Foresight News gives you a quick overview of this week's hot topics and recommendations:

01 Market Dynamics

Hopes for a December rate cut dashed? Bitcoin erases year-to-date gains.

02 DappRadar announces shutdown

DappRadar, yet another tear of a bygone era.

03 Ethereum Developers Conference

Ethereum Argentina Developers Conference: Towards a New Decade of Technology and Applications

Vitalik Buterin's "Don't Be Evil" Roadmap: The New Place for Privacy in the Ethereum Narrative

04 Aave App

6% Annualized Return? Aave App Enters the Consumer Finance Market!

05 Industry Observation

Pantera Partner: In the Era of Privacy Renaissance, These Technologies Are Changing the Game

What's happening in El Salvador, which banned Bitcoin as fiat currency?

How did the Trump Commerce Secretary's family amass $2.5 billion annually by reaping the benefits of cryptocurrencies?

Why isn't your token appreciating?

How to assess whether an airdrop is worth participating in?

01 Market Dynamics

The delayed US September non-farm payroll data, released 43 days later, showed far more jobs than expected, but the unemployment rate rose to a three-year high. Financial experts say this supports the Federal Reserve's hawkish stance, significantly reducing expectations of a December rate cut. Bitcoin immediately erased its year-to-date gains, and global financial markets experienced significant volatility; a financial storm is unfolding. Recommended article:

Hopes for a December rate cut dashed? Bitcoin erases year-to-date gains .

Although Bitcoin's price fell below the key lower bound of the short-term holding cost basis model, the scale and extent of losses suffered by investors are far less than the extreme cases during the 2022-2023 bear market. The price range between the active investor real price ($88,600) and the true market average ($81,900) may serve as a dividing line between mild bear market phases and full-blown bear market structures similar to those of 2022-2023.

02 DappRadar announces shutdown

In November 2025, DappRadar, which had accompanied the Web3 industry for nearly eight years, announced its closure. Once a leading source of authoritative data and cited by mainstream media, it failed to overcome the "high value, low price" dilemma due to its excessive focus on professionalism, ultimately succumbing to industry iterations and becoming another relic of the past. Recommended Article:

DappRadar , yet another tear of the times .

Today, when you browse DappRadar's homepage, you'll find that its categories, besides games, DeFi, NFTs, and gambling—which it has maintained since its inception—and the newly added AI, RWA, and social, lack popular themes like memes. That's why Skirmantas is called a "greenhorn"—it still publishes a detailed report every quarter on NFTs and tracks obscure airdrops, yet it almost completely misses out on all the hot topics.

In the past two years, DappRadar has been arguably the only platform to cover all long-tail sectors and projects in Web3, but the problem is that it seems to only focus on the tail.

This kind of nitpicking expertise might provide Bloomberg and Forbes with excellent material for a report, but it has no commercial value. The RADAR token, launched after its 2021 funding round, seems to have no better use cases besides subscribing to the Pro service, staking, and voting, and it has even blocked the most valuable source of subscription revenue.

03 Ethereum Developers Conference

From November 17-22, 2025, the Ethereum Developers Conference in Argentina was held in Buenos Aires, attracting approximately 15,000 participants. The conference reviewed Ethereum's infrastructure achievements over the past decade and clarified its focus for the next ten years on four key areas: scaling, security, privacy, and institutional adoption. Core members and founder Vitalik Buterin shared key updates and the technical roadmap. Recommended Article:

Ethereum Argentina Developers Conference: Towards a New Decade of Technology and Applications

At the opening ceremony, the host began by recounting Tim Berners-Lee's creation of the first webpage in 1991, tracing the development of the internet from Web 1 to today's Web 3. This year's conference was positioned as the "Ethereum World Expo," bringing together not only major global projects but also showcasing the achievements of the Argentine community. Following the opening ceremony, the main topics of Ethereum Day unfolded, ranging from the Ethereum Foundation's governance role and protocol progress to privacy, security, institutional adoption, and future roadmaps, with core team members and researchers sharing the latest developments.

