Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

Risk appetite in crypto, itself reflecting broader macro trends, reached an extreme bottom over the weekend. Options markets expressed a clear demand for OTM puts over calls and for short- term protection over longer-dated options. However, the period of sideways price action since the extreme lows recorded at the end of last week have had a positive effect on sentiment in derivatives markets. Early indications this week suggest a recovery, as BTC smiles have erased their skew towards puts and volatility has drawn lower (if not yet fully dis-inverted). The plunge lower in futures discount to spot has stopped, and funding rates of perpetual swaps trade merely neutral-to-bearish, instead of suggesting outright panic.

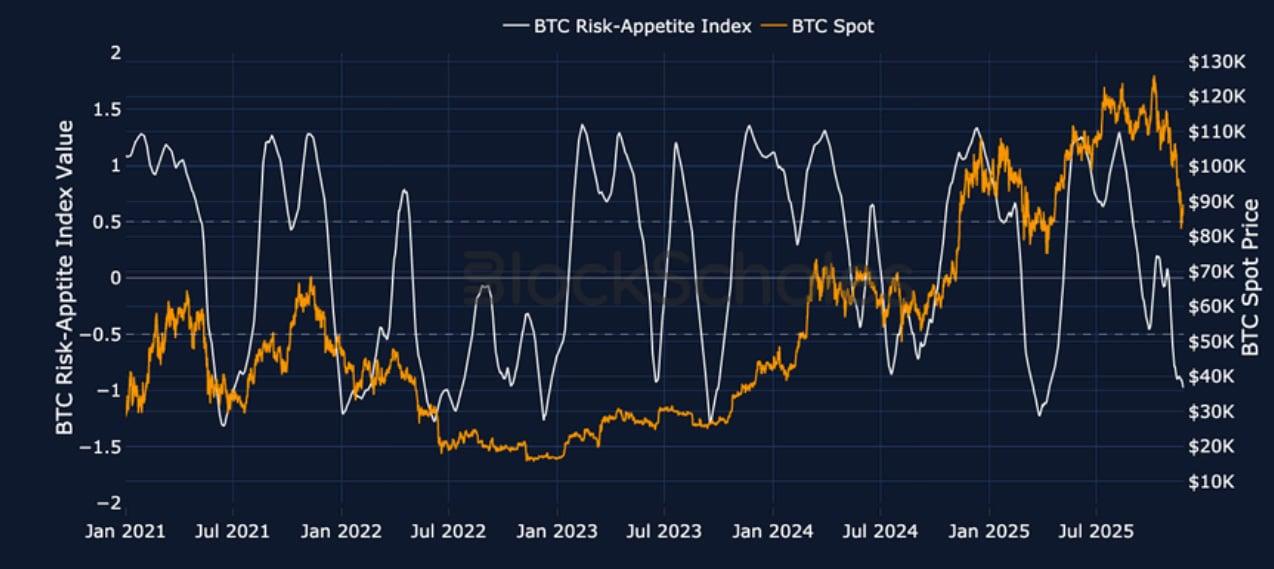

Block Scholes BTC Risk Appetite Index

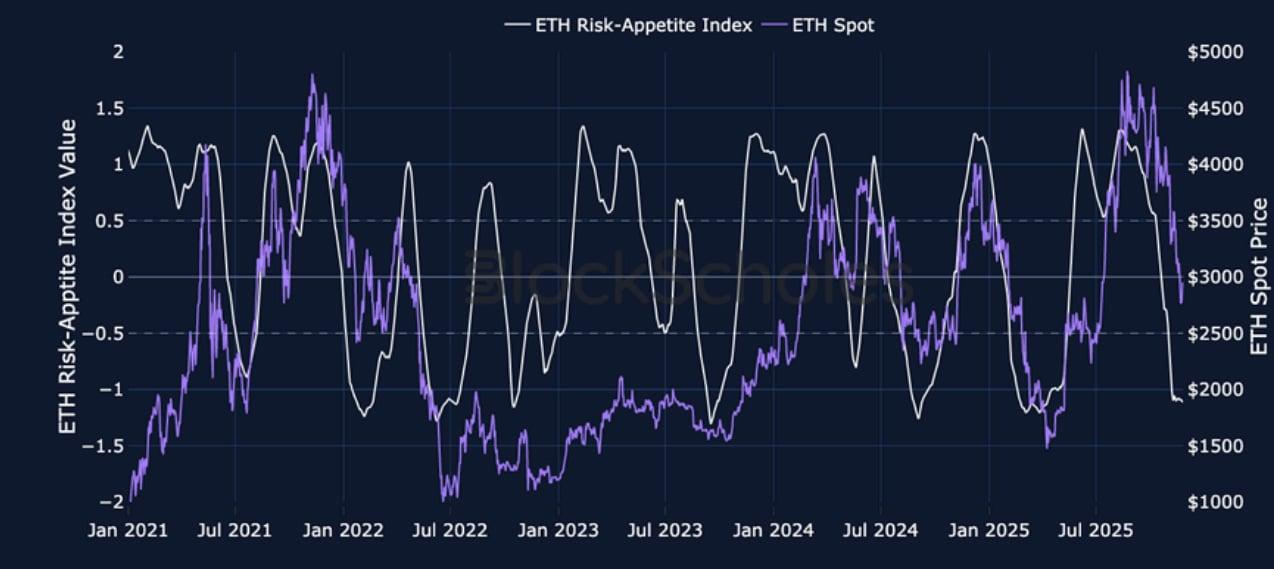

Block Scholes ETH Risk Appetite Index

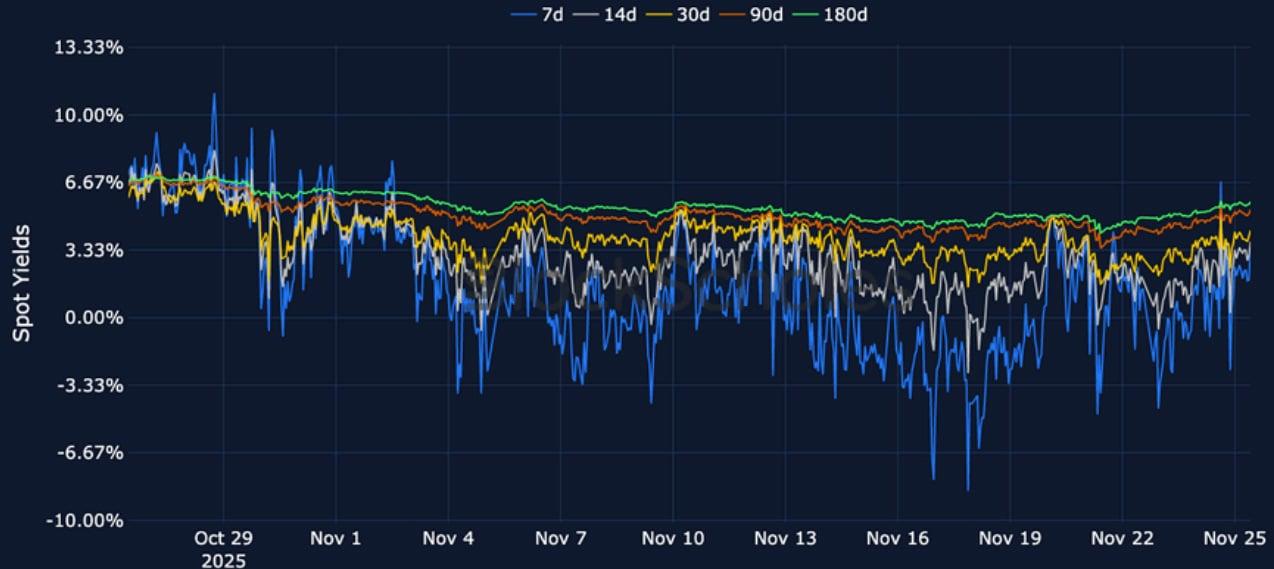

Futures Implied Yields

1-Month Tenor ATM Implied Volatility

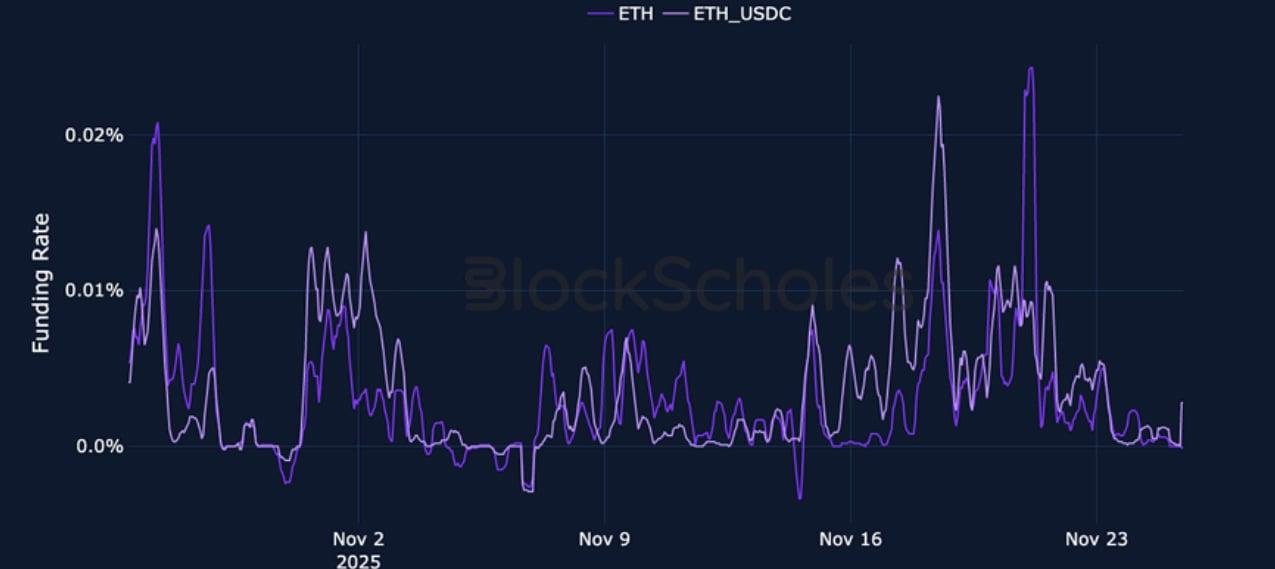

Perpetual Swap Funding Rate

BTC FUNDING RATE – While ETH’s funding rates remain apparently bullish, BTC’s have been subdued with a tilt towards negative rates over the last two weeks.

