A divided Federal Reserve approved a 0.25% rate cut, but concerns about inflation and economic growth, along with Glassnode's emphasis on a "fragile range" for BTC, could continue to keep it below $100,000.

On Wednesday, the Federal Reserve approved a 25-basis-point interest rate cut, its third this year, in line with market expectations. Consistent with previous FOMC meeting price movements, Bitcoin surged past $94,000 on Monday. However, the hawkish interpretation of this rate cut by the media reflects ongoing disagreements within the Fed regarding US monetary policy and the economic outlook.

Given that this week's rate cut has been labeled "hawkish," Bitcoin prices may experience a "sell the fact" after the news has been priced in, and continue to fluctuate within a range until new momentum emerges.

According to CNBC, the Federal Reserve voted 9-3 to cut interest rates, indicating that members remain concerned about the resilience of inflation and believe that the pace of economic growth and the pace of rate cuts may slow in 2026.

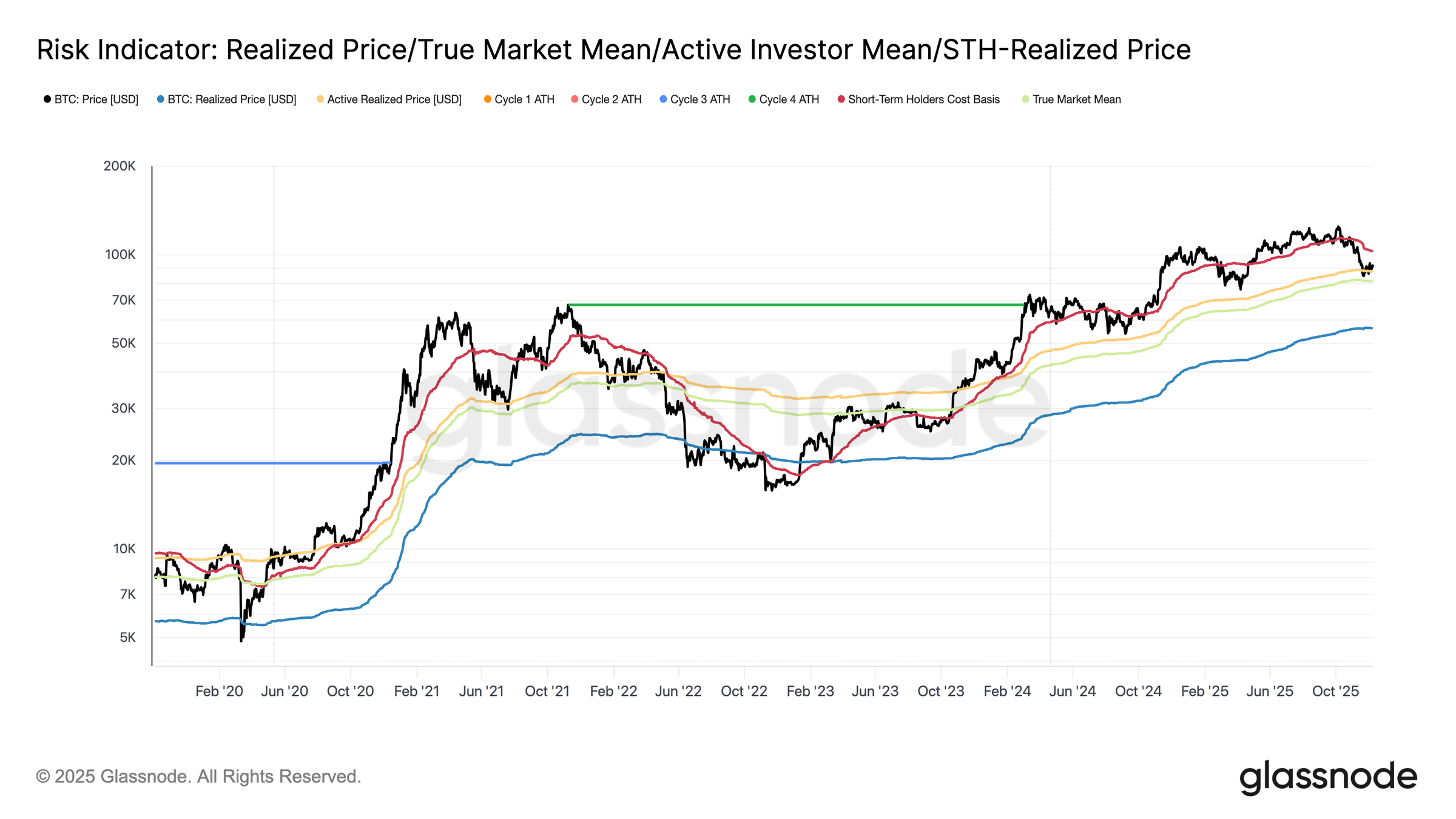

According to Glassnode data, Bitcoin (BTC) at $92,626 remains trapped in a structurally fragile range below $100,000, with its price action constrained between a short-term cost benchmark of $102,700 and a “true market mean” of $81,300.

Glassnode's data also shows that Bitcoin continues to be suppressed below $100,000 amid weakening on-chain conditions, reduced demand for futures, and persistent selling pressure.

Key points:

- Bitcoin's structurally fragile range has kept the market stagnant below $100,000, with unrealized losses continuing to mount.

- Losses surged to $555 million per day, the highest since the FTX crash in 2022.

