Data can sometimes be misleading, especially when the sample size is very small. But the trends behind the data never lie.

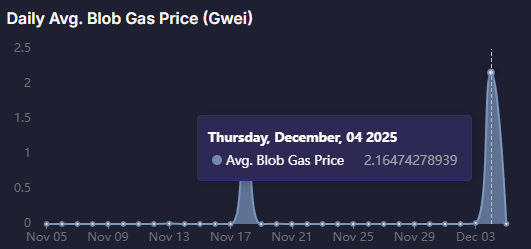

On December 4, within 24 hours of the official launch of the Ethereum Fusaka upgrade, a signal appeared on the chain that was enough to cause panic among laymen and deep thought among experts: the Blob Base Fee soared from the original 1 wei to around 15 million wei, with the peak once approaching 20 million wei.

It surged by 15 million times.

In traditional financial markets, such a surge in costs would typically mean hyperinflation or systemic collapse. But in the crypto world, it's a belated return to value, or even a "correction."

If the previous Dencun upgrade was a "subsidized price reduction" by Ethereum to retain L2, then the Fusaka upgrade finally sheds its veil of sentimentality and begins to calculate like a mature commercial bank. This is not merely an adjustment of technical parameters, but a meticulously planned "two-pronged attack": on the B-side, it ended the free lunch of L2 and initiated a brutal survival-of-the-fittest process; on the C-side, by being compatible with common hardware standards, it quietly activated the hundreds of millions of potential hardware wallets dormant in your pocket.

Ending the Tragedy of the Commons: The Economic Calculation of the Shift from "Freebies" to "Payments"

This surge of 15 million times is because the previous price was fundamentally flawed.

Before Fusaka was implemented, the Blob market was in a very primitive pricing state—lacking a floor price mechanism. As long as the network was not completely congested, the cost for L2 to submit data to the mainnet was only 1 wei (approximately 0.000000001 Gwei).

This absurd pricing leads to a classic "tragedy of the commons": Ethereum's mainnet nodes bear the real physical costs (computing power and electricity) of storage, bandwidth, and KZG proof verification, yet receive almost no return. L2, in its cost-saving efforts, practically crams all data (including massive amounts of spam transactions and inflated volume) into blobs, since it costs almost nothing. L1 essentially subsidizes the rampant growth of L2.

The core proposal in the Fusaka upgrade, EIP-7918 , is essentially an executive order that sets an insurmountable "minimum wage" for Blob resources.

Under the new algorithm rules, the Blob Base Fee is no longer allowed to be as low as dust, but is instead forcibly anchored to 1/15.258 of the L1 execution layer Base Fee. This is a very clever design: it allows the price of the Blob to begin to be linked to the real activity (i.e., real value) of the Ethereum mainnet.

This perfectly explains the astonishing price increase: the previous price was not only cheap, but also unsustainably free. The current price (around 0.01-0.5 Gwei) is still in the low range, but sufficient to cover the physical cost of nodes and effectively curb the abuse of spam data.

For ETH's economic model, this completes the final piece of the puzzle.

In the past, investors have criticized L2 as "draining" Ethereum—stealing transaction volume while contributing very little to ETH burning. With the implementation of EIP-7918, fees have returned to a more rational level. Coupled with the exponential growth in L2 transaction volume in the future, Blob will transform from a simple scaling tool into a new engine for ETH deflation. According to estimates from institutions such as Bitwise, this mechanism could contribute 30% to 50% of the total ETH burning by 2026. This is a huge amount of hidden revenue, being transferred from the profit statements of L2 projects back into the pockets of ETH holders.

Say Goodbye to the "Giant Baby" Era: Vitalik Buterin's Ultimatum

Beyond economic considerations, the deeper signal of the Fusaka upgrade lies in the political sphere: Ethereum is withdrawing its indulgence of L2.

