The problems and errors in thinking I describe below are not unique to crypto. I’m not immune to the points I’m going to make either. The goal is to help us understand how, as an industry, we could do better.

I recently learned that your opportunity is what others are complacent about. Just as people in the past were complacent about an alternative monetary regime while Bitcoin percolated from an absolute niche ideological nerd-snipe into the mainstream, people today are complacent, holding their bags, assuming a greater fool will save them.

Crypto used to be proactive; it has since become reactionary. After the early “startupization” that followed Ethereum’s rise, the space expanded rapidly in both ideation and valuation. The hubris peaked in 2021, and today crypto is no longer the frontier it once was.

Over the years, most players became conditioned to believe that mere participation was enough to outperform other asset classes. Scale ended that illusion. Participation alone is no longer sufficient. The lesson of the past two years is simple: mature or die. The industry needs to move forward, but most people remain stuck, optimizing for wishful thinking instead of reality.

Hypercompetition and Imitation

Game theory describes the current state of crypto as an inadequate Nash equilibrium. Everyone is optimizing for a win in a game that is not positive-sum (not Pareto-optimal). It’s hard for any single player to break out because the incentives to do so have disappeared. In Scott Alexander’s words:

“In a way, it’s this very lack of free energy, this intense competition without space to draw breath, that keeps the inadequacy around and makes it non-fragile.”

The “free energy” here is money (incentive), and the “inadequacy” is the sticky zero-sum game of people repeating the same playbook. Investors chase short-term wins, which pushes founders toward short-term ambitions, and vice versa—a vicious feedback loop. Everyone optimizes for immediate extraction because, economically, it should make sense (even if it’s diminishing at scale).

The only way to escape such an equilibrium is at the individual level: a founder or team that delivers genuine innovation and shifts the incentive structure so the whole system can advance. Yet crypto has been systematically drained of innovation by the dominant incentives of the past four or five years.

To parrot Peter Thiel, we should think of competition as imitation. Imitation feels like validation—doing what others do, desiring what others desire. No wonder everyone in crypto is building the same things: L1s, L2s, DEXes, CEXes, stablecoins, prediction markets, using the same distribution playbooks to sell to the same audiences.

