Highlights of this episode

This week's statistics cover the period from December 5th to December 11th, 2025.

This week's RWA market data shows that the growth of total on-chain market capitalization has almost stagnated, but the number of holders has steadily increased, reflecting that the market has entered a stage of deepening user penetration; the total market capitalization of stablecoins has exceeded $300 billion, but the monthly transaction volume and monthly active addresses have declined significantly, and the market is facing the dual pressure of "liquidity contraction and user activity decline".

On the regulatory front, some countries have made substantial progress in the issuance of tokenized assets. BRICS countries and Bhutan have launched digital currencies with gold as the underlying asset, and the Crown Prince of Malaysia has launched the Ringgit stablecoin. On the project front, the multi-polar layout of stablecoins is accelerating: the Brazilian stablecoin project Crown and the African stablecoin payment infrastructure Ezeebit have successively obtained financing, and YouTube has launched a stablecoin option to pay revenue to American creators.

In stark contrast, stricter regulations in mainland China have led to a sharp drop in inquiries about RWA business in Hong Kong, indicating that the RWA market is evolving in parallel with global expansion and regional compliance challenges.

Data Perspective

RWA Track Panorama

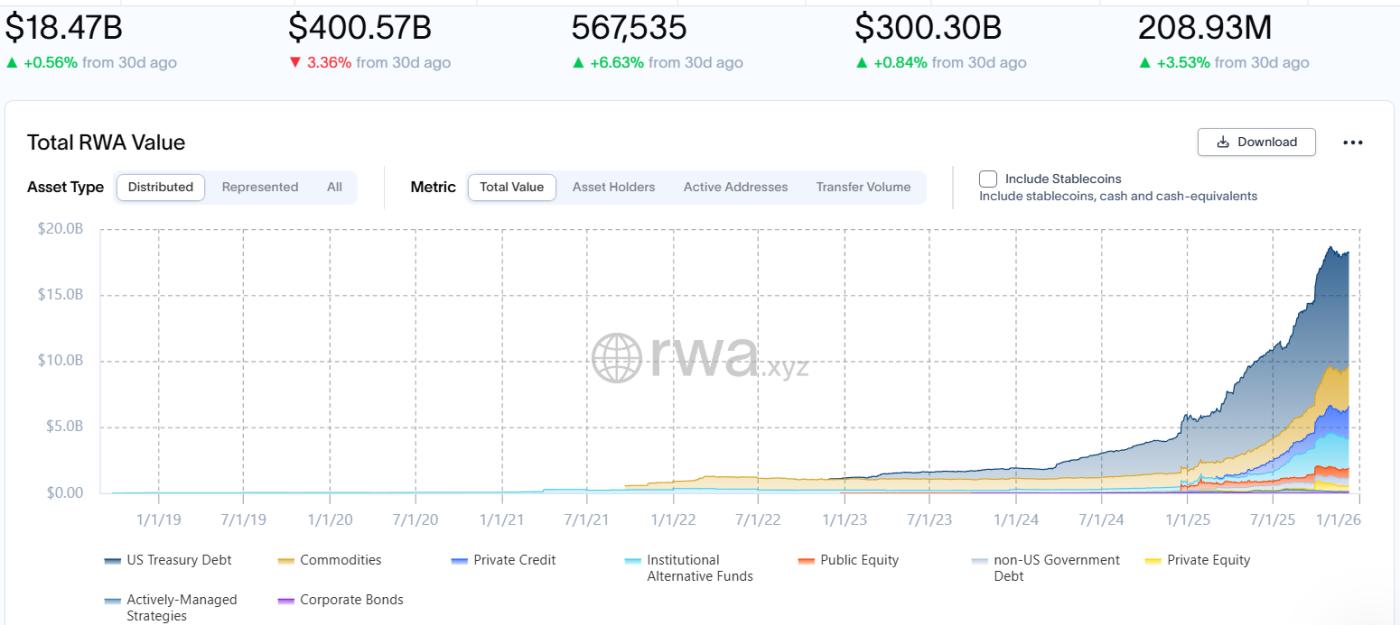

According to the latest data disclosed by RWA.xyz, as of December 12, 2025, the total market capitalization of RWA on-chain was US$18.47 billion, a slight increase of 0.56% compared to the same period last month, with the growth rate slowing down significantly and almost stagnating; the total number of asset holders steadily increased to approximately 567,500, an increase of 6.63% compared to the same period last month, reflecting the continued expansion of the investor base.