ETH FUNDING RATE – Funding rates in ETH have reflected almost none of the bearish positioning seen in other derivatives metrics.

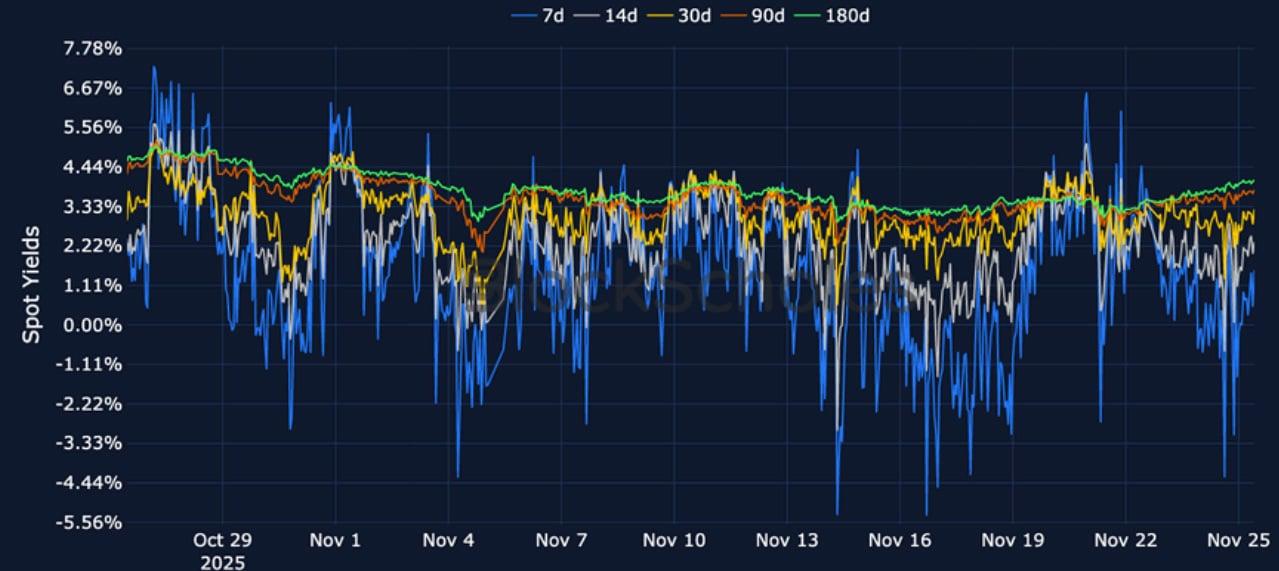

Futures Implied Yields

BTC Futures Implied Yields – BTC futures at all maturities now trade back above spot after a deep discount during the crash lower towards $83K.

ETH Futures Implied Yields – Short-tenor ETH futures has reversed most of their discount to spot prices while longer-tenors trade higher.

BTC Options

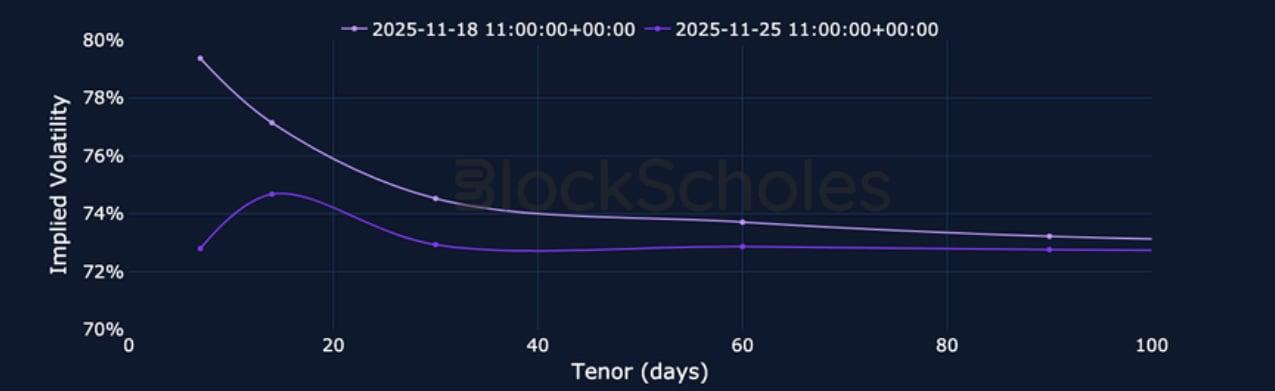

BTC SVI ATM IMPLIED VOLATILITY – The term structure of volatility has now dis-inverted after one of the most extreme spikes in BTC volatility this year.

