The crypto market remains cautious, but several Token are facing significant challenges this week. As prices move sideways, attention is shifting to three prominent altcoins to watch during the third week of December. Each of these projects has special events coming up, ranging from supply changes and network events to changing investor behavior.

These developments could cause significant price fluctuations if either buyers or sellers gain the upper hand in the coming days.

Sei (Sei)

Sei is under ongoing pressure as it enters mid-December, and price movements reflect this caution. The Token has fallen by approximately 23% in the past month and over 60% in the last three months, leaving market sentiment quite weak as investors seek the next direction.

At the time of writing, Sei is trading around $0.124, sideways within a descending triangle pattern on the daily chart. This pattern typically appears at the end of downtrends, when selling pressure begins to weaken and the price is compressed. Currently, Sei is just above the lowest support zone of this structure, so the next few sessions will be crucial. That's why Sei is on the list of altcoins to watch.

Momentum indicators also provide conflicting but noteworthy signals. From December 5th to December 14th, the Sei price formed a new Dip , but the Relative Strength Index (RSI) formed a higher Dip . The RSI measures momentum strength, so this bullish divergence suggests that sellers are weakening, even though prices remain low.

Sei price analysis: TradingView

Sei price analysis: TradingViewWant more in-depth analysis of Token? Sign up for Editor Harsh Notariya's Daily Crypto newsletter here .

However, short-term risks remain significant as Sei prepares to Token Lockup on December 15th. Approximately 55.56 million Sei, equivalent to about 1.08% of the circulating supply, will be injected into the market. Token Lockup unlocks typically create short-term selling pressure, especially when overall sentiment remains cautious.

Key price levels have been fairly clearly defined. If Sei breaks above $0.159, it's highly likely that buyers have absorbed all the newly unlocked Token , opening up opportunities for a recovery to higher resistance levels, such as $0.193 and even further.

Conversely, if the Sei falls further by approximately 3% to the $0.120 region, a breakout from the pattern Dip will emerge. This would weaken the bullish divergence argument above.

Bittensor (TAO)

Bittensor's price is being compressed within a narrow range ahead of the upcoming halving event, creating a clear deciding point. TAO is trading within an isosceles triangle pattern on the daily chart, indicating a balance between buyers and sellers after weeks of pressure. This tug-of-war makes TAO one of the notable altcoins in the third week of December .

TAO has fallen by approximately 15.5% over the past month and about 6.6% over the last seven days. Despite the short-term price weakness, small fluctuations have been observed – a common occurrence before larger swings. This suggests the market is hesitant and not yet firmly in a downward trend.

The halving event is the main highlight. Bittensor's halving will reduce the number of new Token issued, making the new supply scarcer. While history shows that halvings don't guarantee an immediate bull run, they often provide a boost when the price is in a compressed zone like the current one.

Technically, the first bullish signal appeared around $301. If the closing price of the day is above this level, it will break through the upper edge of the triangle and indicate a strong upward trend. That momentum will help the price move towards $321, and if conditions are favorable, it could reach $396 with supportive capital flows and market sentiment.

TAO price analysis: TradingView

TAO price analysis: TradingViewThe downside risk remains. The $277 level is a crucial support zone. If broken, TAO could fall to $255, and if things worsen, $199 would be the next risk zone if market sentiment weakens.

Aster

Aster is one of the altcoins to watch in the third week of December due to the clear "tug-of-war" between whales and the broader market.

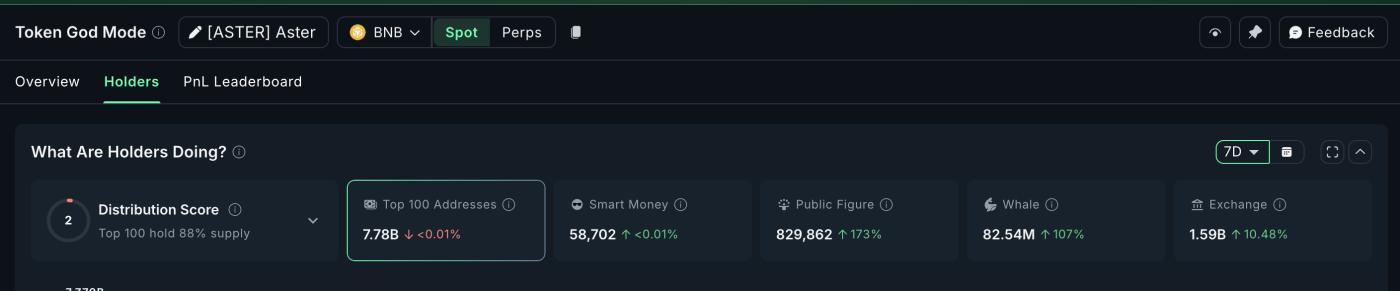

on-chain data shows that whales have been buying heavily ahead of this week. Over the past seven days, the amount of ASTER held by whales has increased by approximately 42.7 million Token, from 39.85 million to 82.54 million ASTER. This represents a 107% increase, demonstrating strong confidence from large investors ahead of the third week of December.

ASTER holder : Nansen

ASTER holder : NansenMeanwhile, the number of ASTER shares on the exchange increased by 10.48%. This suggests that retail investors may be selling off, even as large investors are aggressively accumulating shares.

The conflict between buyers and sellers is also clearly visible on the chart. ASTER has been correcting since November 19, 2023, but is currently consolidating price within a triangle pattern, indicating indecision between the two sides. During this period, a hidden bullish divergence emerged, as from November 3 to December 14, 2023, the price formed higher Dip while the Relative Strength Index (RSI) formed lower Dip , often a sign that selling momentum has weakened.

ASTER price analysis: TradingView

ASTER price analysis: TradingViewThis is often a sign that the price may rebound. If this scenario occurs, the first level to watch is $0.94. If the price closes above this level (on the daily chart), the triangle pattern will be broken and ASTER could head towards $0.98. If buying pressure continues strong, the price could rise by another 16% to $1.08, especially with support from "whales".

Conversely, if the $0.88 level is lost, the bullish divergence will lose its validity and the price could fall to $0.81, at which point control of the market will return to the sellers.