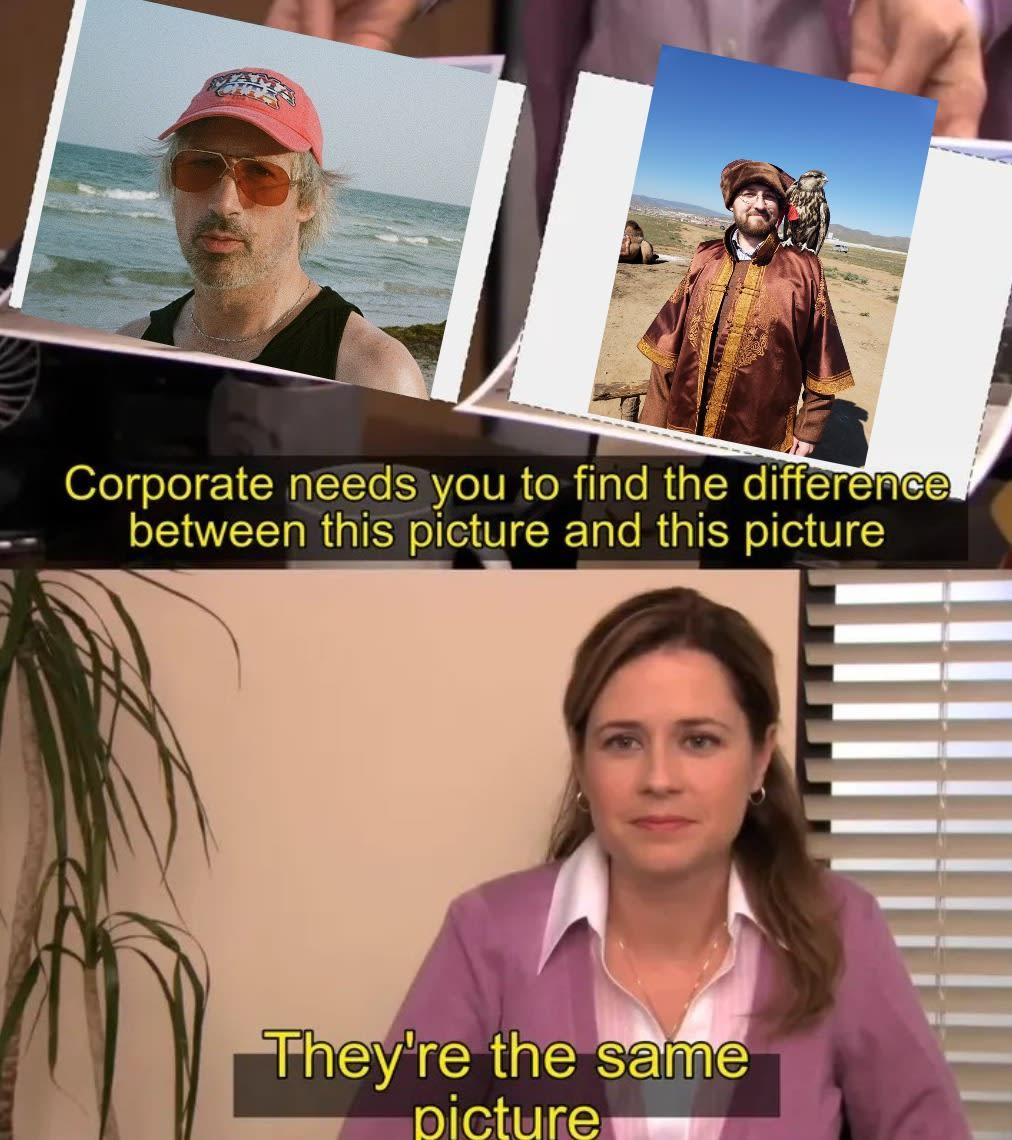

The most attractive pitch has become: “We’re the same (nodding to some existing successful project) but not the same (highlighting a minor technical nuance).” It comforts both investors and founders while exaggerating a difference that is more imaginary than real.

(If you want a similar explanation of these dynamics, this X post does a decent job.)

The Friends We Made Along the Way

Three key memes embody the fallacious thinking that keeps the industry stuck and breeds complacency.

The 4-Year Cycle

If paradise is guaranteed, why bother trying? This is the worst of the memes. One that promises divine intervention will save even the worst sinners. When success feels preordained, effort becomes half-hearted at best. Relying on greater-fool theory only underscores the reactionary ethos: no agency, just waiting for institutions to buy our bags.

Hyperfinancialization

Many have built products and investment theses around hyperfinancialization. Taken as a standalone assumption, it becomes a bet on an infinite gambling TAM. The implicit message: “There are no real problems to solve; users just want to entertain themselves to death.”

This peak expression of indefinite thinking ignores the fact that entertainment and gambling are already saturated markets outside the convoluted crypto pitch. Innovative financial engineering that actually unlocks value for users might have a place, but gambling for gambling’s sake or trading for trading’s sake is self-referential gaslighting.

Web3

The false Web2 vs. Web3 dichotomy is an oversimplistic analogy that hijacked people’s minds. It triggered the “when you have a hammer, everything looks like a nail” mindset, leading builders to take every existing internet service and assume “putting it on blockchain” automatically makes it better.

Skeuomorphism prevents net-new creation. It makes people stare at the old world and declare things like “the social graph needs to be onchain.” It created a blind spot: blockchain is fundamentally a financial graph, and it may not be the right substrate for things like social media.

Whenever someone says “Web3” these days, I suspect they don’t actually know what they’re talking about. There is no such place—it’s just an ideology in search of a problem. That’s a suboptimal way to build truly useful services.

What Will Truly Matter in 10 Years

I dislike lumping Bitcoin together with the rest of crypto; the motivations differ profoundly even if they share an origin. Bitcoin has always been revanchist, wanting to be proven right once, when everything else collapses. The original “world computer” vision of Ethereum (and what followed) was more ambitious and centered on value creation (novel form of networked businesses).

It’s uncanny how a movement founded on rejecting fiat spawned a subculture whose growth now depends on ever more fiat flooding in. The more fiercely foes fight, the more they resemble each other.

The bitcoin religion is reformed by Michael Saylor, and the change of guard is symbolically embodied by the OG “100k sell wall”. The boomerification of bitcoin and the incoherent hyperfinancialization technobabble of the rest of crypto leaves us in limbo.

Short-term expectations never beat long-term fundamentals. Anyone who wants to build and capture real value in this space has to focus on the obvious: value creation. The overcrowded once-frontier must consolidate. Only innovation, not imitation masquerading as competition, can drive further expansion.

But it’s not over; it’s just a new era. A new era demands new skills, new talent, and new ideas, because very few existing players are able or willing to adapt. You can’t build a strong industry on the soft habits of short-term expectations and astrology.

Among the ruins of shattered expectations, look for those who keep delivering quietly—who get better instead of bitter. It’s not about the spotlight; it’s about realizing that people need better plans when staring at the wreckage of their past decisions, and about refining judgment independently of the noise.