- Meteora solves memecoin challenges with fair launches, dynamic fees, and permanent revenue-sharing.

- Its liquidity engine empowers sustainable markets through Dynamic AMMs and automated vaults.

- MET drives governance, staking rewards, and long-term ecosystem incentives across Meteora.

Meteora is transforming the Solana meme-coin landscape with dynamic liquidity, fair launches, and revenue-sharing incentives, while MET powers governance, staking, and long-term ecosystem alignment.

WHAT IS METEORA?

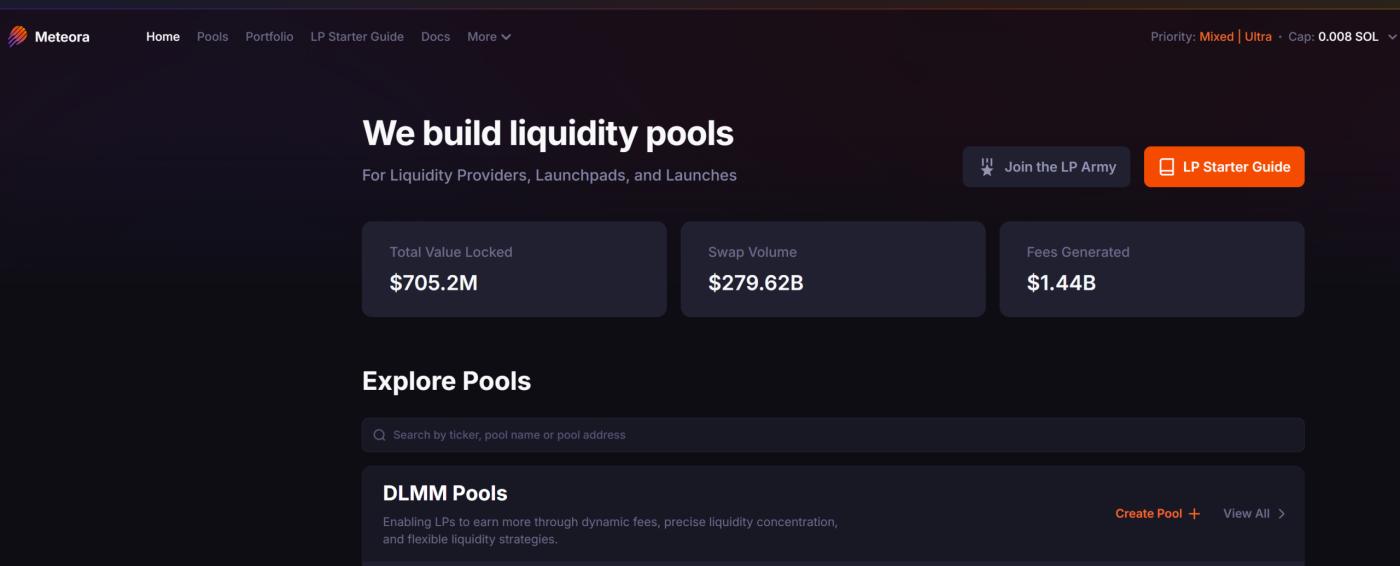

Inside the Solana ecosystem, Meteora has quickly shifted from being seen as just another DEX or memecoin launchpad to becoming one of the key pieces of liquidity infrastructure.

Launched in 2024, its vision is simple but ambitious: fix the broken incentive model behind memecoin economics. Instead of hype-driven launches that collapse the moment liquidity dries up, Meteora aligns incentives between creators, holders, and liquidity providers through continuous fee generation and a more sustainable liquidity model.

In other words, Meteora isn’t trying to stop memes from happening — it’s trying to give them a chance to survive beyond their first viral push.

📌 The Core Architecture of Meteora

To understand what makes Meteora different, look at the three foundational components it provides:

▶ Dynamic AMMs (DLMM / DAMM)

Traditional AMMs struggle during high volatility, often causing unnecessary slippage and leaving liquidity sitting in irrelevant price ranges — especially in meme-coin markets where price can 5x in minutes and retrace just as fast. Meteora’s Dynamic AMMs adjust liquidity ranges automatically based on real-time market movement, improving execution quality and optimizing how LP capital is deployed.

▶ Dynamic Vaults

Dynamic Vaults are not passive yield pods — they’re automated liquidity strategies. Capital inside these vaults shifts toward areas where trading activity is highest, ensuring liquidity is actually used instead of sitting idle. For LPs, this means better efficiency, more fee capture, and a yield model that moves with the market instead of against it.

▶ Fair Token Launch Mechanisms (Alpha Vaults, Bonding Curve, etc.)

One of the biggest criticisms of meme-coin launches is unfair entry: bots front-run, insiders take advantage, and liquidity disappears right after the hype. Meteora’s launch system introduces structured price discovery, anti-bot protections, and fair participation mechanics — reducing rugs and creating healthier early-stage liquidity conditions for new tokens.

🔍 Why Meteora Matters

When these three systems work together, Meteora becomes more than a product — it becomes a liquidity engine powering token creation, trading, and long-term liquidity management across Solana. It’s built for a fast market, a highly social trading culture, and a token economy where attention moves quickly.

Instead of treating liquidity as a short-lived boost, Meteora is building a framework where liquidity becomes a sustainable resource, not a temporary marketing spike.

