Crypto whales have become more active during the early December crash, and their buying patterns show a divergence between three very different Token . One Token is breaking out of all price extensions with strong whale buying demand. Token is following a steady reversal pattern after days of pressure. And the third shows early signs that the strong selling may be cooling off. Collectively, these moves outline where large investors are expecting the recovery and further gains.

Crypto whales have become more active during the early December crash, and their buying patterns show a divergence between three very different Token . One Token is breaking out of all price extensions with strong whale buying demand. Token is following a steady reversal pattern after days of pressure. And the third shows early signs that the strong selling may be cooling off. Collectively, these moves outline where large investors are expecting the recovery and further gains.

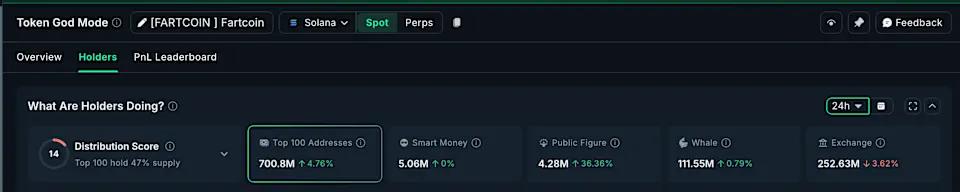

Fartcoin (FARTCOIN)

Fartcoin is the first surprise entry on the list. The Token has surged more than 23% in the past 24 hours, outperforming the December 1 drop. Despite the strong gains, the broader trend remains weak, with a 3.4% monthly decline suggesting the larger structure has not fully recovered. However, crypto whales clearly see opportunity.

In the past 24 hours, the standard whale group increased its holdings by 0.79%, bringing the total to 111.55 million Token. The mega whale group (top 100 holder) increased by 4.76%, bringing the total to 700.8 million Token. In total, whales bought 32.43 million FARTCOIN, worth about $10.70 million at the current price of nearly $0.33. This is a strong signal of confidence in a volatile week.

The price chart helps explain this. The RSI (Relative Strength Index) – which measures momentum on a 0–100 scale – displayed a standard bullish divergence from November 4 to November 22. Price made a Dip while RSI made a higher Dip . This pattern is consistent with a reversal setup and triggered the bounce from $0.17.

If the reversal pattern holds, Fartcoin needs to break clearly above $0.33. This could extend the upside to $0.42 - about +32% from the current price. But if the pattern weakens, the first major support lies at $0.23; losing this level would lead to a deeper retest of $0.17.

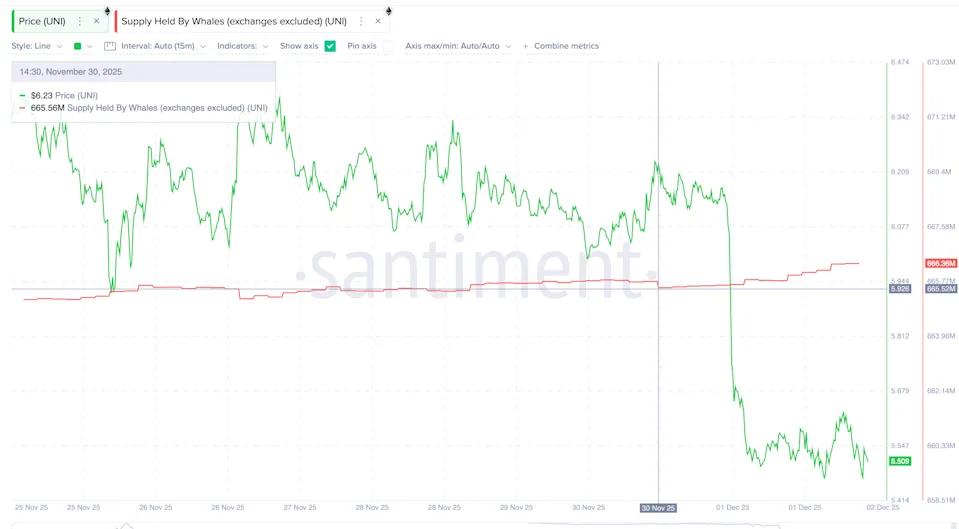

Uniswap (UNI)

Uniswap is one of the more stable groups on the list, and the behavior of crypto whales reflects that. Over the past 48 hours, large holder increased their UNI holdings from 665.56 million to 666.36 million UNI, adding 0.80 million UNI — worth about $4.98 million at current prices. For a DeFi Token that often moves in line with general market liquidation , this quiet accumulation is quite remarkable.

Uniswap has been falling since November 11. The chart shows steady selling pressure, but it may be easing. Wyckoff Volume bars help clarify this. In this setup: red bars show sellers in control, yellow is sellers gaining control, blue is buyers gaining control, and green is buyers taking full control. Over the past 24 hours, the yellow bars have thinned out. The last time this pattern appeared — November 7–8 — buyers came in strong, and UNI rallied 77.7% in the next few sessions.

If the yellow zone continues to disappear and the bar turns blue, this could be the same signal.

For a recovery, UNI must hold $5.40 — a key support zone. A break above $5.90 would show initial strength. Real momentum will only come when UNI breaks above $6.80 — the 0.618 Fibonacci level and one of the strongest technical resistances.

If the breakout occurs, the recovery path could point towards the $8.10 zone.

If the breakout occurs, the recovery path could point towards the $8.10 zone.

If UNI loses $5.40, the structure will weaken, and the price could drop to $4.70, completely destroying the recovery setup.

Pippin (PIPPIN)

Pippin was one of the strongest performing Token during the early December crash. The Token is up nearly 30% in the past 24 hours and has followed every price extension since October 10 — when the uptrend began. This steady climb has attracted the attention of crypto whales, who are buying into the trend.

In the past 24 hours, the standard whale group increased its holdings by 5.16%. After this change, they are holding 274.63 million Pippin Token , which means they added about 13.45 million Token. The top 100 addresses increased by 3.28% and now hold 851.89 million Token, which means they added about 27 million Token. In total, whales have collected nearly 40.45 million Pippin Token , worth about $7.28 million. This is one of the strongest whale accumulation clusters in the meme-coin group this month.

The PIPPIN price chart supports that belief. Since October 10, the Token has broken through all Fibonacci extension levels and is currently trading above 3.618. If this momentum continues, the next major target is around $0.24 — representing a 25% increase from the current range. A daily candle close above $0.24 could push Pippin higher.

The Smart Money Index also supports this rally. This index tracks whether smart, early traders are becoming more active. The index has been making higher highs over the past week, indicating that this group of traders is still supporting the uptrend. When smart money expands along with whale accumulation, this pattern often supports further gains.

A clear drop below $0.10 would weaken the structure and could drag PIPPIN lower. Until then, momentum, whales, and smart money are all pointing in the same direction: the uptrend is still in control.