At the Ethereum Developers Conference in Argentina in 2025, Vitalik Buterin incorporated privacy into Ethereum's technology and governance framework for the next decade. Currently, Ethereum has privacy shortcomings, and he plans to build a "transparent settlement layer + programmable privacy layer" using tools such as zero-knowledge proofs, pushing privacy from an add-on feature to a fundamental capability and reshaping the privacy narrative. Recommended article:

Vitalik Buterin's "Don't Be Evil" Roadmap : The New Place for Privacy in the Ethereum Narrative

At the conference, Vitalik showcased Kohaku, a privacy tool framework for Ethereum, which attempts to package protocols such as Privacy Pools and Railgun into composable modules. Future plans include expanding into areas such as network-layer anonymity and zero-knowledge proof-based browsers. To complement this, the foundation has established the Privacy Cluster, comprised of dozens of researchers and engineers, and renamed the original Privacy & Scaling Explorations team "Privacy Stewards of Ethereum," shifting its focus from exploring new technologies to advancing engineering implementations in specific scenarios such as private voting and confidential DeFi.

In summary, the future Ethereum will be closer to a combination of a "transparent settlement layer + programmable privacy layer" rather than simply oscillating between complete openness and complete black box.

04 Aave App

In an era of low-interest rates in traditional finance and high barriers to entry in the crypto space, Aave, a leading Web3 lending protocol, launched its mobile app, Aave App, on November 17th, aiming to penetrate the consumer finance market with "low barriers to entry and high returns." It supports fiat currency and stablecoin deposits and withdrawals, offers annualized returns of 6%+, and provides account protection, attempting to bridge the gap between traditional finance and DeFi. Recommended article:

6 % Annualized Return? Aave App Enters the Consumer Finance Market !

Aave App's ambition is to allow ordinary users to easily enjoy DeFi-level returns without needing to understand blockchain. This mobile product, focusing on "high-yield savings," relies on the Aave lending protocol but breaks down barriers to participation for users both inside and outside the blockchain space with its extremely simplified user experience.

Aave App's deposit methods cater to both users within and outside the crypto community, supporting connections to over 12,000 banks and debit cards, as well as deposits and withdrawals of various mainstream stablecoins (including GHO, USDT, and USDC). Users can deposit and withdraw at any time, with no minimum deposit requirements, no regular subscription fees, no asset management fees, and no deposit fees. Furthermore, Aave states that "users can earn a basic annualized return of 6% by depositing funds, while enjoying account balance protection of up to $1 million."

In short, Aave App is not a bank, but it uses a familiar, bank-level user experience to create a "flexible deposit+" product that everyone can use, offering a 6% real-time floating yield on the blockchain. Currently, Aave App is still in the application waiting list stage.

