Zcash is sliding toward a crucial support region as sellers maintain strong control across key timeframes. The token trades near $363 after losing major zones that supported the earlier rally.

The latest pullback shows a market struggling to stabilize as momentum weakens, volatility returns, and derivatives activity shifts rapidly. Consequently, traders now watch whether ZEC can hold the current level or extend the broader decline.

Selling Pressure Builds as Key Levels Break

ZEC continues to form lower highs and lower lows, which signals steady weakness. Besides that, price trades under the EMA-9 at $406, while the Supertrend resistance at $424 blocks any early recovery attempt.

This configuration shows immediate pressure because every bounce faces rejection near short-term resistance. The breakdown below the 0.236 Fibonacci level at $424 added more strain and sent ZEC back to multi-week lows.

The closest support sits around $361, which marks the area where buyers reacted previously. A deeper drop can expose the $320–$300 band. Moreover, the structural floor near $280 remains important for medium-term stability. Any failure at these areas can extend the correction that started after the move from $760.

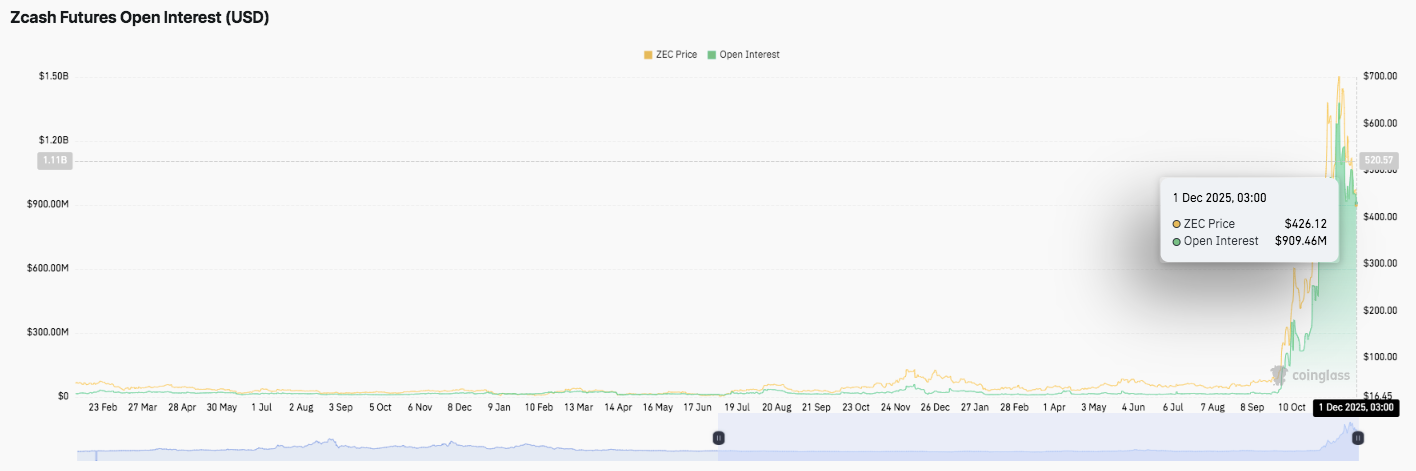

Derivatives Activity Shifts as Open Interest Cools

Zcash futures activity shows a dramatic change this quarter. Open interest stayed quiet for most of the year, then surged sharply from October into early December. It climbed from below $100 million to above $900 million as traders anticipated volatility and chased the rapid rally toward $700. This period reflected heightened speculation and aggressive leverage.

However, the cooldown toward $426 shows a recalibration phase. Many traders reduced exposure as price momentum weakened. Hence, current open interest reflects a more cautious market, with participants waiting for clearer signals before rebuilding positions.