BTC 25-Delta Risk Reversal – Short-tenor BTC smiles briefly erased their skew towards OTM puts as price has recovered from its most extreme bottom.

ETH Options

ETH SVI ATM IMPLIED VOLATILITY – Volatility pricing has fallen, if not yet disinverted, during the sideways moves early this week.

ETH 25-Delta Risk Reversal – Volatility smile skews have recovered during the early-week reprieve from further downside price action.

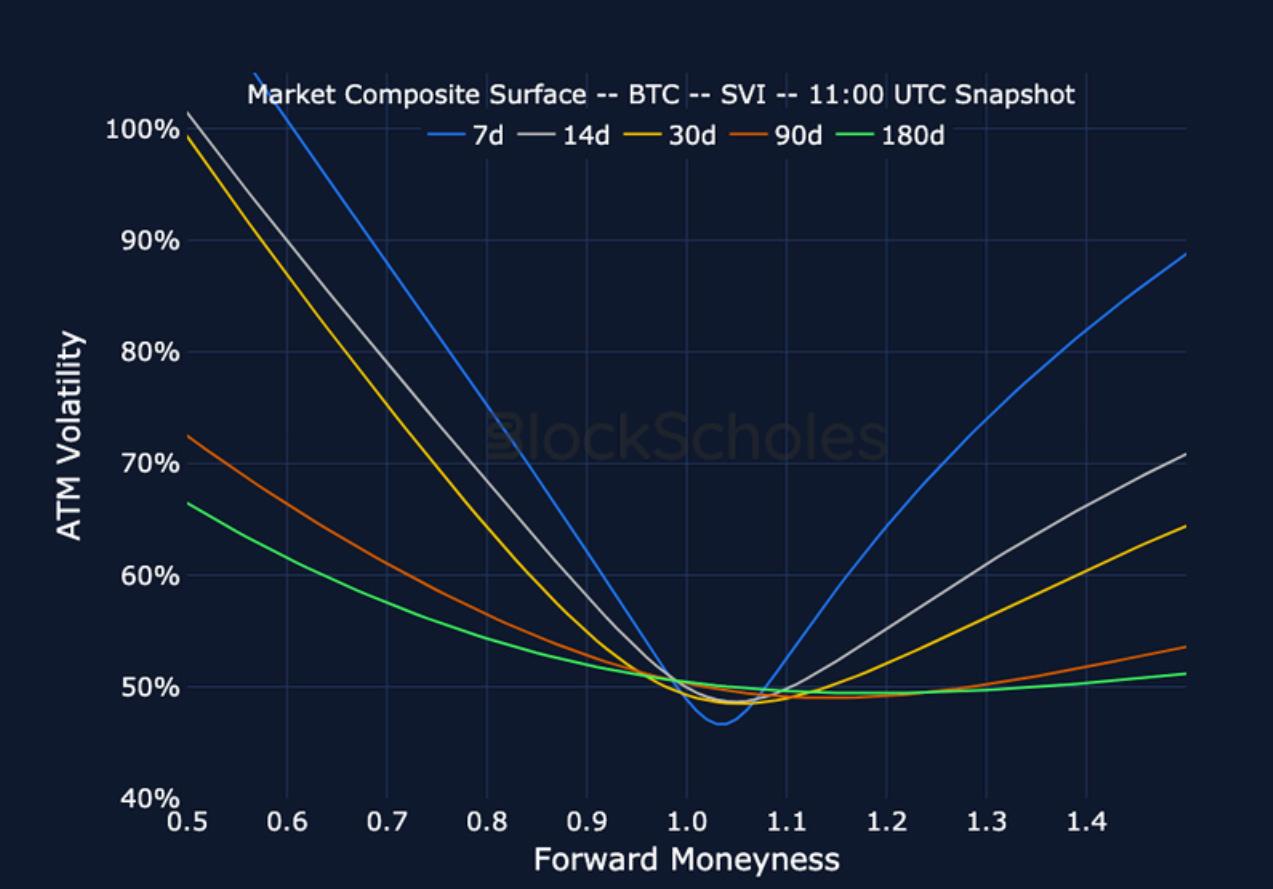

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 9:00 UTC Snapshot.

