Author: Cookie , BlockBeats

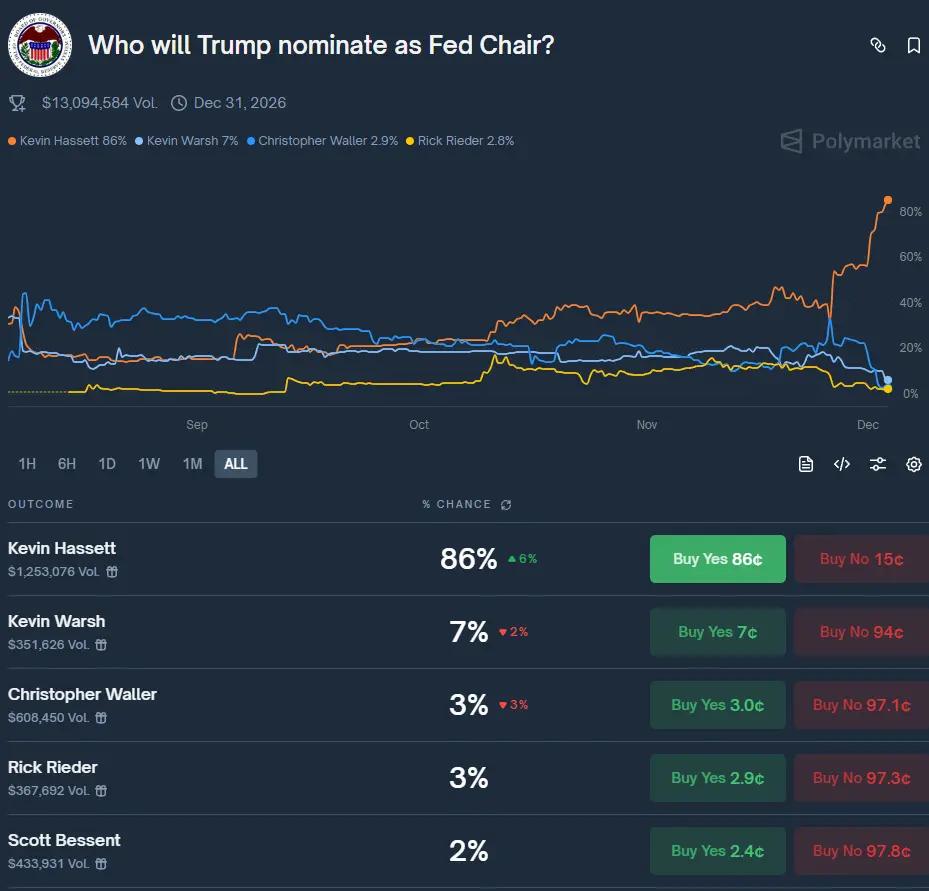

On the prediction market Polymarket, Hassett's probability of being elected as the new Federal Reserve Chairman has risen to 86%, far ahead of other possible candidates for the new Fed Chairman.

Barring any unforeseen circumstances, Kevin Hassett will be the next Federal Reserve Chairman, Trump's favorite.

The actions of the Federal Reserve have always been a significant factor influencing the cryptocurrency market. So, if Hassett ultimately becomes the new Fed Chair as expected, what impact is anticipated on the market?

Accelerate interest rate cuts

Hassett stated in late November that pausing interest rate cuts at this time would be "a very bad time," as the government shutdown had already dragged down fourth-quarter economic growth. He predicted the shutdown would cause a 1.5 percentage point decline in fourth-quarter GDP. At the same time, he pointed out that September's Consumer Price Index (CPI) showed inflation performing better than expected.

Earlier, on November 13, Hassett stated that he expected fourth-quarter GDP to decline by 1.5% due to the government shutdown. He saw little reason not to cut interest rates.

Therefore, if Hassett becomes the new Federal Reserve Chairman, he is expected to push for faster interest rate cuts, potentially lowering the federal funds rate below 3%, or even close to 1%, to stimulate economic growth and employment.

This is also what Trump wants to see.

Resume QE

On December 1, the Federal Reserve officially ended its quantitative easing (QT) policy, marking the end of the balance sheet reduction process that began in 2022. Although some believe that the effects may not be apparent until early next year, the expectation of easing liquidity has been gradually realized.

Hassett may be more lenient on inflation, viewing the 2% inflation target as a flexible upper limit rather than a strict anchor. The focus will be on employment and GDP growth, reducing reliance on data-driven "gradual" decision-making and shifting towards more proactive, pro-growth interventions.

In a September interview with Fox Business, Hassett stated that the U.S. is experiencing a period of supply-side prosperity, and that current interest rates are hindering economic growth and job creation in an economy without genuine inflation. He also indicated that the U.S. is on track to achieve 4% GDP growth.

The view that prioritizes economic development over inflation control makes it possible for the Federal Reserve under Hassett's leadership to restart QE.

Impact on Bitcoin

Every candidate for Federal Reserve Chair, whether or not they directly discuss crypto, will have a structural impact on the cryptocurrency industry. Hassett, in particular, has significant ties to the industry, having publicly held millions of dollars worth of Coinbase stock and served on Coinbase's advisory board.

In addition, he participated in the White House working group on digital asset policy, advocating for leaving room for innovation within the regulatory framework, and believes that crypto technology is a crucial variable influencing the future economic structure. He once stated that Bitcoin will "rewrite the rules of finance."

Hassett's crypto background may reduce regulatory uncertainty and encourage institutions and the Federal Reserve to explore cryptocurrency integration. This could enhance Bitcoin's legitimacy and liquidity, potentially driving prices to new highs.

Many traders are optimistic about the market after Hassett takes office, believing that the bull market will only begin after he takes office, with the expected timeframe being the middle of next year. Therefore, the second half of 2026 is of paramount importance to the cryptocurrency industry.

Recommended reading:

Rewriting the 18-year script: End of the US government shutdown = Bitcoin price will skyrocket?

$1 billion in stablecoins evaporated: What's the truth behind the DeFi collapse?

MMT Short Squeeze Retrospective: A Carefully Designed Money-Making Game