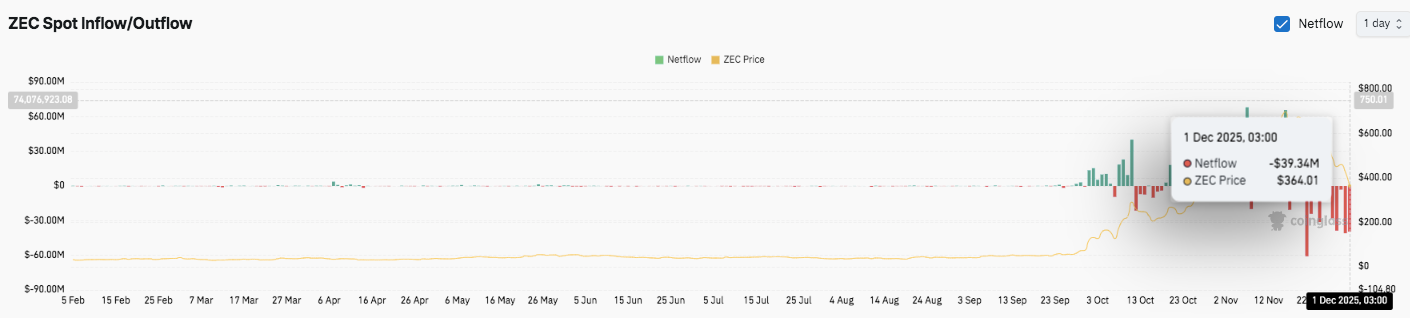

Netflows Point to Aggressive Distribution

On-chain exchange flows also show a significant shift. Netflows stayed mostly neutral from February until late September. Activity increased in October with isolated inflows and heavier outflows in November.

The latest reading shows a notable $39.34 million net outflow as ZEC trades near $364. This pattern signals distribution pressure as traders lock in gains after the extended rally.

Governance Concerns Add Another Layer

Additionally, governance debates resurfaced within the community. Vitalik Buterin raised concerns about token-based governance and warned about long-term risks tied to privacy.

I hope Zcash resists the dark hand of token voting.

— vitalik.eth (@VitalikButerin) November 30, 2025

Token voting is bad in all kinds of ways (see https://t.co/Cvl7CFVgtc ); I think it's worse than Zcash's status quo.

Privacy is exactly the sort of thing that will erode over time if left to the median token holder. https://t.co/NbRqGLOrpj

His remarks revived earlier discussions on how governance models can influence the development of privacy-focused networks. Consequently, market watchers now view governance stability as another factor that may affect ZEC sentiment in the coming months.

Related: Zcash Price Prediction: ZEC Retains Bullish Bias While Cypherpunk Boosts Holdings

Technical Outlook for Zcash Price

Key levels remain clearly defined as Zcash trades inside a pressured structure near multi-week lows.

Upside levels include $406, $424, and $480 as immediate hurdles. A breakout above these layers could open a path toward $569 and the broader mid-range recovery zone near the 0.5 Fibonacci level.

Downside levels include $361–$360 as the immediate trendline support, followed by the $320–$300 demand area. A deeper failure may expose $280, which remains a major structural floor on the higher-timeframe chart.

The resistance ceiling at $424 aligned with the Supertrend and 0.236 Fib acts as the key level to flip for medium-term momentum to shift. Price continues to compress between declining resistance and horizontal support, forming a tightening structure that suggests volatility expansion is approaching.

Will Zcash Recover?

Zcash’s next move hinges on whether buyers can defend $361–$360 long enough to mount a push toward $406 and $424. A strong reclaim of the $424 cluster would weaken the bearish structure and allow ZEC to target $480 and even $569 if inflows strengthen.

However, failure to hold $361 risks breaking the current accumulation shelf, exposing ZEC to $320–$300 and possibly $280.

For now, ZEC remains in a pivotal zone. The recent cooldown in derivatives activity and sustained outflows highlight weakening conviction, but the technical compression suggests a decisive move is approaching. A shift in flows or a strong reaction at support will likely determine ZEC’s next meaningful leg.

Related: Zcash Whale Loses $2.4 Million as Leverage Flush Erases Account Equity

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.