CeFi COMPOSITE – ETH SVI – 9:00 UTC Snapshot.

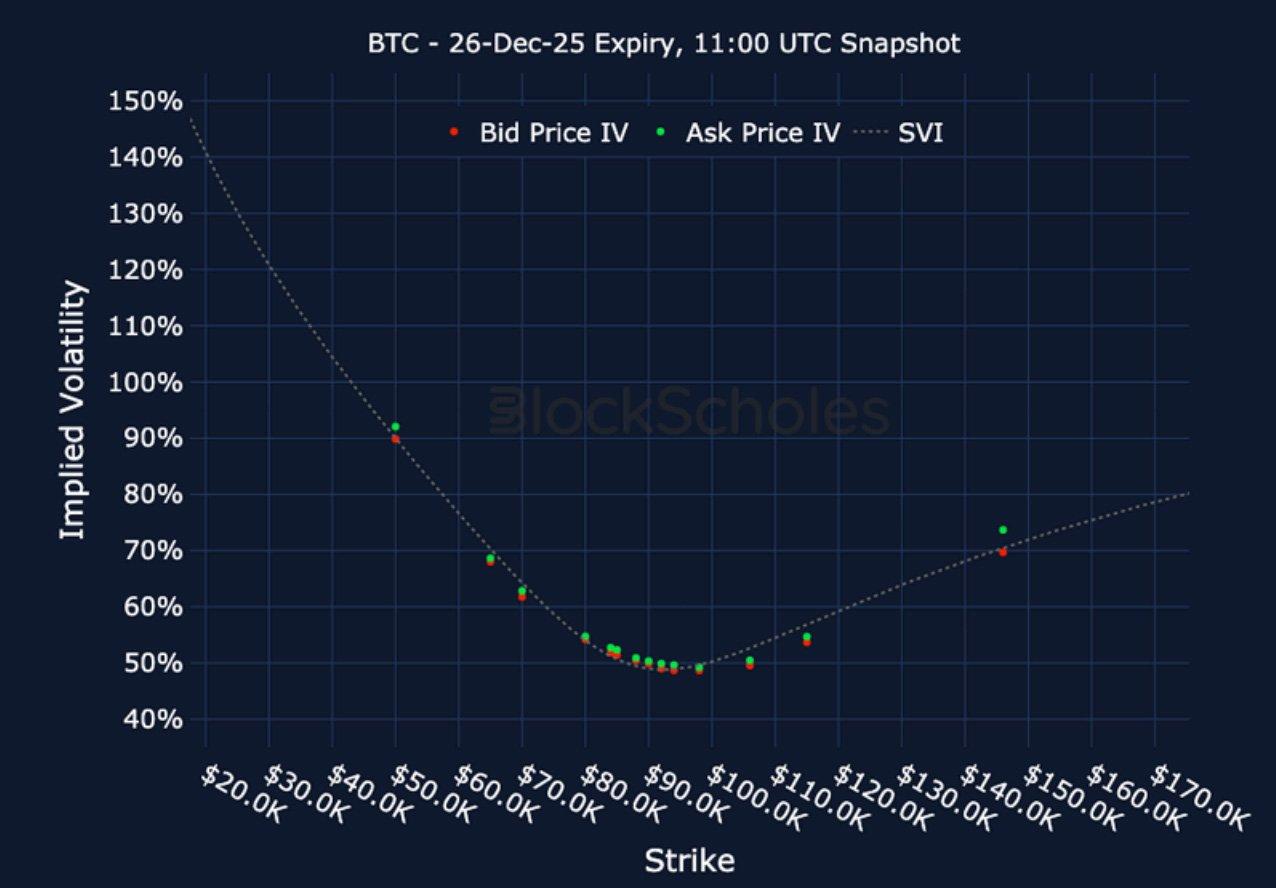

Listed Expiry Volatility Smiles

BTC 26-DEC EXPIRY – 9:00 UTC Snapshot.

ETH 26-DEC EXPIRY – 9:00 UTC Snapshot.

