Stable is a high-performance blockchain specifically designed for stablecoins, allowing users to make direct payments using USDT with a fast, low-fee, and nearly instantaneous experience. Let's explore this project with Coin68 in the article below.

What is a stable? Learn about the first stablechain backed by USDT.

What is a stable? Learn about the first stablechain backed by USDT.

What does "stable" mean?

Stable is a high-performance stablechain (a blockchain designed specifically for stablecoins) that allows users to pay directly with USDT ( Tether ) with a stable, low-fee, and near-instantaneous experience. Stable is built to address the inefficiencies of current crypto payment infrastructure, such as unpredictable fees, slow payment times, and overly complex user experiences.

What does "stable" mean?

What does "stable" mean?

Stable's goal is to expand the utility of USDT, which is currently limited to trading platforms and DeFi, with applications such as:

- Consumer payment solution : Stablecoin integrates debit and credit cards directly linked to USDT, simplifying the use of stablecoins for everyday spending transactions.

- Merchant payment tool : Businesses can accept USDT as a direct payment currency, bypassing expensive third-party processors and significantly reducing transaction costs.

- Stable Pay : A user-friendly wallet optimized for everyday transactions, seamlessly integrating with the Stable ecosystem and ensuring an intuitive user experience.

Key features of Stable

Stablecoins are designed to Vai as the asset issuance and payment layer for USDT, with key features such as:

- Using USDT as Gas Price : Stable allows users to pay transaction fees directly with USDT, eliminating the complexity of holding additional Token and facilitating easy daily transfers and transactions.

- Instant payments with extremely low fees : Transactions on the Stable blockchain are always confirmed within seconds and maintain very low fees, suitable for both small-scale and large-scale payments.

- High throughput : Stable is designed to handle thousands of transactions per second, ensuring fast and reliable performance even during peak usage periods.

- High scalability and security : Stable is perfectly suited as a payment infrastructure for organizations or businesses, with its scalability and robust security measures ensuring the resilience and reliability of this blockchain.

- Cross-chain interoperability : Stable can seamlessly connect USDT across different blockchain ecosystems by utilizing USDT0 and LayerZero technology.

- Developer-friendly : With EVM compatibility and a dedicated SDK and API toolkit, developers can easily build dApps on Stable.

Development roadmap

Stable's development roadmap

Stable's development roadmap

Stable's development roadmap currently has three main phases:

Phase 1 - Q3/2025: Building the foundation

- Use USDT as the fee Token for the Stable blockchain.

- Implementing StableBFT aims to shorten transaction processing times.

- Launching Stable Wallet to enhance user experience.

Phase 2 - Q4/2025: Building the user experience layer

- Implement parallel order matching to improve trading throughput.

- Introducing a comprehensive USDT transfer tool and dedicated block space for businesses to ensure efficient processing and consistent performance.

Phase 3 - Q2/2026: Infrastructure completion

- Upgrade to a DAG-based consensus mechanism to improve speed and fault tolerance.

- Expanding the tools and resources available to developers to support dApp development.

Development team

Stable is operated and developed by:

- Brian Mehler : CEO of Stable, and also a director at Gateway Capital and Formation – Biohacking Studios. Previously, he was Vice President of Investment at Block in Hong Kong, responsible for investment and structuring in the crypto/blockchain sector.

- Sam Kazemian : As the CTO of Stable, he is known as the founder of Frax Finance , a project focused on Algorithmic Stablecoin. He is also a co-founder of IQ.wiki, the world's largest blockchain encyclopedia.

- Thibault Reichelt : COO of Stable, formerly working at the Abu Dhabi Investment Council before moving into venture capital. His portfolio includes companies such as Compound, DYDX, StarkWare, Circle, Wintermute , and Kraken.