Over the past two years, Ethereum has adopted a "let a hundred flowers bloom" strategy for L2. As long as you call it a Rollup, I'll provide you with extremely cheap block space. This tolerance has led to a chaotic L2 landscape – countless projects have used forked code and centralized sequencers to issue tokens and crypto under the guise of "scaling," while in reality remaining stuck in Vitalik's "Stage 0" (i.e., security relies entirely on project-side multisignature rather than code logic, commonly known as "riding a bicycle with auxiliary wheels").

On the eve of the Fusaka upgrade, Vitalik Buterin's tone had subtly but fatally changed. He drew a clear line: if an L2 does not reach "Stage 1" (i.e., possess a valid, permissionless proof of fraud or validity) in the near future, it does not deserve to be called a Rollup.

The surge in Blob costs during the Fusaka upgrade is essentially due to L1 developers no longer being willing to pay for these low-quality L2 services.

This means that 2025 will be the year of the "battle royale" for L2 licenses. Those "zombie L2" licenses that lack real users and revenue, relying solely on venture capital funding, will face a double blow:

- On the cost side : Increased Blob fees have led to a surge in operating costs, making it impossible to fake prosperity through inflated traffic.

- Public opinion suggests that as the Ethereum Foundation tightens its definitions, these technologies will be stripped of their "Layer 2" legitimacy label.

The future landscape is clear: only top-tier L2 enthusiasts with superior technology and a genuine ecosystem will survive, while the rest will be mercilessly crushed by the wheels of history.

Trojan Horse: The Activated iPhone and the Degraded Hardware Wallet

If EIP-7918 was designed to make Ethereum more money, then EIP-7951 is designed to attract more users to Ethereum.

For a long time, the mass adoption of Web3 has faced an awkward choice between two options:

- For security : you'll need to spend a few hundred dollars on a dedicated hardware wallet like Ledger or OneKey, and store your seed phrase like you would a core password.

- For convenience , you have to entrust your assets to a centralized exchange and constantly worry about the next FTX crash.

In fact, each of us carries a top-of-the-line hardware wallet in our pocket. Whether it's the iPhone's Secure Enclave or Android's TrustZone , they all have built-in military-grade security chips (TEEs). The security of these chips is in no way inferior to that of cold wallets on the market.

The awkward thing is that these chips use the NIST standard secp256r1 algorithm curve, while Ethereum (inherited from Bitcoin) uses the secp256k1 curve. This tiny difference of one letter constitutes a mathematically insurmountable gap—when mobile phone chips encounter Ethereum, they are like foreigners who cannot speak the language, unable to sign directly.

The Fusaka upgrade introduces pre-compiled contracts via EIP-7951, essentially opening a "green channel" at the EVM's underlying layer. Developers can now verify the r1 signature of mobile phone chips natively by paying a mere 6900 Gas.

The impact of this change is nuclear-level; it completely reshapes the product logic of wallets: future users will no longer need to know what a private key is, nor will they face the psychological pressure of copying 12 words. You simply need to scan your face and press your fingerprint, just like buying coffee, and the security chip in your iPhone will directly sign the transaction. This offers both hardware-level physical isolation security (the private key never leaves the chip) and a Web2-level smooth experience.

For Ledgers, this might be a game-changer; but for the Ethereum ecosystem, it's the only way to seamlessly integrate 1 billion new users onto the chain.

The End of Fragmentation and the B2B Finale of the "Ethereum Empire"

In addition to the two points mentioned above, the Fusaka upgrade also implies the confirmation of Ethereum's final form: complete B2B transformation.

The current Ethereum ecosystem is very similar to 19th-century Europe—hundreds of L2 servers are like hundreds of small principalities. Although they all revere Ethereum as royalty, their liquidity is fragmented, resulting in an extremely disjointed user experience.

To address this issue, the community is advocating for "Based Rollups" (Rollups based on L1 sorting). Unlike the current L2 (which has its own sorter and is an independent kingdom), Based Rollups return the power to sort transactions to Ethereum L1 validators.

This is an extremely bold "reduction of power" strategy. It means that L2 will no longer be an independent, closed network, but rather more like a tentacle directly extending from Ethereum L1.

