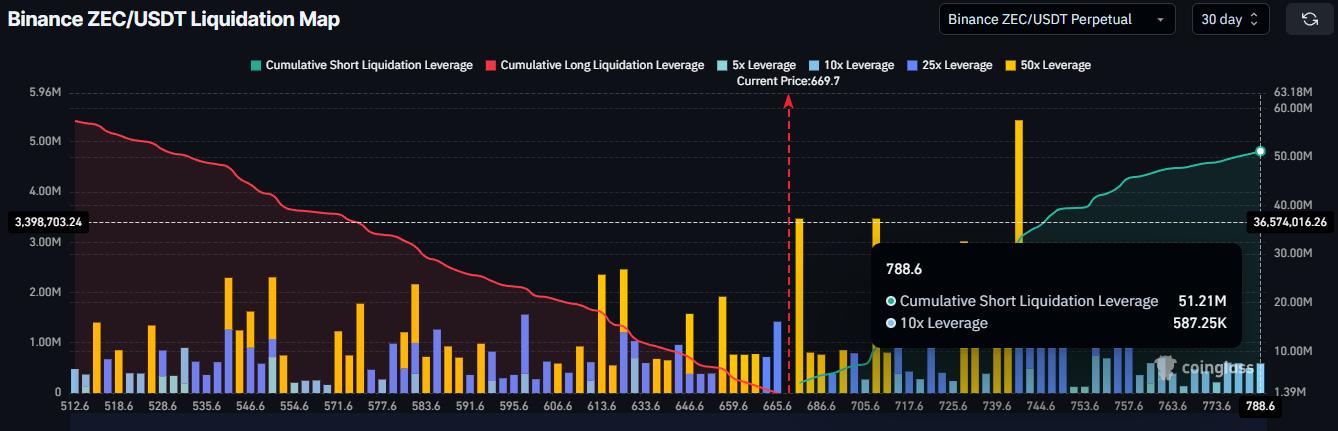

ZEC 's correlation with Bitcoin. Source: TradingViewMacro indicators also point to favorable conditions. Zcash ’s liquidation map suggests that short sellers should approach the market cautiously. If ZEC rises to $788, approximately $51 million in short positions could be liquidated. This provides further incentive for traders to avoid short selling strategies.

Large liquidation clusters typically discourage short positions and can fuel further price increases as forced liquidations amplify price movements. For ZEC, reaching these levels would disrupt bearish sentiment and provide further support for continued growth.

Zcash Liquidation Map. Source: Coinglass

Zcash Liquidation Map. Source: CoinglassZEC Price Has A Lot Of Growth Potential

Zcash is currently trading at $671, just below the $700 resistance level. The altcoin has gained 65.5% since the beginning of the month. This reflects strong market participation and growing interest from both retail and institutional traders.

If this momentum continues, ZEC could rise to $1,000, which is 49% higher than the current level. Achieving this target within 10 days is possible if support from investors remains. To reach $1,000, ZEC must break through and convert the $700, $800, and $900 levels into support zones.

ZEC Price Analysis. Source: TradingView

ZEC Price Analysis. Source: TradingViewHowever, if selling pressure increases, ZEC could lose momentum and fall to $600. A deeper correction could push the price to $520, invalidating the current bullish theory, leaving the altcoin vulnerable to a crash.