After weeks of sluggishness, the Bitcoin market staged a strong rebound on November 26, with prices breaking through the $90,000 mark and recovering all of Tuesday's losses. This breakthrough not only broke the usual pre-Thanksgiving market weakness but also demonstrated multiple positive signals driven by macroeconomic data, fund flows, and market structure.

Macroeconomic data drives market confidence

The latest U.S. employment data showed that initial jobless claims fell to 216,000, the lowest level since mid-April, significantly boosting investor confidence. Although the PPI report showed a slight increase in wholesale prices due to rising energy and food costs, the core PPI increase (2.6%) was the smallest since July 2024. Analysts believe this report may prompt the Federal Reserve to consider another interest rate cut in December.

JPMorgan economists have revised their forecasts, now believing the Federal Reserve will begin cutting interest rates in December, overturning their prediction a week earlier that policymakers would postpone rate cuts until January. Their research team stated that statements from several key Fed officials (particularly New York Fed President Williams) supporting recent rate cuts prompted them to reassess the situation.

JPMorgan Chase currently expects the Federal Reserve to cut interest rates by 25 basis points twice, in December and January.

Fueled by positive macroeconomic news, Bitcoin's price climbed nearly 4% to over $90,000; Ethereum (ETH) rose 2% to $3,025. Major Altcoin, including XRP, Solana (SOL), and BNB, also saw gains. The total market capitalization of the entire crypto market reached $3.08 trillion, rebounding nearly 3% in 24 hours, with trading volume reaching $139 billion. Bitcoin's market capitalization share rebounded to 56.5%, while Ethereum's was 11.5%.

Fund flows reverse, ETFs once again exhibit a siphon effect.

The liquidity situation for ETFs has improved significantly.

Previously, the market faced severe capital outflow pressure, even breaking historical records. However, data released on Wednesday showed that Bitcoin ETFs attracted nearly $129 million, Ethereum ETFs saw inflows exceeding $78 million, Solana (SOL) ETFs added $53 million, and XRP ETFs attracted $35 million. Driven by macroeconomic confidence, institutional funds are reallocating to the crypto market.

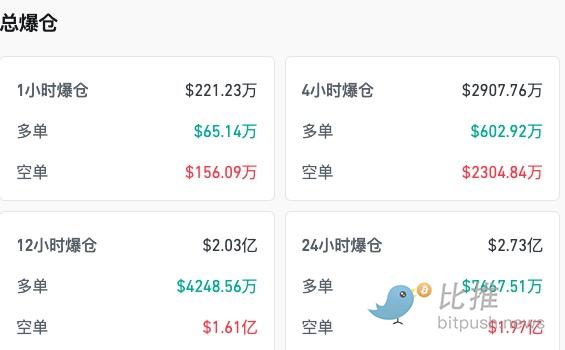

According to Coinglass data, over $273 million in total liquidations occurred in the crypto market in the past 24 hours, with short positions dominating ($197 million). Bitcoin led the way with $86 million in liquidations, followed by Ethereum and HYPE.

Are bottoming features gradually emerging?

