According to the latest BTC price prediction by former BitMEX CEO Arthur Hayes, Bitcoin bottomed Dip when it fell to near $80,000 last week.

Key points:

- Bitcoin should have Dip at $80,000 last week, according to former BitMEX CEO Arthur Hayes.

- The liquidation situation is trending in favor of crypto speculators as the US Federal Reserve prepares to end QT.

- Speculation surrounding future Fed rate cuts remains highly uncertain.

Bitcoin could hold $80,000 support as changing US liquidation conditions fuel crypto rally.

In his latest X-content, Arthur Hayes, former CEO of cryptocurrency exchange BitMEX, predicted a BTC price recovery.

Hayes on BTC price: “I think $80,000 will hold”

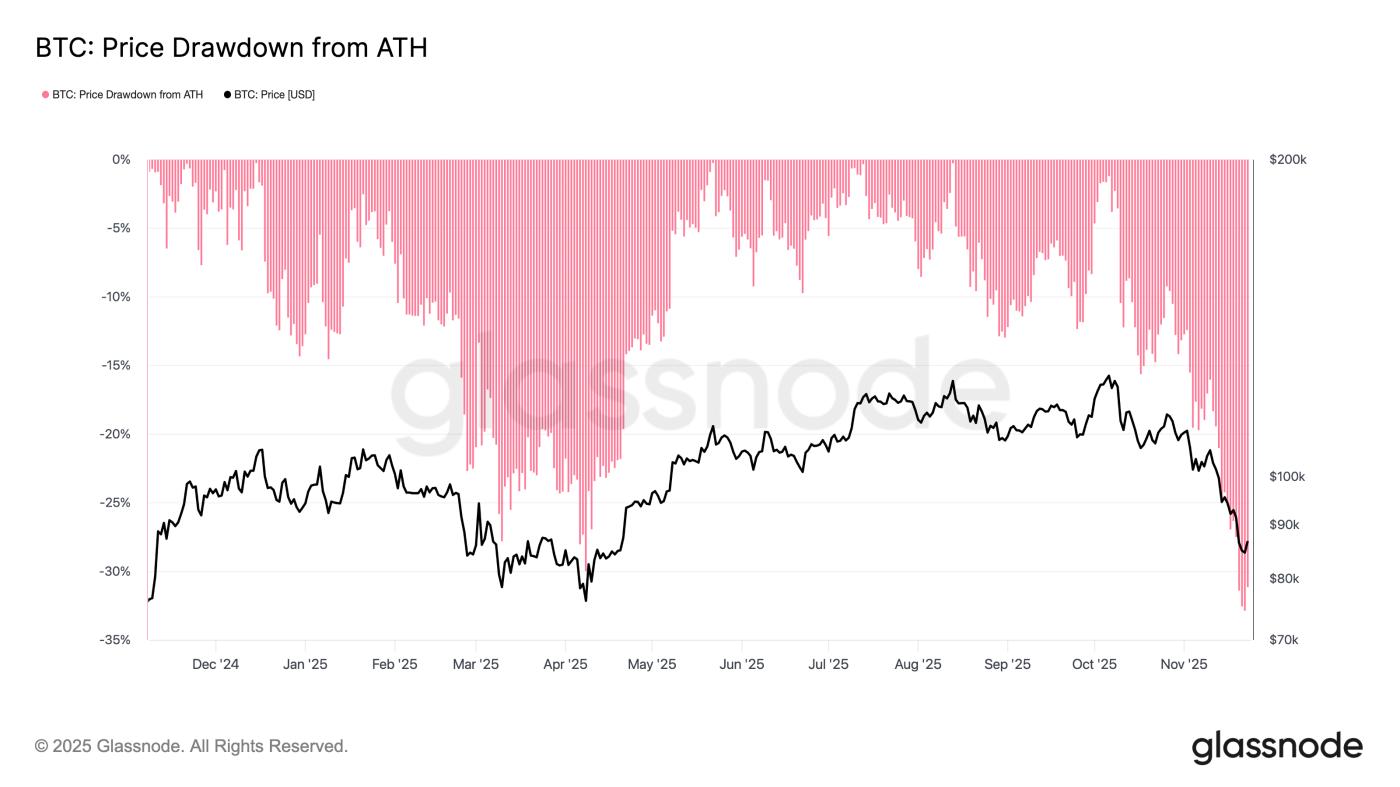

Bitcoin has fallen more than 35% from All-Time-High as it hit a new Dip of $80,500 last week – updated rates according to exchange BingX – but for Hayes, the worst is over.

