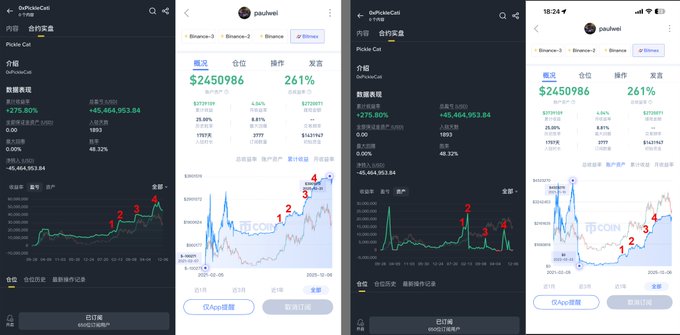

It's unbelievable that someone in the world has such a similar profit/loss curve to me, yet our trading styles are completely opposite! Have I finally found a long-lost bro? @coolish Compare our live trading charts side-by-side; you can see the profitable phases are almost identical. But here's the question: given that high-frequency trading is generally unprofitable for most people, how come: He trades 10+ times a week I barely make a few trades a quarter Then why are our curves still almost synchronized? I'll use my childhood favorite game, League of Legends, as an analogy: I'm like someone who lurks in the bushes, waits for the right moment, unleashes a devastating attack, and then retreats from the battlefield, waiting for the next opportunity. He's more like someone who likes to be in the center of the battlefield, probing back and forth with the enemy, looking for their mistakes, and then initiating a team fight with his ultimate. ⚠️Here's the key point: Regardless of our fighting styles, we both win by winning a crucial team fight, so of course our curves look similar. The problem for most retail investors lies here: > Many people don't understand "high-frequency" trading as last-hitting minions. > It's about constantly engaging in meaningless team fights. > They force team fights when it's not their time. > However, there are only one or two truly crucial team fights that can secure victory. > If you treat every move like a high-risk, high-reward bet, you'll inevitably get wiped out by the market. His kind of "high-frequency" trading is actually: last-hitting minions, farming jungle camps, trial positions, and micro-management. The truly crucial team fights where you unleash your ultimate skill occur are at a low frequency, similar to mine. ⚠️ But ordinary people simply can't control this balance. Traders like Paul (a genius) are one in a million. Some retail investors don't learn, don't practice, and just watch Paul's high-frequency trading and think it's cool. Many high-frequency day traders aren't lacking in talent, but rather they haven't found the right timing and waste opportunities. So you either need to thoroughly understand Paul's methods, or reduce your trading frequency and wait for the right opportunity. Thanks to Paul for providing such a valuable supplementary perspective. I truly hope that more truly skilled traders will share their insights in the future. There are already few true players in the market, and even fewer who can speak out. Cherish them.

This article is machine translated

Show original

paulwei

@coolish

12-06

看到@0xPickleCati 这篇

“日内高频交易是结构性诈骗”雄文,

也看到她在币安实盘上的交易收益曲线各数据,

基本符合她在文中所说的思维:

“每个季度做几次交易,你就能挺过去。

每周做10次以上交易?

...高频只有一个最终结果。

毁灭”

但很多人关注我实盘的人,尤其在最近公开API之后, x.com/0xPickleCati/s…

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content