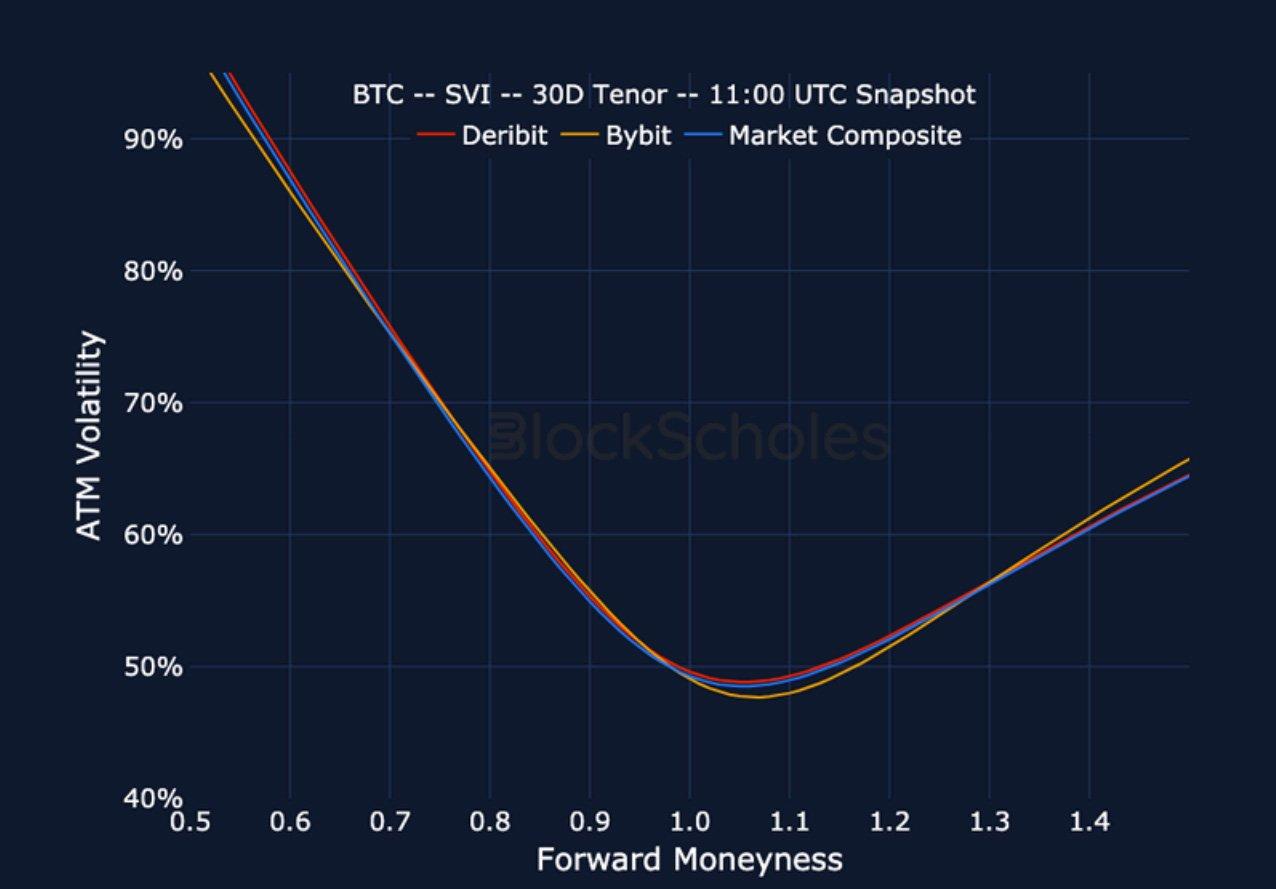

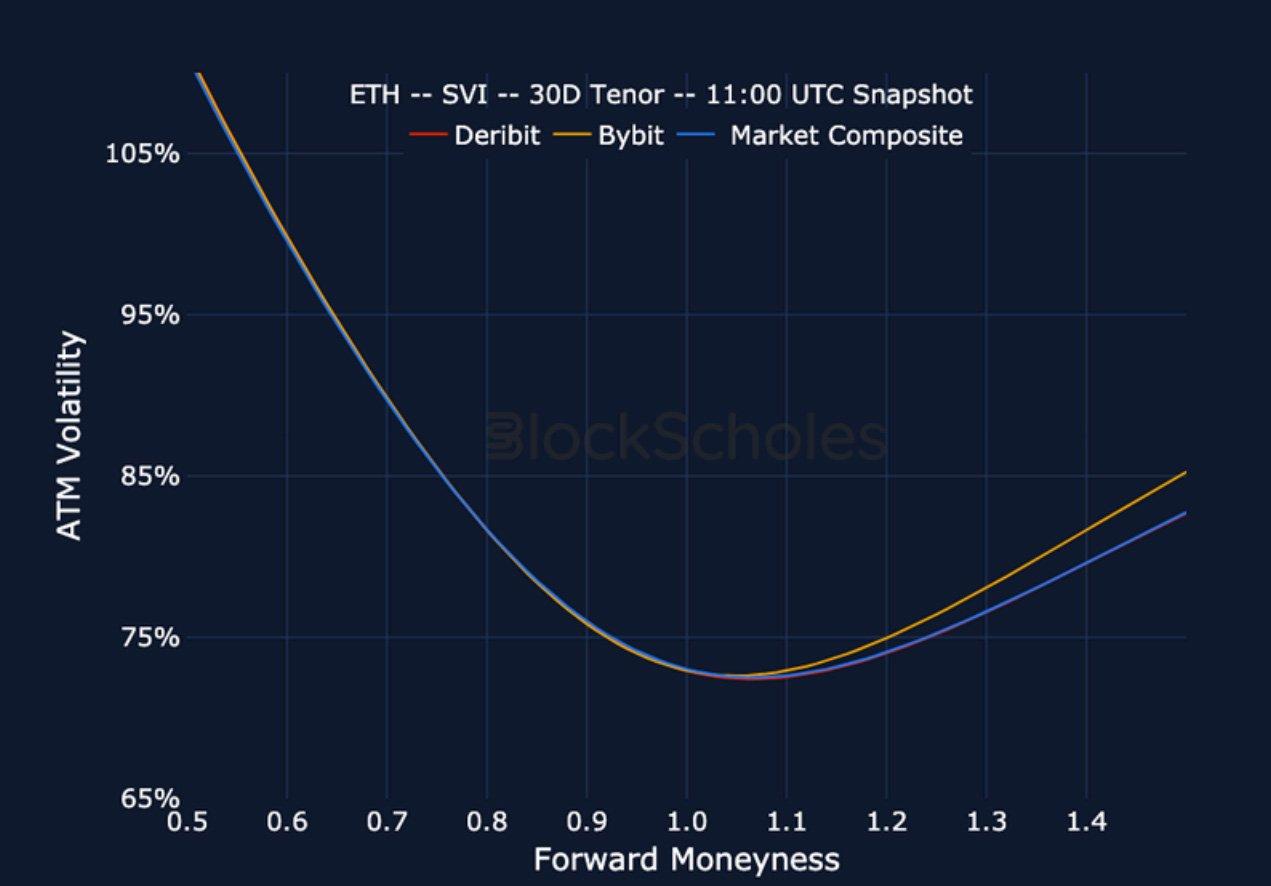

Cross-Exchange Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

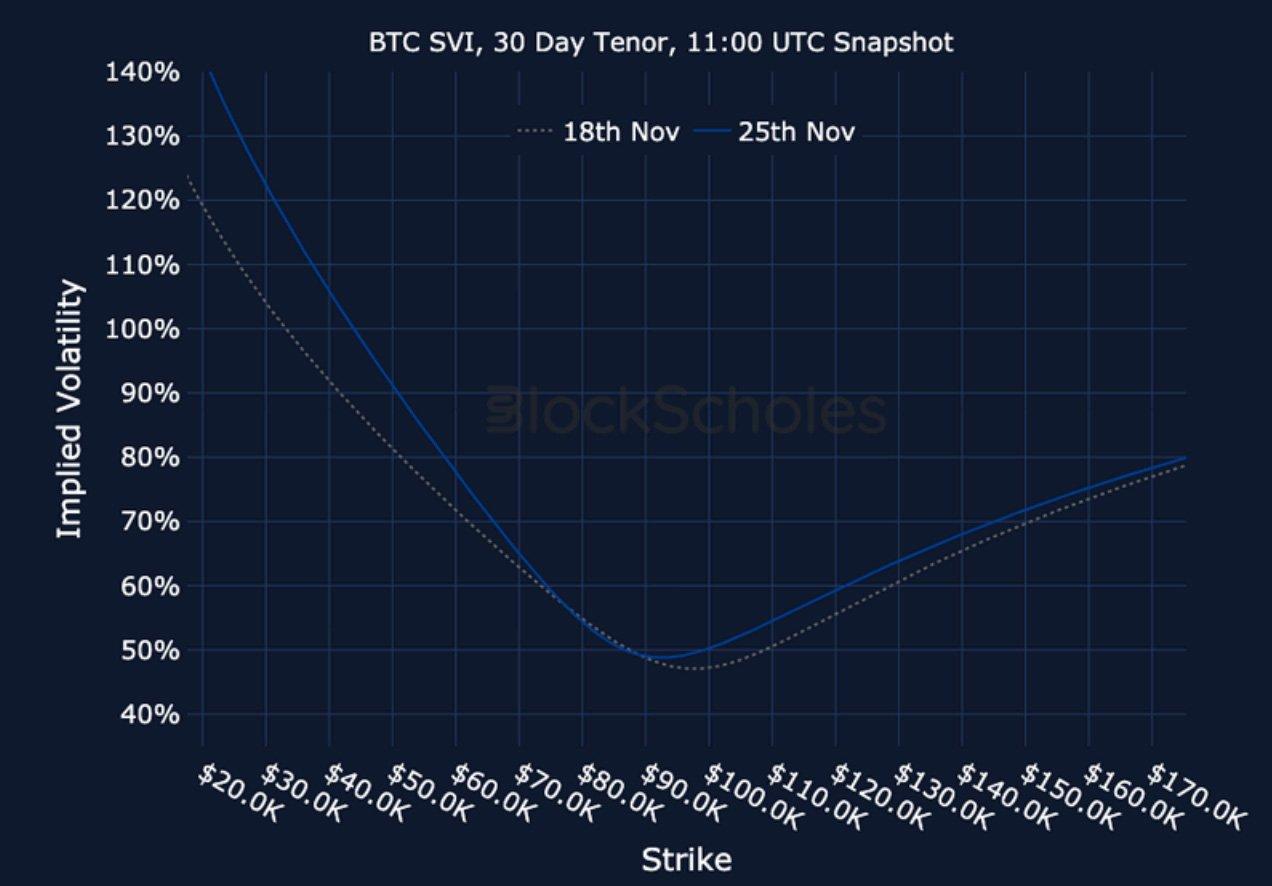

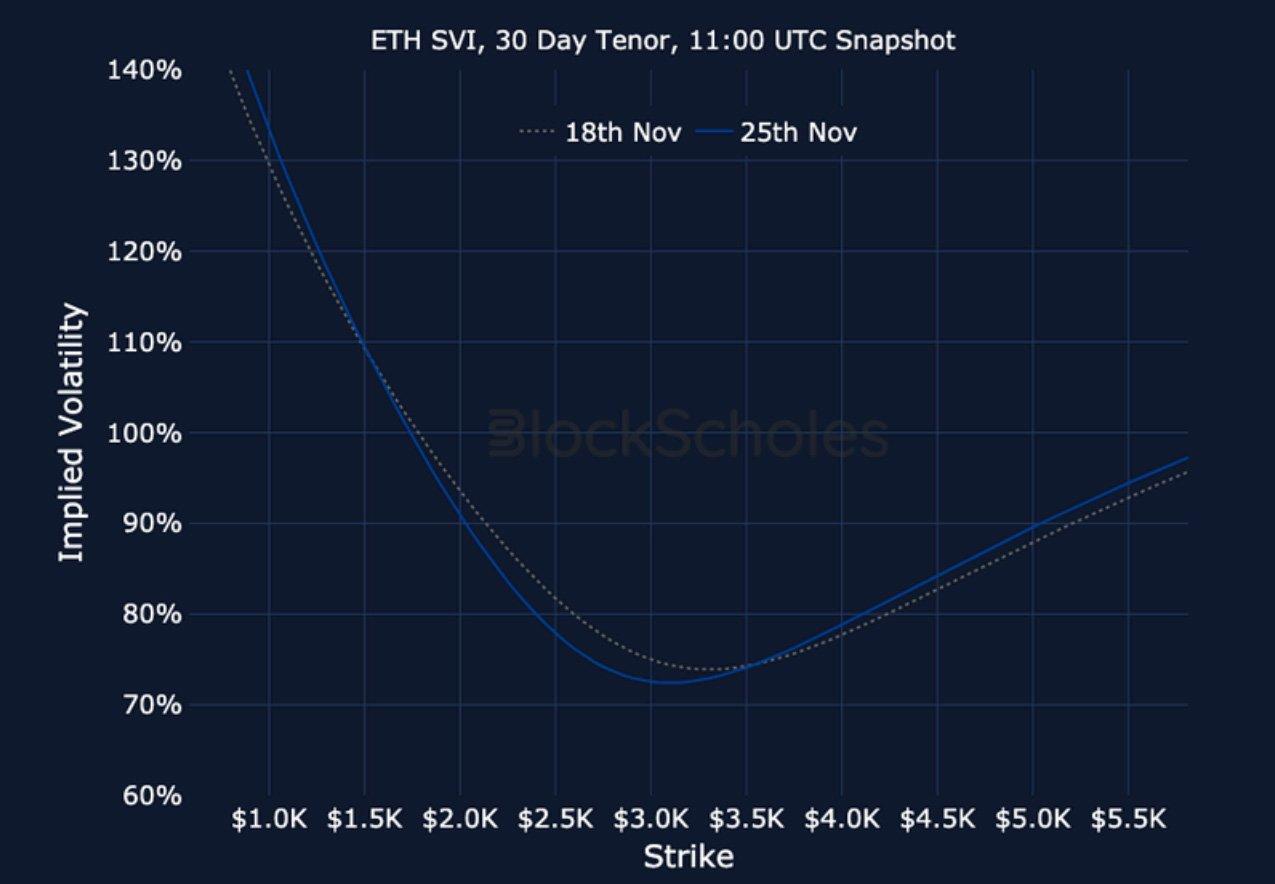

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)

Trading with a competitive edge. Providing robust quantitative modelling and pricing engines across crypto derivatives and risk metrics.

RECENT ARTICLES

Crypto Derivatives: Analytics Report – Week 48

Block Scholes2025-11-26T09:44:19+00:00November 26, 2025|Industry|

Vol Commentary: Bounce or Breakdown?

Cumberland2025-11-24T08:06:23+00:00November 24, 2025|Industry|

Crypto Derivatives: Analytics Report – Week 47

Block Scholes2025-11-19T11:11:52+00:00November 19, 2025|Industry|

The post Crypto Derivatives: Analytics Report – Week 48 appeared first on Deribit Insights.