Stablecoin Market

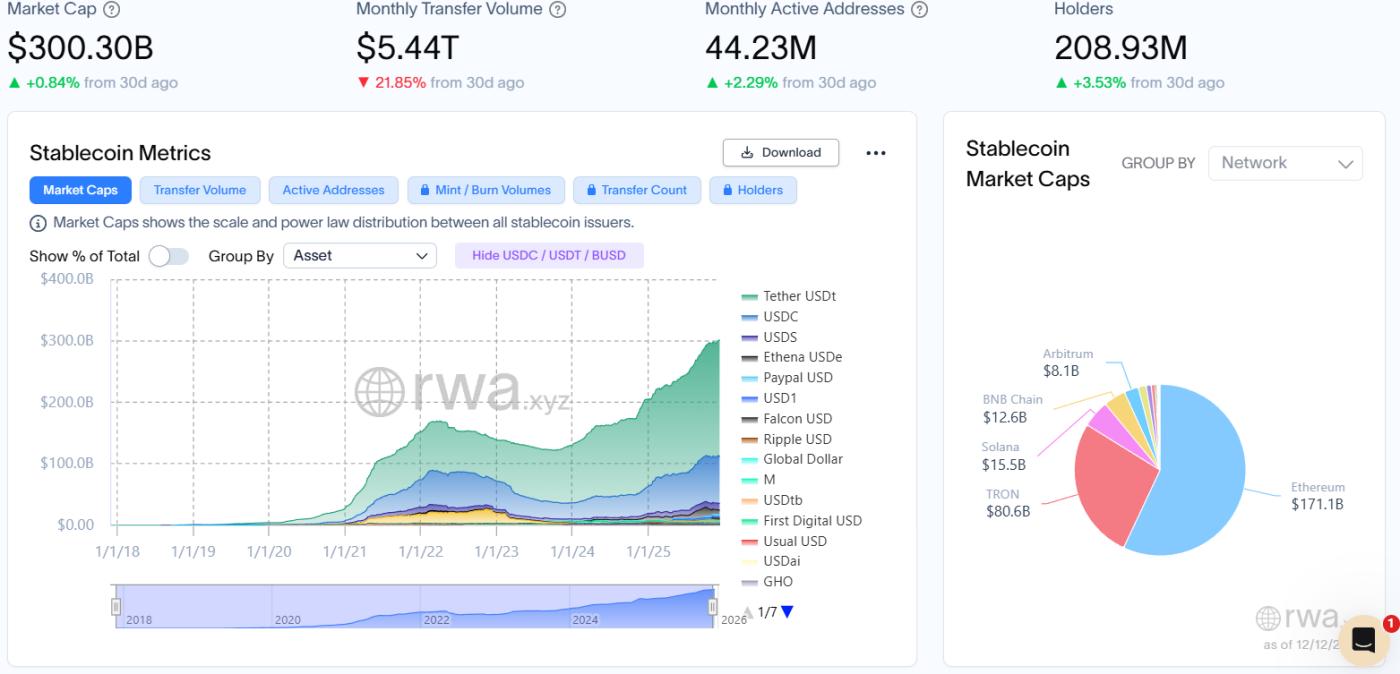

The total market capitalization of stablecoins reached $300.3 billion, a slight increase of 0.84% month-over-month, with the growth rate remaining low, indicating that the overall scale has entered a phase of slow expansion. However, key liquidity indicators have deteriorated significantly: monthly transaction volume plummeted to $5.44 trillion, a sharp decline of 21.85% month-over-month; simultaneously, the total number of monthly active addresses fell to 44.23 million, a slight decrease of 2.29% month-over-month; while the total number of holders steadily increased to approximately 209 million, a slight increase of 3.53% month-over-month, forming a strong divergence and reflecting the market's dual pressure of "liquidity contraction and declining user activity." Although the market capitalization has barely been maintained, the actual capital turnover efficiency and on-chain transaction activity are rapidly declining, reflecting weakened payment and settlement demand or capital outflow from the on-chain system. The data suggests that the market may have shifted from a "stock optimization" phase to a "liquidity decay" phase. The leading stablecoins are USDT, USDC, and USDS. Among them, the market capitalization of USDT increased slightly by 1.99% month-on-month; the market capitalization of USDC increased slightly by 0.58% month-on-month; and the market capitalization of USDS increased by 3.52% month-on-month.

Regulatory news

Russian lawmakers will focus on cryptocurrencies and stablecoins in 2026.

According to Cryptopolitan, Anatoly Aksakov, Chairman of the Financial Markets Committee of the Russian State Duma (lower house of parliament), stated that cryptocurrencies and stablecoins will be a focus of Russian legislation next year. As Russia begins to regulate its crypto sector, building a legal framework for digital finance will be a top priority. Aksakov noted that the Central Bank of Russia has announced its intention to introduce comprehensive cryptocurrency regulations by 2026.

