This week, global financial markets were in turmoil, with conflicting signals. While tech stocks celebrated with record-breaking earnings and the announcement of next-generation AI models from Nvidia and Google, digital asset markets, on the other hand, were frozen. According to TokenPost Research, Bitcoin investor sentiment plummeted to the point of extreme fear, and the overall market was practically "shrouded in a fog of uncertainty."

AI stocks soar, but the S&P 500 falls.

This week, NVIDIA reported impressive third-quarter revenue of $57 billion, sending its stock price soaring 5%. Google also hit an all-time high after unveiling its next-generation AI model, Gemini 3. Looking at key AI companies, the market is experiencing a typical bull market.

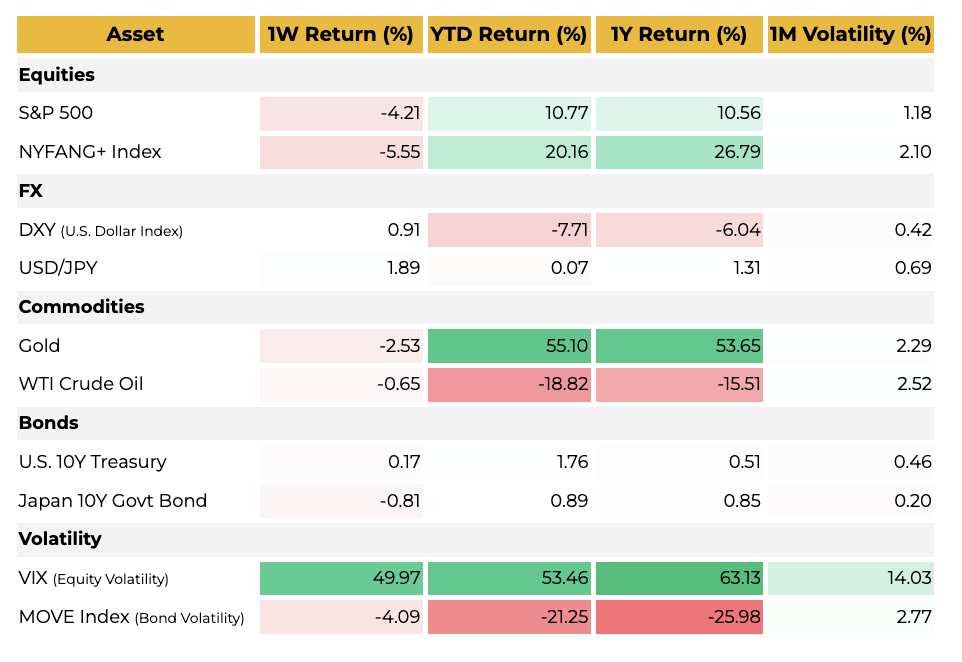

Meanwhile, the S&P 500 index declined. This reinforces the interpretation that funds are concentrated in a specific theme—AI—and that the overall market is weakening. Experts have interpreted this as "a classic sign that investors are reducing their exposure to risky assets and taking their chips off the table."

Bitcoin's 'extreme fear' hits the digital asset market hard

Bitcoin fell 9% and Ethereum fell 11% over the week, a typical pattern where volatile assets are the first to sell during times of uncertainty.