Investors

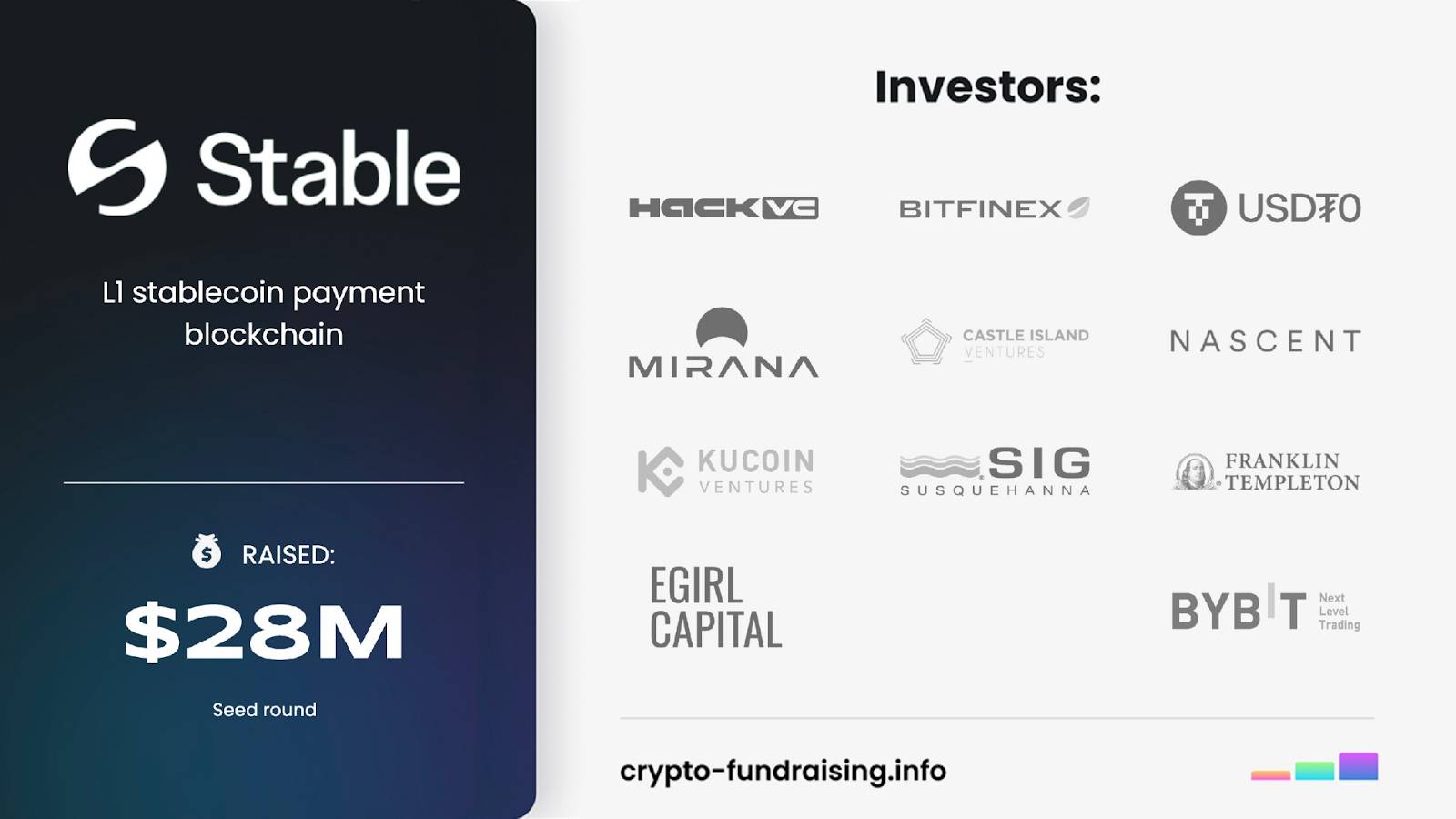

Stable investors

Stable investors

Stable has raised a total of $28 million from investors such as HackVC, Bitfinex, USDT0, Franklin Templeton, etc.