Previously, Russian regulators had long opposed allowing free cryptocurrency trading in the Russian economy. This week, however, the agency signaled its readiness to support easing regulations on cryptocurrency circulation. Currently, crypto assets and their derivatives can only be purchased, traded, and consumed within a very limited "experimental legal regime" by a small group of privileged market participants, including foreign trade companies, financial institutions, and "highly qualified" investors. The Russian monetary authorities are discussing with the Ministry of Finance how to expand investor access and regulate transactions outside the "experimental legal regime." Previously, the authorities had indicated they would allow banks to conduct digital currency-related business and permit funds to invest in cryptocurrency-based derivatives.

The BRICS nations launched "Unit," a digital currency backed by gold.

According to Intellinews, citing the Institute for Economic Strategy of the Russian Academy of Sciences (IRIAS), the BRICS countries have launched a working prototype of a gold-backed trade currency called "Unit." This is a digital trading instrument backed by a reserve basket comprising 40% physical gold and 60% BRICS currencies, with the Brazilian Real, Chinese Yuan, Indian Rupee, Russian Ruble, and South African Rand having equal weights. The pilot project was initiated by IRIAS, which issued 100 Units on October 31, each initially pegged to 1 gram of gold. Although this initiative is not yet official policy, its existence is a direct step towards de-dollarization. The value of "Unit" is designed to fluctuate daily based on the exchange rate of its constituent currencies against gold. As of December 4, market fluctuations had adjusted the value of the reserve basket to the equivalent of 98.23 grams of gold, effectively making each unit worth 0.9823 grams of gold.

Crypto KOL @Mark4XX cautioned that this is merely a pilot project and not a formally adopted currency. It was initiated by the IRIAS organization and is being promoted by some BRICS member countries. Other countries, including some African nations, are closely monitoring it.

Malaysian Crown Prince launches RMJDT, a stablecoin for crypto payments.

According to Bloomberg, Bullish Aim, a company founded by Johor Crown Prince Ismail Ibrahim, has launched RMJDT, a stablecoin backed by RM100 in cash and short-term government bonds, and plans to issue it on the Zetrix blockchain. RMJDT aims to become the standard for crypto payments in Malaysia, improving transaction efficiency and security. Zetrix provides technology for the state-backed "Malaysia Blockchain Infrastructure" platform. Bullish Aim will also invest RM500 million to establish a digital asset vault to purchase Zetrix tokens.

