Bitcoin feels like it's being controlled; the pump and dump are done in one smooth motion, without any hesitation. US stocks, gold, and silver have all gone crazy, but Bitcoin just can't seem to rise. There's also the possibility that large institutions haven't accumulated enough tokens yet.

Currently, the 4-hour chart shows a wide range of fluctuations without a clear trend. I want to wait until Japan announces its interest rate hike before observing the overall market trend.

In the past two days, aside from privacy concerns, I've noticed a resurgence of on-chain memes in the altcoin space. I won't go into details; please research it yourselves and be aware of the risks.

BTC

BTC's hourly chart shows a erratic movement, with retail investors long weak buying interest. However, the momentum for a rebound at the 2-day moving average is still strengthening, and a rebound at the 3-day moving average may take effect next week. After the rebound takes effect, it is still expected to reach around 97400-98800.

The current resistance levels are around 93570 (the middle Bollinger Band on the 2-day chart) and 94250 (the upper Bollinger Band on the 1-day chart). If 93570-94250 is broken, a 3-day rebound will take effect, and the price will likely test the 97400-98800 area. This move is very aggressive and usually coincides with a peak period for short position liquidations. After the upward move, a sharp sell-off may occur next week due to significant negative news.

The bulls should defend 89,000 (a drop below this level would lead to a sharp decline), while the bears should focus on defending 94,600 (a breakthrough here would lead to an attack on 98,000).

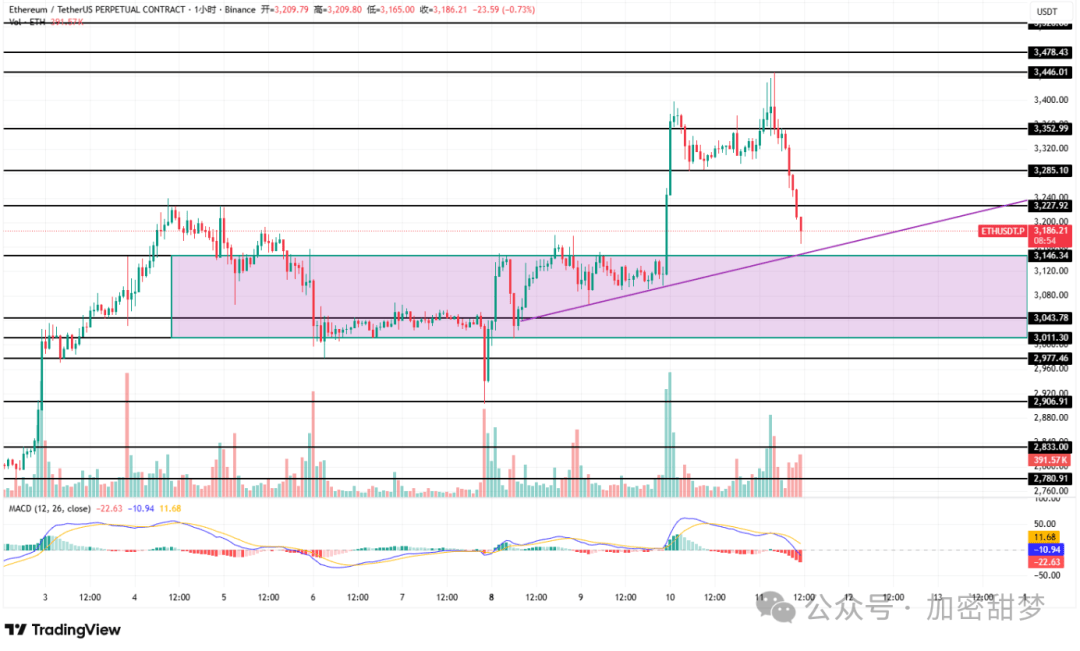

ETH

ETH's resistance today is 3272, and support is 3150 (3142 for the lower bound). A break below 3150 in the short term would likely lead to a larger drop. The trading range is narrowing, and the price is consolidating to the right.

The upward momentum at the 2-day moving average is strengthening, with strong resistance at 3372-3440. A break above this level would lead to 3495-3555. Therefore, the downside defense should be at 3450, and the upside defense at 3140.

LUNA

LUNA was immediately dismissed, and Do Wkon was sentenced to 15 years. After his release, he will likely be extradited to South Korea and serve at least several decades more, essentially rendering him useless.

Almanak

Almanak, which previously raised $2 million on the Legion IPO platform with a valuation of $90 million, has seen its market capitalization plummet to $36 million after its official listing last night. This means that those who participated in the IPO have suffered a 60% loss. The team has yet to respond to the issue of the IPO price falling below the initial offering price.

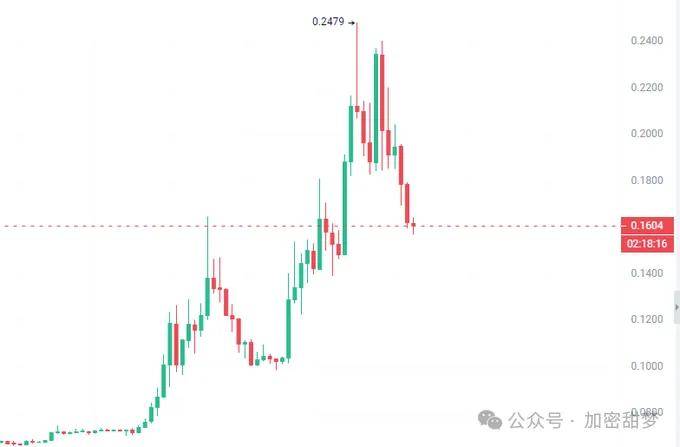

MERL

Over the past few weeks, MERL has touched the 0.5 level three times, each time turning around just before reaching it, and closing with a long upper shadow in each instance, a typical case of "sell-off at the right point".

The current technical pattern is somewhat bearish, with almost no room for further gains above 0.5 in the short term. Unless there's a significant volume spike and a firm hold above that level, each rebound is likely to be shorted again. Personally, I think chasing highs is too risky before seeing a genuine breakout signal; I'd rather short long.

The market is constantly changing, and specific entry and exit points should be determined based on real-time conditions. Follow the trend after a breakout! No matter how high your confidence level, please strictly adhere to your stop-loss and take-profit strategies! That's all for today! Follow me so you don't get lost! ( Add me on QQ: 3958133807 with a note, and I'll add you to my learning and discussion group.)