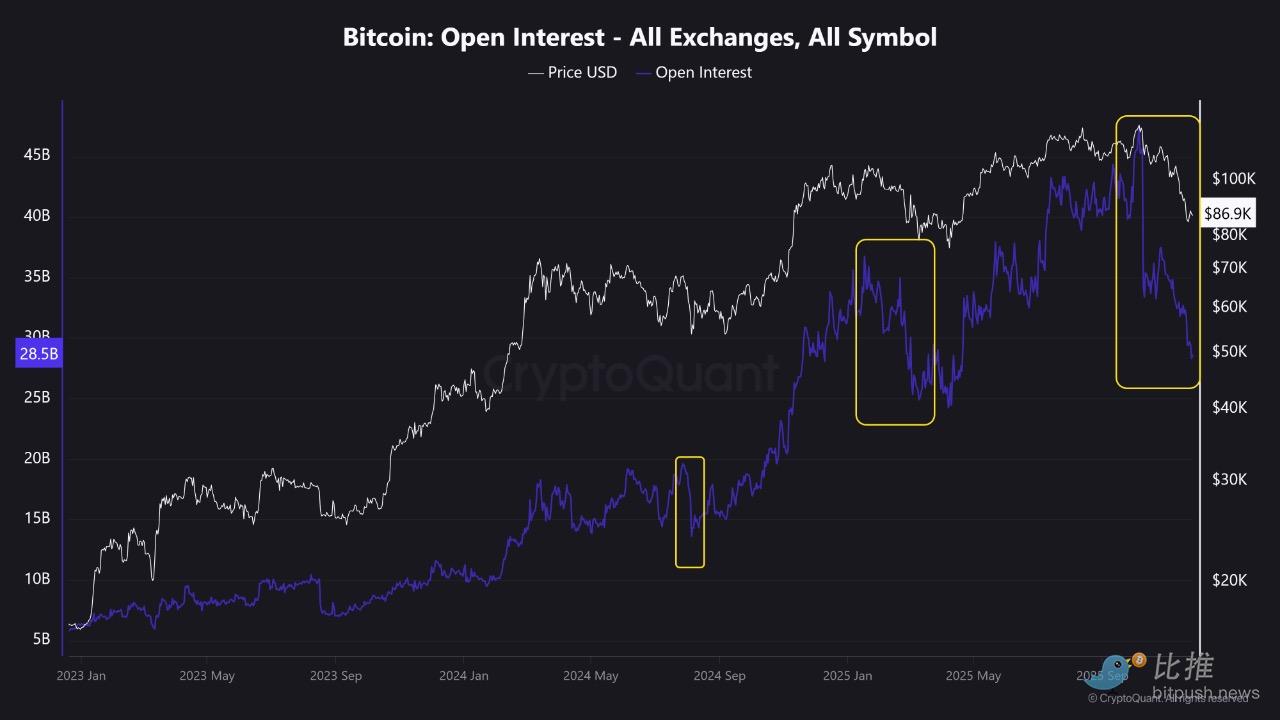

CryptoQuant analyst Abramchart points out that the market has just experienced the largest drop in open interest (OI) this cycle , with the total volume plummeting from approximately $45 billion to $28 billion. This sharp contraction should not be interpreted as the start of a bear market , but rather as a significant leverage cleansing (long squeeze) , clearing out previously overextended speculative positions. This is generally seen as a sign that the market is moving towards health and accumulating momentum for future gains.

Furthermore, despite recent market volatility, Bitcoin's price has remained stable above the average cost price of $79,000 for ETFs , indicating that there has been no meaningful selling by large institutional funds. This provides significant psychological and financial support to the market.

By combining several indicators that have recently attracted market attention, we can see deeper structural changes:

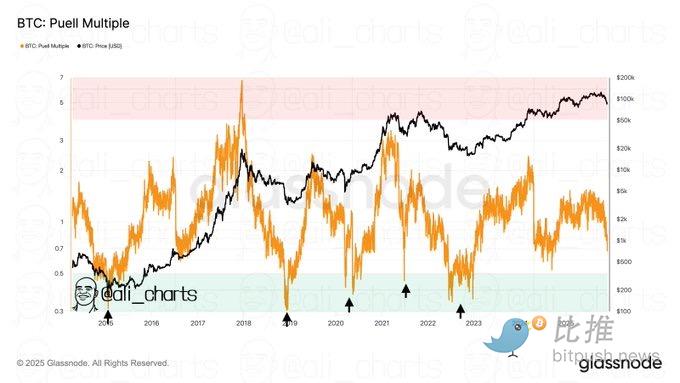

Puell Multiple near the bottom of the cycle

On-chain analyst Ali observed that the Puell Multiple indicator is currently at 0.67, which, although not yet below the key threshold of 0.50 at the bottom of historical cycles, is very close.

Historical data shows that since 2015, when this indicator falls below 0.50, it has often signaled the bottom of a Bitcoin cycle. This suggests that miners' selling pressure may be easing, and the market is entering a crucial observation window, potentially indicating the arrival of a medium-term bottom.

The technical outlook has turned positive.

Technical analyst Skew Δ points out that on the 4-hour chart, Bitcoin is currently showing a bullish technical structure, with multiple momentum and trend indicators (50EMA, RSI, Stoch RSI) all pointing positively.

$88,000 is the lifeline for the bulls, while $90,000 to $92,000 will be a key resistance/battle zone to confirm whether the market can initiate a stronger structural uptrend. Traders should closely monitor price action around these key levels.

risk

Despite improved short-term sentiment, liquidity constraints during Thanksgiving could amplify volatility. Wintermute trading strategist Jasper De Maere points out that the options market indicates traders generally expect Bitcoin to fluctuate between $85,000 and $90,000, betting that the market will maintain its current position rather than experience a breakout.

In the medium to long term, the structural support level of $74,000 needs to be monitored. A weekly close below this level could indicate a weakening macroeconomic environment, potentially triggering a deeper correction. Currently, Bitcoin is still nearly 30% down from its all-time high of $126,000. Whether this rebound can truly transform into a sustainable upward trend ultimately depends on whether macroeconomic policies and funding conditions can provide sustained and strong support.

Author: Seed.eth

Twitter: https://twitter.com/BitpushNewsCN

BitPush Telegram Community Group: https://t.me/BitPushCommunity

Subscribe to Bitpush Telegram: https://t.me/bitpush