Crypto market performance

Currently, the total market capitalization of cryptocurrencies is $3.13 trillion, with BTC accounting for 58.7% at $1.83 trillion. The market capitalization of stablecoins is $309.1 billion, an increase of 0.49% in the last 7 days. Stablecoins have seen positive growth for three consecutive weeks, with USDT accounting for 60.21%.

Among the top 200 projects on CoinMarketCap , most declined while a few rose. Specifically: BTC fell 0.14% in 7 days, ETH rose 2.34% in 7 days, SOL fell 1.52% in 7 days, M rose 25.79% in 7 days, and ZEC rose 16.26% in 7 days.

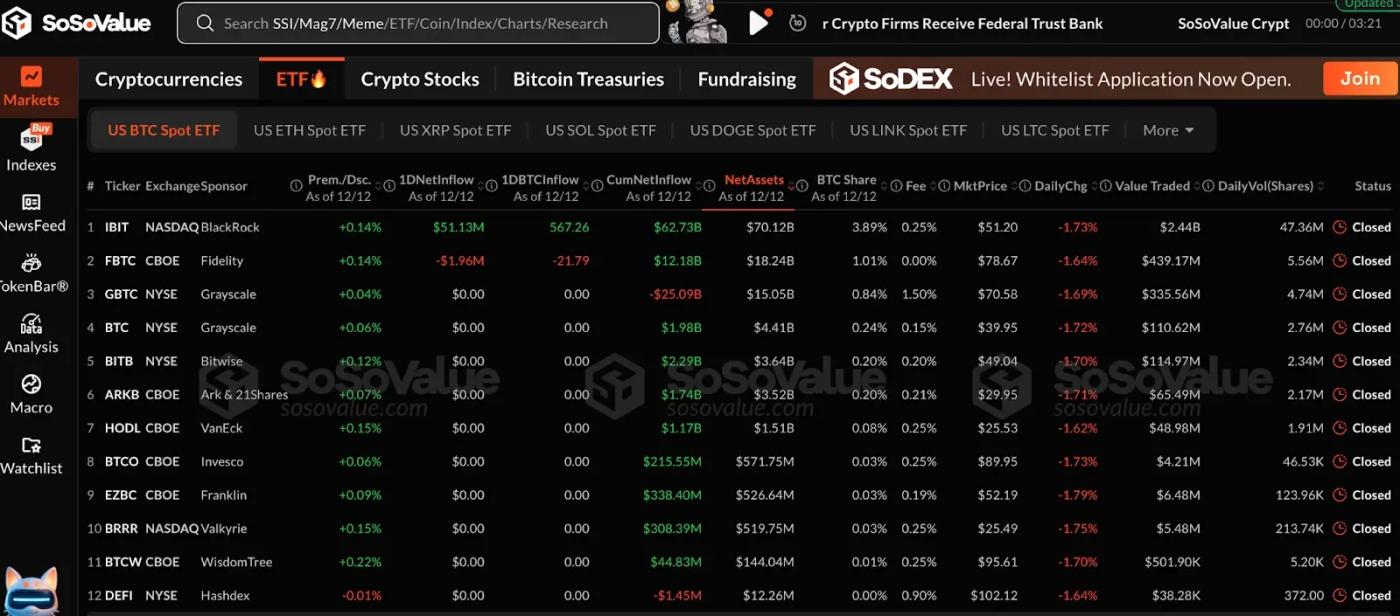

This week, US Bitcoin spot ETFs saw net inflows of $286.2 million; US Ethereum spot ETFs saw net inflows of $209 million.

Market Forecast (December 15 - December 21) :

The current RSI is 46.17 (neutral range), the Fear & Greed Index is 28 (higher than last week, generally in the fear range), and the Alternative Season Index is 35 (neutral, slightly lower than last week).

Observations reveal that after the Federal Reserve announced its rate cut on December 11th, the market reaction was muted, except for gold. This was not due to a single reason, but rather because the market had already fully priced in the 25 basis point rate cut before the meeting, leading to profit-taking after the positive news was fully priced in. Furthermore, Powell's hawkish remarks, coupled with macroeconomic uncertainties, put pressure on risk assets such as cryptocurrencies. Cryptocurrencies are expected to remain range-bound next week.

BTC core range: $86,000-$94,200

ETH core range: $3,100-$3,400

SOL Core Range: $125-$145

For short-term traders: It is recommended not to chase highs near the aforementioned key resistance levels (such as BTC $94,200, ETH $3,400, SOL $140). Wait for a clear price breakout or a pullback after encountering resistance before attempting to test the price with a small position near key support levels (such as BTC $86,000, ETH $3,190, SOL $125). Always set a narrow stop-loss order.

For medium-term swing traders: Reduce trading frequency and patiently wait for prices to break out of the current "December opening range." Consider a "phased entry" strategy, which involves establishing small initial positions in strong support areas (such as $120-$130 for SOL), using a break below the support level as a stop-loss or wait-and-see signal. Simultaneously, closely monitor the sustainability of US ETF fund flows, as this is a crucial indicator of market sentiment.