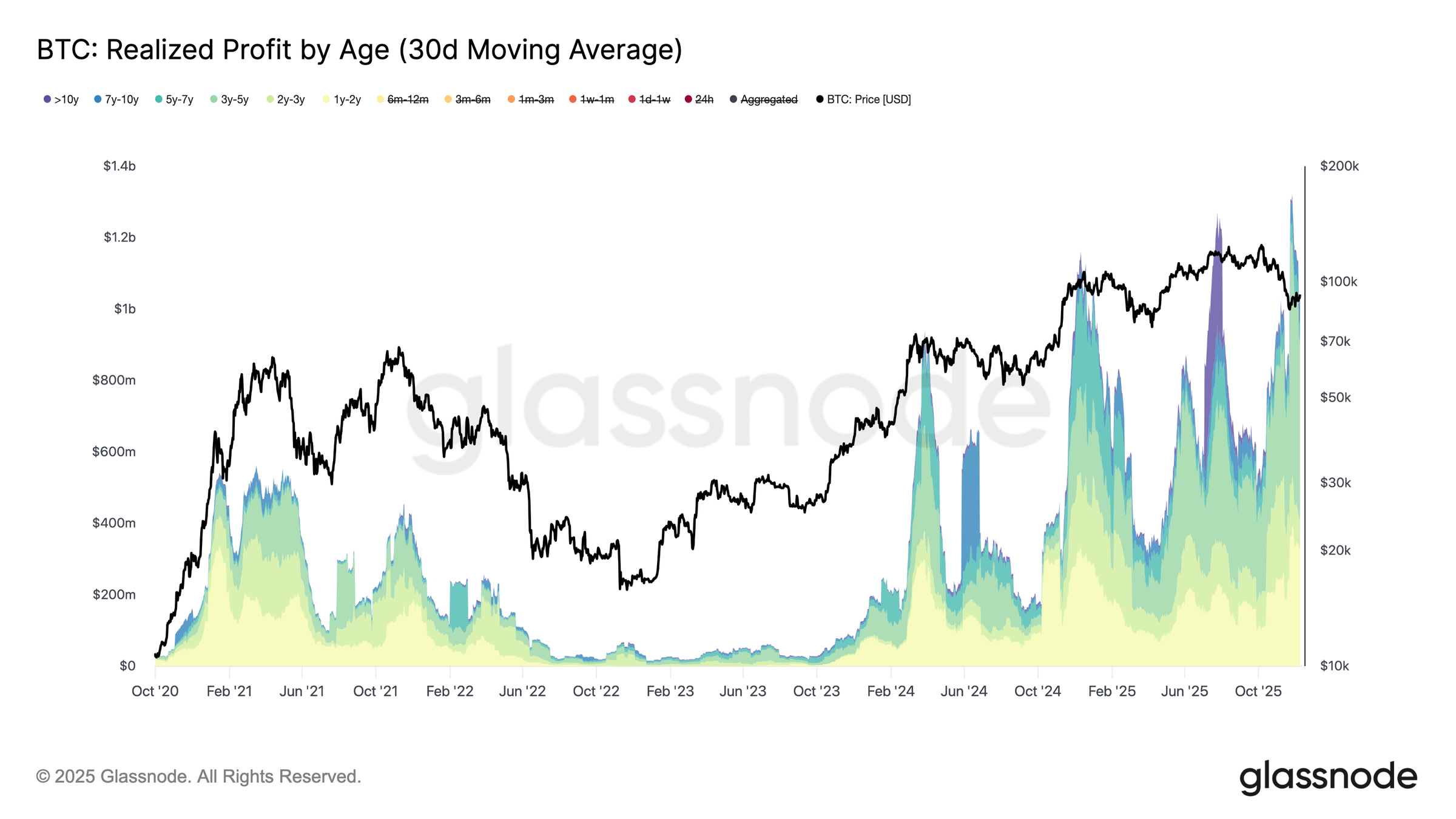

- Large-scale profit-taking by holders of more than a year, along with the capitulation of top buyers, has prevented Bitcoin from regaining the STH (Short-Term Holder) cost benchmark.

- The Fed's rate cuts may not significantly boost Bitcoin's price in the short term.

Bitcoin's time to return to $100,000 is running out.

According to Glassnode, Bitcoin's inability to break through $100,000 reflects escalating structural pressures: time is against the bulls. The longer the price remains trapped in this fragile range, the more unrealized losses accumulate, increasing the likelihood of a forced sell-off.

Realized price and true market mean for Bitcoin. Source: Glassnode

The relative unrealized loss, measured by the 30-day simple moving average (SMA), has risen to 4.4%, ending a two-year period below 2% and signaling a more stressful market environment. Despite Bitcoin's rebound from its November 22 lows to around $92,700, realized losses, adjusted for entity changes, continue to climb, reaching $555 million per day, consistent with levels seen during the FTX capitulation.

Meanwhile, long-term holders (holding for more than a year) are realizing profits exceeding $1 billion per day, peaking at a record $1.3 billion. The capitulation from top buyers and the massive distribution by long-term holders may keep BTC below key cost benchmarks, preventing it from reclaiming the $95,000–$102,000 resistance zone, which is the upper limit of the vulnerable range.

Realized profit by age. Source: Glassnode

The spot-driven rebound met with a shrinking futures market.

