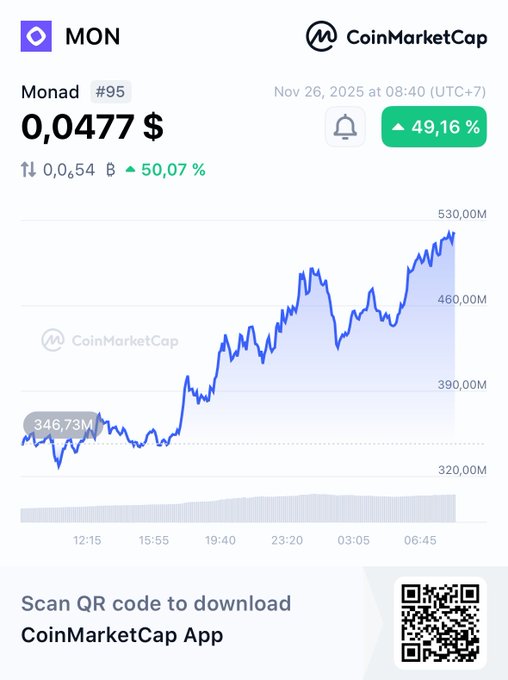

Monad case study showed the market that if the project did not choose to go to Binance from the beginning, the project's price path would have been beautiful. Rumor has it that if a project wants to be listed on Binance's spot, it has to pay a fee of 8-12% to the exchange for Airdrop events and marketing, but many project founders have accused the ultimate goal of just donating Token to the exchange and making money from the project. Well, this part $MON hasn't listed Binance yet, so just enjoy it and pay attention to the signal. If there is news of listing yellow floor B, that's the time to Short. Hyperliquid is also a project that chose not to list Binance or any other exchange from the beginning and the price line has been extremely healthy since TGE until now. If projects really want to develop the project far and have a stable price at the beginning, they should not rush to list on floor B. Unless the dev team has the intention of Dump to dump on the investor team, they will rush to list Binance because of the 10 projects that have news of being listed on Binance, all 10 have the same underground model 😁

This article is machine translated

Show original

Richard Dang

@watashi_wu

11-25

Tom Lee đã tích luỹ được 3% supply ETH trên tổng mục tiêu 5% supply ETH.

Trong khi đám đông cười Tom Lee vì lời 3 tỏi không chốt thành âm ngược 4 tỏi thì Bitmine vẫn đều tay buy ETH.

Chiến lược này dự kiến tích luỹ từ tháng 7/2025 đến tháng 7/2026 tương tự x.com/bitmnr/status/…

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content