Understanding the present

Review of the week's major events

1. On December 7th, Matt Huang, co-founder of the crypto investment firm Paradigm, posted on social media, "I don't know who needs to hear this, but this is the 'Netscape moment' or 'iPhone moment' for cryptocurrency. It's operating on an unprecedented scale, far larger than we ever imagined, accelerating at both the institutional and cypherpunk levels."

2. On December 10th, the draft of the "CLARITY Act" is expected to be released this week, with hearings and a vote scheduled for next week;

3. On December 10th, Bloomberg reported that SpaceX is expected to IPO in mid-to-late 2026, with a valuation of approximately $1.5 trillion and fundraising well over $30 billion, potentially becoming the largest IPO in history. The specific timeline will depend on market conditions.

4. On December 9, as the year-end approaches, Wall Street banks are bracing for rising pressure in the money market, which analysts say could prompt the Federal Reserve to weigh measures to rebuild a liquidity buffer in the $12.6 trillion market.

5. On December 10, according to Decrypt, SEC Chairman Paul Atkins stated at the Blockchain Association's annual policy summit that many types of ICOs should be considered non-securities transactions and therefore not within the SEC's regulatory scope.

6. On December 12, the U.S. District Court for the Southern District of New York announced that Terraform Labs founder Do Kwon was sentenced to 15 years in prison for fraud and other offenses in the Terra and Luna token crash.

Macroeconomics

1. On December 11, the Federal Reserve lowered its benchmark interest rate by 25 basis points to 3.50%-3.75%, marking the third consecutive rate cut at its meeting, in line with market expectations. This brings the total rate cuts this year to 75 basis points.

2. On December 11, the number of initial jobless claims in the United States for the week ending December 6 was 236,000, the highest since the week ending September 6, 2025. This figure was higher than the expected 220,000 and the previous week's 191,000.

3. On December 12, according to the Federal Reserve's interest rate watcher, the probability of a 25 basis point rate cut in January was 24.8%.

ETF

According to statistics, from December 8th to December 12th, US Bitcoin spot ETFs saw a net inflow of $286.2 million. As of December 12th, GBTC (Grayscale) experienced a total outflow of $25.039 billion, currently holding $15.061 billion, while IBIT (BlackRock) currently holds $70.093 billion. The total market capitalization of US Bitcoin spot ETFs is $120.07 billion.

Net inflows into the US Ethereum spot ETF : $209 million.

Predicting the future

Project progress

1. Yala stated that all native BTC under the institutional model will be withdrawn from the Yala protocol, and the full redemption plan and timeline will be announced on December 15th;

2. The deBridge Q2 airdrop claim window will close on December 19th;

3. PayPal is launching a Bitcoin giveaway for US users, with the giveaway ending on December 21.

Important events

1. At 21:30 on December 16, the United States will release the seasonally adjusted non-farm payrolls (in thousands) for November;

2. At 20:00 on December 18th, the UK will announce its central bank interest rate decision for the period ending December 18th.

3. At 21:15 on December 18, the Eurozone will announce the European Central Bank's deposit facility interest rate for the period ending December 18.

4. At 21:30 on December 18, the United States will release the November unadjusted CPI annual rate and the number of initial jobless claims (in thousands) for the week ending December 13.

5. At 23:00 on December 19, the US November core PCE price index year-on-year rate will be released.

Token unlocking

1. Connex (CONX) will unlock 1.32 million tokens on December 15, worth approximately $21.35 million, representing 1.61% of the circulating supply;

2. Starknet (STRK) will unlock 127 million tokens on December 15th, worth approximately $14.15 million, representing 5.07% of the circulating supply.

3. Arbitrum (ARB) will unlock 92.65 million tokens on December 16, worth approximately $18.98 million, representing 1.9% of the circulating supply;

4. ZKsync (ZK) will unlock 173 million tokens on December 17, worth approximately $5.64 million, representing 3.26% of the circulating supply.

5. Melania Meme (MELANIA) will unlock 26.25 million tokens on December 18, worth approximately $2.93 million, representing 4.79% of the circulating supply.

about Us

Hotcoin Research as Hotcoin Exchange 's core research and investment team is dedicated to transforming professional analysis into practical tools for your investment decisions. We analyze market trends through our "Weekly Insights" and "In-Depth Research Reports"; and our exclusive "Hotcoin Selection" (AI + expert dual screening) helps you identify potential assets and reduce trial-and-error costs. Every week, our researchers also host live streams to discuss hot topics and predict trends. We believe that warm support and professional guidance can help more investors navigate market cycles and seize the value opportunities of Web3.

Risk Warning

The cryptocurrency market is highly volatile, and investing in it inherently carries risk. We strongly recommend that investors fully understand these risks and invest within a strict risk management framework to ensure the safety of their funds.