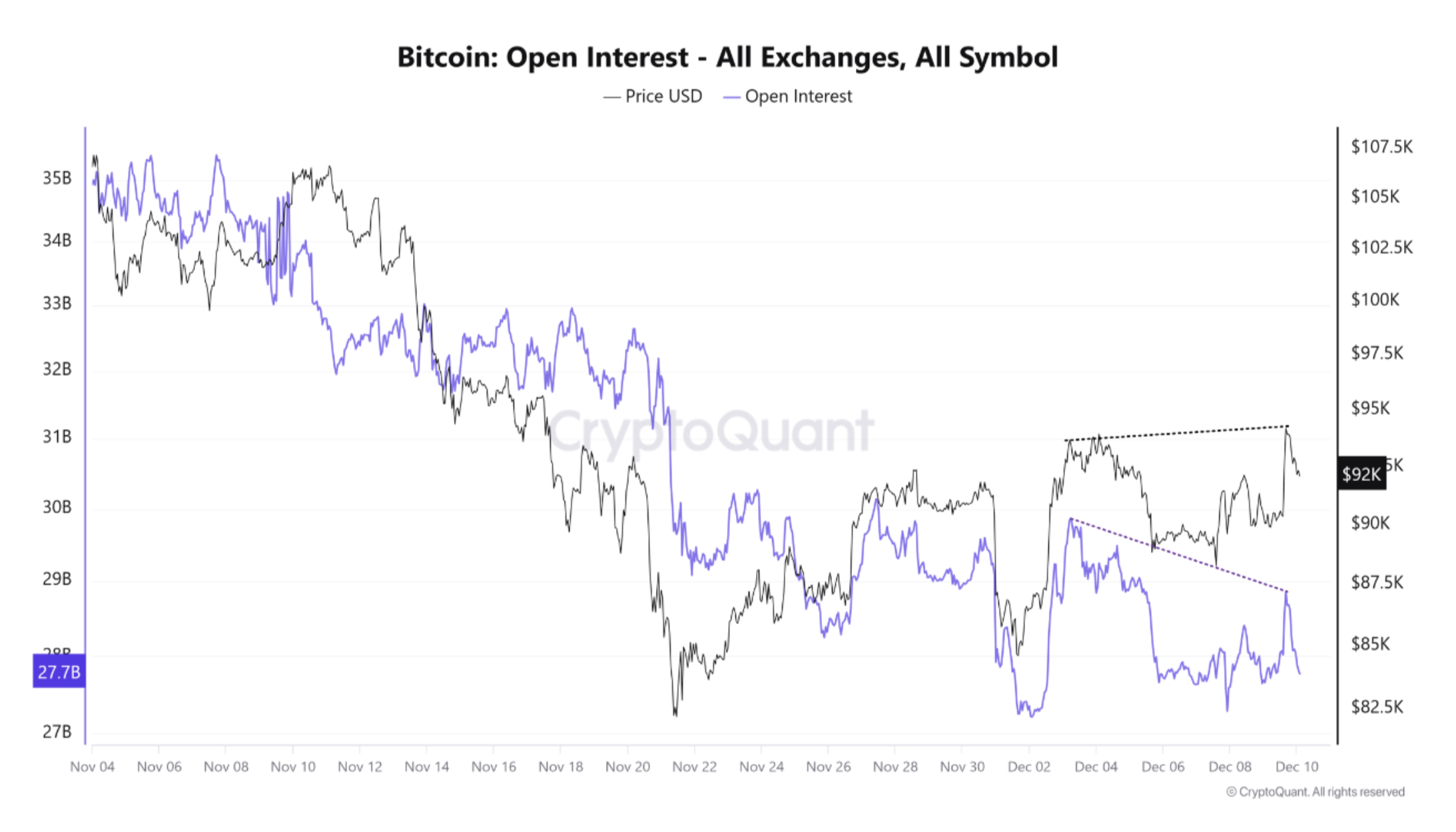

CryptoQuant data shows that the crypto market typically rebounds before the FOMC meeting, but recently there has been a significant divergence: Bitcoin prices have risen while open interest (OI) has continued to decline.

Bitcoin price versus open interest divergence. Source: CryptoQuant

During the correction period since October, the OI (Onshore Indicator) had been declining, but even after Bitcoin bottomed out on November 21 and prices rose, the OI continued to fall. This suggests that the rebound was primarily driven by spot demand rather than leveraged speculation.

CryptoQuant adds that while spot-driven rallies are generally healthier, historically sustained bull market momentum still requires increased leverage. Given that derivatives trading volume structurally dominates, with spot trading currently accounting for only 10% of derivatives activity, this spot-dominated force may be difficult to sustain if market expectations for future rate cuts weaken before the meeting.