Bhutan issues gold-backed digital token TER on the Solana blockchain

According to CoinDesk, Bhutan is expanding its national blockchain strategy with a gold-backed digital token issued by the Gelephu Mindfulness City, a special administrative region of the country, and backed by the Kingdom's sovereign framework. According to an announcement on Thursday, the TER token aims to be a new bridge between traditional stores of value and blockchain-based finance. The token is issued on the Solana blockchain, with issuance and custody handled by DK Bank, Bhutan's first licensed digital bank. In the first phase, investors can purchase TER tokens directly through DK Bank, combining the familiarity of traditional asset purchases with the transparency of on-chain ownership. The announcement states that TER aims to provide international investors with an accessible, tokenized version of gold, offering the advantages of digital custody and global transferability.

The UK's FCA has stated that stablecoins will be one of its key regulatory focuses in the future.

According to DL News, the UK Financial Conduct Authority (FCA) has announced that stablecoins pegged to fiat currencies such as the US dollar or British pound will be a major focus of future regulation. This move is part of a broader UK initiative to boost economic growth, which also includes digitizing financial services, enhancing international trade competitiveness, and expanding lending to small businesses. In a statement to Prime Minister Keir Starmer, FCA CEO Nikhil Rathi wrote that the FCA plans to "finalize digital asset rules and advance progress on UK-issued sterling stablecoins" by 2026. Rathi stated, "We will continue to take greater risks to support economic growth while remaining committed to protecting consumers and ensuring market integrity." Rathi also stated that in addition to advancing AI application cases, the agency is prioritizing the migration of traditional assets to blockchain. He said, "We will also enable our world-leading asset management industry to tokenize its funds, thereby improving efficiency and competitiveness."

According to Bloomberg, the U.S. Securities and Exchange Commission (SEC) has granted a license to Depository Trust & Clearing Co. (DTCC) in the form of a no-action letter, allowing the company to custody and endorse tokenized stocks and other real-world assets (RWAs) on a blockchain. This move enables DTCC to offer tokenization services on a pre-approved blockchain for three years. SEC Commissioner Hester Peirce stated in a press release, “While the project is still in the pilot phase and subject to various operational constraints, it marks a significant step towards the market’s migration to the blockchain.” Michael Winnike, Head of Global Strategy and Market Solutions for Clearing and Securities Services at DTCC, said in an interview that with the license, DTCC will also extend its record-keeping operations to the blockchain. DTCC, as a core clearing and settlement center in the U.S. financial system, plays a crucial role in the equity and fixed-income product sectors. Many liquid assets in the U.S. market are held in DTCC’s custody arm, Depository Trust Co. The company expects to launch its new tokenization service in the second half of next year.

In addition, Paul Atkins, Chairman of the U.S. Securities and Exchange Commission (SEC), stated on the X platform that the U.S. financial market is moving towards an "on-chain" era, and the SEC is prioritizing innovation and actively embracing new technologies to help realize this on-chain future.

According to Bloomberg, a cross-party group of British MPs has urged Chancellor of the Exchequer Rachel Reeves to oppose the Bank of England's proposal to cap stablecoin holdings in the country, arguing that the policy would undermine the government's efforts to position the UK as a leader in the digital asset space. In a letter to Reeves, MPs, including Peter Cruddas, CEO of trading platform CMC Markets Plc, stated that the Bank of England's plan to limit the amount of stablecoins an individual can hold would not reduce risk but would instead encourage capital outflows overseas. The group wrote: "We are deeply concerned that the UK is moving towards a fragmented and restrictive approach that will hinder innovation, limit adoption, and push activity overseas."

Last month, the Bank of England unveiled its proposed stablecoin rules, stating that it would temporarily cap individual stablecoin holdings at £20,000 (approximately $26,350) and corporate holdings at £10 million. The bank also requires issuers of pound-pegged tokens to deposit at least 40% of their reserves backing the token with the central bank as interest-free deposits. These proposals have drawn criticism from cryptocurrency companies, who argue that they are too restrictive.