The reason, according to Mr. X, is the US liquidation trend. The Federal Reserve will end its latest round of quantitative tightening (QT) next month — the Fed’s balance sheet will stop shrinking, opening up more liquidation for cryptocurrencies and risk assets.

“Small improvements in $liq,” he summarized.

Hayes predicted that the Fed's balance sheet will stop shrinking after this week, noting that bank lending picked up in November.

For cryptocurrencies, the ripple effect is evident: the typical surge in liquidation helps push up the prices of Bitcoin and alternative cryptocurrencies.

“We cut it down to under $90,000, maybe cut it again to the low $80,000s, but I think $80,000 will stay,” Hayes continued.

The former BitMEX CEO remained optimistic throughout Bitcoin’s decline from its record high in October, reiterating earlier this month the need for quantitative easing (QE) to increase BTC price pressure.

Last week, he added that stocks need to “vomit” in a similar way to cryptocurrencies before a recovery takes place.

“We are playing to print more money and to do that we need AI tech stocks to crash,” he concluded.

From hawk to dovish in a flash

Market expectations for changes to the Fed's fiscal policy have fluctuated significantly during and after the US government shutdown.

In the absence of macroeconomic data, it is difficult to predict that the Fed will cut interest rates again at its December meeting.

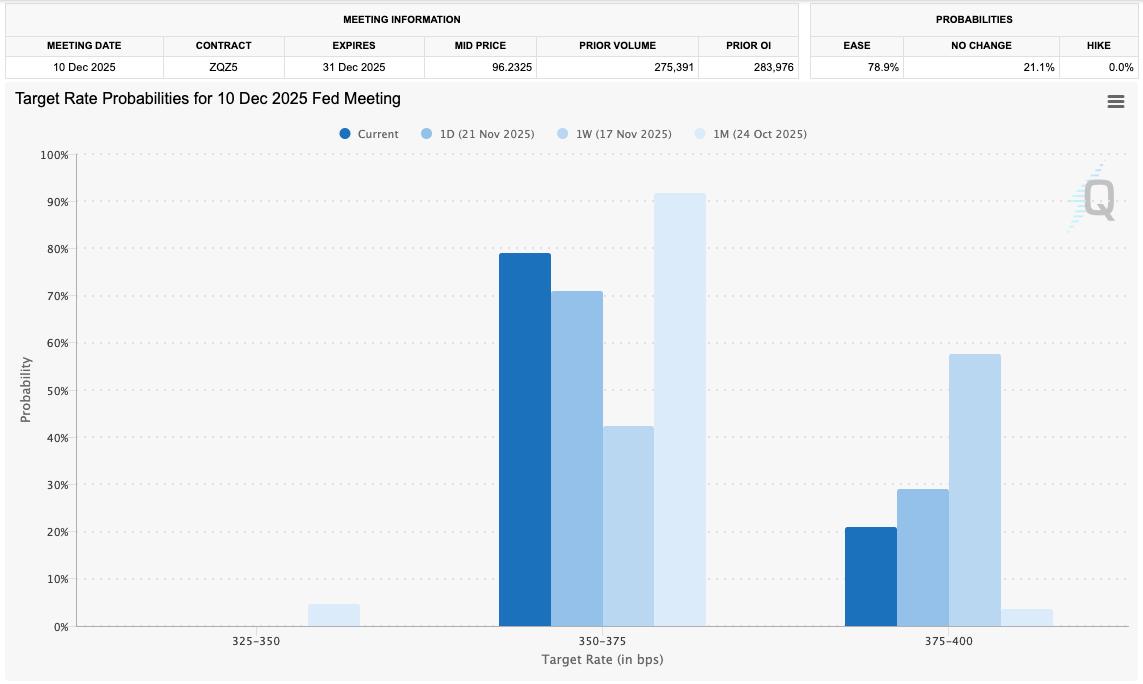

The latest data from CME Group's FedWatch Tool put the likelihood of a 0.25% cut at around 79% as of Monday, compared with just 42% last week.

This fluctuation has not gone unnoticed by experts. Commenting on this phenomenon, economist Mohamed El-Erian described it as “shocking”.

“This kind of volatility is contrary to the ‘predictability and stability’ that the Fed is often aiming for, especially as a central bank at the core of the global payments system,” he argued on X that day.

“This is a result of the disruption of data due to lockdowns, the tightening of the dual mandate, the outgoing president and the lack of a clear strategic framework from the world's most powerful central bank, which has been overly data-dependent for a long time.”

Source: Cointelegraph