The winds of interest rate hikes have finally blown, and market volatility has intensified accordingly. Based on past declines, the market hasn't bottomed out yet. I've repeatedly emphasized these past few days that interest rate hikes are a clear negative factor, and any rebound is an opportunity to short. This round of decline is practically an open secret. So, there's not much more to say; just follow the strategy.

In the past 24 hours, a total of 188,440 people across the internet have had their positions liquidated, with a total liquidation amount of $650 million. Long positions were liquidated for $577 million, and short positions for $73.7145 million.

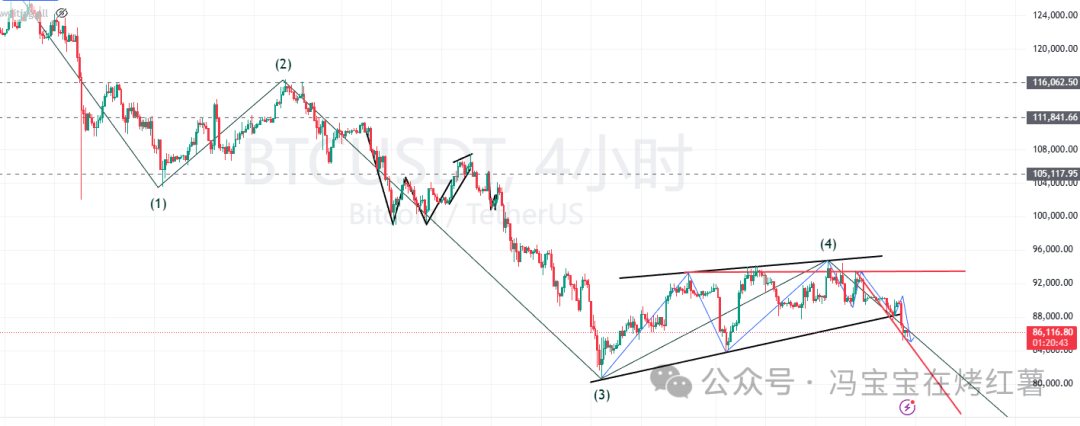

BTC

This round of Bitcoin decline is an accelerated move following the breakout of an ascending wedge pattern, and it has now broken through key support. Yesterday's slight rebound, while seemingly strong, was actually a bull trap; the rebound only reached 90,000 before quickly falling back, showing clearly insufficient strength. Although short-term indicators show decreasing bearish volume and a possible golden golden cross at a low level, the upside potential is limited; a strong rebound will likely not exceed 88,000, while a weak rebound will struggle to break 87,000.

Operationally, it is recommended to short again when the price rebounds to the 87,000-88,000 range, with a target of 83,000-80,000. Note that there are no signs of a bottom on the daily chart yet; if the 80,000 level is breached, the downside target will be 75,000. The overall trend remains downward; do not blindly try to buy the dips.

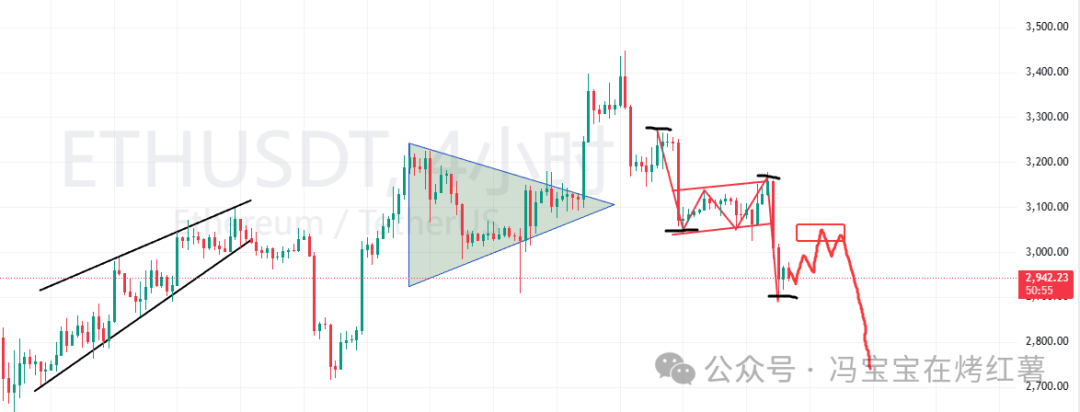

ETH

Ethereum's bearish flag pattern is essentially complete. The initial rapid decline formed the "flagpole," followed by consolidation to form the "flag," before the price plummeted again. Many people mistakenly thought it was a consolidation rectangle yesterday and went long, only to find the pattern had quickly reversed course after a false breakout. The price action unfolded as expected, immediately starting to fall after the false breakout.

The 4-hour chart suggests the downtrend may continue, with two possibilities: either a direct and decisive drop, or a rebound followed by another drop. Personally, I believe short after a rebound is safer, as a sharp drop is prone to a rapid rebound.

