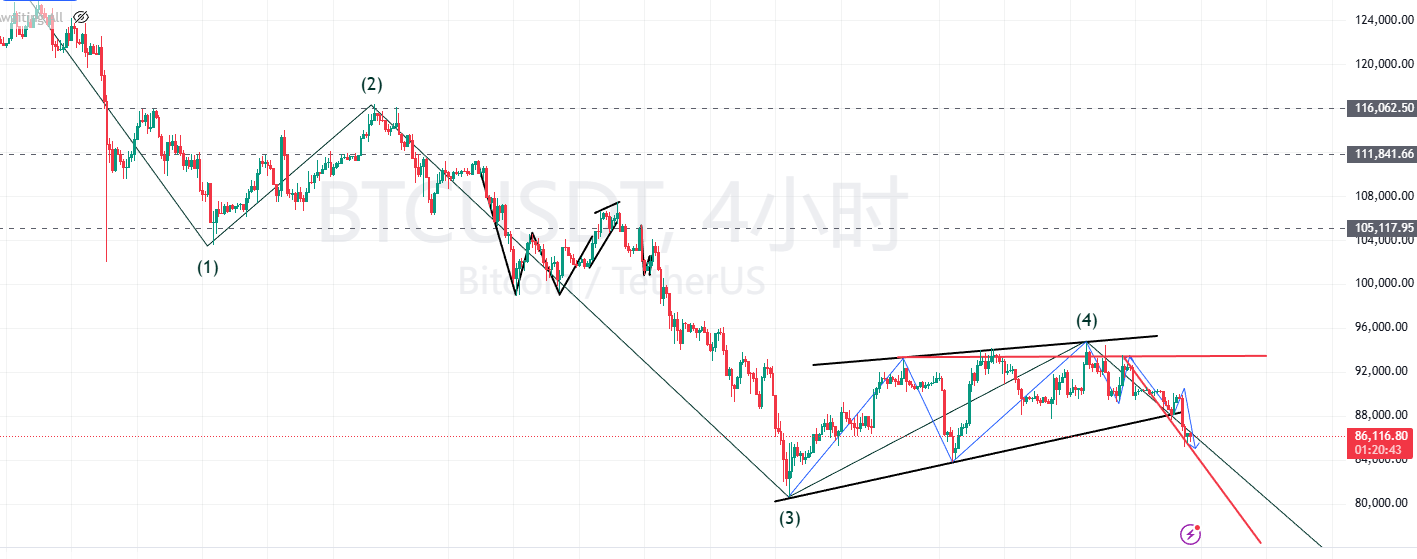

This drop in Bitcoin is the first accelerated decline within an ascending wedge pattern, and it has now broken through the support level. Yesterday's small V-shaped rebound probably trapped many people; it looked like it was going to rebound directly, and even Banmuxia said it was a buy signal above 90,500, but I went short at that level. Why? Because yesterday's rebound was clearly weak; it only briefly touched 90,000 before immediately falling back down.

The downtrend is still ongoing, so don't rush to buy. If you really want to buy, wait until it drops to between 83,000 and 80,000. Otherwise, once this pattern is complete, the low point will be at least around 80,000.

Looking at the smaller timeframes, the bearish momentum is weakening, and a "golden cross" signal is about to appear, but the price won't rise much: in a strong uptrend, it might reach 88,000, but in a weaker uptrend, it will likely turn downwards around 87,000. Therefore, my strategy remains to sell short on any rebound.

Looking at the 4-hour chart, the pattern has broken down. A rebound to the 87,000-88,000 range would present an opportunity to short, with an initial target of 83,000-80,000. Furthermore, the daily chart shows no signs of a bottom, suggesting a potentially larger drop could begin at any time. If the 83,000-80,000 level fails to hold, the next target is 75,000. The overall trend is clearly downward.