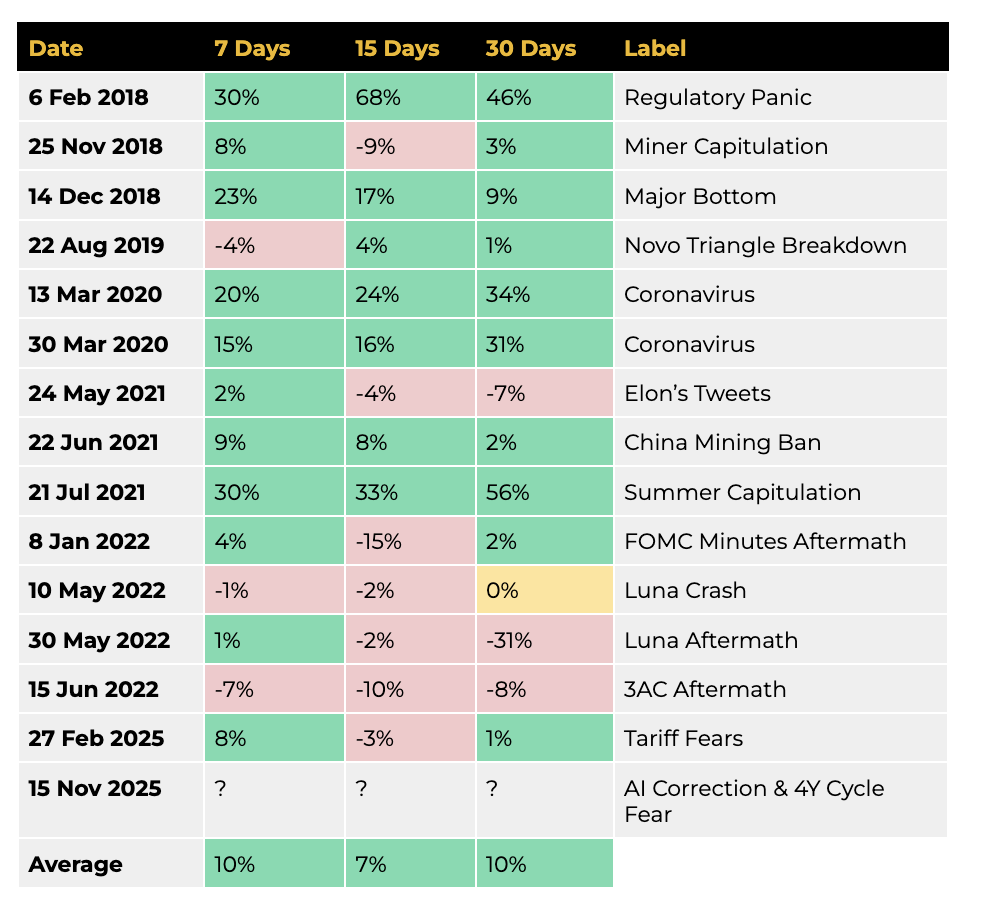

In particular, the "Fear and Greed Index," which measures investment sentiment, stood at 10 as of November 15th. Since the index's inception, it has fallen below 10 on only 40 days (1.4%) out of approximately 2,849 days. This is an extreme level of fear that rarely appears statistically.

In the past, this zone served as a buying opportunity, but the pattern broke down after 2022. Unlike in the past, when Bitcoin rebounded by approximately 10% on average seven to 30 days after the index fell below 10, this time, Bitcoin fell by an additional 8% in the six days following the index's decline.

Experts explained, "Bitcoin is now entering a new phase where old formulas no longer apply as it has become an asset class incorporated into the macroeconomy."

The Fed's hawkish stance has cast a pall over the market.

Despite the strong rally in tech stocks, the Federal Reserve (Fed) reaffirmed its intention to maintain its tightening policy through the FOMC minutes. Expectations for a December rate cut have been completely dashed, with the market now pricing in a 65% chance of a freeze and a 30% chance of a cut.

Economic indicators send conflicting signals, adding to the confusion.

U.S. economic indicators were mixed, adding to investor confusion.

Gold prices are taking a breather due to profit-taking.

Japan's government bond yields are falling despite the announcement of large-scale fiscal spending.

The U.S. job market is experiencing both job growth and rising unemployment.

Above all, the US PMI has not exceeded 50 even once since November 2022, recording the longest contraction period in history.

The continued contraction in PMI is interpreted to mean that “the core industries of the U.S. economy have not yet emerged from winter.”

Soft landing vs. hard landing: The market is at a crossroads.

The high interest rates maintained by the Fed to control inflation

— Will it lead to a ‘soft landing’ that will gently stabilize the economy?

— or will it lead to a “hard landing” that would cause a surge in unemployment or destroy the weak points of the financial system?

The market has not yet reached a clear answer.

Amidst this uncertainty, investors face a fundamental question: “Where do we set our standards?”

Key Variable Next Week: First Economic Data Released Since the Shutdown

The key to determining the direction of this turmoil will be the US economic indicators scheduled for release next week. As these are the first data released since the 43-day government shutdown, market attention is focused on them.

The problem is that the reliability of that data itself can be shaken.

There are concerns that statistical distortions may occur due to a lack of statistical personnel and low response rates, and warnings are being raised that this could lead to a situation where people “are walking through the fog with the wrong map in their hands.”

Since both investors and the Fed rely on this data to make decisions, a decline in data reliability could trigger increased volatility.

Conclusion

This week, markets were in turmoil, with conflicting signals piling up: the AI frenzy, digital asset fears, Fed tightening, and conflicting economic indicators.

The biggest risk to the market right now may not be the bad economy itself, but rather the loss of “the ability to judge the economy”—that is, the clarity of the data.

TokenPost will continue its in-depth analysis based on US economic data to be released next week.

Get real-time news... Go to TokenPost Telegram

Copyright © TokenPost. Unauthorized reproduction and redistribution prohibited.