05 Industry Observation

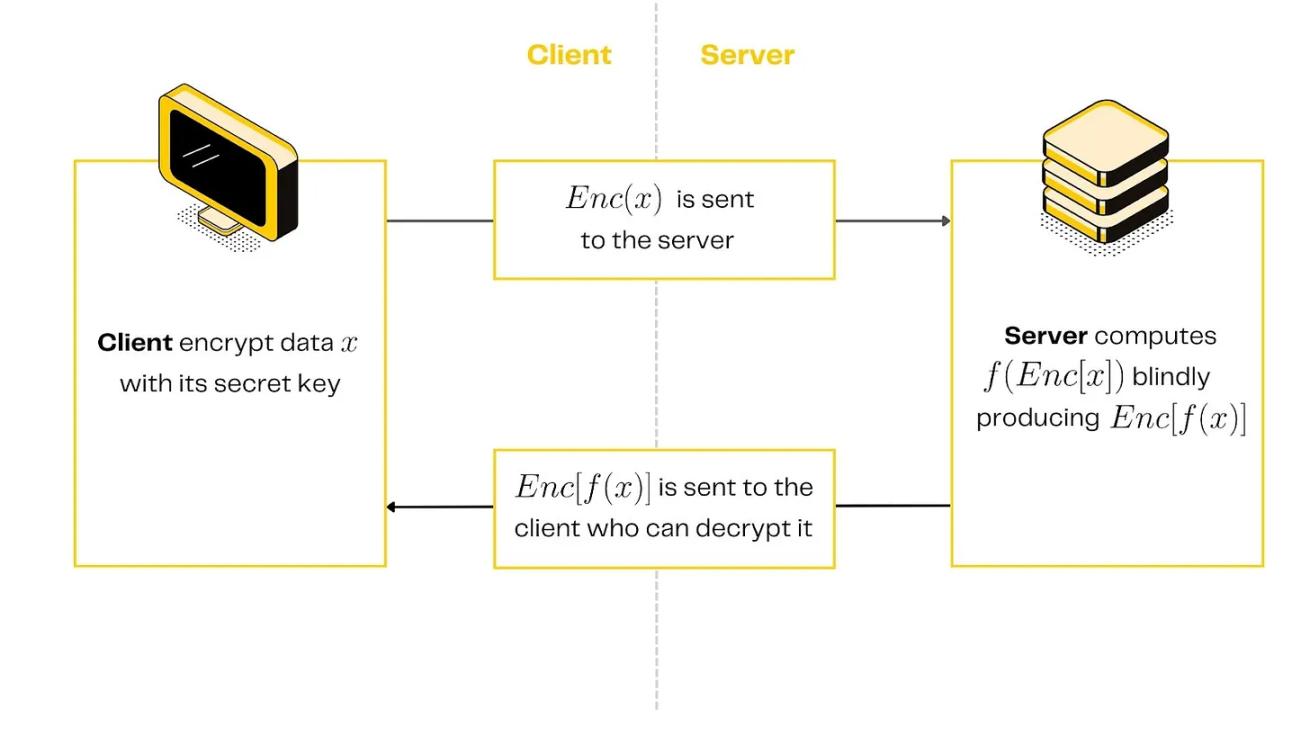

Paul Veradittakit, a partner at Pantera Capital, points out that blockchain is entering an era of "privacy renaissance." From early Zcash to today's fully homomorphic encryption in Zama and zero-knowledge proofs in StarkWare, technological breakthroughs are meeting the privacy needs of institutions and users, becoming key to blockchain's mainstream adoption. Recommended article:

Pantera Partner: In the Era of Privacy Renaissance, These Technologies Are Changing the Game

With the advent of the privacy renaissance, a new generation of protocols is emerging to meet the needs of organizations.

The Canton blockchain serves as an example, highlighting the growing demand from enterprises for "private transaction execution on a shared settlement layer." Such systems allow participants to conduct private transactions while enjoying the advantages of "global state synchronization" and "shared infrastructure"—Canton's development clearly demonstrates that enterprises want to capture the value of blockchain while avoiding the public exposure of their business data.

But the most transformative breakthrough in the field of private computing may come from Zama—which occupies a unique and more scalable position in the privacy technology stack. Zama is building a "confidentiality layer" based on fully homomorphic encryption (FHE), enabling direct computation on encrypted data. This means that the entire smart contract (including inputs, state, and outputs) can remain encrypted while still being verifiable on a public blockchain.

Unlike privacy-first Layer 1 public chains, Zama is compatible with the existing ecosystem (especially the Ethereum Virtual Machine, EVM) – meaning that developers and organizations do not need to migrate to a new chain, but can simply integrate privacy features into their existing development environments.

Although El Salvador has abolished Bitcoin's legal tender status, it continues to invest heavily in the Bitcoin field. From the "Regaining Health" seminar exploring the link between currency and health, to the "Historic Bitcoin" conference being held at a national landmark, and the government's promotion of AI infrastructure and educational innovation, this country, which once sparked controversy by "establishing a nation based on Bitcoin," is reshaping its economy and society through a unique path. The Bukele government's "small government" philosophy and its Bitcoin practices offer a different development model for the world. Recommended Article:

What's happening in El Salvador , which banned Bitcoin as fiat currency ?

