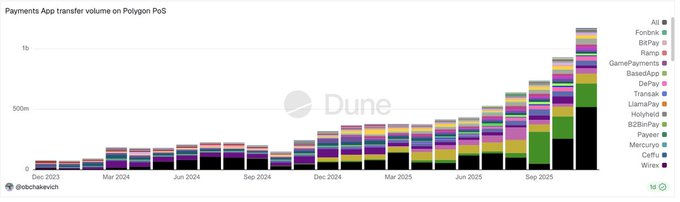

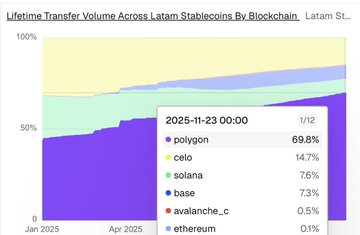

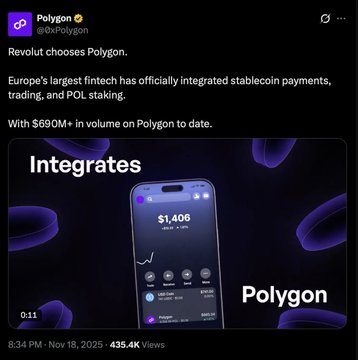

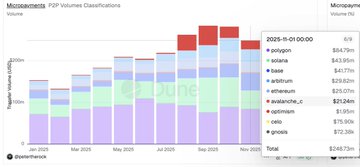

Polygon’s payments strategy is working, and the numbers are starting to show it. Polygon went all in on this early, low fees, high throughput, and a serious focus on global fintech integrations. Every month has been a record breaking month on payments volume since may with November hitting 1.17 Billion. This shows consistent growth and a massive change since last year's November which was 244M Polygon More than $10B worth of international stablecoins move through Polygon, one of the highest across any network. That’s real cross-border usage. In November alone, Polygon processed $380M+ in LATAM stablecoin transfers, roughly 90% of the market. The lifetime share of transfer volume in LATAM also continues to rise, now at 69.8% and 3.4 Billion processed. Polygon Revolut integrated stablecoin payments, trading, and POL staking, and they’ve already moved $690M+ on Polygon. With 14M+ crypto users across 38 countries, this puts Polygon in a strong position to capture a big chunk of European users. Polygon Polygon is also the largest network for micropayments with $84M+ in volume last month, far ahead of Solana’s $43M and has over 33% marketshare and a leader in micropayments. Polygon Payments are one of the few crypto use cases actually scaling, and right now most of that growth is happening on Polygon. S/O to @sandeepnailwal @0xAishwary @0xMarcB and the rest of their team for all the great work.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content