Reserve Bank of India Deputy Governor Warns of Stablecoin Risks

According to Zhitong Finance, the Deputy Governor of the Reserve Bank of India stated in a public speech that stablecoins could exacerbate the risk of dollarization of local currencies, weaken emerging economies' ability to regulate capital flows, and threaten the independence of monetary policy. Furthermore, their circulation could drive up credit costs and trigger a currency substitution effect. Foreign stablecoins could also lead to a loss of seigniorage revenue for many countries.

Local News

According to Yicai Global, mainland companies' RWA (Rich Virtual Currency) business in Hong Kong has frozen, with inquiries plummeting by over 90% in two months, and most projects being asked to postpone. Seven industry associations jointly issued a risk warning, explicitly prohibiting member companies from participating in the issuance and trading of virtual currencies and RWA tokens within mainland China, emphasizing that those who "knowingly or should have known" will be held accountable, and rejecting the "overseas entity + domestic team" model. Regulators stated that they have not approved any RWA tokenization activities, highlighting risks such as fictitious assets, business failures, and speculative trading. Stocks related to RWA concepts have fallen, with companies like Langxin Group and GCL Energy Technology experiencing significant pullbacks from their recent highs.

Project progress

According to Criptonoticias, international money transfer giant Western Union has announced the issuance of payment cards that support pre-charged stablecoins, initially targeting countries and regions with high inflation, aiming to further expand its strategy of integrating digital assets into payment services. Western Union CFO Matthew Cagwin stated that the payment card primarily provides greater stability to purchasing power, especially in economies with significant currency depreciation, such as Argentina where inflation exceeded 200% last year. The USD-denominated stablecoin card helps remittance recipients better preserve the value of their funds. Furthermore, Western Union revealed that it is also preparing to launch USDPT, a USD payment token issued by Anchorage Digital on the Solana network, previously planned for a 2026 launch.

Paradigm invests $13.5 million in the Brazilian stablecoin project Crown.

Crypto venture capital firm Paradigm announced a $13.5 million investment in Brazilian stablecoin company Crown, valuing the company at approximately $90 million. This marks Paradigm's first investment in Brazil. Crown stated that its stablecoin BRLV, pegged to the Brazilian real (BRL), has become "the world's largest emerging market stablecoin" and is fully backed by Brazilian government bonds, currently valued at approximately 360 million reais (about $66 million).

BRLV primarily targets institutional clients, allowing investors to earn high interest rates (approximately 15%) in Brazil by holding the stablecoin. Paradigm states that Crown has established a strong scale effect and is poised for rapid expansion in Brazil.

According to PR Newswire, MetaComp, a Singapore-licensed stablecoin cross-border payment and fund management service provider, announced the completion of a $22 million Pre-A round of financing. Investors in this round include Eastern Bell Capital, Noah, Sky9 Capital, Freshwave Fund, and Beingboom Capital, with 100Summit Partners serving as the exclusive financial advisor.

The new funding will be used to accelerate the expansion of its StableX Network, which integrates SWIFT with multiple stablecoin networks to provide businesses with a real-time cross-border settlement layer. MetaComp holds a Major Payments Institution license issued by the Monetary Authority of Singapore, and its stablecoin payment business has a monthly transaction volume exceeding US$1 billion, covering more than 30 markets. The company plans to deepen its business presence in Southeast Asia, South Asia, and the Middle East.

African stablecoin payment infrastructure Ezeebit raises $2.05 million in seed funding.

According to bitcoinke, Ezeebit, a crypto payments startup regulated by the South African FSCA, announced the completion of a $2.05 million seed funding round. The funds will be used to accelerate product development and merchant expansion in South Africa, Kenya, and Nigeria. The company supports instant settlement in stablecoins and next-day local fiat currency payments, and has processed over 30,000 transactions. Investors include Raba Partnerships, Founder Collective, and executives from industry giants such as VISA, Revolut, and Talos.