>>> More to read: What is PUMP? Pump.fun Token Explained

HOW METEORA SOLVES THE BIGGEST CHALLENGES IN THE MEME-COIN MARKET

The meme-coin market is fun, chaotic, and unpredictable — but underneath the hype, there are real structural problems that make most tokens short-lived. Price spikes rarely translate into healthy ecosystems, liquidity often disappears after launch, and users are left wondering whether the next big meme is a community asset or just a sophisticated exit plan.

This is where Meteora steps in — not to stop speculation, but to redesign the incentive framework so that creativity, liquidity, and community can coexist in a sustainable way.

❗ The Core Problems in the Meme-Coin Market

Before understanding Meteora, it’s important to recognize the recurring issues meme-coins face:

▶ Pump-and-Dump Cycles

Most meme-coins follow the same pattern: a viral launch, extreme FOMO, then a brutal unwind once early holders take profit. Late participants become exit liquidity, community trust collapses, and the token dies before it ever matures.

▶ Misaligned Incentives

Creators often make money instantly through marketing, pre-allocation, or stealth advantages, while holders take on long-term volatility without meaningful upside participation. Without aligned incentives, no one is truly invested in sustaining the project.

▶ Permanent Locked Liquidity With No Yield

Many meme-coins lock liquidity permanently to prove they’re “not a rug.”

While this builds trust, it also removes a potential revenue stream that could fund development, marketing, and long-term contribution — leaving creators with no reason to stay engaged once hype fades.

🔍 How Meteora Fixes These Issues

Instead of patchwork solutions or temporary incentives, Meteora introduces a scalable, revenue-sharing model designed around sustainability and fairness.

▶ Permanent Fee Generation

With Meteora, locked liquidity doesn’t just sit there — it earns fees from every trade. Both creators and top holders can benefit from this ongoing revenue stream, turning liquidity into an asset rather than a marketing sacrifice.

The result: incentives finally align with longevity, not exit timing.

▶ Dynamic Fee Model (0.15%–15%)

Instead of a fixed fee, Meteora adjusts trading fees based on market activity.

High volatility? Higher fees to capture revenue and protect liquidity.

Stable price action? Lower fees to encourage trading and onboarding.

This balance keeps the ecosystem accessible while still generating sustainable income.

▶ Referral-Based Ecosystem Growth

To accelerate adoption, Meteora gives 20% of dynamic fees to trading bots, aggregators, and ecosystem partners that drive volume. This creates a circular incentive loop — more integrations lead to more activity, which leads to more fees, which strengthens liquidity and community participation.

📌 The Impact of Meteora’s Model

By fixing the underlying incentive design rather than just the surface experience, Meteora transforms the meme-coin economy:

- Trading becomes a long-term ecosystem rather than a one-day hype cycle.

- Creators have reasons to build beyond launch day.

- Holders don’t just speculate — they participate in a shared economy.

Instead of asking “how long before this dies?”, Meteora creates a framework where meme-coins have a realistic chance to evolve into lasting on-chain cultural assets.

>>> More to read: What is Sapien (SAPIEN)?

WHAT IS MET?

The MET token sits at the center of the Meteora ecosystem, acting as the mechanism that aligns users, creators, and protocol development. Instead of being just another utility token, MET is designed to reinforce the protocol’s sustainability, reward long-term participation, and support the liquidity layers that make Meteora work.

Here’s how MET functions inside the ecosystem:

1️⃣ Governance Utility

Holding MET gives users a voice in shaping the future of Meteora. Token holders can vote on:

- Protocol upgrades

- Fee distribution rules

- Incentive parameters

- Treasury and ecosystem allocations

This governance structure ensures that changes reflect community participation rather than centralized control.

2️⃣ Staking and Revenue Sharing

Staking MET unlocks additional value, including:

- A share of platform-generated revenue

- Reduced protocol fees

- Priority access to selected vaults, launches, or experimental features

Instead of passive holding, staking connects participation with real economic upside.

3️⃣ Liquidity Incentives

To strengthen the liquidity engine of Meteora, MET can be used to incentivize:

- LP participation in DLMM / DAMM pools

- New token launches and early market depth

- Cross-protocol collaborations and integrations

This creates a continuous cycle: more liquidity brings better execution, which attracts more users — which, in turn, increases protocol fees returned to stakers.

4️⃣ Tokenomics and Emissions

The design of MET follows the “Phoenix Rising” release model — balancing accessibility with long-term sustainability.

▶ Key structure:

- 48% of supply becomes liquid at listing

- The remaining supply is released gradually over time

- The schedule prevents aggressive early dumping

- Allocation supports builders, contributors, and ecosystem growth

This structure helps reduce early sell pressure and encourages participants to grow alongside the protocol rather than exit immediately.

📌 Market Adoption

In 2025, MET was listed on Binance and received the Seed Tag — a signal that the token is still in an early but high-potential stage of development, recognized by one of the largest exchanges.

In short, MET isn’t just a reward token — it’s the coordination mechanism that powers governance, staking, liquidity, and ecosystem growth within Meteora. As the protocol expands across Solana’s liquidity stack, MET becomes increasingly important as the connective layer between utility, incentives, and long-term alignment.

ꚰ CoinRank x Bitget – Sign up & Trade!

〈What is Meteora (MET)?〉這篇文章最早發佈於《CoinRank》。