Tonight's non-farm payroll data may have little impact, but positive data could trigger a short-term rebound. The rebound high is expected to be in the 3030-3050 range. Short can be considered around 3044, which is the lower edge of the flag pattern that has turned into resistance. If the price continues to fall afterward, the target is the 2730-2780 area.

Copycat

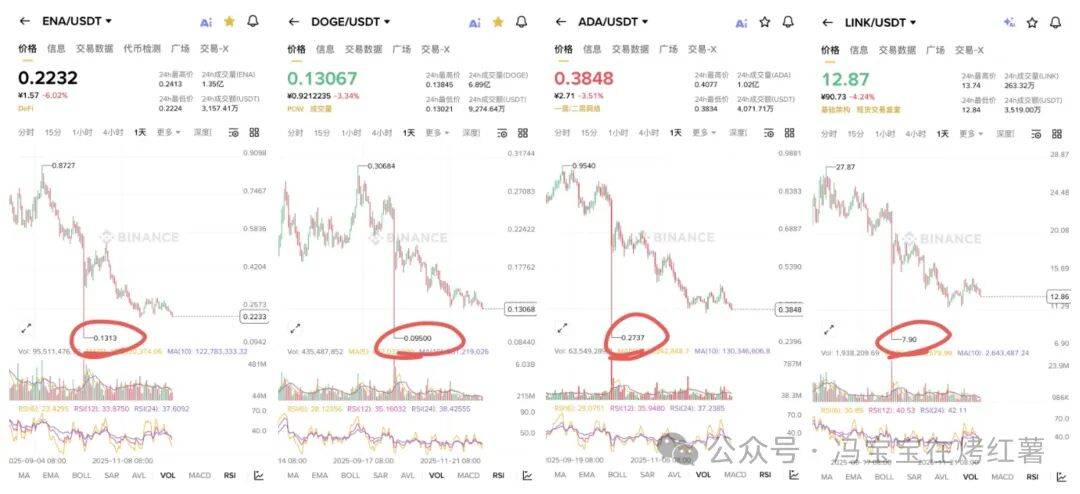

Many people ask me where is the best time to buy the dips Altcoin ?

A: To be honest, it's impossible to predict accurately, but I have a method for everyone to refer to. Around the price drop near the 1011 black swan event, you can consider trying to bet on a rebound if the price fluctuates upwards by 10%.

For example, $ENA is around 0.1313, $DOGE is around 0.095, $ADA is around 0.27, and $LINK is around 7.9. These positions can fluctuate upwards by about 10%, because the market was unable to place orders to support the price due to the black swan event on October 11. These price spikes may be the true value of these altcoins.

Of course, the market makers might not allow the price to return to this level, so it's only recommended to test the waters in small increments near key price levels. Some Altcoin have already fallen below 1011; where is the buy the dips? Why would you buy these altcoins? Be careful they don't turn around and take your money.

The current market is described as a bear market, yet a few cryptocurrencies are experiencing meteoric rises of several times their initial value. Conversely, while it's touted as a bull market, the overall market is volatile and unpredictable.

There are two relatively feasible approaches: either follow the trending coins on the gainers list, or wait for them to rise and then short. $FOLKS dropped from 46 to 14 in two days; that 4000% and 8000 dollars difference are easily captured.

Because most cryptocurrencies tend to fall back to where they started rising. It's not recommended to set stop-loss orders for small capital, otherwise you're easily shaken out by market fluctuations. Low-market-cap coins like FHE may continue to rise, making short unsuitable unless trading volume significantly shrinks. Currently, chasing the rising stocks on the list seems to have a higher success rate.

$ASTER

My ASTER futures position is currently underwater, but my short positions are profitable, so overall I haven't lost money. I've repeatedly warned before that 0.9 is the cost line for CZ's publicly buy the dips, and once it's broken, it could easily trigger a sharp drop. The best short of action is to short, and so far, it seems my strategy has worked correctly.

$SOL

Currently, SOL is near the bottom of its daily trading range, so we are bearish but not short. However, we should try going long at this point, as the risk-reward ratio is high and the risk is low. We suggest opening long positions at 125 or 122.9, with a stop-loss below 121, a target of 135, and a position size of 5.5% using 10x leverage. This is a good opportunity!

$RATS

The daily chart shows a strong upward trend, with three consecutive positive days forming a W-shaped bottom. The MACD has crossed above the zero line, suggesting a potential continuation of the upward movement and a test of the 0.00005 resistance level. A pullback to around 0.000035 could present a buy the dips opportunity for a swing trade, with a target of 0.00005 .

$MERL

After a sharp 17% surge, the price consolidated in the 0.46-0.47 range, indicating a low-liquidity trap set by major players. The subsequent price action may involve selling pressure, bottoming out, and a sharp drop. It is recommended to short on rallies in the 0.46-0.48 range , with a short-term target below 0.4 , and further down to 0.35 .

Every sharp drop is followed by a period of great potential. Those who are unsure about future market strategies can follow Potato (or similar product/service): TDTB07