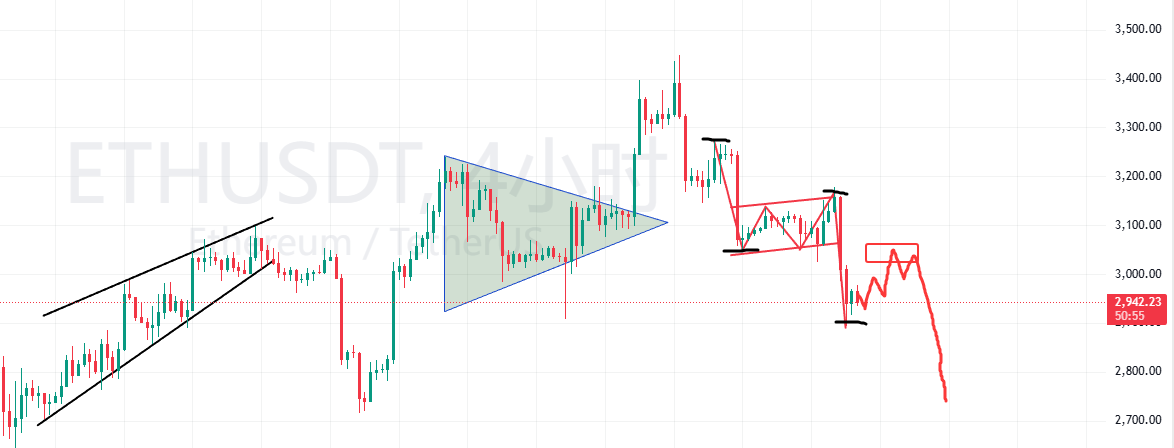

Ethereum's bearish flag pattern is essentially complete. The first wave of decline formed the flagpole, followed by sideways consolidation to form the flag, and then a rapid decline began. Yesterday, many people were misled by the market, mistaking the flag pattern for a consolidation range and blindly buying in, thinking it would rise. In fact, I warned yesterday that this was a bearish trap, and the price would definitely fall back after a brief rise.

As expected, the market immediately fell after the false breakout. My previous prediction of a low of 2930 was based on the decline of the first wave of the "flagpole" pattern. After a bearish flag pattern is formed, the final wave of decline is usually similar to the first wave.

The flag pattern is nearing its end, but there are no signs of a bottom yet. Looking at the 4-hour chart, the decline will likely continue, with only two possible scenarios: a direct drop or a rebound followed by another drop. I lean towards the latter, as short after a rebound is more prudent, as a sharp drop is more likely to be followed by a rapid rebound. Furthermore, there's the non-farm payroll data tonight; even if its impact is minor, positive data could drive the price back to the 3030-3050 range.

If you want to place a short, 3044 is a good level. This level used to be the lower edge of a flag pattern, which has now become resistance. If it falls again, the target could be the 2730-2780 range.

There's not much market activity during the day; it's mainly a consolidation and correction phase. There will be some activity at night. If you want to trade, it's recommended to wait for a rebound before entering a position. It's not advisable to go long now because the current trend is either a rebound followed by a decline or a direct drop. Long is risky and not cost-effective. Don't lose the big picture for a small gain.

The following are the on-chain monitored cryptocurrencies:

I've already sold out of BSC and SOL ecosystem tokens, and it's almost time for the 1-2 week investment period I mentioned before.

The exchange's view: If the support level of 83,000 fails to hold, it is highly likely that the price will fall below 80,000. Just continue to wait.

A few coins I'd like to buy on dips:

Let's keep an eye on the trend.

It's a real pity I missed out on $fhe; I listed it at a slightly lower price. It's rebounded fourfold now, so I'll have to keep monitoring it until it drops again.

I don't know when Pinpin will peak; I'll just wait for a sharp drop before looking for opportunities.

I placed a buy order at the level where the candlestick pattern appeared on the monthly chart.

I'll wait for $Aster to drop to 0.5, then buy some and hold the position until it's worthless.

$Bob also has a price of 0.01 listed, waiting to snag a bargain. Actually, it's easier to trade when the market is bad because there are only a few hot topics, and only a handful of coins can experience a surge. Just keep an eye on rebound opportunities and find cost-effective entry points. This is much simpler than the chaotic market in a bull market where various coins are flying around and it's hard to find the main trend.

The market is constantly changing, and specific entry and exit points should be determined based on real-time conditions. Follow the trend after a breakout! No matter how confident you are, please strictly adhere to your stop-loss and take-profit strategies! That's all for today! Follow me so you don't get lost! QQ: 2178747366, QQ: 2499660658 ( Add me with a note, and I'll add you to our learning and discussion group).