RWA tokenization network Real Finance announced it has raised $29 million in private funding.

According to Cointelegraph, Real Finance, a tokenization network for Real-World Assets (RWA), announced it has secured $29 million in private funding to build its RWA infrastructure layer. The round included a $25 million capital commitment from digital asset investment firm Nimbus Capital, with participation from Magnus Capital and Frekaz Group.

The funds will be used to expand its compliance and operational infrastructure to develop a full-stack RWA platform. The company's short-term goal is to tokenize $500 million worth of RWA, representing approximately 2% of the current tokenized asset market. The current RWA market is primarily dominated by US Treasury products, private credit, and institutional alternative funds, with tokenized money market funds and other asset types also experiencing rapid growth. Industry experts predict that the market may see even stronger growth in the coming year as the regulatory environment becomes clearer.

According to Fortune, Circle will partner with the privacy-focused blockchain Aleo to launch a new stablecoin, USDCx, designed to provide "bank-grade privacy." The coin's transaction history will be invisible to the public, appearing only as encrypted data "blocks," but each transaction will include a compliance record that Circle can access upon law enforcement request. Aleo co-founder Howard Wu stated that USDCx meets institutions' needs for confidentiality and has already attracted interest from potential partners such as Request Finance and Toku.

Stripe's Tempo blockchain, developed in partnership with Paradigm, is now in public beta.

According to Bloomberg, Stripe's Tempo blockchain, developed in partnership with crypto venture capital firm Paradigm, has launched its public beta, open to all businesses and focusing on stablecoin payments. New partners include UBS, Cross River Bank, and prediction market platform Kalshi, while existing partners include Deutsche Bank, Nubank, OpenAI, and Anthropic. Tempo's independent payment channel design enables a fixed transaction fee rate (0.1 cents per transaction), reducing the impact of gas fee fluctuations on settlements, and supports any USD stablecoin as a payment method for transaction fees.

According to The Block, Superstate, led by Compound founder Robert Leshner, announced the launch of "Direct Issuance Programs," allowing publicly traded companies to raise funds directly from KYC-verified investors by issuing tokenized shares. Investors can pay with stablecoins and enjoy instant settlement. The service will run on Ethereum and Solana, with the first offering expected to launch in 2026. The program requires no underwriters, complies with the SEC regulatory framework, and aims to promote the on-chaining of capital markets.

Stripe acquires Valora wallet team to expand its stablecoin services.

According to The Block, payment giant Stripe has expanded its cryptocurrency business by acquiring the team of crypto startup Valora through an "acquisition-style hiring" deal. On Wednesday, Valora founder Jackie Bona announced that the team would join Stripe to pursue its mission of expanding access to the global financial system. Specific terms of the deal, including the number of Valora employees joining Stripe, were not disclosed. According to Bona, the acquisition does not appear to include the intellectual property behind Valora's technology. She wrote that the app will "return to its birthplace, cLabs, to continue operating, with cLabs leading its future development."

Launched in 2021, Valora is a mobile-first, user-controlled cryptocurrency wallet application, specifically for stablecoins on the CELO blockchain. Valora aims to make sending cryptocurrency as simple as sending a text message. It has previously partnered with peer-to-peer applications like M-Pesa to expand into the African market and with stablecoin issuer Tether to promote the global adoption of stablecoins.

According to CoinDesk, State Street and Galaxy Asset Management plan to launch a tokenized liquidity fund in early 2026. This fund will utilize stablecoins to enable 24/7 investor liquidity, expanding the application of public blockchains in institutional cash management. Named the "State Street Galaxy Onchain Liquidity Sweep Fund" (SWEEP), the fund will accept subscriptions and redemptions in PayPal's stablecoin PYUSD, provided the fund has available assets to process related requests. Only qualified buyers meeting predetermined thresholds will be able to invest. Ondo Finance has committed approximately $200 million as seed funding for the product. The two companies anticipate launching the SWEEP fund on the Solana blockchain initially, followed by Stellar and Ethereum blockchains. Galaxy Asset Management plans to leverage Chainlink's tools to facilitate cross-chain data and asset transfers.

