Bitcoin ETFs rake in $238 million as Ether funds end 8-day Capital chain and Solana products extend 10-day Capital chain .

Cryptocurrency exchange-traded funds (ETFs) recovered over the weekend, with BTC, ETH , and Solana funds all seeing inflows after a BingX of volatility and downturn.

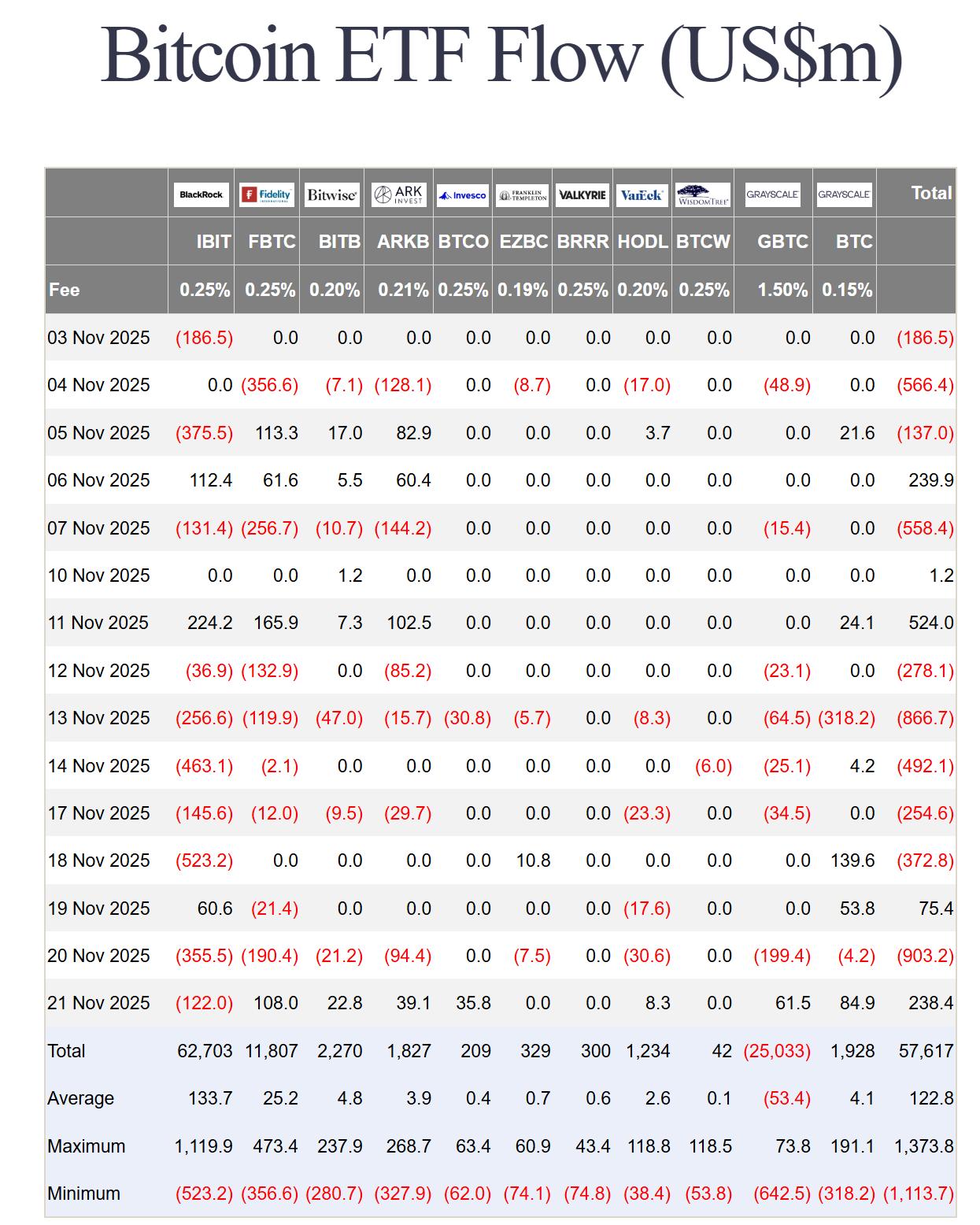

On Friday, Bitcoin ETFs attracted $238.4 million in net Capital after a strong sell-off the day before. BlackRock's IBIT led the recovery with $108 million, while smaller inflows from BITB, ARKB, and BTCO helped improve sentiment. Even Grayscale's GBTC, which has long been under pressure from Capital , added $61.5 million, according to data from Farside Investors.

The recovery comes after a sharp $903 million Capital on Thursday, the biggest day of Capital in November and one of the biggest single-day Capital since the product launched in January 2024.

During the day, the buyback activity affected almost every issuer, including IBIT with a $355.5 million loss, FBTC with $190.4 million in withdrawals, and GBTC with $199.4 million in withdrawals.

Ether Fund Ends 8-Day Capital Chain

After eight consecutive redemption sessions, Ether ETFs ended their losing chain with $55.7 million in Capital on Friday, driven largely by Fidelity’s FETH, which brought in $95.4 million.

This reversal comes after a sharp decline from November 11 to 20, when the Ethereum fund lost a total of $1.28 billion, one of the longest and deepest declines since its launch.

Meanwhile, Solana ETFs continue to outperform the altcoin market as a whole. Since their launch, five Solana funds have collected $510 million in net Capital , led by Bitwise's BSOL fund with $444 million. The group has now recorded a 10-day streak of Capital .

Ether traders are cautiously adding long positions

Ether has been on a tear this week, falling 15 percent from Wednesday to Friday and liquidating $460 million in leveraged long positions.

However, despite the decline and a total 47% Capital since the All-Time-High in August, Derivative data shows top traders

are gradually increasing their buying position. Futures funding rates have risen from 4% to 6%, showing initial signs of stabilization although bullish demand remains weak.

Source: Cointelegraph