With the cost structure following Fusaka, Ethereum L1 will evolve into a purely "global settlement layer." Its direct clients will be reduced to only two categories:

- L2 networks : They are wholesalers that wholesale block space (Blob) to L1 networks and then resell it to users.

- Financial institutions and whale : Enabling final confirmation of ownership of large assets through hardware-level security provided by EIP-7951.

This is Ethereum's "coming of age": it is no longer a geek experiment that sacrifices business logic in pursuit of ultimate decentralization, but a hierarchical, clearly defined digital financial empire that has begun to powerfully collect rent.

Investor Survival Guide

Faced with the dramatic changes brought about by the Fusaka upgrade, ordinary investors cannot simply watch from the sidelines. The market rules have changed, and your investment strategies must evolve accordingly.

1. Advice for die-hard ETH bulls: Deflationary logic is returning, but beware of the L2 narrative trap.

- Positive aspects : The surge in Blob fees is a genuine positive. This means that ETH burning no longer relies solely on high gas costs on the mainnet; for the first time, the prosperity of L2 cryptocurrencies has truly translated into deflationary momentum for ETH. In the long term, ETH is transforming from a "governance token" to "underlying internet infrastructure," with increasing rental yields.

- Risk point : Beware of variations of the "L2 leeching theory." Although L1 has started to collect rent, if a large number of fake L2s create a false prosperity, this is still unsustainable.

- Trading Strategy : Focus on the ETH/BTC exchange rate . Fusaka has fixed Ethereum's fundamental flaws. For long-term investors, now is the time to re-evaluate Ethereum's value proposition, especially as the market remains obsessed with the "Solana killer" narrative. Ethereum is quietly building its moat.

2. Advice for L2 investors: A major cleanup is imminent; use this standard to "examine" the underlying issues.

Your L2 tokens could very well go to zero. Please immediately review your holdings using the following three criteria:

- Standard A: Has Stage 1 been met? Look at L2Beat's data. If there's no valid proof of fraud/validity, and the project team doesn't have a clear timeline, even if it's a VC darling, resolutely avoid it. Vitalik Buterin's patience has run out, and the market's patience will follow.

- Standard B: Does it generate real revenue? After the Blob price increase, if this L2 platform continues to rely on massive subsidies to maintain a low price and lacks genuine DeFi or GameFi revenue support, its cash flow crisis is only a matter of time. Focus on projects with positive cash flow (Sequencer Revenue > Data Cost).

- Standard C: Does it support based or interoperability? Isolated systems have no future. If an L2 blockchain continues to operate within a closed ecosystem, failing to support cross-chain atomic swaps or shared sorters, it will be marginalized.

- Conclusion : Abandon those "assembled chains" that issue tokens for the sake of issuing tokens, and concentrate your holdings on leading protocols such as OP, ARB, Base, and ZKSync, which have technological moats and real ecosystems.

3. Advice for interactive users and those who enjoy freebies: Increased costs, upgraded experience.

- The bad news : With the implementation of the base price mechanism for Blob fees, the interaction cost (gas fee) of L2 may increase slightly, and volatility will also increase. The days of processing tens of thousands of transactions for 0.001U may be over.

- Good news : Account Abstraction (AA) wallets are about to explode in popularity. Stay tuned for next-generation wallet applications that support EIP-7951 (secp256r1).

- Operational strategy :

- Defense : Avoid unnecessary interactions when L2 network gas spikes (usually when the mainnet is congested).

- Offense : Actively experience and ambush smart wallet projects based on Passkey (biometric) technology. This is not only an upgrade in experience, but also a potential goldmine for the next Alpha track (AA Wallet track). Future airdrop standards will likely favor genuine users of AA Wallets to filter out scripted users.

The Fusaka upgrade marks a watershed moment in the crypto world. It tells us that the free lunch is over, technological compatibility has begun, and an industry shake-up is underway. In this transformation, only those who understand the underlying logic will be able to stand firm in the next wave.