The market is currently somewhat subdued. Following last week's sharp drop after the news of Japan's interest rate hike, liquidity has dried up again. In the recent minor pullback, the price is currently hovering around $87,328. It's worth noting that despite short-term price pressure, Bitcoin has successfully held its key structural support area overall.

The impact of concentration of shares and liquidity

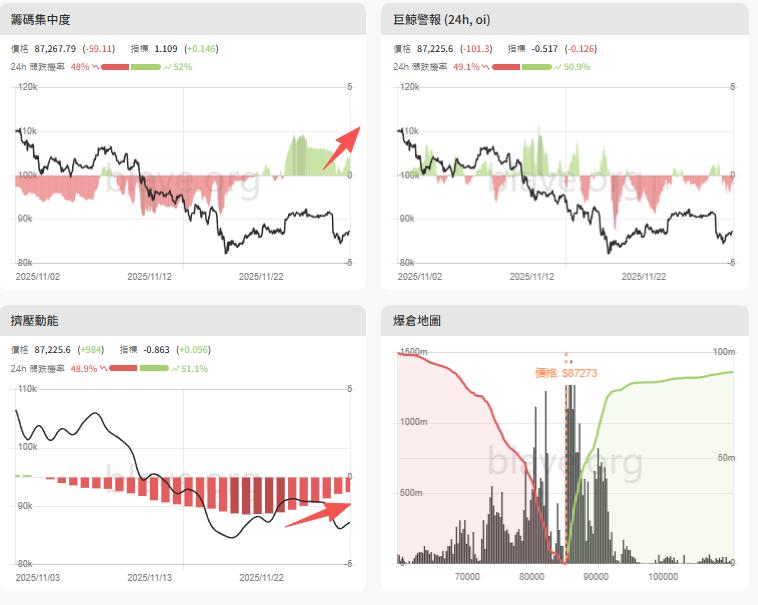

A key structural change is the increased concentration of shares. This reflects that major market participants (or large investors) are gradually increasing their holdings. While this concentration trend may compress market liquidity in the short term, its deeper significance lies in providing strong potential support for price bottoms. Meanwhile, we have noticed a decrease in whale level trading activity over the past 24 hours, with their position changes stabilizing, suggesting that these major funds are adopting a more cautious wait-and-see strategy after recent volatility.

Buyers actively accept orders, but the short-term direction remains unclear.

Despite the price pullback, an "unusually aggressive" buying signal was observed in the 24-hour bullish/bearish momentum analysis. A large number of active buy orders entered the market during the decline, providing solid support and becoming a key factor supporting the expected price rebound.

However, the market's short-term direction remains somewhat ambiguous. Data projects an upward probability of approximately 53.7%, just over 50%, with relatively low expected returns. This strongly advises investors to exercise extreme caution in short-term trading, as the market may be entering a consolidation phase, awaiting a clearer catalyst.

Macro Narratives and Institutional Beliefs

The recent short-term drop in Bitcoin prices to the $86,000 range is mainly attributed to news of Japan's interest rate hike, market deleveraging, and necessary portfolio adjustments by institutions, rather than a sign of deteriorating fundamentals.

Yesterday, Strategy mentioned the possibility of selling Bitcoin to pay shareholder dividends, but so far there's been no correlation or significant market movement. Large corporations continue to hold substantial amounts of BTC. From MSTR's perspective, they know the market is watching them, and many institutions are trying to close their positions before they do. If MSTR waits until the price falls to its anticipated critical point before selling, its sell orders will face extremely low liquidity and huge slippage, leading to actual losses or a significant reduction in profits.

Therefore, MSTR's rational choice would be to act ahead of time. At the current price level, if its holdings are still profitable ("selling now would still yield some profit"), and anticipating the downside risk caused by competitive selling by institutions in the short term, it will tend to preemptively sell to obtain the best execution price.

Summarize

Based on various indicators, the Bitcoin market is currently in a structure where short-term corrections coexist with a less clear long-term outlook. Despite significant short-term volatility, the current price level shows a stable supply structure and strong buying interest. Funding levels do not show any clear signs of a bearish shift. The market is dynamic, and our analysis will be updated if there are any major changes in key data.