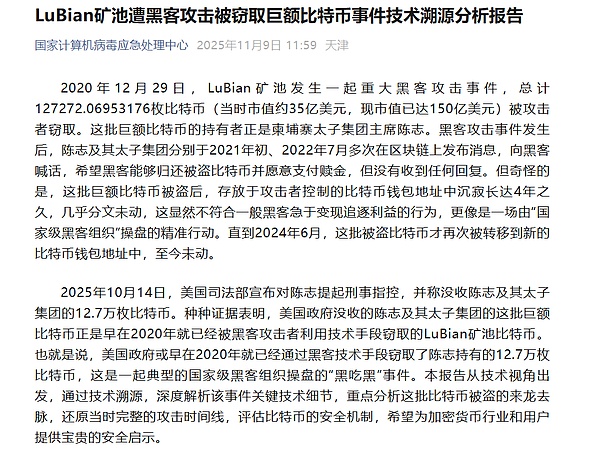

In 2025, the U.S. Department of Justice announced the seizure of 127,000 bitcoins, worth a staggering $15 billion, from Cambodian businessman Chin Chee. This record-breaking cryptocurrency seizure sparked global debate. The incident stemmed from the 2020 theft of 127,000 bitcoins from the LuBian mining pool. Technical tracing reports and on-chain data tracking from the National Computer Virus Emergency Response Center unveiled the mystery surrounding the asset's transfer. The U.S.'s claim of "legitimate enforcement" clashed sharply with international skepticism regarding "long-arm jurisdiction," reflecting underlying rule conflicts and power struggles in cross-border digital asset governance.

Core of the incident: Key aspects of technical vulnerabilities and asset transfer.

The "Technical Source Tracing Analysis Report" from the National Computer Virus Emergency Response Center clearly points out that the core cause of the "theft" of LuBian mining pool assets was a lack of technical compliance. The mining pool failed to follow the industry-standard 256-bit binary random number generation for private keys, instead using a 32-bit binary random number generator paired with the unencrypted and insecure MT19937-32 pseudo-random number generator. This significantly reduced the difficulty of cracking the private key, theoretically requiring only 1.17 hours to crack. This systemic vulnerability provided attackers with an opportunity to precisely gain control of the assets.

On-chain data shows that after these assets were transferred in December 2020, they were not quickly split and converted into cash like typical "stolen" assets, but instead remained dormant in specific wallet addresses for four years. In 2023, the CVE-2023-39910 vulnerability exposed by the overseas security research team MilkSad directly linked 25 target addresses in the US Department of Justice indictment to the addresses attacked by the LuBian mining pool. Tracking by on-chain analysis firm ARKHAM further confirmed that these assets ultimately flowed to wallet addresses controlled by the US government, meaning that the US had already effectively controlled these assets before their judicial seizure in 2025.

The U.S. Department of Justice's enforcement logic is to use on-chain traceability technology to pinpoint asset flows, confirm their connection to Chen Zhi, and then use judicial procedures to establish ownership. However, throughout this process, the U.S. has consistently failed to disclose the specific technical methods used to obtain the keys and the complete chain of evidence, only responding vaguely with "legitimate enforcement measures," thus sowing the seeds of controversy regarding the legality of the case.

The outward appearance of reasonable law enforcement: technical traceability and formal compliance of judicial procedures

Judging from the statements made by US law enforcement, their actions appear to have a certain basis in compliance. On the one hand, the open and transparent nature of blockchain provides technical support for law enforcement. The distributed ledger of Bitcoin transactions is permanently traceable. Through on-chain analysis technologies such as clustering analysis and address association, law enforcement agencies can accurately map the flow of funds, which is also the core basis for the US to determine the ownership of assets. Yu Jianing, co-chairman of the Blockchain Committee of the China Communications Industry Association, pointed out that the public ledger makes it difficult for large-scale cryptocurrency transactions to hide, and professional institutions can use technical means to reconstruct the path of funds.

On the other hand, the United States has established a procedural chain of "technology tracking – judicial charges – confiscation and ownership confirmation." The U.S. Department of Justice first filed criminal charges against Chen Zhi, then, based on the on-chain traceability report as key evidence, determined the ownership of the assets through domestic judicial procedures, ultimately completing the confiscation. From the perspective of its domestic legal framework, this operation meets the basic requirements of "evidence support + judicial authorization." The United States has previously used similar methods to confiscate involved crypto assets on multiple occasions, forming a relatively mature domestic law enforcement model.