Figure plans to introduce the securitized stablecoin YLDS into Solana.

According to Business Insider, Figure Technology subsidiary Figure Certificate Company (FCC) plans to natively mint YLDS—a registered publicly traded debt security—on the Solana blockchain. YLDS is a securitized stablecoin designed to maintain a fixed dollar price and provide continuous yields through US Treasury bonds and Treasury repurchase agreements. Exponent Finance, a decentralized finance yield exchange platform on Solana, plans to be the first user of YLDS.

Keel launches $500 million plan to promote on-chain RWA development in Solana.

According to CoinDesk, Keel, the capital allocation platform under the Sky ecosystem, announced the launch of a $500 million investment plan called "Tokenization Regatta," which aims to attract real-world asset (RWA) projects to the Solana network through financial support and resource matching. The plan will provide direct financing for RWA projects issuing debt, credit, and funds, and more than 40 institutions have already expressed interest.

JPMorgan Chase creates Solana-based USC token to facilitate Galaxy Digital's debt issuance.

According to The Block, Coinbase and Franklin Templeton completed a transaction on the Solana blockchain, purchasing debt tokens from Galaxy Digital. JPMorgan Chase arranged a commercial paper issuance for a subsidiary of Galaxy Digital Holdings, according to an announcement on Thursday, marking "one of the first debt issuances ever executed on a public blockchain." The companies did not disclose the size or terms of the debt issuance.

This marks Galaxy Digital's first issuance of commercial paper in the United States and the debut of its USCP token. The USCP token is a tokenized version of Galaxy Digital's short-term corporate debt, created by JPMorgan Chase on Solana to facilitate this transaction. Proceeds from both the issuance and redemption will be paid using Circle's USDC stablecoin. Coinbase, one of JPMorgan Chase's blockchain partners, provided private key custody and wallet services for the newly issued USCP token and facilitated USDC deposits and withdrawals.

YouTube introduces new option to pay revenue to U.S. creators using stablecoins.

According to Fortune magazine, YouTube is allowing its creators to receive earnings via PayPal's stablecoin. May Zabaneh, head of PayPal's crypto business, confirmed the arrangement, stating that the feature is officially live and currently only available to US users. A spokesperson for YouTube's parent company, Google, also confirmed the news, saying that YouTube has added a way to pay creators their earnings via PayPal's stablecoin. PayPal added the ability for recipients to receive payments in PayPal's stablecoin PYUSD earlier this year. YouTube subsequently chose to offer this option to its creators—creators can use it to receive a share of the revenue they earn from content published on the platform.

Ripple has completed its $200 million acquisition of stablecoin platform Rail.

According to Cointelegraph, Ripple has officially completed its $200 million acquisition of stablecoin platform Rail.

Circle's euro-backed stablecoin, EURC, is now available on the World App.

According to official sources, Circle's euro-backed stablecoin EURC is now available on the World App. Users can now buy, sell, and send EURC through the World Wallet.

According to Bloomberg, AirAsia's operator has signed an agreement with Standard Chartered Bank's Malaysian branch to explore issuing a stablecoin backed by the Malaysian ringgit in the Southeast Asian country. This comes days after a member of the Malaysian royal family announced the launch of a similar token.

According to a statement released on Friday, Capital A, founded by AirAsia founder Tony Fernandes, signed a letter of intent with Standard Chartered Bank Malaysia to jointly develop and test a stablecoin through the Digital Asset Innovation Centre regulated by Bank Negara Malaysia. The statement indicated that Standard Chartered Bank Malaysia will act as the issuer of the stablecoin, while Capital A may initially pilot wholesale use cases in real-world scenarios. This marks Capital A's first foray into the regulated digital asset space.

