Bitcoin linked to the now-defunct Silk Road exchange has shown signs of movement after more than a decade of silence, raising new questions about who controls these coins and the implications of this latest activity for the market. Blockchain data shows that in the past 24 hours, 176 transactions have been made from the previously dormant Silk Road Bitcoin wallet group, totaling approximately $3.14 million, to a new group of wallet addresses.

An accumulation pattern, not a market sell-off.

This pattern of movement immediately attracted attention because these wallets are rarely active, and Bitcoin "hibernating," a phenomenon associated with the early Dark Web markets, often causes anxiety among retail investors.

However, the structure of this coin movement suggests that it is a controlled restructuring process, not a hasty sell-off.

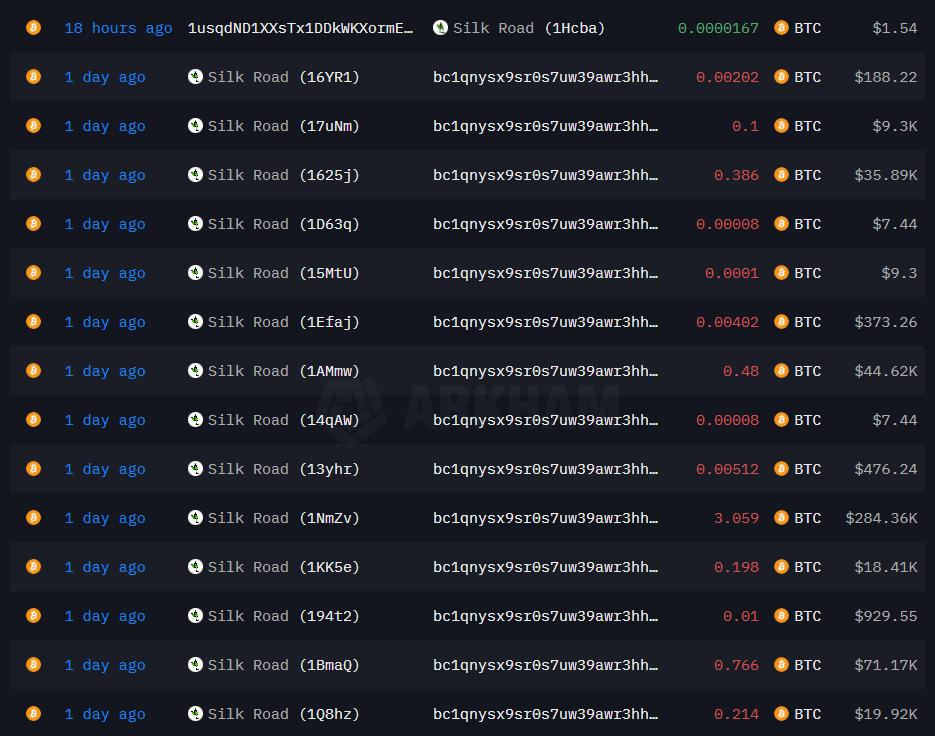

Silk Road 's Bitcoin wallet completed 176 transactions over three years. Source: Arkham

Silk Road 's Bitcoin wallet completed 176 transactions over three years. Source: Arkhamon-chain data shows that the transfers were all made in small, evenly distributed batches, a type of transfer analysts often associate with wallet pooling. This Bitcoin did not go to exchanges or coin mixing services — which would typically be indicative of liquidation or money laundering .

Instead, this Bitcoin appears to be being consolidated into several new wallets, a method many users choose when they need to clean up old UTXOs, rearrange management permissions, or prepare for future steps.

This move is quite similar to some past coin transfers by both individual owners and addresses belonging to law enforcement agencies.

Possible motives behind Bitcoin transfers on the Dark Web

This activity could indicate several different scenarios. It's highly possible that an organization currently controlling these coins – whether it's an individual who was involved with Silk Road from the beginning or a government agency – is updating its wallet structure.

The US government had previously collected large amounts of Bitcoin seized from Silk Road before holding an auction, and the court had also approved the sale of over 69,000 BTC related to Silk Road seizures earlier this year.

Another possibility is that an individual has recently regained access to an old wallet key after many years. The amount of BTC that was "dormant" during the 2011–2013 period sometimes reappears when the original owner recovers the wallet or transfers assets through inheritance.

Such "revive" activities for old wallets typically occur through regular, slow chain of transactions, similar to what we see on the blockchain today.

The likelihood of this Bitcoin being used for money laundering or being prepared for immediate sale is quite low. Typically, money laundering involves thousands of small transactions, circular transfers, or direct input into coin mixing services – something that hasn't appeared yet.

The significance for Bitcoin

The impact on the market remains relatively limited. Real selling pressure will only arise when these coins are transferred to exchanges.

Analysts will continue to monitor whether this new group of addresses will move coins to centralized orOTC trading platforms.

However, transactions from wallets that once belonged to the darknet still hold symbolic significance. They demonstrate that Bitcoin, even in its early days, can be traceable, and that movements more than a decade later can still occur unexpectedly.

In addition, these coin transfers also partly reflect the sensitivity of supply in the market, especially in the context of institutional money flows, ETF activity, and macroeconomic factors that are making the market more volatile.