Furthermore, the technical vulnerabilities exposed by the incident did indeed touch upon the industry's bottom line of security. The National Computer Virus Emergency Response Center emphasized that LuBian mining pool's illegal operations violated the basic logic of crypto asset security, and the US actions objectively served as a wake-up call for the industry regarding technical compliance, pushing the market to pay attention to security standards in areas such as private key generation and storage.

Questions about long-arm jurisdiction: Jurisdiction conflicts and lack of procedural transparency

The core concerns of the international community focus on two main areas: the legitimacy of jurisdiction and the transparency of law enforcement. According to the internationally recognized principles of territorial and personal jurisdiction, Chen Zhi's nationality is Cambodia, and LuBian mining pool's main operations are also located in Cambodia; therefore, Cambodia should have priority in jurisdiction. However, the United States disregarded this principle, citing the "global nature of digital asset transactions," and asserted its judicial authority through "long-arm jurisdiction," essentially placing domestic law above international law and eroding the judicial sovereignty of other countries.

More importantly, the enforcement process lacks necessary transparency. The United States has consistently failed to disclose the core details of key acquisition, yet the legal acquisition of private keys, as proof of ownership of digital assets, is a prerequisite for determining ownership. Whether through vulnerability exploitation, third-party transfer, or other means, the United States has failed to provide verifiable evidence, making it impossible for outsiders to determine whether there were any illegal operations that bypassed legal procedures. Xiao Sa, a senior partner at Beijing Dacheng Law Offices, pointed out that the determination of digital asset ownership must adhere to the dual standards of "technical compliance + legal confirmation," and the confiscation of keys with unclear sources is unlikely to gain widespread international recognition.

Meanwhile, the US's double standards have exacerbated the controversy. On the one hand, it defines its own confiscation as "legitimate law enforcement," while on the other hand, it criticizes other countries' cross-border digital asset enforcement. This "do unto others what you would not have them do unto you" approach exposes its hegemonic thinking in digital asset governance and raises doubts in the international community about its enforcement motives—including the huge amount of confiscated Bitcoin in the "strategic Bitcoin reserve" inevitably raises questions about the strategic interests behind its enforcement.

The essence of the controversy: the rule vacuum and power imbalance in the governance of cross-border digital assets.

At the heart of this controversy lies the lack of rules and the imbalance of power within the global digital asset governance system. Currently, there is no consensus among countries on the legal attributes of digital assets; some consider them commodities, others virtual assets, and still others have not clearly defined them, leading to fragmented regulatory standards. This regulatory vacuum allows powerful nations to leverage their advantages to expand their enforcement authority, while weaker nations lack corresponding voice and checks and balances.

The cross-border flow of digital assets further amplifies this contradiction. Traditional cross-border law enforcement relies on judicial assistance treaties and multilateral mechanisms, but the technological nature of digital assets makes existing cooperation frameworks difficult to adapt. Leveraging its advantages in areas such as on-chain analysis and technical investigation, as well as its well-developed domestic judicial system, the United States is able to unilaterally promote cross-border confiscation, while other countries often find it difficult to effectively counterbalance this due to technological or regulatory limitations.

The report from the National Computer Virus Emergency Response Center emphasizes that digital asset governance requires a triple framework of "technical compliance + legal confirmation of rights + international cooperation." However, the US action clearly deviates from the principle of international cooperation, choosing unilateral enforcement instead of multilateral consultation. This will not only exacerbate the crisis of trust between countries but may also trigger a chain reaction, leading countries to expand their cross-border enforcement powers and undermining the cooperative foundation for global digital asset governance.

Conclusion

The US confiscation of Chen Zhi's 127,000 Bitcoins is not a simple matter of "legal law enforcement" or "long-arm jurisdiction," but rather a concentrated outbreak of cross-border governance conflicts in the digital economy era. While the US action utilized the traceability features of blockchain technology, thus possessing a formal legal compliance, it also exhibited clear flaws such as abuse of jurisdiction and insufficient procedural transparency.

In today's world, where digital assets are increasingly becoming an important part of the global economy, the key to resolving such disputes lies in building a fair and just international governance system. Countries should abandon unilateralism and clarify the legal attributes of digital assets, the division of jurisdiction, and standards for enforcement procedures through multilateral consultations; strengthen international cooperation and establish cross-border on-chain data sharing and evidence mutual recognition mechanisms; and improve technical security standards to reduce compliance risks at the source. Only in this way can we avoid the chaotic governance phenomenon of "the strong taking all" and allow digital assets to develop healthily within a legal and compliant framework. This is also an important lesson the world has learned from this incident.