According to official sources, MSX has completed spot trading of US telecommunications company $SATS.M, multinational alcoholic beverage company $DEO.M, Destiny Tech 100 closed-end fund $DXYZ.M, and BTC DAT $XXI.M; new contracts for global media and entertainment giant $DIS.M have also been added.

Insights Highlights

The Evolution of the Latin American Stablecoin Market: From Survival to Growth

PANews Overview: Real-world assets (RWA) and stablecoins are profoundly reshaping the financial system globally, driven by two core forces: First, in developed markets (such as the US, Japan, and Europe), traditional finance and blockchain technology are deeply integrated, aiming to improve asset liquidity, operational efficiency, and global accessibility through tokenization. A prime example is Japan's "dual-track" regulatory system, which clearly distinguishes institutional-grade stablecoins from DeFi applications. Second, in emerging markets (such as Latin America), structural challenges like high inflation and financial exclusion are forcing stablecoins to evolve from "survival tools" into "growth engines," directly giving rise to a new species: "Crypto Neobanks," integrating payments, savings, and high returns. The technological foundation for all this lies in building trusted data bridges (such as Chainlink oracles ensuring the authenticity of asset value) and secure contract execution environments (such as Aave's institutional-grade risk control) to bridge the trust gap between on-chain and off-chain systems. However, large-scale deployment still faces significant bottlenecks, including the disconnect between legal ownership and on-chain tokens, high compliance costs, cross-chain security risks, and the valuation challenges of non-standard assets (such as real estate and equity). In the future, the evolution of RWA will present a "dual-engine" pattern: on one end, standardized, low-risk assets such as government bonds and gold will serve as the cornerstone of trust and liquidity; on the other end, diversified, high-yield assets such as catastrophe bonds, fan economy, and equity in unlisted companies will continuously expand their boundaries. Ultimately, this transformation is not only about technology, but also a fusion of institutional trust and algorithmic trust, which will redefine the paradigm of asset ownership, participation rules, and global capital flows.

Bloomberg: Stablecoins may not be able to help the US escape its debt and deficit quagmire.

PANews Overview: Although the US has passed the landmark Genius Act, establishing a regulatory framework for stablecoins and anticipating their ability to absorb overseas dollars and domestic funds to massively purchase US Treasury bonds, thereby reducing the government's long-term financing costs, strategists at mainstream financial institutions such as JPMorgan Chase and Deutsche Bank hold a cautiously skeptical view. They believe that, constrained by factors such as the act's prohibition on interest payments, the stablecoin market's growth may be far lower than the official expectations of trillions of dollars. Its funds mainly come from transfers from existing Treasury bond holders such as money market funds, rather than creating new demand. Even if the scale expands significantly, its incremental demand for Treasury bonds is only a drop in the ocean compared to the US's massive debt of over $30 trillion. Furthermore, it may trigger the Federal Reserve to adjust its own balance sheet to hedge against this, and it faces restrictions from overseas capital controls. Therefore, while stablecoins can play a certain role, they cannot single-handedly help the US escape its fundamental debt and deficit predicament.

PANews Summary: Seven national-level financial industry associations in China jointly issued a risk warning, explicitly defining Real-World Asset Tokenization (RWA) as "illegal activities related to virtual currencies" for the first time. This signifies a fundamental shift in regulatory attitude—RWA is no longer considered an innovative technology awaiting regulation but is directly included in the scope of crackdown. The document clearly states that any RWA activity involves unapproved "financing and trading," posing multiple risks, and that "China's financial regulatory authorities have not approved any Real-World Asset Tokenization activities," completely negating its current compliance space. More importantly, the risk warning emphasizes holding domestic institutions and individuals providing services to RWA projects (including those in technology, promotion, and payment) jointly liable. This effectively declares that the entire business and service chain built around RWA is unsustainable within China. Therefore, for relevant practitioners, the choice for conducting RWA business in the Chinese market is very clear: either completely relocate all business, teams, and operations to compliant overseas regions, completely severing ties with the Chinese market; or completely abandon the RWA business direction.