This article is machine translated

Show original

While reviewing data from the oracle sector recently, I discovered a very perplexing phenomenon: a stark misalignment between asset prices and product performance.

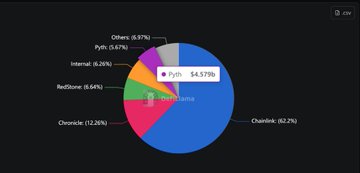

I'm unsure if the market hasn't caught up yet, or if it's still clinging to outdated valuation logic. The current market capitalization hierarchy looks like this:

- Chainlink $LINK Market Cap 9.5 billion / FDV 13.7 billion

- Pyth $PYTH Market Cap 370 million / FDV 650 million

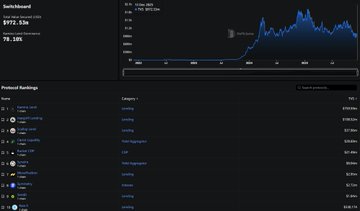

- Switchboard $SWTCH Market Cap 6.4 million / FDV 37.5 million

Switchboard's market cap is less than 2% of Pyth's.

This valuation gap usually indicates a significant technological or ecosystem lag, but after analyzing the actual business data, the situation is quite the opposite.

1/ Actual Testing of Latency and Block Rate

In DeFi, especially on high-frequency chains like Solana, speed is not just about the user experience, but also the foundation of risk control.

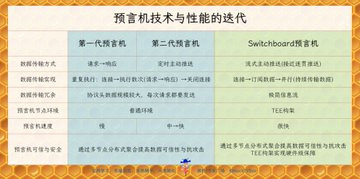

- Pyth's on-chain latency is approximately 1.8 seconds. Without paying priority fees, there's about a 30% probability of failing to be added to the chain on time.

- Switchboard boasts a latency of only 3-4 milliseconds. Thanks to its TEE architecture and Surge model, it has a 95% probability of completing block writing in the next slot, even without paying priority fees.

2/ Differences in Architectural Patterns: Most oracles on the market, including Chainlink and Pyth, still rely on consensus propagation or are primarily permissioned, which limits scalability to some extent.

Switchboard follows the TEE (Trusted Execution Environment) approach, making it the only oracle currently capable of achieving millisecond-level latency with "permissionlessness."

Its newly launched on-chain subscription model allows anyone to directly subscribe to data streams with token payments, without sales intervention or API approval.

This is the form that Web3 infrastructure should possess.

3/ Business Capacity: Although its market capitalization is only over 6 million, it already covers leading protocols such as Jito, Drift, and Kamino, protecting over $5 billion in on-chain value.

/ On one hand, there's a mainstream target with a market capitalization of 370 million but a latency of 1.8 seconds; on the other hand, there's a target with a market capitalization of 6.4 million but a latency of only 3... Millisecond-level technology targets

This inversion between fundamentals and market capitalization is extremely rare

This may mean that pricing power in the oracle sector is currently still in the hands of brand inertia rather than technology and efficiency. However, if the market eventually returns to rationality, this asymmetry itself is worth noting.

@switchboardxyz @hermidao1

Yes, the Switchboard's data really does speak for itself.

I also researched the principles behind its speed before I could definitively say that it truly is fast.

TVBee

@blockTVBee

12-15

Switchboard预言机:技术不是用来叙事的,而是用来做事的

任何一个项目、任何一项技术,不要看他说了什么,而是要看他做了什么

——鲁迅。

┈┈➤从预言机说起

╰┈✦预言机的两个优势

在Web3,链多、Defi项目更多,反衬的作为Defi刚需的预言机更加稀缺。

Bee Brother is the most professional!

Thank you, Teacher Chaochao.

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content