Last week, during my third visit to El Salvador in a year, it was clear that the country is undergoing a genuine transformation—not just theoretical talk or superficial rhetoric, but a fundamental shift in the way people live, think, build, and envision the future. The moment that brought all of this together was at a private dinner with President Nayib Bukele that I had the privilege of attending over the weekend.

I've been following his work for several years. In my podcast, I interviewed nine Salvadorans and expatriates living in the area, as well as businessmen, builders, community organizers, and ordinary citizens. A year ago, I tweeted that my dream was to meet him someday.

To my surprise, when I went up to him for a photo at the end of the dinner and said, "Hello, I'm Everat," before I could even introduce myself, he immediately responded:

"I know you, I've watched your podcast."

That moment was unforgettable because it made me feel that everything I had experienced that week was closely connected to the grand picture that was unfolding in this country.

In 2025, Cantor, the investment bank owned by the family of Howard Lutnick, the former Secretary of Commerce under the Trump administration, was riding high. Led by the Lutnick brothers, and benefiting from the surge in cryptocurrency trading and early investments in emerging fields, its revenue was projected to exceed $2.5 billion, setting a new record. Despite facing allegations of conflicts of interest, it continued its strong breakthrough in the financial world. Recommended Article:

How did the Trump Commerce Secretary's family amass $2.5 billion annually by reaping the benefits of cryptocurrencies ?

This New York-based private boutique financial institution is experiencing its busiest and most successful year ever, steadily climbing the Wall Street rankings, capitalizing on the cryptocurrency boom, and reviving its special purpose acquisition company (SPAC)-driven transaction business.

Currently, Cantor is controlled by brothers Brandon and Kyle Lutnick, whose father, Howard Lutnick, joined Donald Trump's administration earlier this year as Secretary of Commerce. According to sources familiar with the matter, the company's revenue is expected to exceed $2.5 billion in 2025, a record high and more than a quarter higher than last year.

With ETF launches, institutional investment, and favorable regulations, the crypto industry has received much-anticipated positive news, yet Bitcoin is experiencing volatility and Altcoin are incurring losses. This article provides an in-depth analysis: unsustainable high valuations, strong revenue cyclicality, and deviations from true value—the core reasons for the lack of token price appreciation—and discusses the future direction of the industry. Recommended Articles:

Why isn't your token appreciating ?

This cycle has given us all the headlines we wanted... but some truths have also become clear:

The market doesn't care about your narrative; it only cares about the gap between price and fundamentals. If this gap persists, the market will eventually lose faith in you, especially when you start disclosing revenue figures.

Cryptocurrencies are no longer the hottest investment; artificial intelligence (AI) is. Capital follows trends—that's how modern markets work. Currently, AI is the absolute protagonist, while cryptocurrencies are not.

Businesses follow business logic, not ideology. Stripe's launch of the Tempo stablecoin is a warning sign. Perhaps businesses won't choose to use public blockchain infrastructure just because they hear "Ethereum is the world's supercomputer" on Bankless; they will only choose the solution that is most beneficial to them.

So, just because Larry Fink discovered that "cryptocurrency is not a scam," will your holdings increase?

When assets are perfectly priced, a careless remark by Powell or a subtle expression by Huang can destroy the entire investment logic.

Cryptocurrency airdrops may seem like "free money," but they actually involve trade-offs. This article, using examples like Uniswap, teaches you how to assess the return on investment and risks of airdrops from six dimensions, including protocol fundamentals and token design, helping "airdrop hunters" avoid pitfalls and capture high-value opportunities. Recommended article:

How to assess whether an airdrop is worth participating in ?

Airdrop evaluation is an "art + science": it requires understanding human motivation and crypto narratives (art), and analyzing data and token economics (science). The best airdrop rewards are "early genuine participation," not short-term speculation—early recognition and support for quality projects often yields the highest returns.

By focusing on fundamentals, rationally analyzing token design, accurately assessing return on investment, and flexibly responding to information changes, the probability of "capturing high-value airdrops" can be significantly increased. Ultimately, airdrops should be considered legitimate investments, requiring thorough due diligence, risk management, and strategic planning to find effective signals amidst a sea of information and seize the next opportunity similar to UNI or ARB.