Tokenomics

Token information

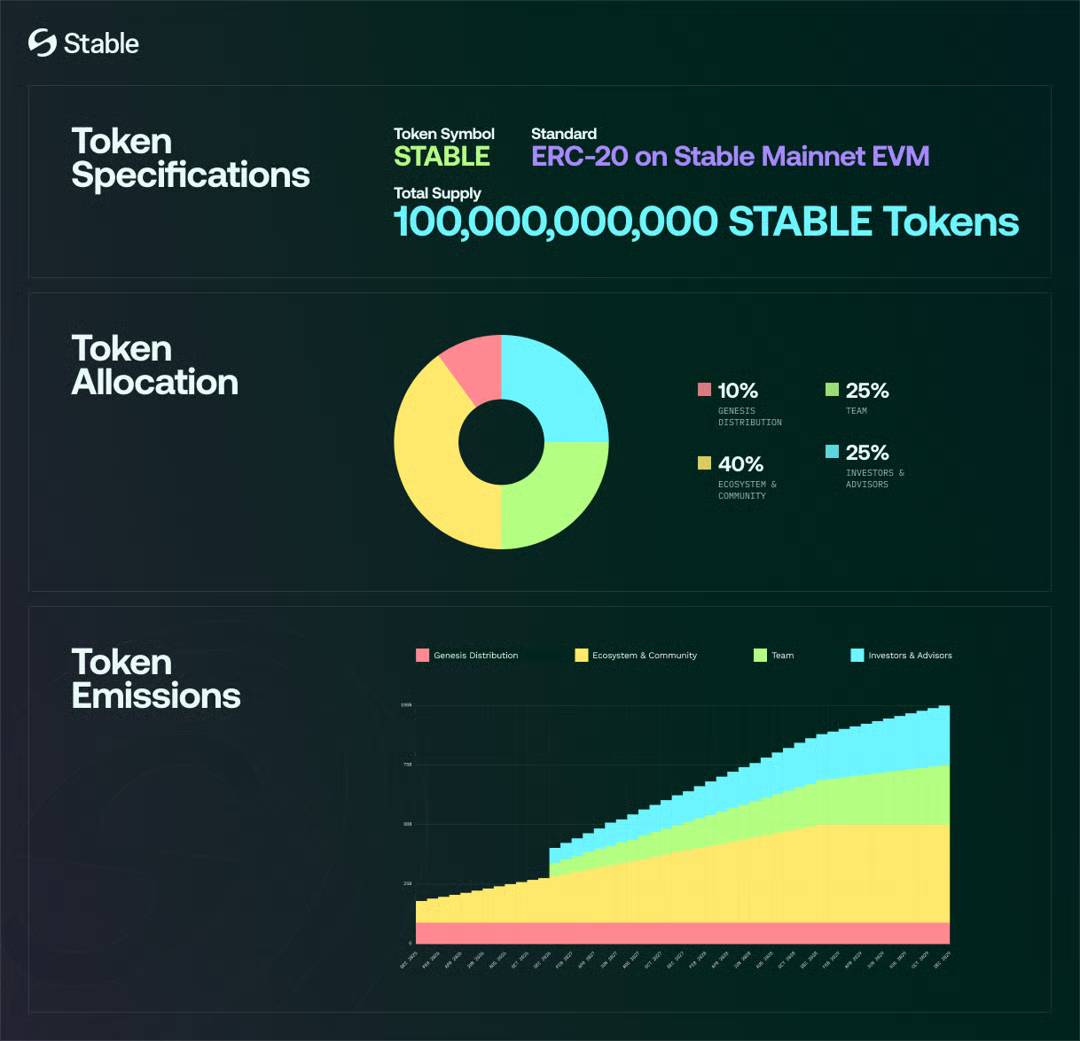

Token name | Raw |

Symbol | STABLE |

Calcium | Stable Mainnet |

Contract | 0x011ebe7d75e2c9d1e0bd0be0bef5c36f0a90075f (BNB Chain) |

Total supply | 100,000,000,000 |

Token allocation ratio

STABLE Token allocation ratio

STABLE Token allocation ratio

STABLE Token are allocated as follows:

- Airdrop - 10% : Unlock 100% at TGE.

- Ecosystem & Community - 40% : Unlock 8% at TGE, the remainder vesting over 3 years.

- Development team - 25% : 1-year training program, followed by 3-year vesting.

- Investor - 25% : Locked for 1 year, then vested for 3 years.

Token Use Case

STABLE Token are used for:

- Stake in the Delegated Proof of Stake (StableBFT) model is used to secure the network.

- Participate in voting on protocol upgrades, network parameter adjustments, crowdfunding allocation, and strategic decisions for the Stable ecosystem.

- Staking rewards, liquidity mining, and support for new dapps.

- Link USDT fees in the vault to STABLE Stake requirements.

Summary

Above is all the information about the Stable project. Coin68 hopes that readers have grasped the basic information to better understand the project and its highlights. We wish you more useful knowledge!

Note: The information in this article should not be XEM investment advice, and Coin68 is not responsible for any decisions you make.